Friday, 28.09.2018

- Topic 1: Germany – A warm fall

- Topic 2: Ferrari/Porsche – Luxury car bodies in new splendor

Germany

A warm fall

Just as it enters the year of its 30th anniversary, the DAX™ has been thrown out of step. Since the start of the year, the Deutscher Aktienindex™, launched on July 1, 1988, has recorded a negative performance of 4.4%.¹ As is the case on other stock exchanges, the simmering trade conflict is regarded as the main source of friction for the German stock market. Nevertheless, the current ifo Business Climate Index shows that the mood within the German economy remains at a comparatively high level despite all of the factors contributing to the uncertainty. With an ETT (symbol: ETDAX), investors can use the current weakness in the DAX™ to enter the market. While the participation product is directly linked to the fluctuating performances of 30 large caps, the aim of the new Worst of Kick-In GOAL on Bayer, SAP and Volkswagen (symbol: KCMSDU) is to achieve a relatively stable performance. The DAX™ trio allow a coupon of 6.50 percent p.a. This return opportunity is linked to a 40% safety buffer.

Every month, the Munich-based ifo Institute asks around 9,000 managers about the current situation on the markets and their expectations for the next six months. This survey helps form the Business Climate Index, which is one of the most important early indicators for the German economy. Although the barometer became slightly gloomier in September, falling to 103.7 points after totaling 103.9 points in the previous month, the Index still remained at a historically high level. “The German economy is stable, even if there is increasing uncertainty,” commented Clemens Fuest, President of the ifo Institute, on the latest results. (Source: ifo Institute press release, 24.09.2018)

The customs dispute between the US and China that continues to simmer is weighing heavily on the mood on the Frankfurt Stock Exchange. Added to this is an instable political situation, which is unusual for Germany. Nevertheless, the Grand Coalition of the CDU, CSU and SPD would now like to focus on the business at hand after the recent quarrels regarding Hans-Georg Maassen, former President of the Federal Office for the Protection of the Constitution. The German regional elections in Bavaria and Hesse on October 14 and 28, respectively, could be indicatory in this respect. In addition to the two polls, DAX™ investors are likely to keep a close eye on the reporting season over the coming weeks, as this will show whether and to what extent the protectionism that is emerging worldwide is having an impact on the business of the major export-oriented German corporations.

Opportunities: Should the results of the elections cure the DAX™ of its recent lethargy, the ETT (symbol: ETDAX) would be an effective investment instrument. The open-end product tracks the key index with a conversion ratio of 10:1. Investors also benefit from the attractive profit sharing schemes of the German large caps, with dividends being reinvested in net terms. No management fees are typically incurred for this structure.² SAP traditionally kicks off the reporting season on the DAX, with the software group presenting its quarterly figures on October 18. Together with those of Bayer and Volkswagen, the SAP share serves as the underlyings for a new Worst of Kick-In GOAL (symbol: KCMSDU). Investors can make concrete plans here thanks to an annual coupon payment of 6.50%. If none of the shares fall level with or below the barrier of 60% of the initial fixings, investors will also receive their nominal amount back in full at the end of the term.

Risks: These products do not have capital protection. The ETT will make a loss if the underlying index falls below the initial price. If the underlyings of the Worst of Kick-In GOAL touch or fall below the respective Kick-In Level (barrier), the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

DAX™ (5 years)¹

Consolidation at a high level: The DAX™ has been trending sideward for more than a year. During this time, the area has emerged as a support level for the benchmark at around 12,000 points.

Source: UBS AG, Bloomberg

As of 27.09.2018

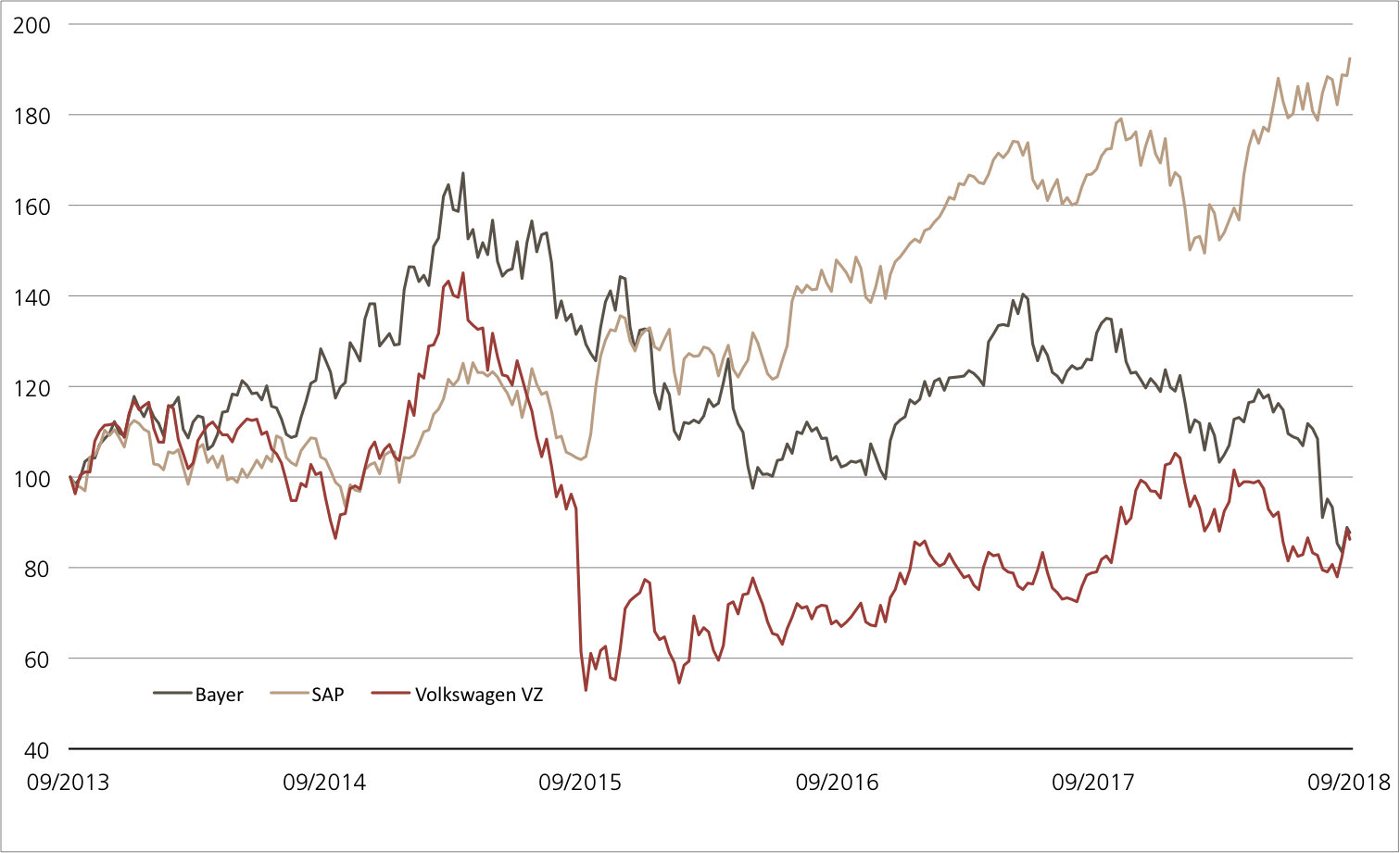

Bayer vs. SAP vs. Volkswagen (5 years)¹

Three equities, two directions: While Bayer and Volkswagen have posted a negative performance over the last five years, the DAX™ heavyweight SAP was able to significantly increase its market capitalization.

Source: UBS AG, Bloomberg

As of: 27.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

6.50% p.a. Worst of Kick-In GOAL auf Bayer / SAP / Volkswagen

| Symbol | KCMSDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 |

| Underlying | Bayer / SAP / Volkswagen VZ |

| Currency | EUR |

| Coupon | 6.50% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 03.04.2020 |

| Issuer | UBS AG, London |

| Subscription until | 03.10.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 27.09.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 9’080.14 | 1.6% |

| SLI™ | 1’488.24 | 1.6% |

| S&P 500™ | 2’905.97 | -0.1% |

| Euro STOXX 50™ | 3’433.15 | 1.9% |

| S&P™ BRIC 40 | 4’056.94 | 2.1% |

| CMCI™ Compos. | 943.22 | 1.4% |

| Gold (troy ounce) | 1’199.10 | -0.8% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

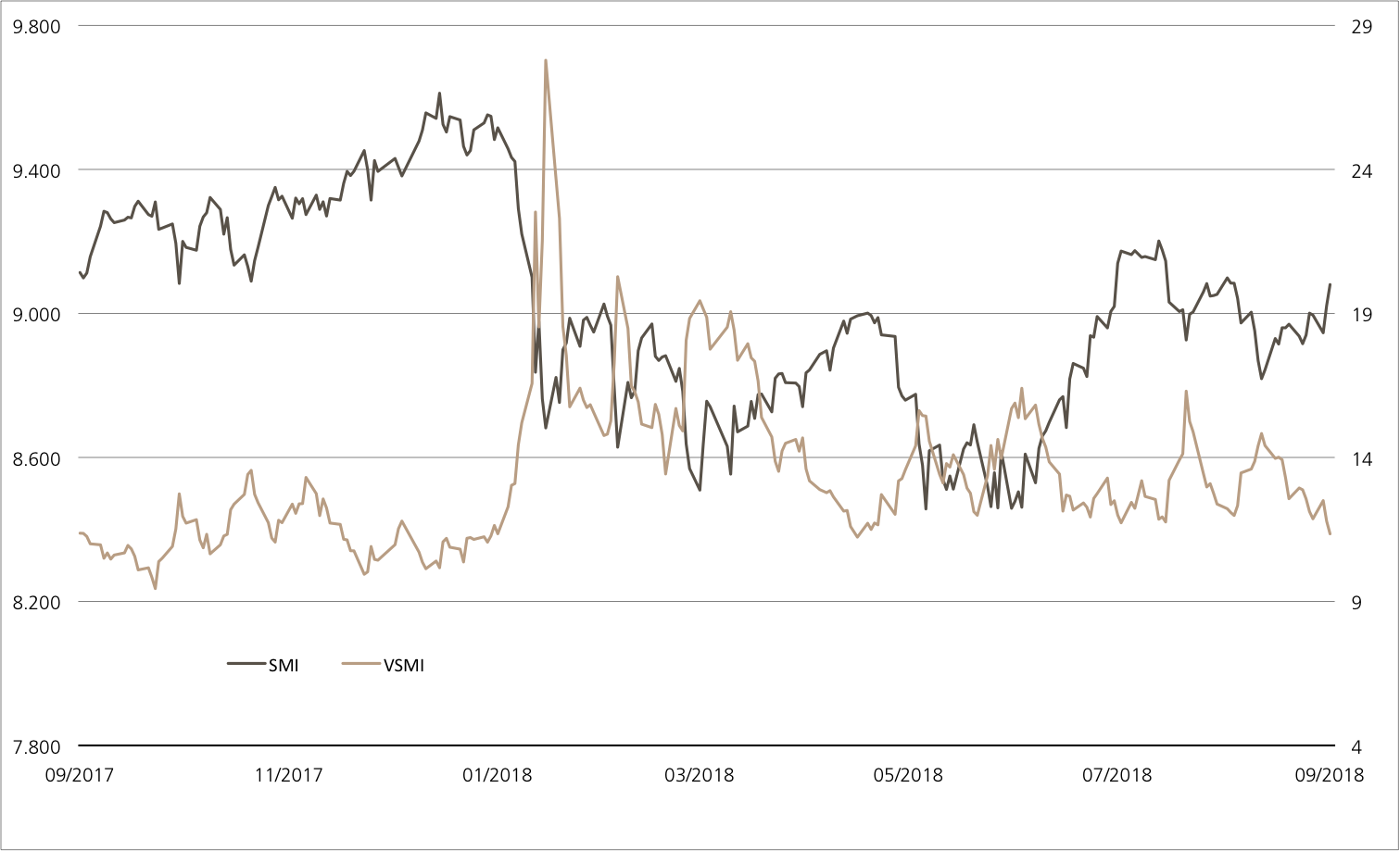

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 27.09.2018

Ferrari/Porsche

Luxury car bodies in new splendor

The events in the sports car segment are coming thick and fast at the moment, as luxury manufacturer Ferrari wants to place 15 new models on the market by 2022. Their aim by this point in time is for some 60% of their cars to come equipped with a hybrid engine. Alternative engines are also a hot topic at rivals Porsche. The company was the first German car maker to announce its intention to withdraw from the diesel market. It now focuses solely on gasoline engines, hybrid models and electric vehicles. Investors have the option of including both of the car stocks in their portfolio. The new Worst of Kick-In GOAL (symbol: KCOIDU) in subscription has an attractive annual coupon of 8% and offers a safety buffer of 30%.

The traditional combustion engine is increasingly becoming obsolete. Electric engines are now also making waves in the sports car industry. Porsche has removed diesel engines from its product range and increased its focus in the areas of hybrid and electric mobility. It is estimated that more than EUR 6 billion will be pumped into these technologies by 2022. As early as 2025, every second new Porsche vehicle could be electrically powered, be it via a hybrid engine or a completely electric engine. The long-established Italian company Ferrari is also following this path. At its recent presentation of the new medium-term development plan in Maranello, CEO Louis Camilleri announced a plethora of new models – with 15 new models and model variants being planned to be released in the three areas of Sport, GT and Special Series between 2019 and 2022. This will also include a sporty all-terrain vehicle, which has suffered long delays. The aim of this offensive push is to further diversify the current product range. By 2022, some 60% of the Ferraris produced will be hybrid models. This should also see profits increasing further. The Group’s operating margin is expected to reach 38% in 2022, after totaling 31.9% in the second quarter of 2018.

Opportunities: Should any investors want the two luxury car body manufacturers to be part of their portfolio as a pair, they would be advised to take a look at the Worst of Kick-In GOAL (symbol: KCOIDU). The configuration of this new issue is very impressive – The product is in subscription and has an annual coupon of 8% as well as an initial risk buffer of 30%. Provided that neither the Ferrari share nor the Porsche share fall level with or below the barrier of 70% of the initial fixing level, the maximum return will be paid out. The product issued in Swiss francs includes currency hedging. The security matures after exactly one year.

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier), the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

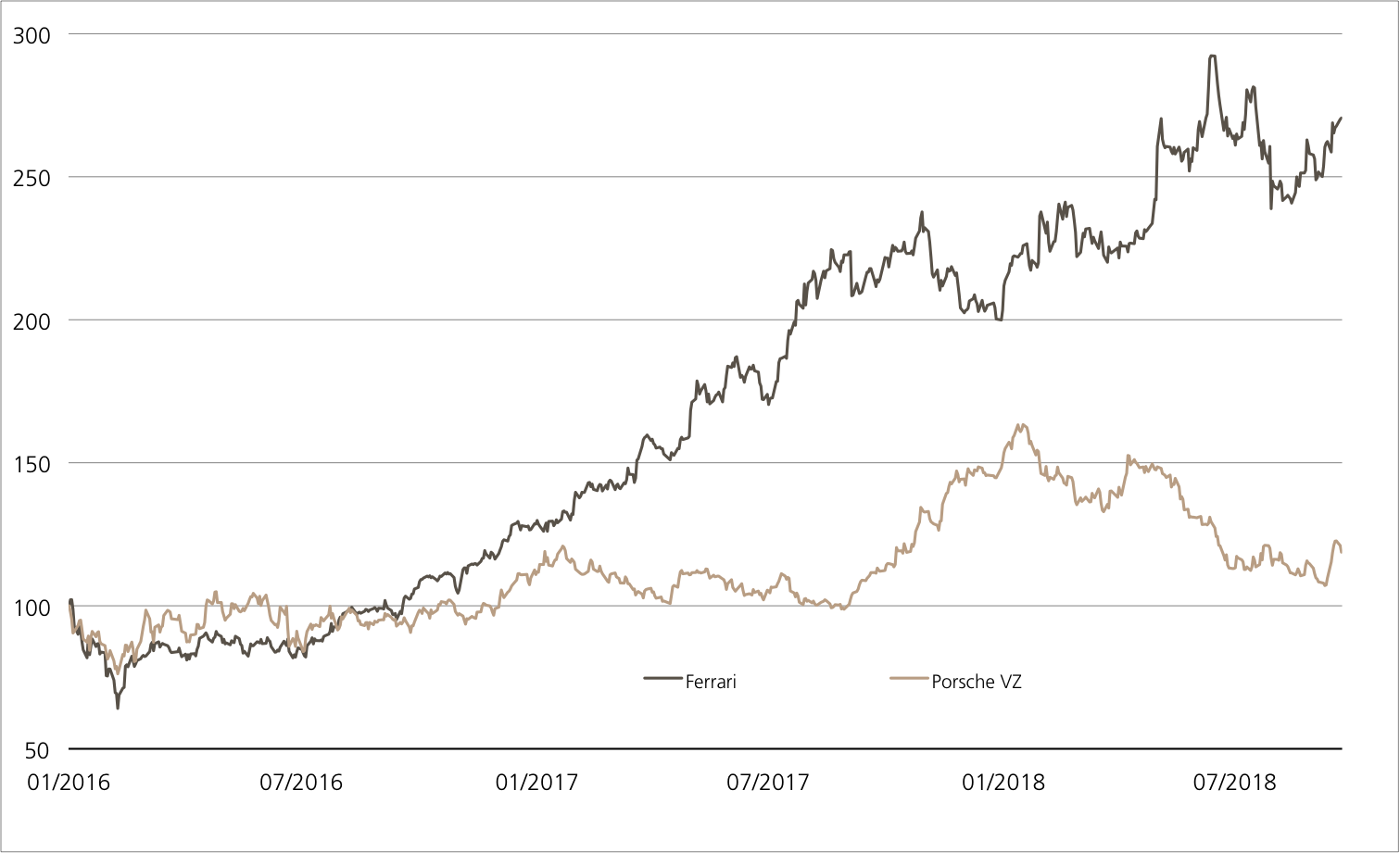

Ferrari vs. Porsche (since 04.01.2016, Start Ferrari-Listing in Mailand)¹

Source: UBS AG, Bloomberg

As of: 27.09.2018

8.00% p.a. Worst of Kick-In GOAL on Porsche / Ferrari

| Symbol | KCOIDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 |

| Underlyings | Ferrari / Porsche |

| Currency | CHF (Quanto) |

| Coupon | 8.00% p.a. |

| Kick-In Level | 70.00% |

| Expiry | 10.10.2019 |

| Issuer | UBS AG, London |

| Subscription until | 10.10.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 27.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.