Friday, 14.09.2018

- Topic 1: Food producers - Food is always in demand

- Topic 2: Major Swiss corporations - Many positive surprises

Food producers

Food is always in demand

We feast all year round – barbecues are lit in summer, winter is filled with one Christmas dinner after another, and there are plenty of culinary treats like chocolate Easter bunnies and pumpkins to enjoy in spring and fall too. So food is always in demand. As this is the case even in difficult economic times, the industry is often described as defensive with comparatively low economic sensitivity. The growing world population and increasing prosperity in emerging markets are also proving to be growth drivers, too. With the UBS ETT (symbol: ETFOO) on the STOXX™ Europe 600 Food & Beverage Index, you can participate in the share performance of the major European food groups in a diversified manner.² For those interested in optimizing their return, the new Callable Worst of Kick-In GOAL (symbol: KCKHDU) on Danone, Mondelez, Nestlé and Lindt & Sprüngli could prove appealing. The subscription product has a barrier of 55% of the initial fixing as well as an annual coupon of 5%.

Food companies around the world are currently in good health. One of the highlights of the reporting season just ended was provided by Nestlé (see also page 3). New CEO Mark Schneider has brought the world market leader back on track with a targeted reorganization of the company. In the first six months of 2018, organic growth adjusted for one-off effects increased by 2.8%. We expect this to pick up even more in the second half of the year. Schneider expects a positive performance of around 3%. Fellow compatriot Lindt & Sprüngli is likewise enjoying growth. Revenues in local currencies improved by 5.1%, in particular due to a good performance in emerging markets, while half-year profits rose by a disproportionate 12.7%. In the medium to long term, Lindt & Sprüngli wants to increase its profitability by 20 to 40 basis points.

Mondelez has also proved to be a positive surprise. The world’s second-largest confectionery producer exceeded expectations in its interim report for the second quarter. The US group is currently benefiting from a disciplined spending policy set out by its management as well as strong sales of Cadbury chocolate and Oreo cookies. Leading yogurt manufacturer Danone has also further expanded its business in 2018; however, the French company is currently experiencing headwinds in Morocco. Consumers are accusing the company of abusing its market power and charging excessive prices. CFO Cecile Cabanis is nevertheless remaining calm on this issue and expects to be able to compensate for the losses in sales elsewhere. The targets for the year as a whole were therefore confirmed at the half-year stage.

Opportunities: The abovementioned food groups make up the four underlying assets of the new Callable Worst of Kick-In GOAL (symbol: KCKHDU). The subscription product has a maximum term of three years and an annual coupon of 5%. The product can be repaid early for the first time after one year – and then every three months. The Kick-In Level is at 64% of the underlying prices. Investors wanting an even more-diversified investment will find the ETT (symbol: ETFOO) on the STOXX™ Europe 600 Food & Beverage Index is just what they are looking for. The product fully participates in the performance of the European food industry without any maturity constraints. The product currently contains 22 stocks.

Risks: The products do not have capital protection. Should the underlying assets deliver a negative performance, the ETT will incur commensurate losses. Worst of Kick-In GOALs, however, have conditional capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the four shares (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

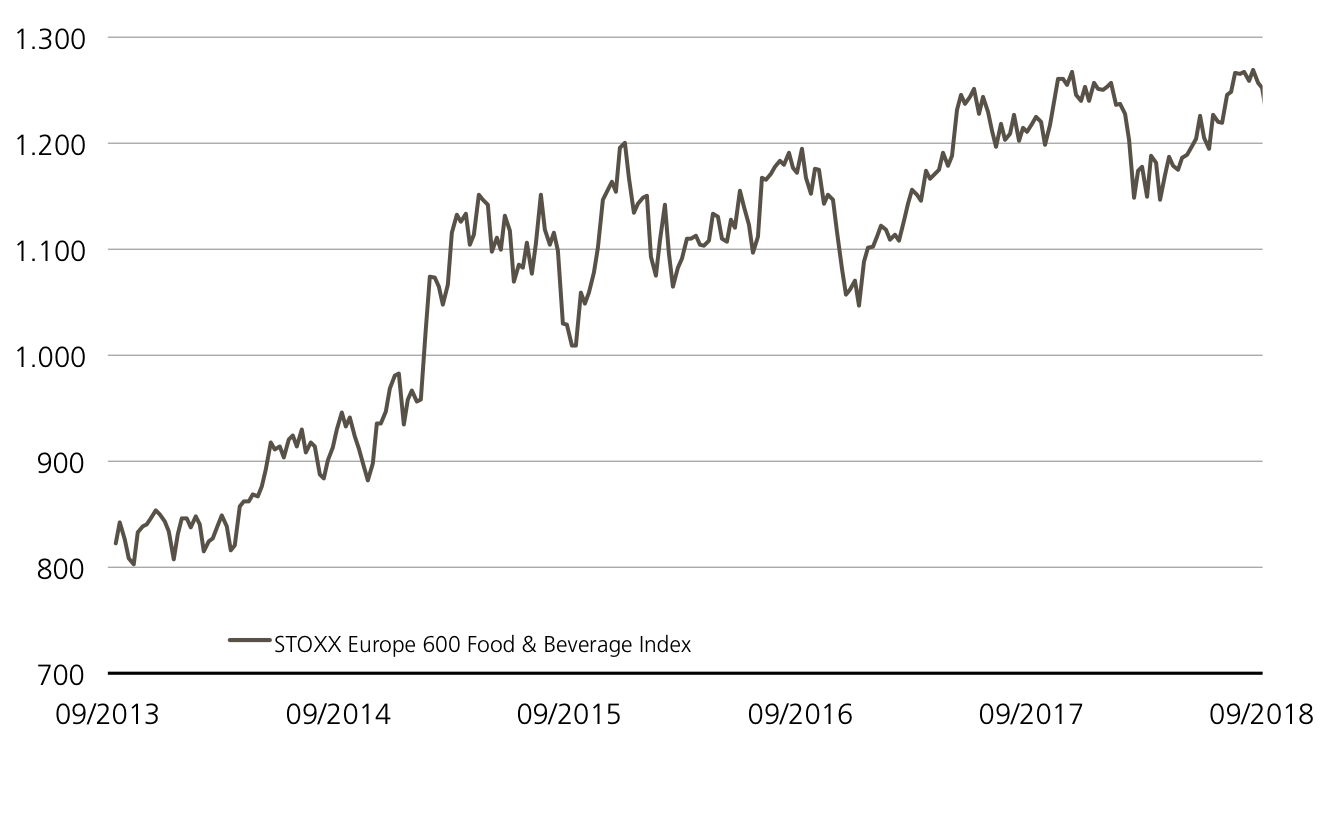

STOXX™ Europe 600 Food & Beverage Index (5 years)¹

Although its momentum has slowed somewhat recently, the STOXX™ Europe 600 Food & Beverage Index has enjoyed a steady upward trend over the last five years.

Source: UBS AG, Bloomberg

As of 13.09.2018

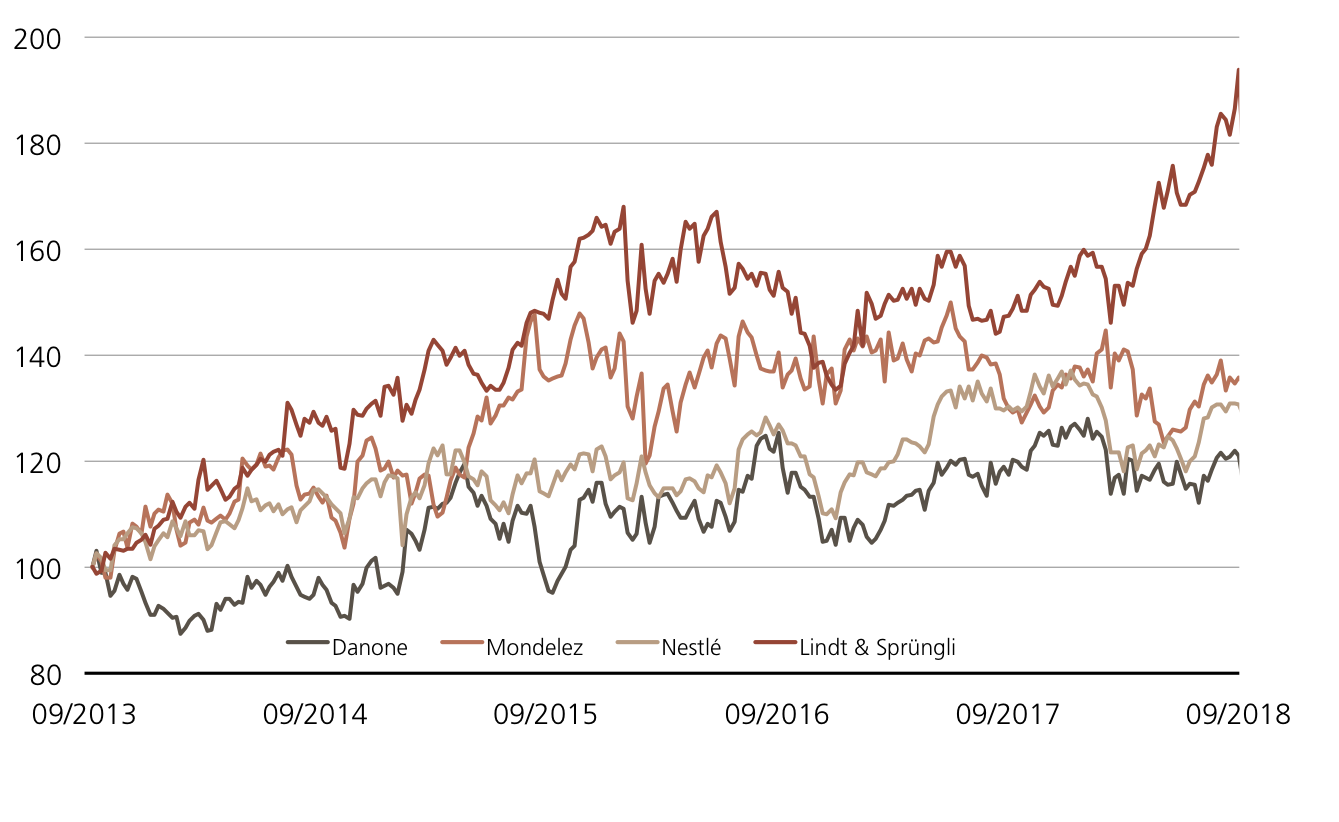

Danone vs. Mondelez vs. Nestlé vs. Lindt & Sprüngli (5 years)¹

The food companies Danone, Mondelez, Nestlé and Lindt & Sprüngli enjoyed varying rates of growth, with the premium chocolate producer leading the pack with a positive performance of 78%.

Source: UBS AG, Bloomberg

As of: 13.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETT on STOXX™ Europe 600 Food & Beverage Index

| Symbol | ETFOO |

| SVSP Name | Tracker-Certificate |

| SPVSP Code | 1300 |

| Underlying | STOXX™ Europe 600 Food & Beverage NR Index |

| Ratio | 1:1 |

| Currency | EUR |

| Administration fee | 0.00% p.a. |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/ask | EUR 1’225.00 / 1’232.00 |

5.00% p.a. Callable Worst of Kick-In GOAL on Danone, Mondelez, Nestlé, Lindt & Sprüngli

| Symbol | KCKHDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | Danone, Mondelez, Nestlé, Lindt & Sprüngli |

| Currency | CHF (Quanto) |

| Coupon | 5.00% p.a. |

| Kick-In Level | 55.00% |

| Expiry | 20.09.2021 |

| Issuer | UBS AG, London |

| Subscription until | 19.09.2018, 15:00 Uhr |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 13.09.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’960.13 | 1.0% |

| SLI™ | 1’462.36 | 0.8% |

| S&P 500™ | 2’888.92 | 0.0% |

| Euro STOXX 50™ | 3’326.60 | 0.3% |

| S&P™ BRIC 40 | 3’833.53 | -1.8% |

| CMCI™ Compos. | 933.75 | 1.3% |

| Gold (troy ounce) | 1’210.90 | 0.8% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

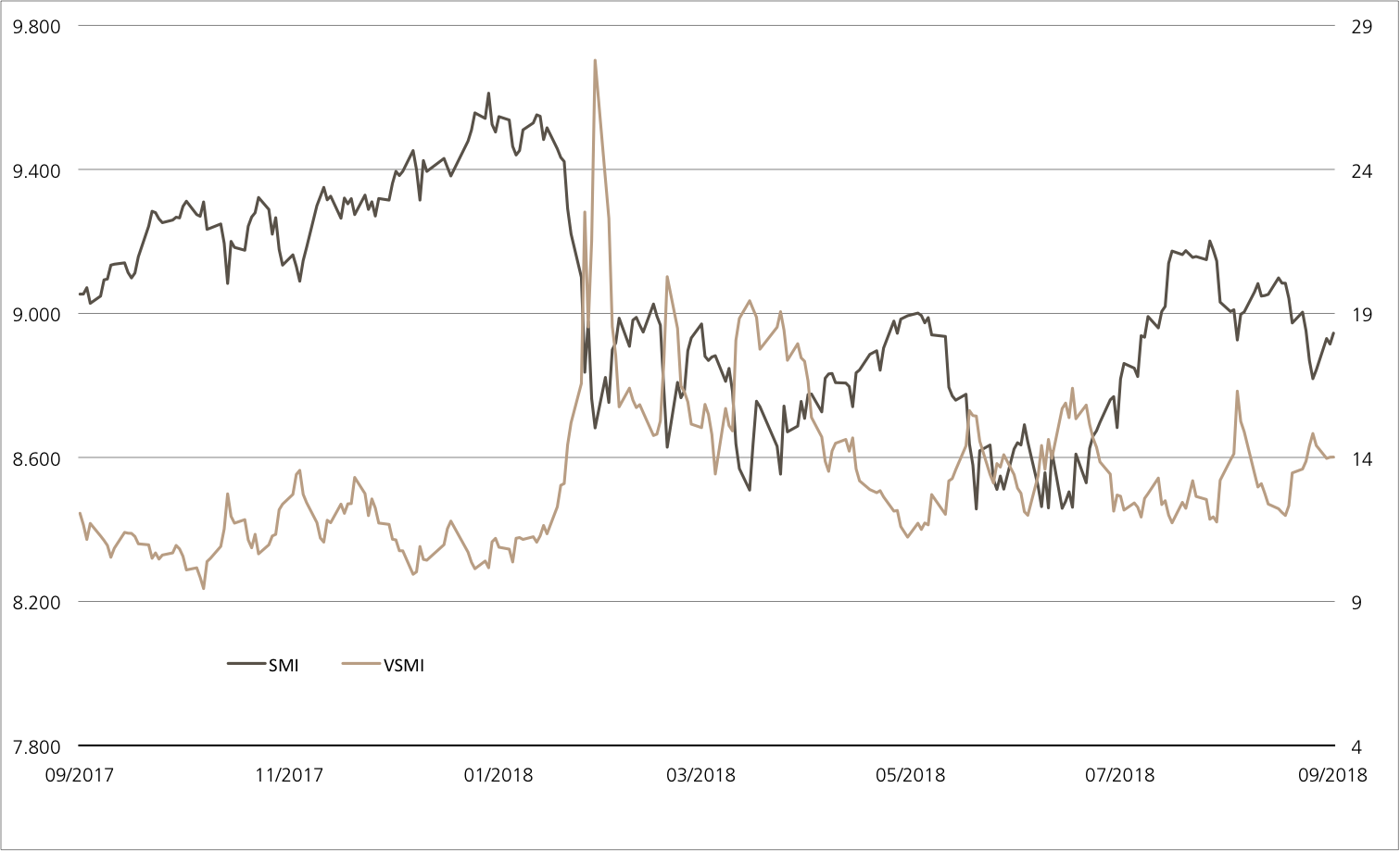

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 13.09.2018

Major Swiss corporations

Many positive surprises

Richemont presented its interim report for the current reporting season on Monday, making it the last of the 20 SMI™ members to do so. The overall conclusion is impressive – the results of three-quarters of Swiss blue chips exceeded the expectations of the financial community, including those of the three heavyweights Nestlé, Novartis and Roche as well as Zurich Insurance Group. These four SMI™ stocks make up the new Callable Worst of Kick-In GOAL (symbol: KCKEDU). The product, which is in subscription until September 19, pays out an annual coupon of 5% on a quarterly basis. This return opportunity comes with an initial risk buffer of 46%.

Roche proved to be one of the highlights of the recent reporting season. The largest manufacturer of cancer medication in the world not only posted its highest growth in almost five years, it also raised its outlook once again. An increase in sales by a moderate single-digit percentage is now expected in the current financial year, after it had only raised its forecast revenue growth rate to a low single-digit percentage in April. Domestic competitor Novartis also performed well in the first half. For example, the ophthalmic division, which is due to go public in the first half of 2019, increased its adjusted operating income by 14%. Due to the successful first six months, the sales and profit forecast for the full year has been confirmed. While Nestlé narrowed its growth target from 2–4% to 3%, Zurich Insurance stuck to its medium-term objectives. “At the midpoint of our three-year plan, we stand well on track to achieve all indicated targets by the end of 2019,” said Group Chief Executive Officer Mario Greco. (Source: Thomson Reuters media report, August 9, 2018)

Opportunities: With the four SMI™ stocks serving as the underlyings for the Callable Worst of Kick-In GOAL (symbol: KCKEDU), an annual coupon of 5% is possible. Starting on December 27, this coupon will be paid out quarterly irrespective of the performance of the underlying assets. Meanwhile, the repayment of the CHF 1,000 notional is linked to the underlying shares. The quartet has a comfortable safety buffer of 46%. If the buffer holds out until the end of the term, the maximum return will be paid out. Due to the callable function, the product can be repaid prematurely – for the first time after one year.

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

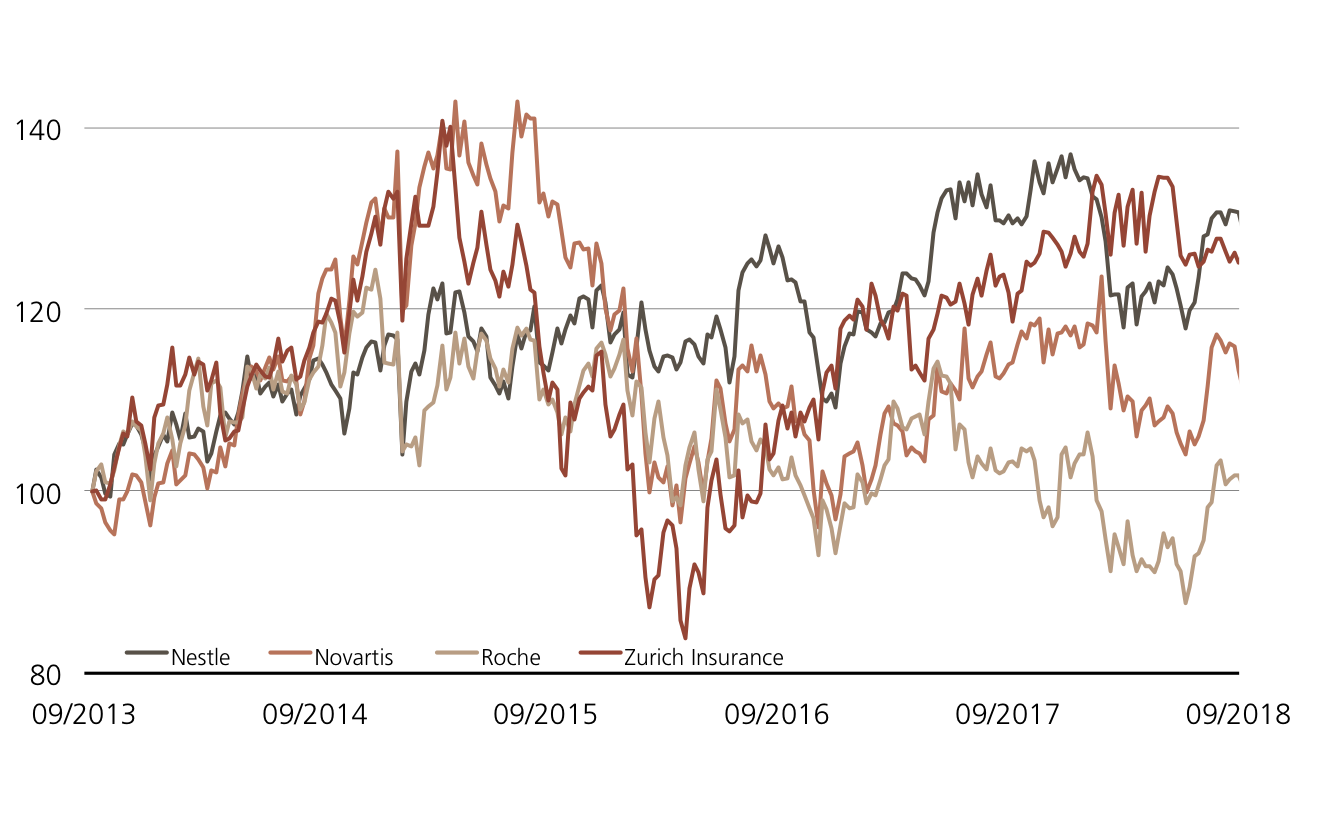

Nestlé vs. Novartis vs. Roche vs. Zurich Insurance (5 years)¹

Source: UBS AG, Bloomberg

As of: 13.09.2018

5.00% p.a. Callable Worst of Kick-In GOAL on Nestlé, Novartis, Roche, Zurich Insurance

| Symbol | KCKEDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | Nestlé, Novartis, Roche, Zurich Insurance |

| Currency | CHF |

| Coupon | 5.00% p.a. |

| Kick-In Level | 54.00% |

| Expiry | 20.09.2021 |

| Issuer | UBS AG, London |

| Subscription until | 19.09.2018, 15:00 Uhr |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 13.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.