Friday, 30.11.2018

- Topic 1: G20 summit - Tango of the superpowers

- Topic 2: Logitech/Oerlikon/Straumann - An interesting mid-cap trio

G20 summit

Tango of the superpowers

On November 30th and December 1st, the heads of states and governments of the leading economies will meet for the G20 summit; However, the spotlight in Buenos Aires will mainly be on Donald Trump und Xi Jinping. The US President and his Chinese counterpart may potentially discuss the current trade dispute in a private meeting. According to UBS CIO GWM, signs that tensions are easing would be met with open arms on the markets. The experts believe it possible that positive surprises will occur in two other areas with a view to the coming months. This assessment was the reasoning behind CIO GWM increasing the overweighting of global equities in the asset allocation. With an ETT (symbol: ETWRLD) on the MSCI™ World Net Total Return Index, investors can replicate this strategy. A global approach can also be taken with the Callable Kick-In GOAL (symbol: KCWDDU) on EURO STOXX 50™, S&P 500™ and SMI™. Nevertheless, this product is not reliant on rising prices to deliver the maximum annual return of 6%. Rather, the three prominent indexes start the two-year term with a safety buffer of 45%.

It’s the ultimate event – the countries that will be in attendance at the G20 summit represent 85% of the global economic output and 75% of global trade. They also are home to two-thirds of the world’s population (source: www.g20.org). One of the main topics of the summit will be the trade dispute between the US and China, which has been simmering for months. In the run-up to the event, hopes were not particularly high that a potential face-to-face meeting between US President Donald Trump and China’s ruler Xi Jinping would lead to a solution. CIO GWM is generally of the same opinion. However, the experts believe that there is a 20% chance of a market-friendly result, for example in the form of at least a temporary agreement.

Looking ahead to the coming months, CIO GWM has identified two additional areas where there could be positive surprises. For example, it states that China is attempting to compensate for the negative effects of US punitive tariffs with fiscal measures and by adjusting its monetary policy. According to CIO GWM, there are signs that this proactive attitude is beginning to take effect. In addition, growth in Europe in the first half of 2019 could produce a positive surprise. Meanwhile, CIO GWM identifies the main risks as being an escalation of the tariff dispute and US interest rate hikes exceeding expectations. Following the recent equity market correction, strategists believe that it is now a favorable time to enter the market. This is also due to the drop in the valuation level and the potential for surprises outlined above. (Source: UBS CIO GWM: “UBS House View Monthly Letter”, November 15, 2018)Opportunities: The ETT (symbol: ETWRLD) on the MSCI™ World Net Total Return Index allows investors to take up a diversified position on the global equity market. More than 1,600 companies from 23 developed countries are contained in the underlying. The Callable Kick-In GOAL (symbol: KCWDDU) on EURO STOXX 50™, S&P 500™ and SMI™ offers an alternative to direct participation in the global benchmark. Irrespective of the performance of the underlying indexes, the product pays a coupon of 6% per year. As long as none of the underlyings equal or fall below the barrier at a low 55% of the initial prices, investors will receive their nominal repaid in full on the date of maturity. If the issuer exercises the callable function, the term can be ended after just one year. Starting with December 5, 2019, there is a right to termination every three months.

Risks: The aforementioned products do not have capital protection. The ETT will make a loss if the underlying index decreases. If the underlying assets for the Kick-In GOALs touch or fall below the respective kick-in level and the callable feature does not apply, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the three indexes (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

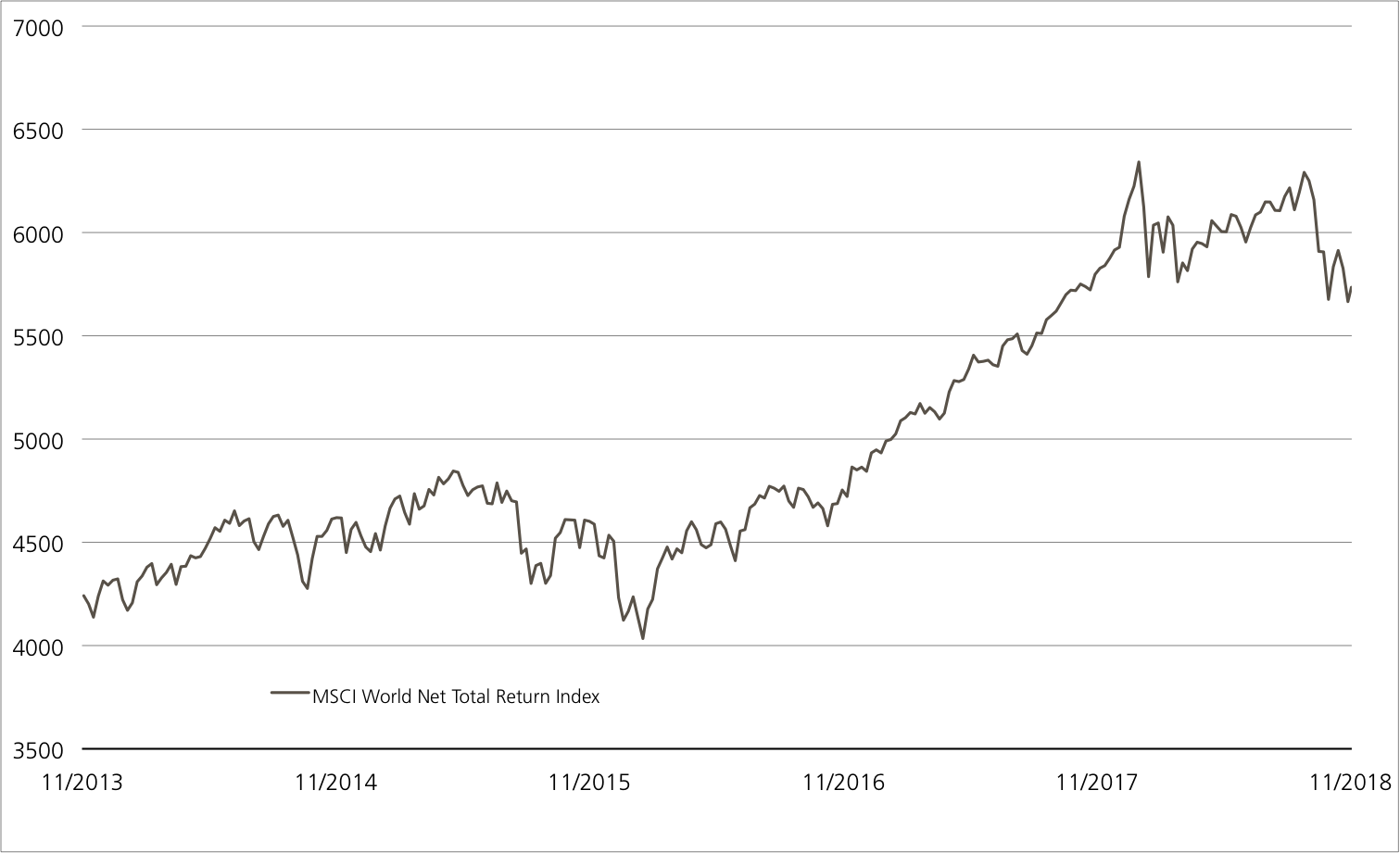

MSCI™ World Net Total Return Index 5 years¹

At the end of September, the “world select” came very close to equaling the all-time high reached at the beginning of 2018. Shortly before this summit, however, the MSCI™ World Net TR Index suffered a downturn.

Source: UBS AG, Bloomberg

As of 28.11.2018

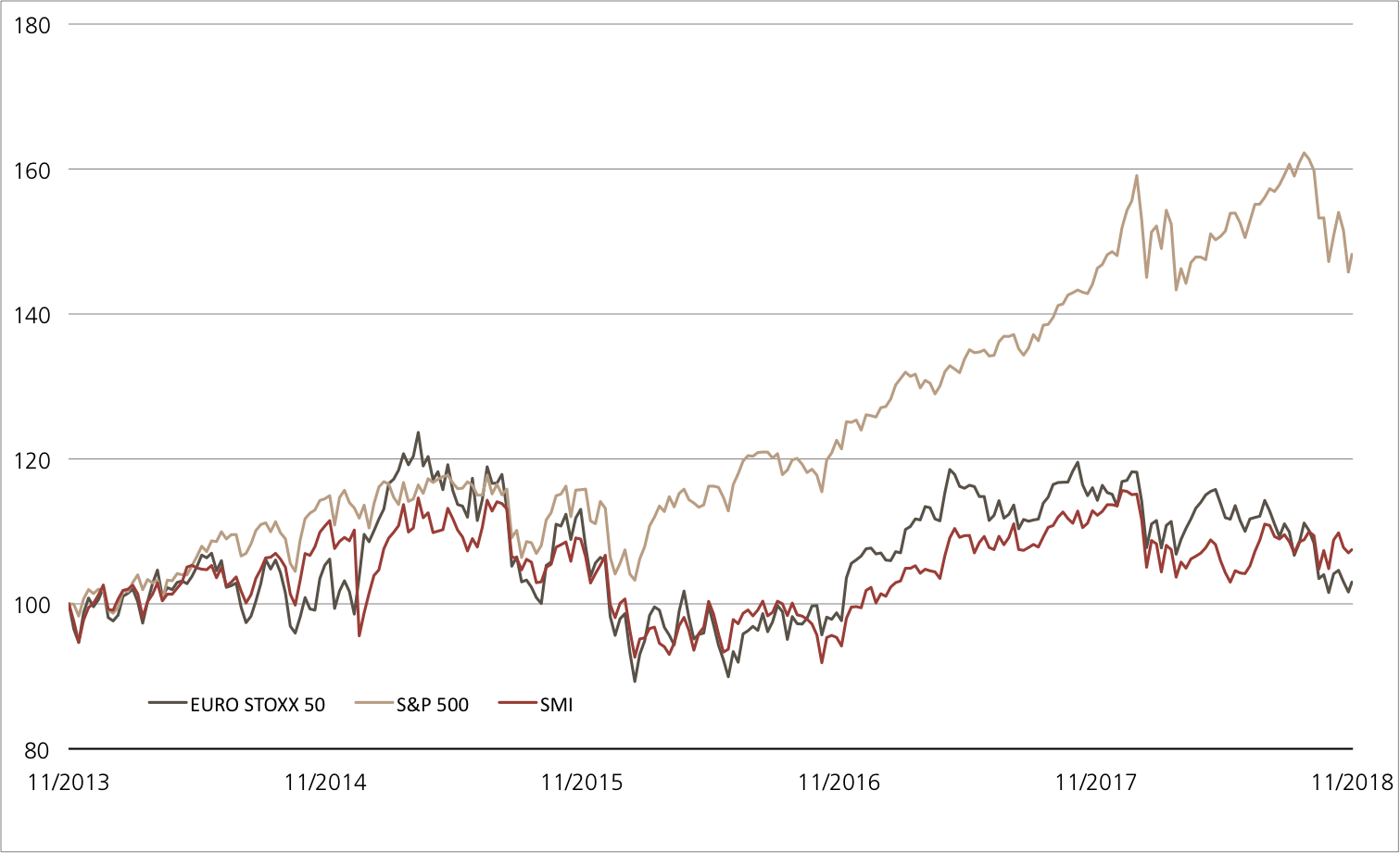

EURO STOXX 50™ vs. S&P 500™ vs. SMI™

(5 years; for illustrative purposes only; figures in %)¹

For the past five years, Wall Street has been the measure of all things related to the global equity markets. Compared to the S&P 500™, the European benchmarks are clearly lagging behind.

Source: UBS AG, Bloomberg

As of: 28.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

6.00% p.a. Callable Worst of Kick-In GOAL on EURO STOXX 50™ / S&P 500™ / SMI™

| Symbol | KCWDDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | EURO STOXX 50™ / S&P 500™ / SMI™ |

| Currency | USD |

| Coupon | 6.00% p.a. |

| Kick-In Level | 55.00% |

| Expiry | 07.12.2020 |

| Issuer | UBS AG, London |

| Subscription until | 05.12.2018, 14:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 28.11.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’894.58 | 0.6% |

| SLI™ | 1’377.63 | 0.7% |

| S&P 500™ | 2’743.49 | 3.5% |

| Euro STOXX 50™ | 3’168.29 | 0.5% |

| S&P™ BRIC 40 | 3’956.98 | 2.7% |

| CMCI™ Compos. | 881.07 | -2.0% |

| Gold (troy ounce) | 1’229.80 USD | 0.1% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

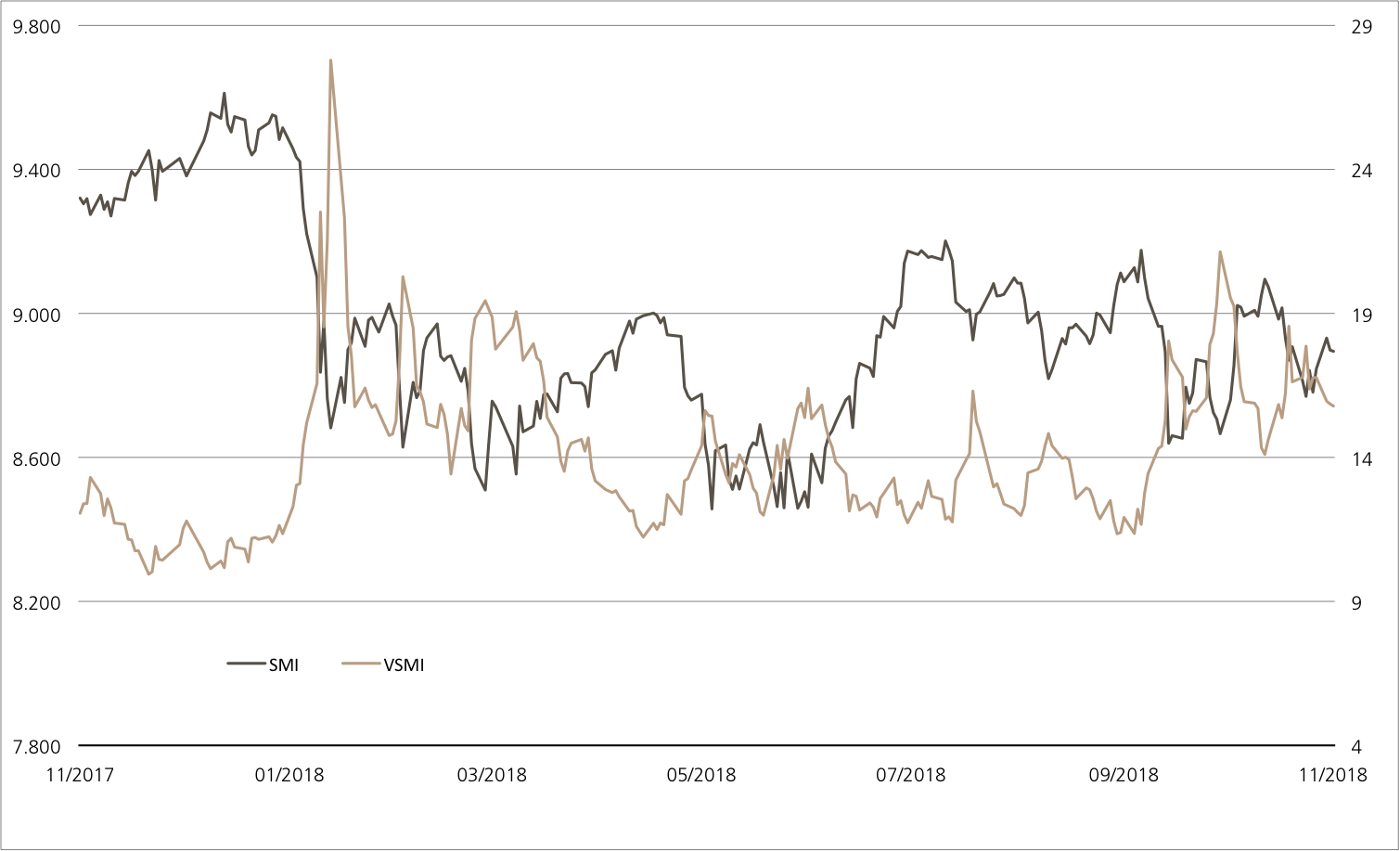

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 28.11.2018

Logitech/Oerlikon/Straumann

An interesting mid-cap trio

There is a distinct lack of good news on the stock market in these current tense times. And yet, there are instances here and there, for example at Straumann. The leading implant manufacturer from Basel has already increased its forecast twice this year due to its flourishing business. There is also exciting news at Logitech. Last weekend, the computer accessories manufacturer ended takeover talks with US headphone manufacturer Plantronics. Meanwhile, the OC Oerlikon industrial group announced its plans to further expand its partnership with Airbus. The new Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCWPDU) offers investors the opportunity to invest in the Swiss mid-cap trio with conditional partial protection. The product pays out a double-digit percentage coupon of 10% every year and also provides a risk buffer of 40%.

Straumann is currently enjoying strong growth. In the third quarter, organic sales growth amounted to 18.1% and was thus two percentage points higher than expected. As a result, the dental specialist raised its forecast for the year once again. Organic growth in the high (previously: medium) 10% range and a further improvement in the EBITDA margin are now expected for 2018. CEO Marco Gadola is happy with the strong product range, such as the new mini implants with a diameter of just 2.4 millimeters. Logitech also wanted to bring in new products and thus focused on US headphone manufacturer Plantronics. According to Thomson Reuters, the transaction would have cost more than USD 2.2 billion, which would be by far the largest acquisition made by Logitech. However, according to insiders, the deal collapsed due to differing price expectations. (Source: Thomson Reuters media report, November 26, 2018) In the meantime, Oerlikon is enjoying continuing organic growth. The group’s Surface Solutions segment has been awarded the prized status of “Qualified Supplier” by Airbus. In addition, Oerlikon confirmed its targets for 2018 after recording pleasing nine-month figures.

Opportunities: The ER Worst of Kick-In GOAL (symbol: KCWPDU) is the perfect solution for investors wanting to include the SMIM™ shares in their portfolios. The product available for subscription pays an annual coupon of 10% regardless of the price performance of the three shares. The repayment of the nominal is linked to the underlyings. Provided that the barrier of 60% of the starting prices remains intact, investors will remain safe from losses. The maximum return can also be achieved earlier due to the early redemption function. Requirement: The underlyings all have to be at or above their starting price on one of the quarterly observation days (first date: June 4, 2019).

Risks: ER Kick-In GOALs do not have capital protection. If the underlyings equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the three shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

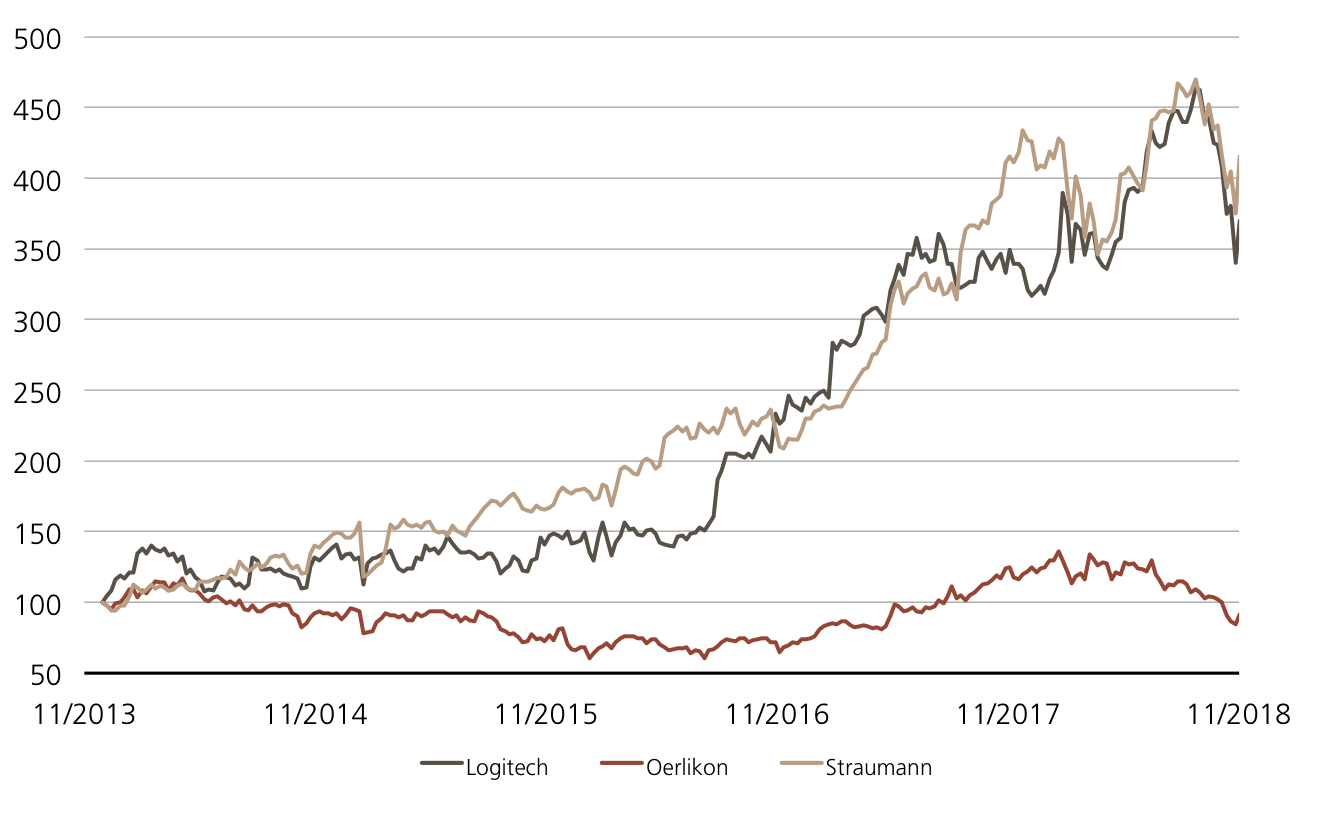

Logitech vs. OC Oerlikon vs. Straumann

(5 years; for illustrative purposes only; figures in %)¹

Source: UBS AG, Bloomberg

As of: 28.11.2018

7.00% p.a. ER Kick-In GOAL on Continental, Michelin

| Symbol | KCWPDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Logitech / OC Oerlikon / Straumannn |

| Currency | CHF |

| Coupon | 10.00% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 05.06.2020 |

| Issuer | UBS AG, London |

| Subscription until | 05.12.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 28.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.