Friday, 02.11.2018

- Topic 1: US Information Technology - The Moment of Truth

- Topic 2: Industrial metals - A steely trio

US Information Technology

The Moment of Truth

The reporting season on Wall Street is in full swing. Quarterly results from Apple out this Thursday (after the US market closes) mark the high point of the current slew of numbers. Even though the figures we have already seen from the US tech sector have mostly been ahead of expectations, prices have been under pressure recently. The S&P 500™ Information Technology Index has fallen by 10.9% from all its all-time high at the start of the month.1 Investors who see this setback as a chance to get on board can use an ETT (symbol: ETINFU). The participation product replicates the S&P 500™ Information Technology Index with no time limitation and no management fees.2 An alternative to a 1:1 investment in the US IT sector is the Early Redemption (ER) Worst of Kick-In GOAL on Alphabet, Microsoft and Apple. The subscription product has a 9.5% annual coupon. The barriers are set at a low 60% of the initial prices of the sector trio.

Soon after the closing bell on Wall Street, on Thursday evening (after editorial deadline) a release from Apple will come over the ticker. The world’s largest listed company is announcing its results for the fourth quarter of its fiscal year 2017/2018 (to 30 September). CEO Tim Cook and his management team will also be holding a conference call at 10:00pm CET to talk in detail about recent business performance and the outlook for the key Christmas quarter. The sheer size alone of the iPhone manufacturer means the quarterly numbers are hugely important for Wall Street.

According to FactSet, profit announcements from IT companies in the earnings season so far have in general been one-tenth ahead of average analyst expectations. Of all sectors in the US, information technology has shown the second-largest beats. In the trading week to 26 October, consensus forecast earnings growth for the third quarter rose from 17.0% to 21.9%. Microsoft and Intel had a major influence on the upgrade. The two groups reported earnings per share for the past quarter 18.8% and 21.7% ahead of expectations respectively. (Source: FactSet, Earnings Insight, 26 October 2018.)Opportunities: The exchange traded tracker (ETT) (symbol: ETINFU) passively replicates the 65 stocks in the S&P 500™ Information Technology Index. Investors can use the liquid product to anticipate a rebound in the sector benchmark. A longer-term buy and hold strategy is also possible. Alphabet, along with Apple and Microsoft, is one of the underlyings for a new ER Worst of Kick-In GOAL (symbol: KCTKDU). An index reshuffle recently removed the Google parent company from the IT sector and put it in communication services. This has no impact on the opportunities for the subscription product: as long as none of the underlyings touch or fall below the 60% barrier, the investment ends with an annual return of 9.50%. The early redemption feature means early repayment with pro rata coupon is possible. This is conditional on all of Alphabet, Apple and Microsoft closing at or above the starting level on one of the quarterly observation days (first date: 7 November 2019).

Risks: The aforementioned products do not have capital protection. Should the underlying assets deliver a negative performance; the ETT will incur commensurate losses. If the underlyings on the Kick-In GOAL touch or fall below the respective Kick-In Level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

S&P 500™ Information Technology Index vs. S&P 500™ Index five years¹

Over the last five year, the IT sector has outperformed the broad US equity market by a considerable distance. The most recent correction has done little to reduce this massive differential.

Source: UBS AG, Bloomberg

As of 01.11.2018

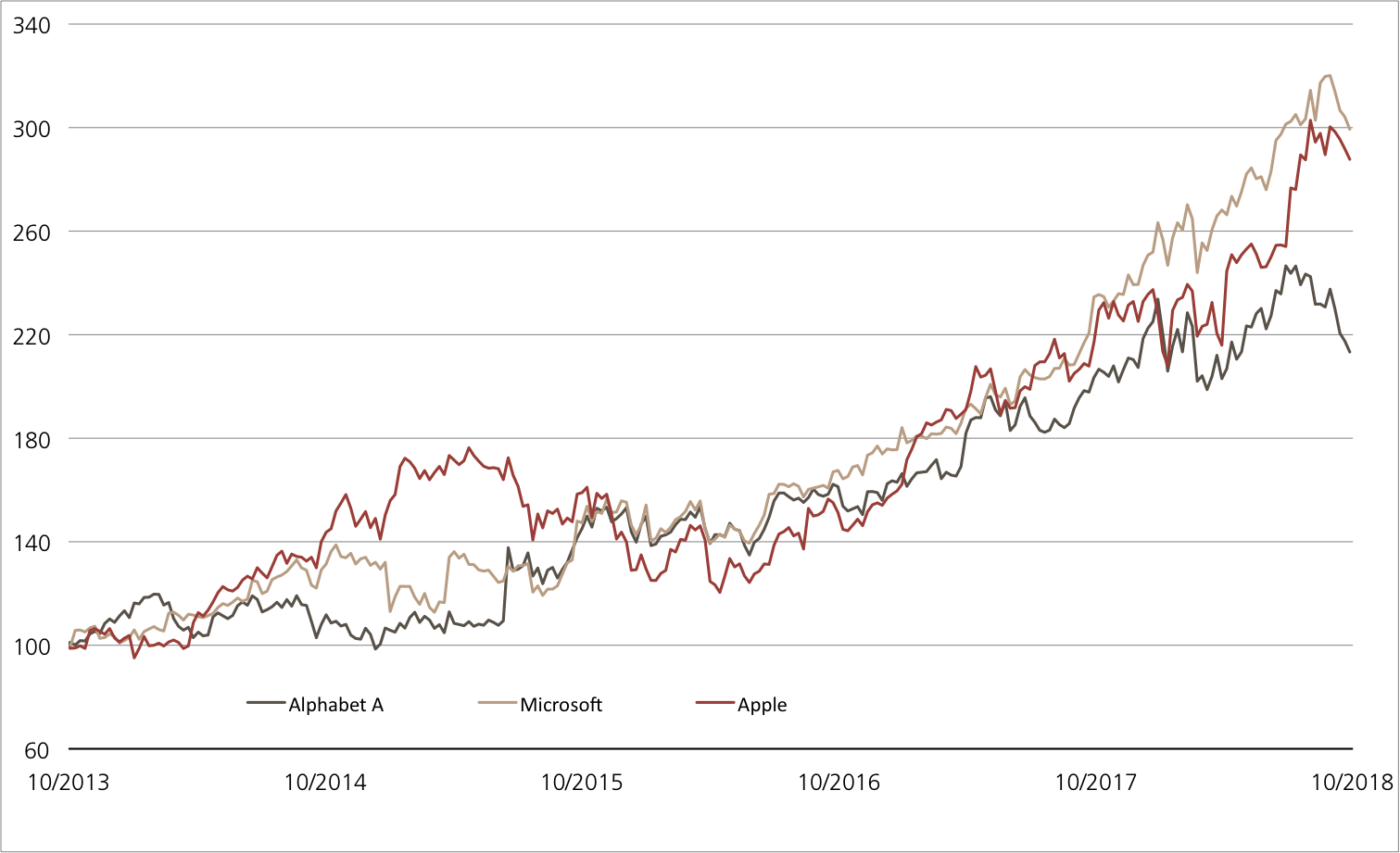

Alphabet A vs. Microsoft vs. Apple five years¹

Microsoft enjoys a run: over five years the software stock has even done slightly better than Apple. Google

parent company Alphabet can no longer keep up with those two.

Source: UBS AG, Bloomberg

As of: 01.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETT on S&P 500™ Information Technology Index

| Symbol | ETINFU |

| SVSP Name | Tracker Certifikat |

| SPVSP Code | 1300 |

| Underlying | S&P 500™ Information Technology Index |

| Currency | USD |

| Ratio | 1:1 |

| Administration fee | 0.00% p.a.² |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | USD 1’213.00 / 1’215.00 |

9.50% p.a. ER Worst of Kick-In GOAL auf Alphabet / Microsoft / Apple

| Symbol | KCTKDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | Alphabet A / Microsoft / Apple |

| Currency | USD |

| Coupon | 9.50% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 23.10.2020 |

| Issuer | UBS AG, London |

| Subscription until | 07.11.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 01.11.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 9’022.16 | 3.4% |

| SLI™ | 1’420.48 | 4.6% |

| S&P 500™ | 2’711.74 | 2.1% |

| Euro STOXX 50™ | 3197.51 | 2.1% |

| S&P™ BRIC 40 | 3’787.34 | 1.1% |

| CMCI™ Compos. | 928.22 | -2.2% |

| Gold (troy ounce) | 1’215.00 USD | -1.3% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

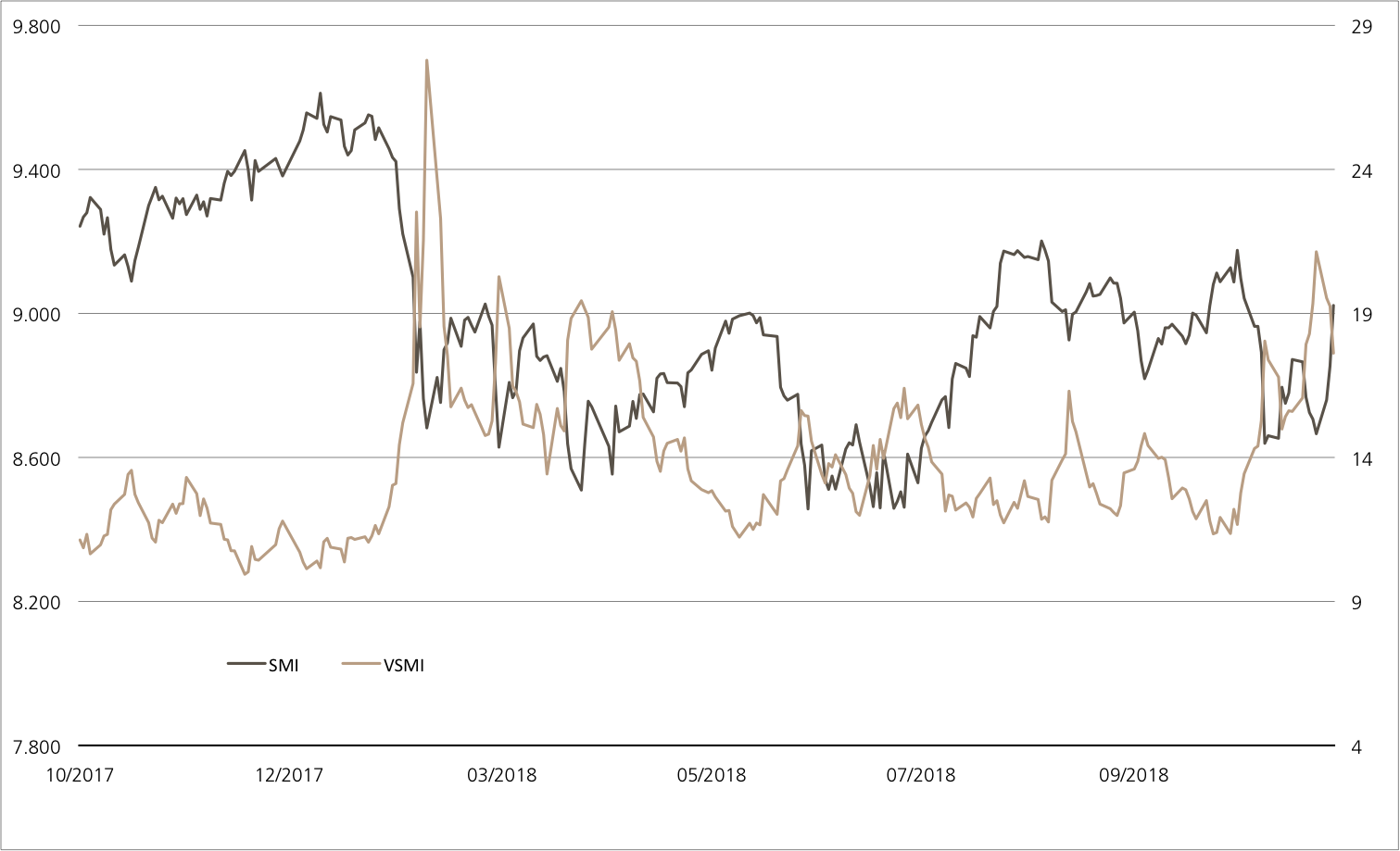

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 01.11.2018

Industrial metals

A steely trio

The commodity market overall has been stable year to date, but industrial metals stocks are mostly down. The segment has been hit by concerns about an economic slowdown as a result of the burgeoning trade dispute. Although actual demand for metal continues to be robust, stocks in the sector are under pressure. UBS has combined three sector representatives (US Steel, ArcelorMittal and Rio Tinto) in a Callable Worst of Kick-In GOAL (symbol: KCTUDU). The product pays an annual coupon of 11.00% regardless of price performance. This opportunity comes with a 46% safety buffer.

On 16 October, the World Steel Association published its short-term market outlook. They assume that global demand for steel will rise by 3.9% to 1,657.9 million tonnes this year. In 2019, the market will grow a further 1.4% to 1,681.2 million tonnes. Not surprisingly, the 2018 forecast sees the largest increase in demand in emerging markets. Growth in Asia-Oceania, the largest market for sales due to Chinese demand, is expected to be 5.0%. However, the association also points out that risks have risen too, mentioning rising trade tensions and volatile exchange rates. (Source: World Steel Association, press release, 16 October 2018)

These are precisely the factors holding the sector back on the stock market. Take ArcelorMittal: the world’s largest steel producer lost 20% of its capitalization in a month. According to Thomson Reuters, analysts expect the group to boost profit by 22% this year. Whether and to what extent this is realistic will become clearer on 1 November (after our publication deadline). That is when the company releases its third quarter figures. On Friday 2 November US Steel, another major sector player, announces its quarterly earnings.

Opportunities: The two steel producers and Rio Tinto have been selected as the underlyings for a new Callable Worst of Kick-In GOAL (symbol: KCTUDU). One of the miner’s products is iron ore, a key input for making steel. Provided none of the three stocks touch or fall below the barrier at a low 54% of the initial prices, the structured product pays a maximal return in line with the 11.00% annual coupon on maturity. Important: The issuer has a call option. If it exercises the callable function on one of two possible dates, holders receive nominal plus the pro rata coupon.

Risks: Kick-In GOALs do not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

US Steel vs. ArcelorMittal vs. Rio Tinto 5 years¹

Source: UBS AG, Bloomberg

As of: 01.11.2018

11.00% p.a. Callable Worst of Kick-In GOAL on US Steel / ArcelorMittal / Rio Tinto

| Symbol | KCTUDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | US Steel / ArcelorMittal / Rio Tinto |

| Currency | EUR (Quanto) |

| Coupon | 11.00% p.a. |

| Kick-In Level | 54.00% |

| Expiry | 31.10.2019 |

| Issuer | UBS AG, London |

| Subscription until | 07.11.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 01.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.