Friday, 26.10.2018

- Topic 1: Low-volatility strategy - Get off the roller coaster

- Topic 2: Gold - The crisis currency moves up

Low-volatility strategy

Get off the roller coaster

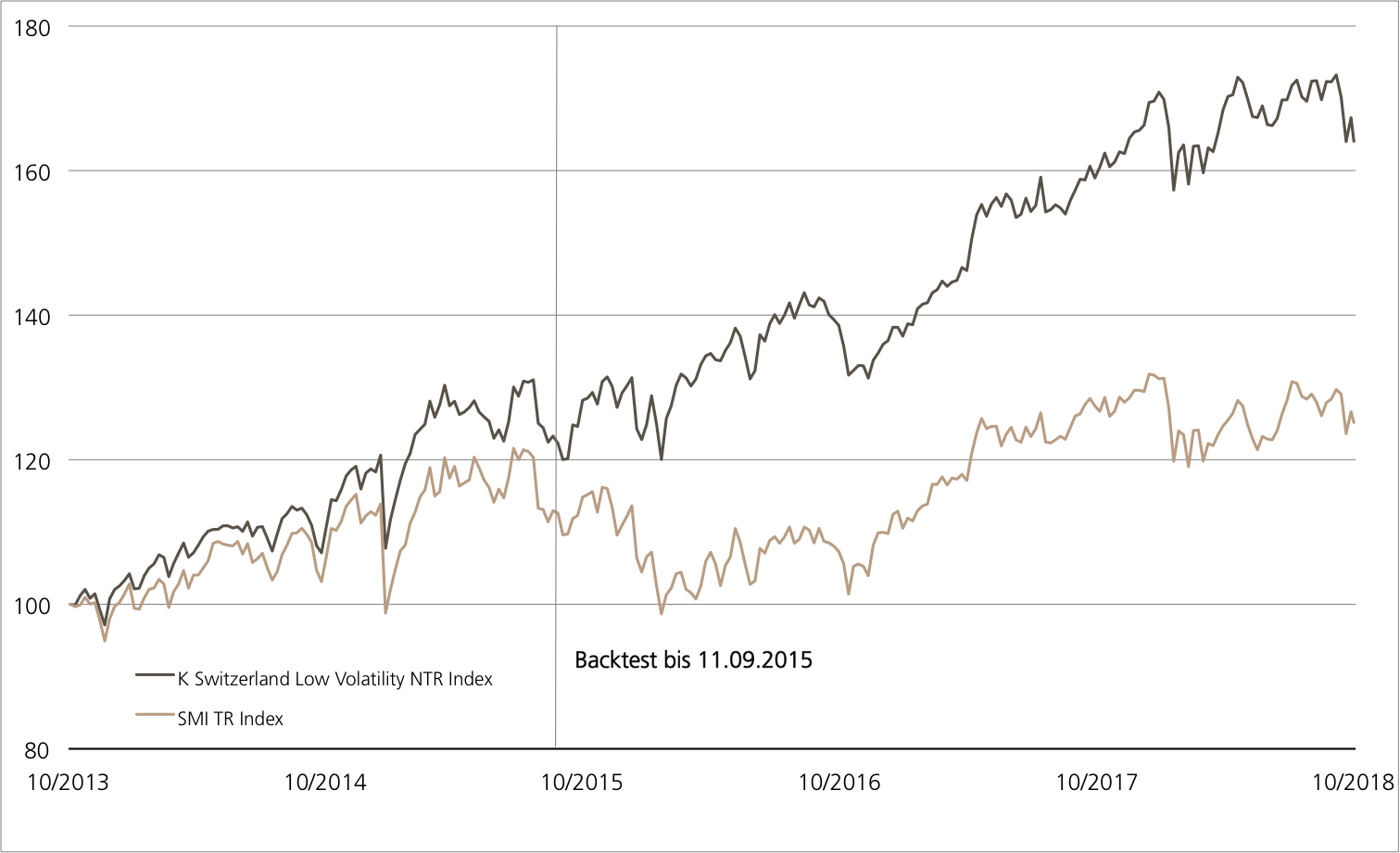

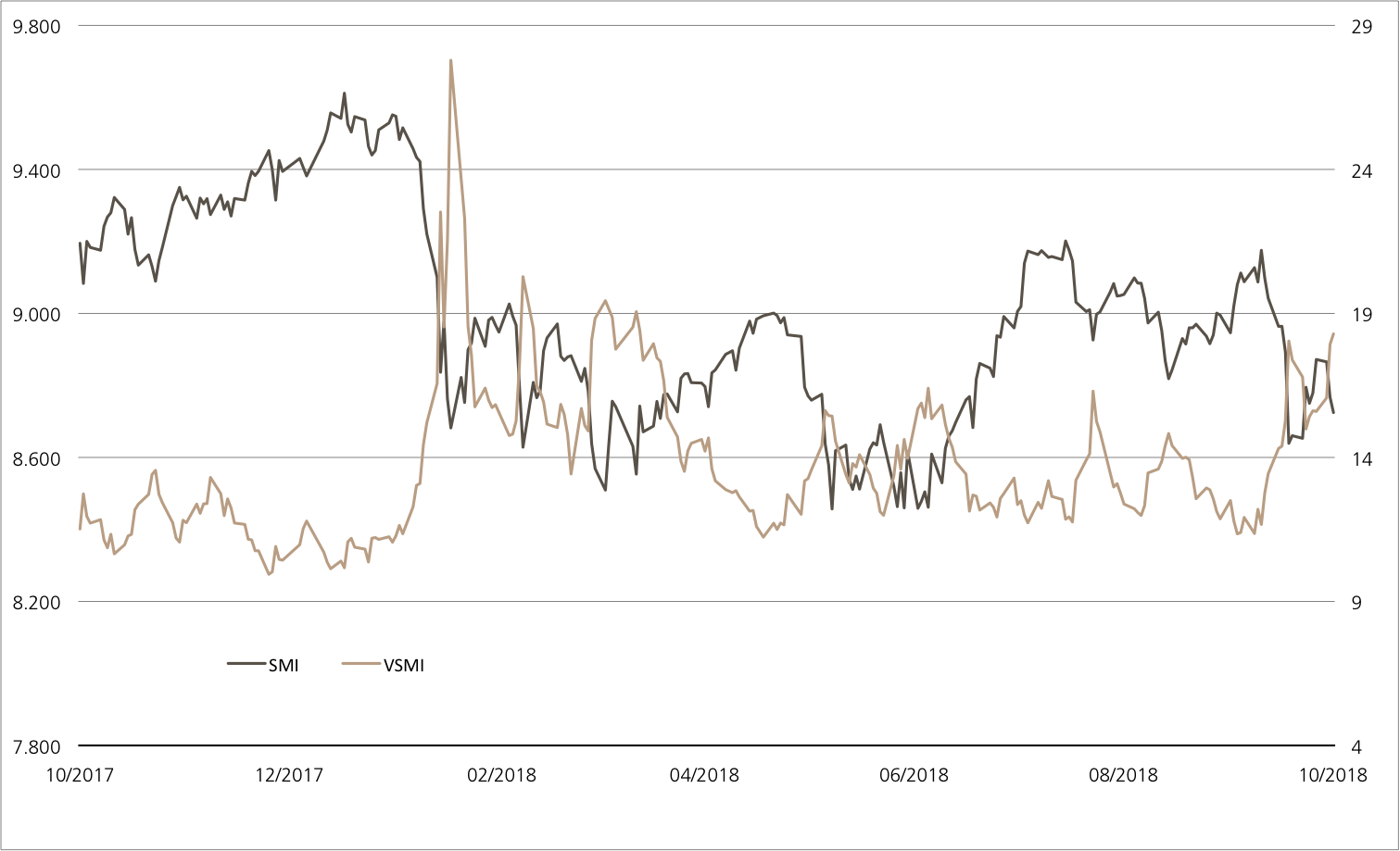

Trade disputes, Brexit chaos and a controversial Italian budget proposal – these three factors have been making life uncomfortable for investors recently. They have also caused the turbulence on the global equity markets to rise sharply. Collective sentiment is reflected in implied volatilities. The range of fluctuation priced into options shot up at the start of the fourth quarter (see chart). In an environment like this, investment strategies targeting stocks with relatively low volatility could come into their own once again. The same goes for the K Switzerland Low Volatility NTR Index. Year to date this underlying has extended its long-term outperformance of the SMITM.1 A PERLES (symbol: SOLVZU) can give investors exposure to this benchmark in their portfolio.

Performance on the Swiss equity market is something of a roller coaster at the moment. The SMITM gained 5.6% between July and September 2018. This was the strongest performance the domestic blue chip index had posted since the first three months of 2013. But it was not enough for a breakout to the upside. Instead, recent weeks have seen the SMITM move down smartly. Shortly before the end of October the performance for the month was down 3.5%.1 Over extended periods these ups and downs in prices reduce returns. Academic studies have demonstrated that portfolios of relatively low-volatility stocks beat the broader market in the long term. This puts them at odds with traditional capital market theory, which assumes that the more risk an investor takes, the higher the return on a diversified portfolio. Robert Haugen and James Heins documented the “low volatility anomaly” as long ago as 1972. Twenty years after that, US researchers Eugene Fama and Kenneth French published a three-factor model. One of the characteristics this featured as driving returns was low volatility.

This is the starting point for the K Switzerland Low Volatility Index. The benchmark is based on smart beta methodology. In other words, the composition of the index does not weight the constituent stocks by market capitalization in the traditional way. Instead, it implements a low-volatility strategy in the Swiss equity market. Candidates for inclusion come from the 300 companies with the largest capitalization. Every month a filter selects the 20 stocks with the lowest range of price fluctuations from this universe. Weightings are based on inverse volatility, so the less a stock price moves compared to the other index constituents, the higher its percentage. The weighting of a single component is capped at 10% to avoid cluster risk. The current composition of the K Switzerland Low Volatility Index reflects the full range of the domestic equity market: there are nine stocks in the SMITM and 11 second and third-liners. These include several shares which have been little affected by the recent market turbulence. Helvetia Holding, PSP Swiss Property and Lindt & Sprüngli, for example, have risen year to date¹.Opportunities: The PERLES is listed on SIX (symbol: SOLVZU) and is a way of taking a diversified position in the 20 lowest-volatility stocks on the Swiss equity market. The product replicates the K Switzerland Low Volatility Index for an annual management fee of 1.00%. Any dividends on the constituents are reinvested net in the underlying. The term is limited to a total of seven years, but this can be extended by the same period.

Risks: This product does not have capital protection. With a PERLES, losses are incurred if the underlying index falls. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

K Switzerland Low Volatility NTR Index vs. SMI™ TR Index

(5 years; for illustrative purposes only; figures in %)¹

The K Switzerland Low Volatility Index has risen in the past. Over a five-year period the smart beta benchmark has outperformed the SMITM considerably.

Source: UBS AG, Bloomberg

As of 25.10.2018

Helvetia Holding vs. Lindt & Sprüngli vs. PSP Swiss Property

(5 years; for illustrative purposes only; figures in %)¹

Insurance, chocolate and real estate are the industries Helvetia, Lindt & Sprüngli and PSP operate in, all of which have contributed to the recent outperformance of the K Switzerland Low Volatility Index.

Source: UBS AG, Bloomberg

As of: 25.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

PERLES on the K Switzerland Low Volatility Index

| Symbol | SOLVZU |

| SVSP Name | Tracker-Certifikat |

| SPVSP Code | 1300 |

| Underlying | K Switzerland Low Volatility Index |

| Ratio | 1:1 |

| Currency | CHF |

| Administration fee | 1.00% p.a. |

| Participation | 100% |

| Expiry | 17.04.20123 |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 251.25 / 252.75 |

K Switzerland Low Volatility Index – Composition as of 31.08.2018

| Helvetia | PSP Swiss Property |

| Baloise | Swiss Prime Site |

| Nestlé | Swiss Re |

| Kuehne & Nagel | Swiss LIfe |

| Swisscom | SGS |

| Lindt & Sprüngli | Schindler Holding |

| Geberit | Roche Holding |

| Givaudan | EMS Chemie |

| Partners Group | Barry Callebaut |

| Zurich Insurance | Pargesa Holding |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 25.10.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’724.61 | -0.3% |

| SLI™ | 1’358.59 | -2.9% |

| S&P 500™ | 2’656.10 | -5.5% |

| Euro STOXX 50™ | 3’130.33 | -3.5% |

| S&P™ BRIC 40 | 3’744.33 | -3.2% |

| CMCI™ Compos. | 949.39 | -1.6% |

| Gold (troy ounce) | 1’231.10 USD | 0.3% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 25.10.2018

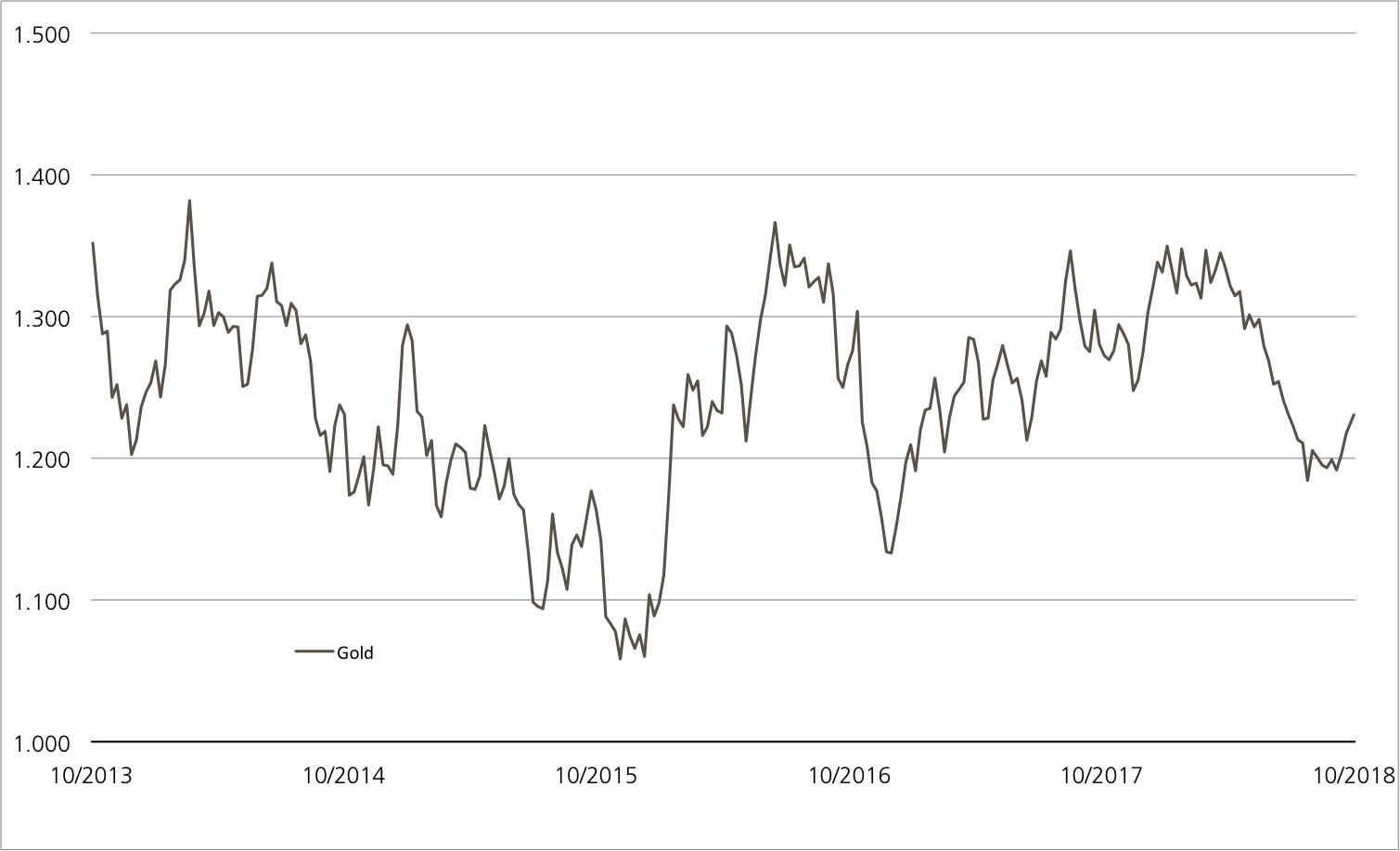

Gold

The crisis currency moves up

The weather may have been nice in October, but things were less agreeable on the stock market. As discussed on the preceding pages, equity market corrections pushed volatility up sharply. At the same time, gold showed signs of life. The crisis currency has risen 3.4% since the end of September.¹ Logically, the ETC (Symbol: CGCCIU) on the UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index broke out to the upside of its downward technical trend. This participation product makes it possible to take roll-optimized positions in the precious metal.

Most investor showed little interest in gold as a safe haven until the end of the third quarter. The steep increase in interest rates in the USA and the associated strength of the dollar weighed on it in particular. While the greenback itself remains in demand as a crisis currency and is holding up at a high level, the gold price has shot up in recent weeks. Clearly the rise in general uncertainty factors has driven increasing numbers of investors to switch to risk-off mode. The situation in Italy is of special concern for financial markets. The government of the right-wing Lega party and the populist Five Star movement is planning to raise far more new debt in 2019 than its predecessor had indicated. The EU Commission has rejected Rome’s draft proposal, something which has never happened before in the history of the Eurozone. “If trust is eroded, all Member States take damage, our union takes damage,” said Commission Vice-President Valdis Dombrovskis of this unprecedented step. Italy now has three weeks to react to the criticism and submit a new budget for 2019 to Brussels. (Source: Thomson Reuters media report, 23 October 2018)

Opportunities: The ETC (Symbol: CGCCIU) on the UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index allows investors to diversify their portfolios simply and cheaply. The product underlying replicates the gold price by using various futures contracts. As is typical for the CMCI index family, positions are taken across the entire forward curve and all liquid maturities. A hedging mechanism ensures that fluctuations between the US dollar (the currency gold is priced in) and the Swiss franc (the product currency) are neutralized every month.

Risks: This product does not have capital protection. With an ETC, losses are incurred if the underlying index falls. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Gold (in US dollars per fine ounce) 5 years¹

Source: UBS AG, Bloomberg

As of: 25.10.2018

ETC on the UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index

| Symbol | CGCCIU |

| SVSP Name | Tracker-Certifikat |

| SPVSP Code | 1300 |

| Underlyings | UBS Bloomberg CMCI Gold Monthly Hedged TR Index |

| Currency | CHF |

| Ratio | 10:1 |

| Administration fee | 0.38% p.a. |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 74.75 / 75.10 |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 25.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.