Friday, 07.09.2018

- Topic 1: Japan – Highs and lows in Nippon

- Topic 2: Computer games – The gaming market is booming

Japan

Highs and lows in Nippon

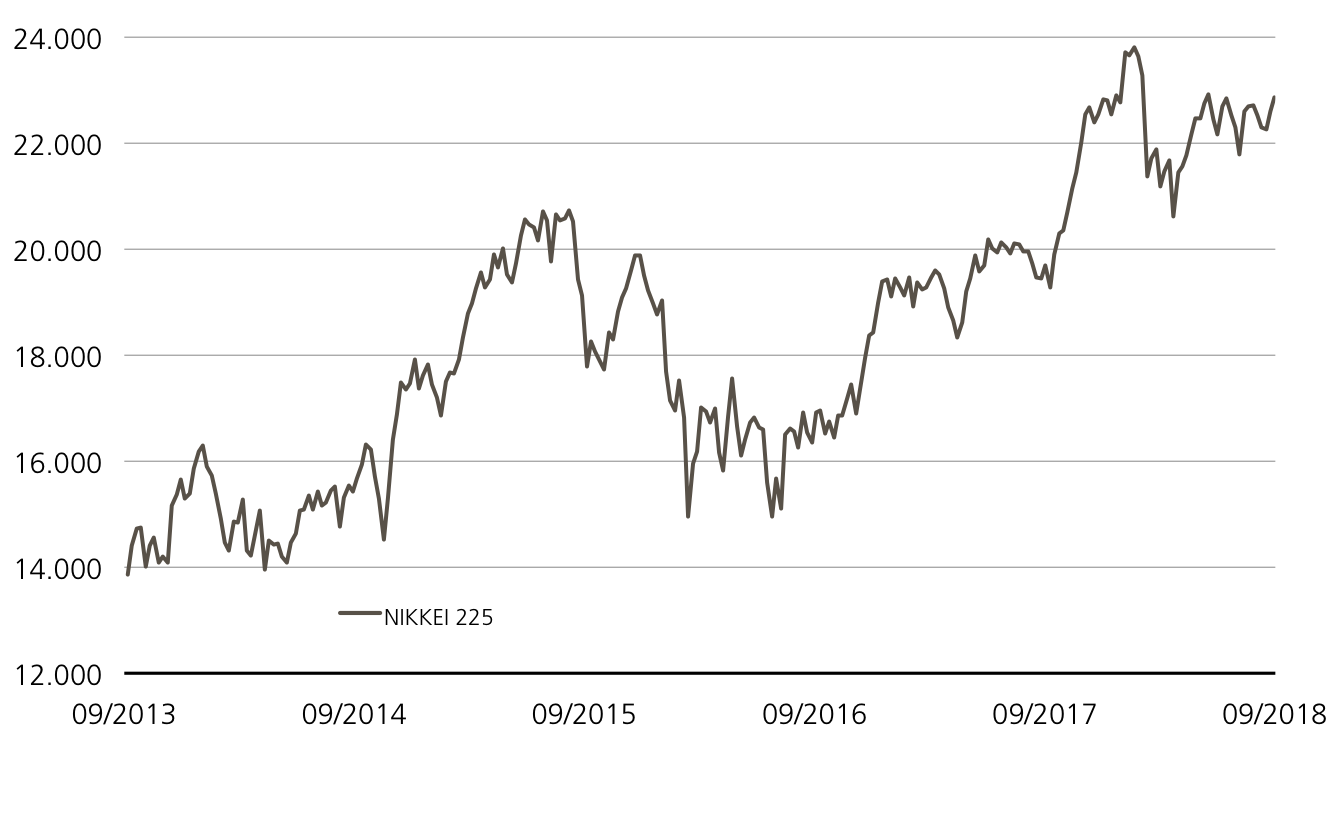

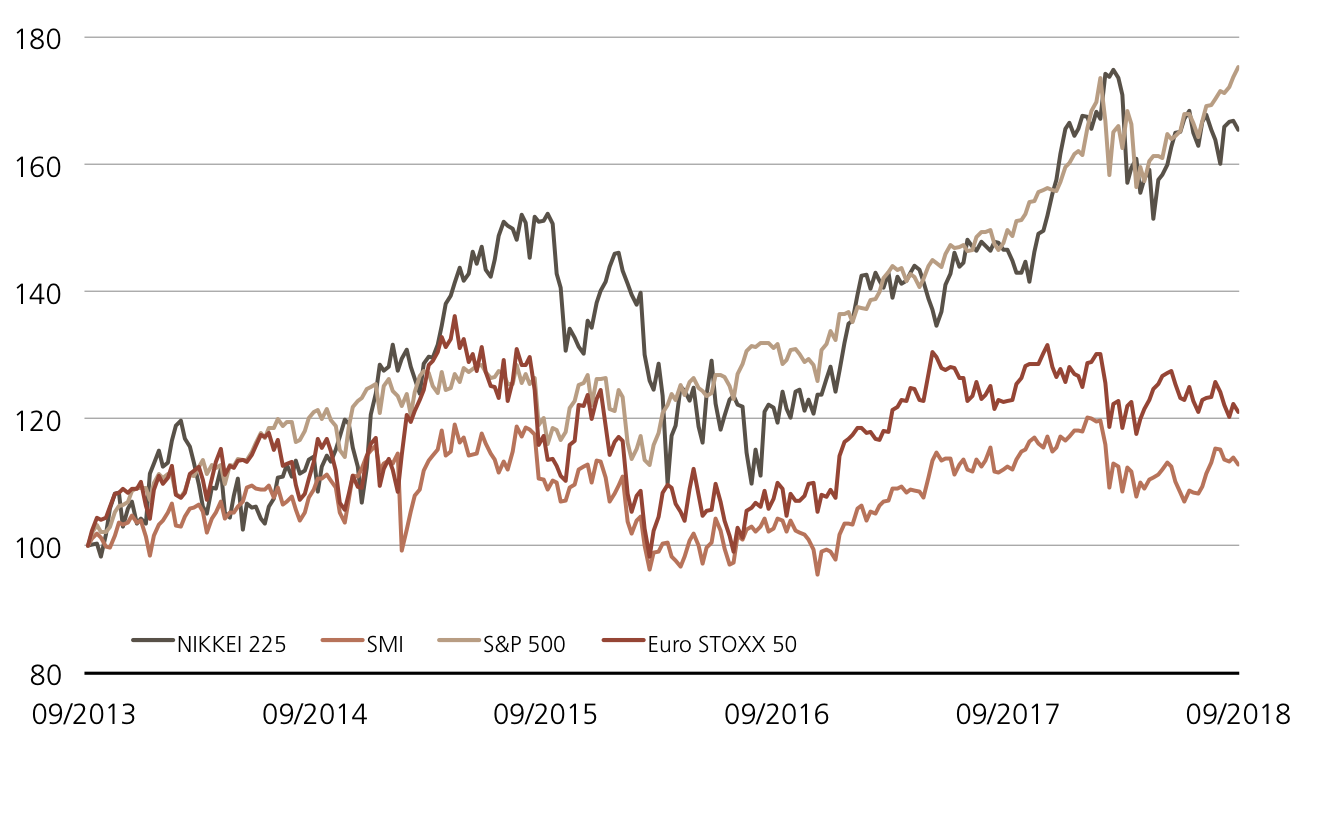

The Japanese economy finds itself in a constant state of fluctuation. While the economy continued to expand for more than two years until the end of 2017, the longest growth period since the end of the 1980s, the first quarter of 2018 saw the country suffer a setback. Despite all of the efforts of Prime Minister Shinzo Abe, Japan’s economic recovery is lacking in stamina. Nevertheless, the government is not admitting defeat, as it can ultimately rely on the central bank and its expansive monetary policy. “There will be no interest rate hikes for a good while,” clarified the current Governor of the Bank of Japan Haruhiko Kuroda recently in an interview with the «Yomiuri Shimbun» newspaper. (Source: Thomson Reuters, media report, 9.1.2018). The Open End PERLES (symbol: NIKKY) on the NIKKEI 225™ allows for direct participation – at no cost – on the key Japanese index. More cautious investors can use the new Callable Worst of Kick-In GOAL (symbol: KCITDU) to invest in the NIKKEI 225™, S&P 500™, SMI™ and Euro STOXX 50™ with conditional partial protection. The product provides a risk buffer of 40% and a return opportunity of 4.50% p.a.

The Japanese economy is currently traversing many highs and lows. For example, the employment situation in the “Land of the Rising Sun” was on the negative side in August, as the unemployment rate increased by slightly more than it was expected to, reaching 2.5% after standing at 2.4% in the previous month. In addition, Japan’s industrial output in July was down 0.1% on the previous month, which contrasted with the general consensus that it would increase by 0.2%. The decline in output was partly due to lower vehicle and steel exports. Nevertheless, the Japanese economy is displaying encouraging signals. Following the decline in the gross domestic product (GDP) in the first quarter, the economy performed a turnaround in the subsequent period between April and June. Thanks to rising consumer spending and higher investments, the country is back on track to enjoy growth. According to a first estimate, GDP was up 0.5% on the previous quarter, after economists had only forecast an increase of 0.3%.

Meanwhile, the trade dispute with the US is hanging over Japan like the Sword of Damocles. US President Donald Trump is pressuring Tokyo to sign a bilateral free trade agreement under the threat of higher tariffs. The Japanese government is reluctant to sign such an agreement and continues to look to multilateral free trade agreements. For example, the EU and Japan concluded a free trade agreement in mid-July after five years at the negotiating table. The agreement thus creates a common economic area for over 600 million people in which more than a quarter of the world’s GDP is generated. Both parties emphasized that the conclusion of this agreement points the way for “free, fair and rule-based trade and takes a stand against protectionism”.

Opportunities: Since the incumbent Prime Minister Shinzo Abe took office at the end of 2012, the NIKKEI 225™ has more than doubled. ¹ For investors who want to invest in further upward trends, an Open End PERLES (symbol: NIKKY) is available on the Japanese benchmark index. The participation product tracks the price history of the underlying. Please note: The product denominated in CHF does not include currency hedging. If, on the other hand, you would like to operate with partial protection due to global political and economic uncertainties, you could take a look at the Callable Kick-In GOAL (symbol: KCITDU) on the NIKKEI 225™, S&P 500™, SMI™ and Euro STOXX 50™. The 40% risk buffer allows for moderate setbacks without putting the return opportunity of 4.50% p.a. at risk.

Risks: These products do not have capital protection. With Open End PERLES, losses are incurred if the underlying index falls. If, for Worst of Kick-In GOAL, the underlyings equal or fall below the respective kick-in level (barrier) and the callable feature does not apply, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the four shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

NIKKEI 225™ Index (5 years)¹

Source: UBS AG, Bloomberg

As of 05.09.2018

SMI™ vs. Euro STOXX 50™ vs. S&P 500™ vs. Nikkei 225™ (5 years)¹

Source: UBS AG, Bloomberg

As of: 05.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

4.50% p.a. Callable Worst of Kick-In GOAL on SMI™ / Euro STOXX 50™ / S&P 500™ / Nikkei 225™

| Symbol | KCITDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | SMI™ / Euro STOXX 50™ / S&P 500™ / Nikkei 225™ |

| Currency | CHF (Quanto) |

| Coupon | 4.50% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 03.09.2021 |

| Issuer | UBS AG, London |

| Issue price | 100.00% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 05.09.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’868.86 | -2.4% |

| SLI™ | 1’450.84 | -2.4% |

| S&P 500™ | 2’888.60 | -0.9% |

| Euro STOXX 50™ | 3’315.62 | -4.1% |

| S&P™ BRIC 40 | 3’902.26 | -4.9% |

| CMCI™ Compos. | 921.68 | -1.1% |

| Gold (troy ounce) | 1’201.30 | -0.8% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

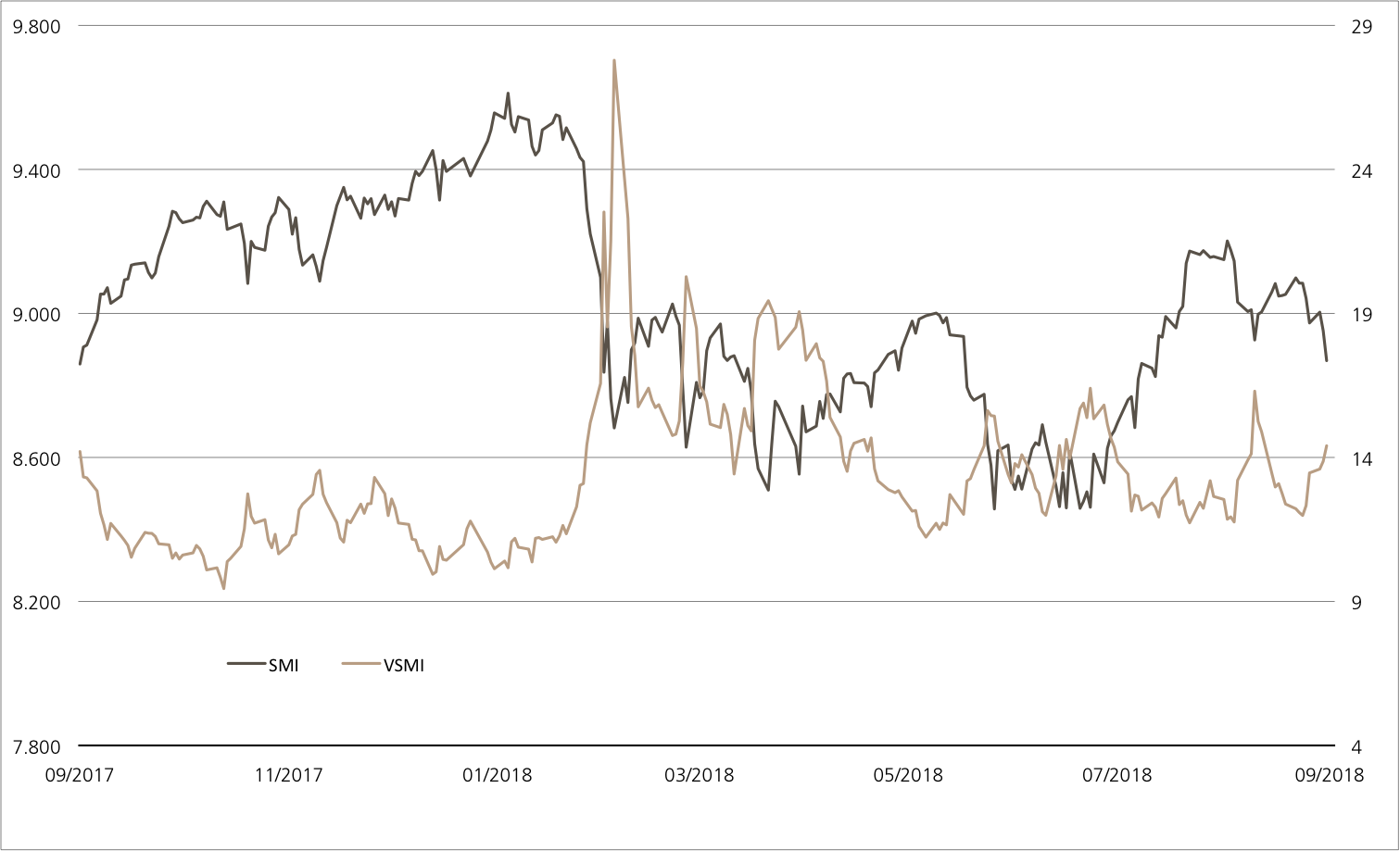

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 05.09.2018

Computer games

The gaming market is booming

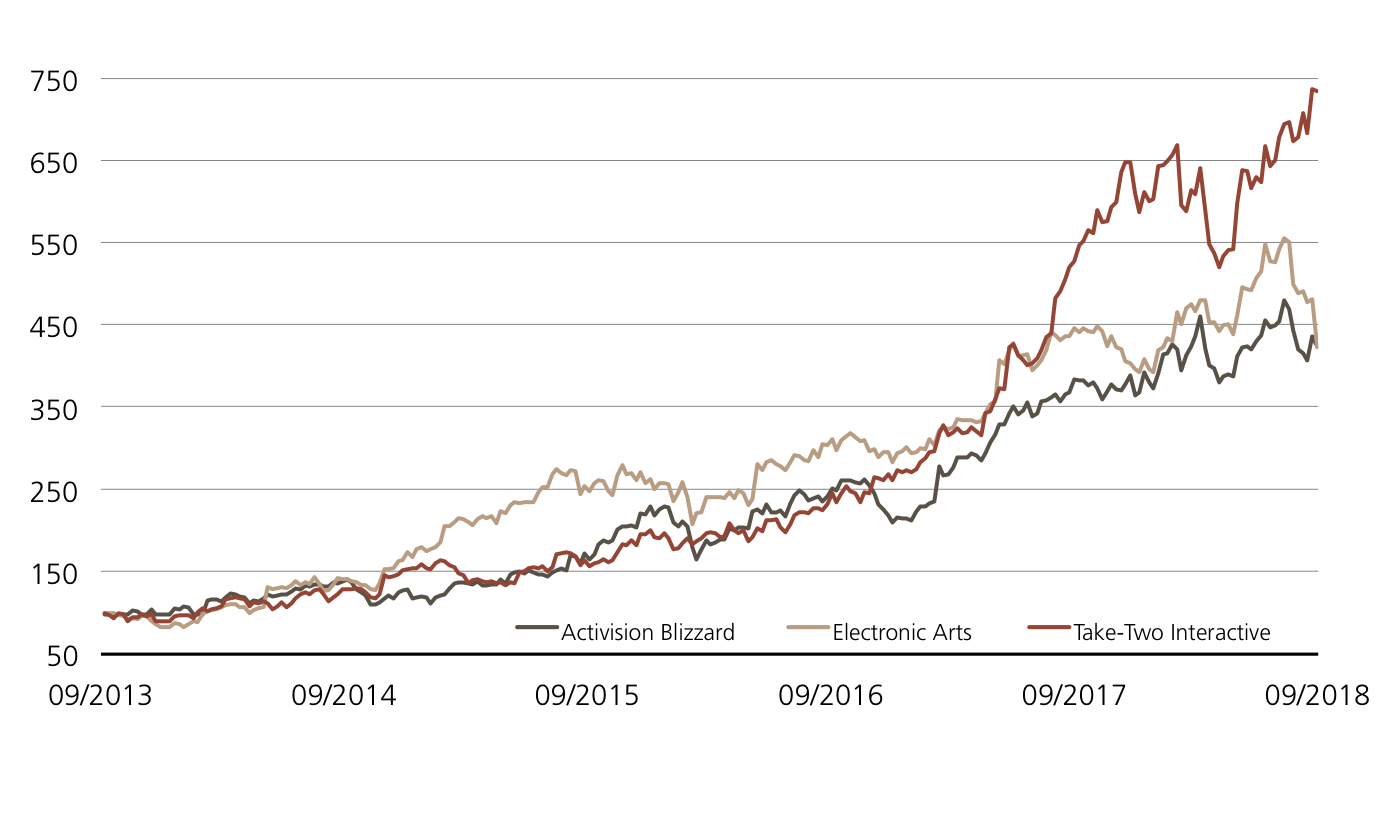

At the end of August, gamers from around the world arrived en masse in Cologne for the world’s largest trade fair for video games, Gamescom, setting new records with over 1,000 exhibitors and 370,000 visitors. Activision Blizzard were just one of the big names in attendance, with the US video games developer being presented with the Gamescom Award for the best action game. The holding company also gave visitors a glimpse of the eagerly awaited game “Call of Duty: Black Ops 4”, which has been given a retail release on October 12, 2018. Gamers are not the group of people to love Activision , the company also has a huge number of fans on the equity market. The share price has more than tripled in value over the past few five years. Competitors Electronic Arts and Take-Two have recorded even greater growth in their respective share prices in the same period of time. ¹ In the event that the trio will take a little break, the Worst of Kick-In GOAL (symbol: KCJJDU) currently in subscription is suitable. If the barrier remains intact at 60% of the starting prices, the product returns the maximum amount of 12.00% p.a.

Global growth: According to information provided by market researcher Newzoo, video games sales look set to increase from the USD 121.7 billion recorded in the past year to USD 180.1 billion in 2021, primarily thanks to the increasing popularity of mobile games. This equates to an average annual growth rate of 10.3%. (Source: Newzoo.com) Take-Two and Activision have also shown strong growth lately, with both companies’ Q2 figures exceeding expectations. While Activision has seen its profits enjoy surprisingly strong growth of 65% thanks to the success of the «Call of Duty» blockbuster series, Take-Two has been a positive surprise with sales increasing by just under 12%. The increase in the company’s revenues has been driven by games such as Grand Theft Auto and NBA 2K18. Although the third company under the spotlight, Electronic Arts, likewise achieved an impressive interim result, its outlook for the current quarter is disappointing. At the same time, however, the company will be bolstered by new games such as “Madden NFL” and *Battlefield V”, which are scheduled to be released in the second half of the year.

Opportunities: The new Worst of Kick-In GOAL (symbol: KCJJDU) for Activision Blizzard, Electronic Arts and Take-Two Interactive has a coupon of 12.00% p.a. The distribution will be paid out regardless of the performance of the three US games developers. Meanwhile, the final repayment is linked to the underlyings. If none of the shares fall at or below the barrier of 60% of the starting price, investors will receive the nominal amount fully repaid upon maturity.

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In level (barrier), the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the three shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Activision vs. Electronic Arts vs.Take-Two (5 years)¹

Source: UBS AG, Bloomberg

As of: 05.09.2018

12.00% p.a. Worst of Kick-In GOAL on Activision / Electronic Arts / Take-Two

| Symbol | KCJJDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 |

| Underlyings | Activision, Electronic Arts, Take-Two |

| Currency | USD |

| Coupon | 12.00% p.a. |

| Strike Level | 100% |

| Kick-In Level | 60.00% |

| Expiry | 12.09.2019 |

| Issuer | UBS AG, London |

| Subscription until | 12.09.2018, 15:00 Uhr |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 05.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.