Friday, 12.10.2018

- Topic 1: Cybercrime - Security on the information superhighway

- Topic 2: Medical technology - A sector in upheaval

Cybercrime

Security on the information superhighway

Hacker attacks are currently a hot topic in the media. For example, the UK is accusing Russia of being responsible for cyber attacks made against political institutions. (Source: Thomson Reuters media report, October 10, 2018) A data scandal on Facebook is also causing quite a stir. According to the US company, hackers exploited a breach in security, which enabled them to spy on approximately 50 million profiles (Source: https://newsroom.fb.com/news/2018/09/security-update/). These examples show that the protection mechanisms used need to be improved and become more effective. Consequently, the demand for IT security services – from private users and companies to entire countries – is likely to remain high in the future. This long-term trend could also be a good capital investment. The Open End PERLES on the Solactive Global Cyber Security Index make it easy and cost-effective to invest in the sector. The products, which can be traded in Swiss francs (symbol: KCFJDU) and US dollars (symbol: KCFKDU), have a management fee of 0.75% p.a.

Siemens is an impressive example of the significance of cybersecurity. A total of 1,275 employees are responsible for IT security at the industrial group. After all, Siemens records around 1,000 attacks a day. It is rapidly becoming clear that IT security is a global market worth billions. According to the «Cybersecurity Market by Solution» report, global spending in this area will reach a volume of USD 152.71 billion in the current year – and this figure is set to increase in the future. Estimates state that the market will grow to USD 248.26 billion by 2023, corresponding to an average annual growth rate of 10.2% between 2018 and 2023. The main drivers behind this are the increasing number of hacker attacks and stricter data protection guidelines. (Source: MarketsandMarktes, September 2018) Internet security is a wide-ranging field. Encryption, anti-virus protection, firewalls and data recovery are just a few of the areas that IT security companies need to address. It could therefore make sense to diversify your portfolio by investing in this growth trend. The Solactive Global Cyber Security Index includes a total of 14 international security companies, all of which are specialists in their fields. For example, Japanese company Trend Micro is best known for its antivirus software, while Israeli firm Check Point Software excels in firewall and VPN products. The current heavyweight in the index is Fortinet. The company, which last year even founded an independent subsidiary that focuses solely on cybersecurity products for government agencies, recently received a fillip from the index provider S&P Dow Jones. As of October 11, 2018, Fortinet replaced Envision Healthcare Corp. on the S&P 500™ indices. The “promotion” came as a result of a strong share price performance, as the market value of Fortinet increased by a huge 113% within the space of a year.¹

Opportunities: The price curve of the Solactive Global Cyber Security Index is likewise trending strongly upward. Although the barometer also paid the price for the recent market weakness, the index reached a new record high until mid-September. Positive growth of 21.4% has been recorded since the end of the year 2017.¹ The Open End PERLES in Swiss francs (symbol: KCFJDU) and US dollars (symbol: KCFKDU) give investors easy access to companies offering promising IT security solutions. The products track the performance of the Solactive Global Cyber Security NTR Index. Although there is an annual management fee of 0.75%, the net dividends distributed to members are reinvested.

Risks: The aforementioned products do not have capital protection. Should the underlying assets deliver a negative performance; the Open End PERLES will incur commensurate losses. The currency risk must also be taken into account, as the trading currency of the products may differ from the currencies of the index members. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

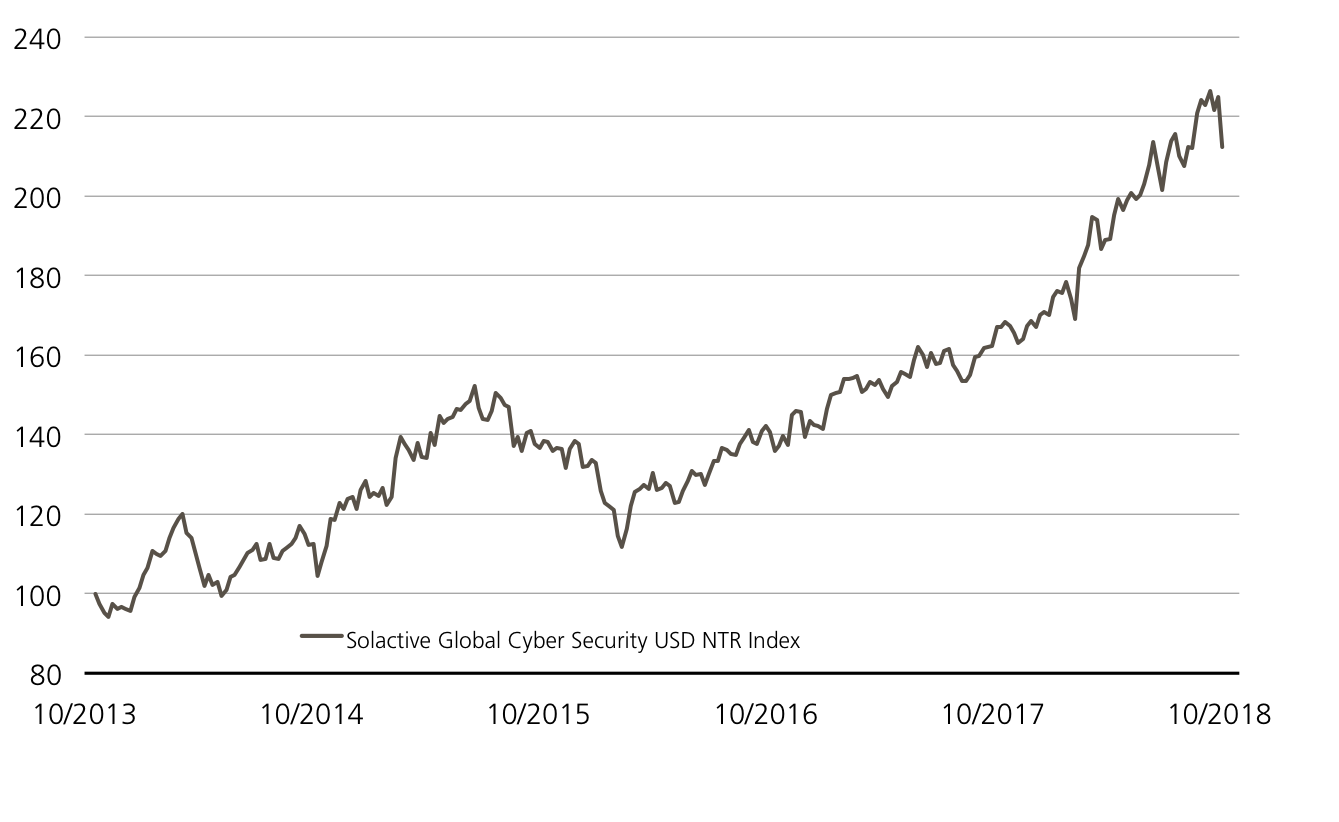

Solactive Global Cyber Security USD NTR Index since October 18, 2013 (launch day)¹

The IT security sector benefits from the increase in spending on security. This is impressively reflected in the Solactive Global Cyber Security Index, which has achieved an average return of 19.9% p.a. since its launch.

Source: UBS AG, Bloomberg

As of 10.10.2018

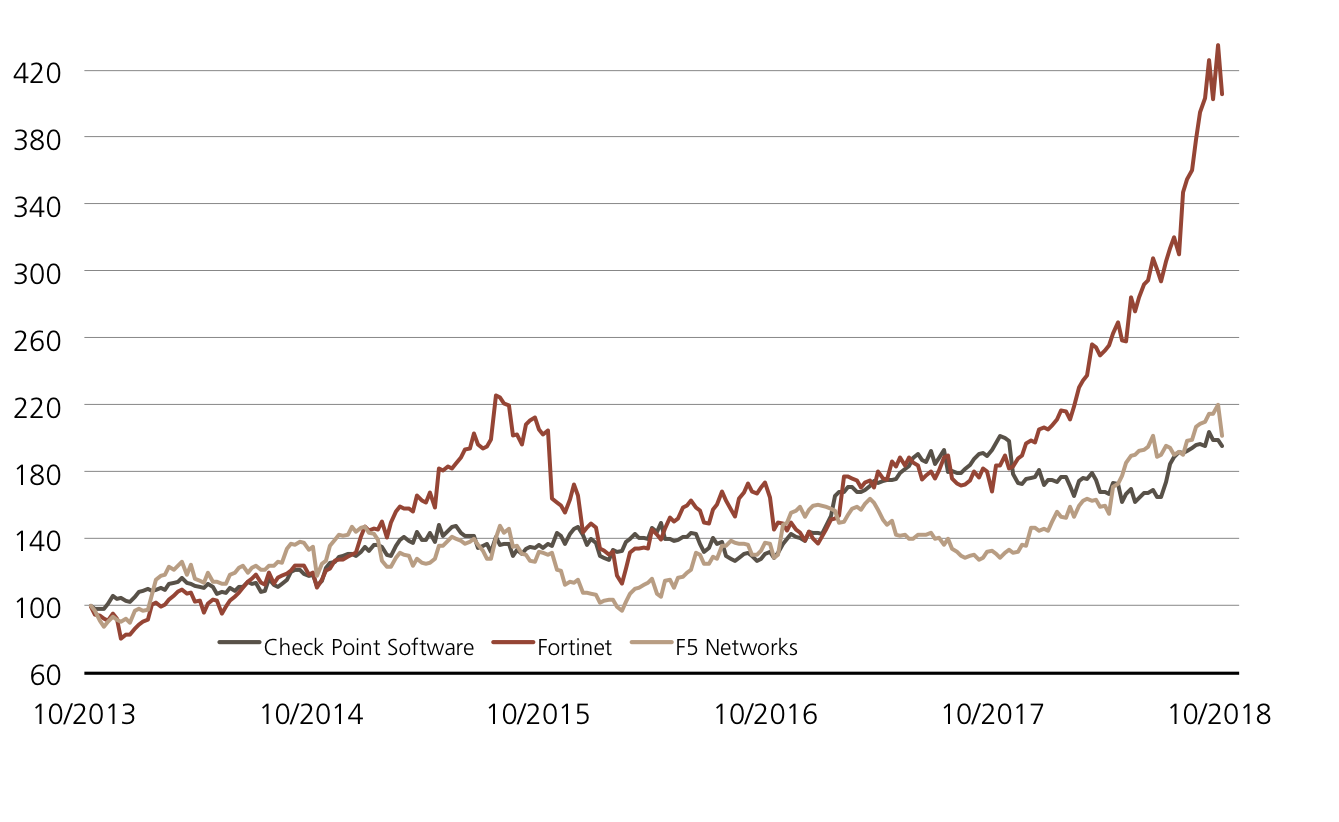

Check Point Software vs. Fortinet vs. F5 Networks (5 years) ¹

(for illustrative purposes only; figures in %)

The current heavyweights on the Solactive Global Cyber Security Index – Check Point Software, Fortinet and F5 Networks – are posting significant growth on a five-year basis. Fortinet has even recorded growth in excess of 400%.

Source: UBS AG, Bloomberg

As of: 10.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

Open End PERLES on Solactive Global Cyber Security NTR Index (CHF)

| Symbol | KCFJDU |

| SVSP Name | Tracker-Certificate |

| SPVSP Code | 1300 |

| Underlying | Solactive Global Cyber Security USD NTR Index |

| Ratio | 1:1 |

| Currency | CHF |

| Administration fee | 0.75% p.a. |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 200.10 / 202.20 |

Open End PERLES on Solactive Global Cyber Security NTR Index (USD)

| Symbol | KCFKDU |

| SVSP Name | Tracker-Certificate |

| SPVSP Code | 1300 |

| Underlying | Solactive Global Cyber Security USD NTR Index |

| Ratio | 1:1 |

| Currency | USD |

| Administration fee | 0.75% p.a. |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | USD 202.00 /204.00 |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 10.10.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’892.88 | -3.1% |

| SLI™ | 1’416.66 | -4.8% |

| S&P 500™ | 2’785.68 | -4.8% |

| Euro STOXX 50™ | 3’266.90 | -4.1% |

| S&P™ BRIC 40 | 3’829.43 | -4.9% |

| CMCI™ Compos. | 963.86 | -1.4% |

| Gold (troy ounce) | 1’193.40 | -1.4% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

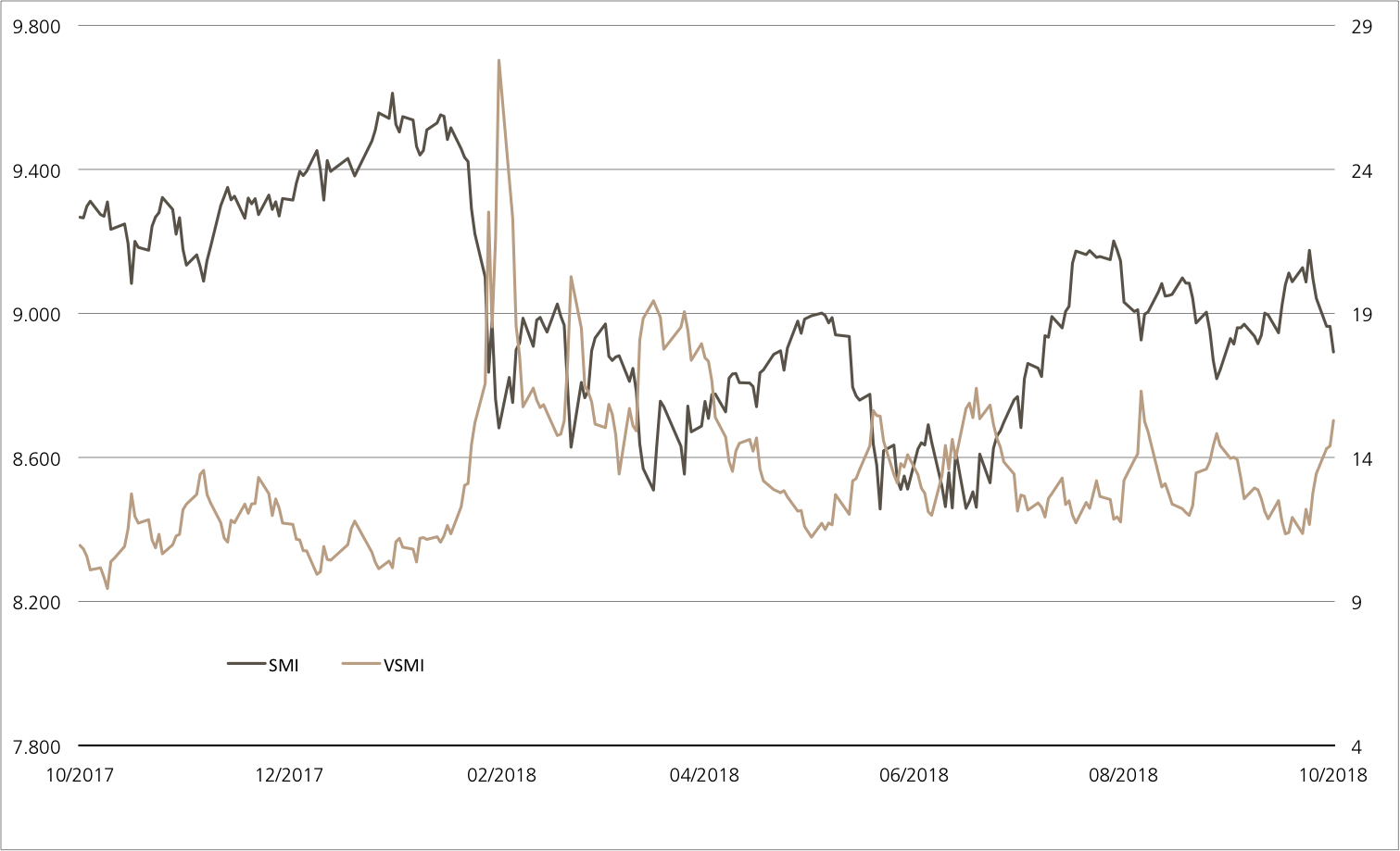

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 10.10.2018

Medical technology

A sector in upheaval

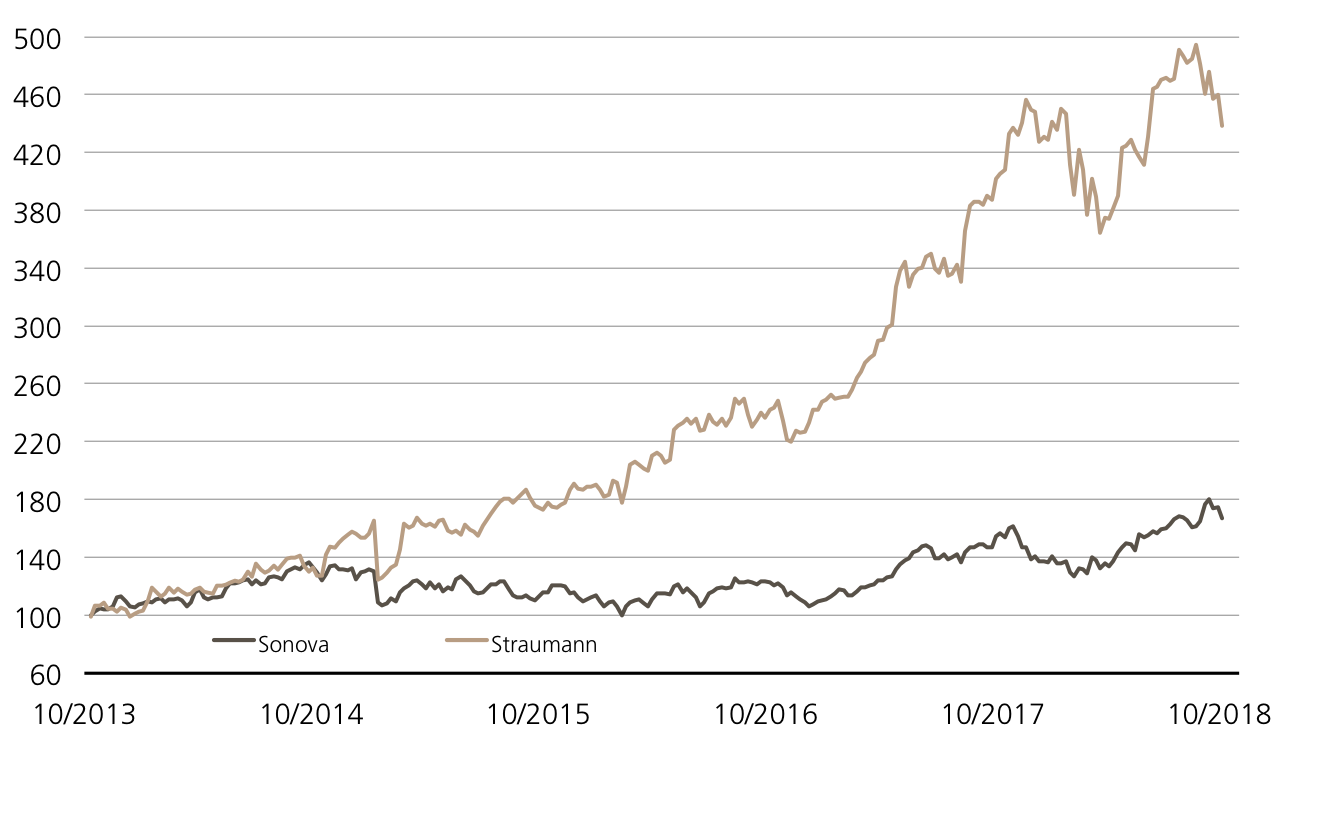

Commotion on the hearing aid market: The US company Bose, known for its speaker systems, has received FDA approval for a hearing aid. People with mild to moderate hearing loss can adjust the settings of this device to meet their needs. The increase in the competition on the market has placed the shares of Sonova under pressure, with the Swiss company’s equities losing about a tenth of their value following the announcement. Medical technology company Straumann also experienced a similar situation.¹ Weak tidings from the industry, among other things, has had a negative impact here. For example, Stratec Biomedical provided a huge surprise by issuing a profit warning. In view of the now reduced share prices of Sonova and Straumann, a partial protection product on the duo might make sense. The Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCQVDU) in subscription offers attractive conditions in this regard. If the barrier remains intact at 69% of the starting prices, the product will yield a maximum amount of 5% p.a. in 18 months at the latest.

Two factors should not be overlooked in the current weakness of Sonova’s share price: Firstly, the group started its extensive share buy-back program on October 10. The hearing aid manufacturer would like to spend up to 1.5 billion Swiss francs on this program. Secondly, an important investors’ day will be held on October 16. Market participants hope that Sonova will use the meeting to announce a new hearing aid that will outperform competing products. At Straumann, on the other hand, things will only start getting exciting at the end of October, as this is when the implant specialist will publish its results for the third quarter. The company’s half-year figures delivered a positive surprise, as management increased its forecast for organic growth in 2018 by some 15%.

Opportunities: The two aforementioned medical technology equities do not need to post price gains for the new ER Worst of Kick-In GOAL (symbol: KCQVDU) to yield the maximum return of 5% p.a. All that is required is that both equites remain above the barrier of 69% of the initial fixing levels during the 18-month term. However, due to the early redemption function, the maximum return can also be achieved earlier. For this to happen, Sonova and Straumann both have to be at or above the initial fixed price on one of the quarterly observation days (first date: October 24, 2019).

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Sonova vs. Straumann (5 years) ¹

(for illustrative purposes only; figures in %)

Source: UBS AG, Bloomberg

As of: 10.10.2018

5.00% p.a. ER Worst of Kick-In GOAL on Sonova / Straumann

| Symbol | KCQVDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Sonova, Straumann |

| Currency | CHF |

| Coupon | 5.00% p.a. |

| Kick-In Level | 69.00% |

| Expiry | 23.04.2020 |

| Issuer | UBS AG, London |

| Subscription until | 24.10.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 10.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.