Friday, 01.02.2019

- Topic 1: Gaming Industry Basket - Play and win

- Topic 2: BP / Total / Royal Dutch Shell - Integrated oil companies post their results

Gaming Industry Basket

Play and win

Football is played everywhere; on the field next door, in the schoolyard and even on the beach. But the popular sport is encountering increasing “digital” competition. Virtual kicking is on the march. The Fifa computer game developed by the listed US group Electronic Arts (EA) claims to have sold over 260 million units, making it the most successful video sport game of all time. (Source: EA, media report, 05.09.2018) Given the growth numbers, it is no wonder that the competition is constantly increasing. According to the market research company Newzoo, the global games market likely grew by a total 13.3% in 2018 to USD 137.9 billion. (Source: Newzoo, 02.11.2018) Now UBS is giving investors the ability to take a broadly diversified position in this fast-growing segment via the brand new PERLES on the gaming industry basket (symbol: GAMECU).

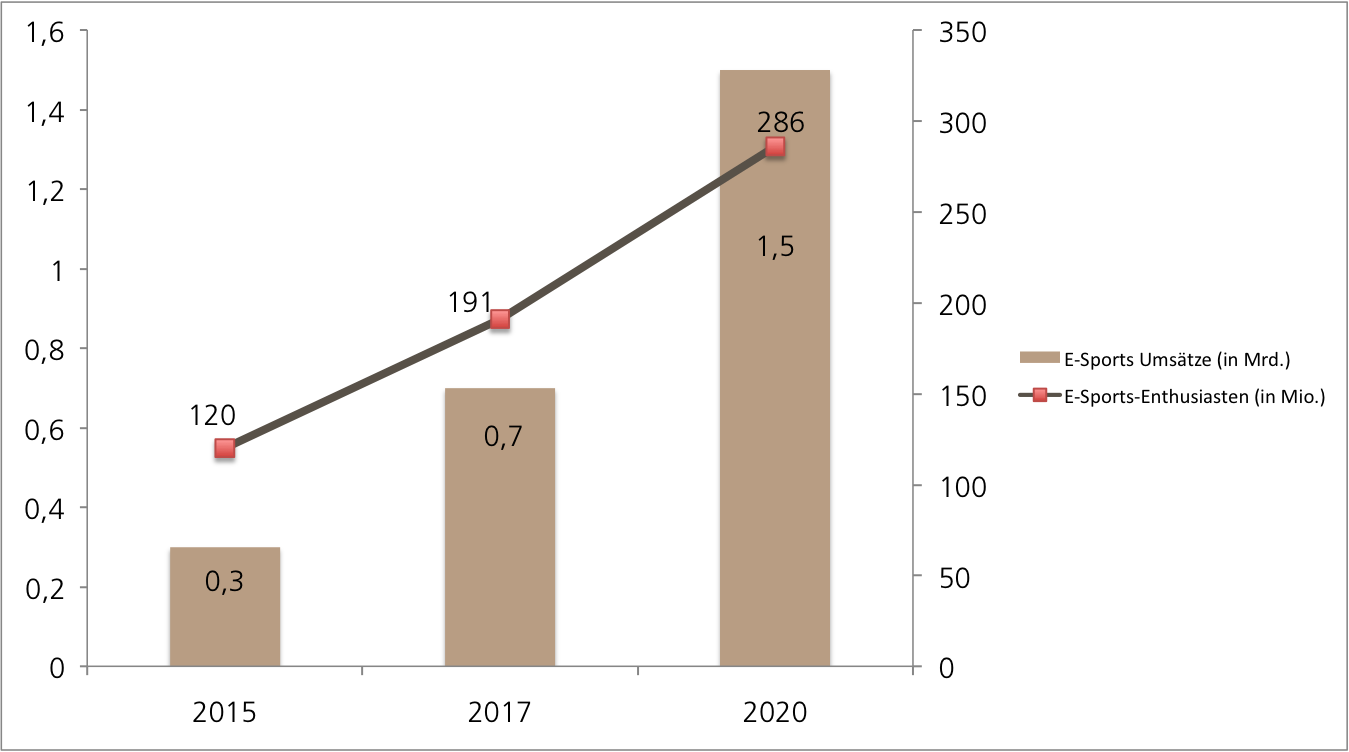

One of the growth drivers in the sector is e-sports. The market for sporting competitions between people using computers has more than doubled in recent years. According to UBS CIO GWM it will grow by another 100% to USD 1.5 billion by 2020. The number of e-sports enthusiasts will rise to 286 million by that date. This is equivalent to growth of around 50% compared to 2017. (Source: UBS CIO GWM, Global e-leisure, 21.01.2019)

Geographically, China sets the pace in the global e-gaming segment. The experts at Newzoo expect that last year the country was once again the largest gaming market in the world at USD 34.4 billion. (Source: Newzoo, 03.08.2018) But it’s not just the Chinese who are fanatical about gaming, the whole of Asia loves it. UBS CIO GWM assumes that sales of video games in Asia will rise to USD 200 billion by 2030, equivalent to an annual average growth rate of 9.5%. (Source: UBS CIO GWM, Game on, Asia, 19.09.2018) As in many other areas of life, gaming too is seeing the trend towards mobile. According to the researchers at Newzoo, mobile games were the largest segment in the global gaming market in 2018, accounting for 47%. The experts think that the shift towards mobile platforms, and especially towards smartphones, will continue in 2019. Newzoo is forecasting that the global market for mobile games will grow to USD 174 billion by 2021, giving it 52% of total revenues. (Source: Newzoo, 02.11.2018) The largest developer of online games is currently Tencent. Recently the Chinese firm has been suffering from the government’s pause on authorizing new games in view of protecting minors and combating gambling addiction. This has dampened growth at Tencent in the recent past. This year, however, the authorities have again started issuing sales permits, causing the stock price to rise.¹Opportunities: The gaming specialists just mentioned, Electronic Arts and Tencent, are only two of the companies in the new gaming industry basket. They also include Japanese developer Nexon, Take-Two Interactive from the US and the cult firm Nintendo. There are a total of 13 international companies in the well-diversified basket, which consists of Ubisoft of France plus half each from Asia and the USA. The PERLES, which is open for subscription (symbol: GAMECU), allows investors to participate in this innovation-driven growth sector one-to-one (minus a management fee of 0.50% p.a.). Dividends are taken into account on a net basis. At the start of the basket the constituents are all equally weighted, the product term is seven years.

Risks: This product does not have any capital protection. With a PERLES, losses are incurred if the underlying basket falls below the entry price. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

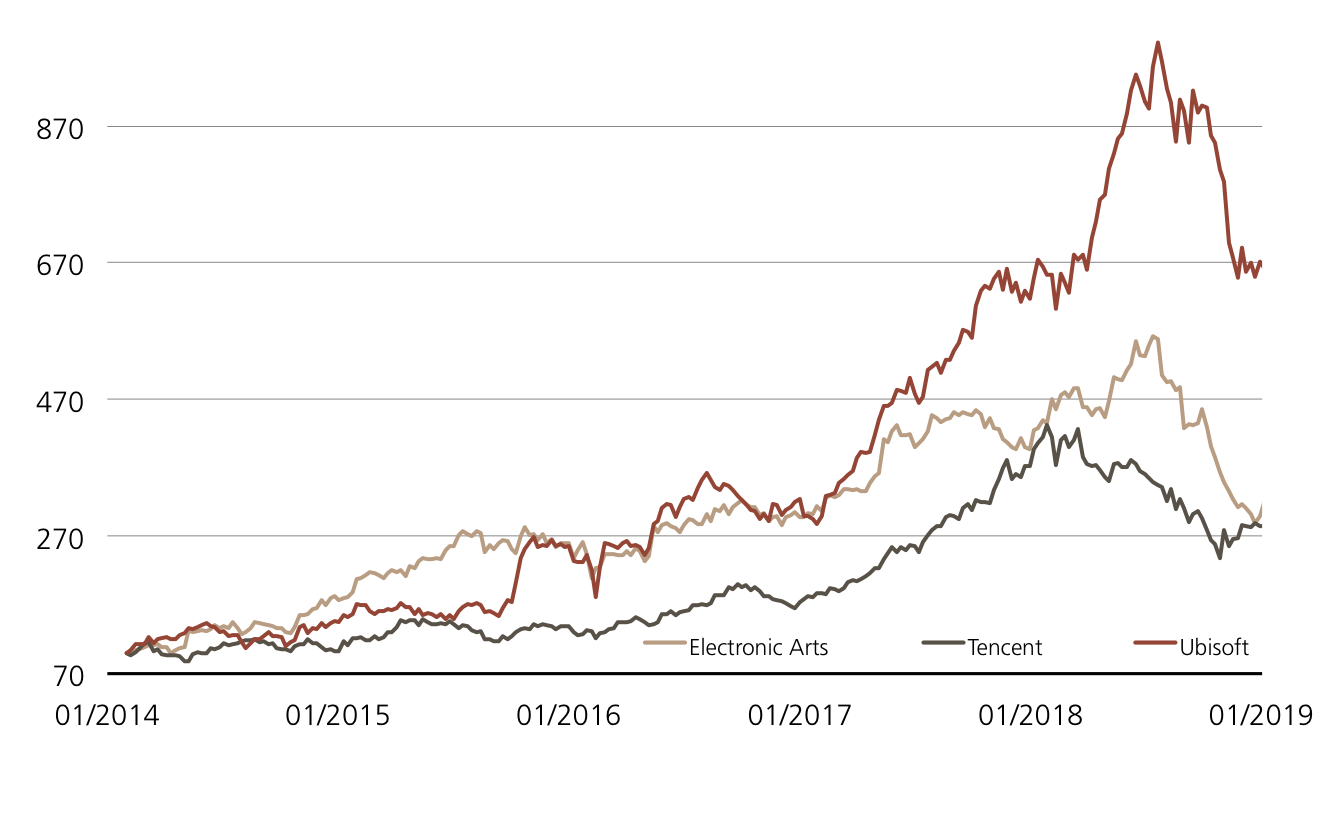

Electronic Arts vs. Tencent vs. Ubisoft

(5 years; for illustrative purposes only; figures in %)

The international gaming trio Electronic Arts, Tencent and Ubisoft have seen their stock prices multiply in recent years. Recently there has been a correction, which is just bottoming out.

Source: UBS AG, Bloomberg

As of 30.01.2019

Forecast growth in revenue and players in e-sports (2015 to 2020)

Experts are predicting that both revenue and the number of players will rise sharply in e-sports in the next few years. (Source: UBS CIO GWM, Global e-leisure, 21.01.2019)

Source: UBS AG, Bloomberg

As of: 30.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

Basekt members at a glance

| Company | Weighting |

| Tencent | 7.6923% |

| Nintendo | 7.6923% |

| Electronic Arts | 7.6923% |

| Take-Two Interactive Softw. | 7.6923% |

| NetEase | 7.6923% |

| Zynga | 7.6923% |

| Nexon | 7.6923% |

| Turtle Beach | 7.6923% |

| Kingsoft | 7.6923% |

| Sea | 7.6923% |

| Ubisoft Entertainment | 7.6923% |

| Bandai Namco | 7.6923% |

| Square Enix | 7.6923% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 30.01.2019

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’965.71 | 0.1% |

| SLI™ | 1’394.47 | 0.3% |

| S&P 500™ | 2’681.05 | 1.6% |

| Euro STOXX 50™ | 3’161.74 | 1.6% |

| S&P™ BRIC 40 | 4’130.54 | 2.6% |

| CMCI™ Compos. | 906.03 | 1.1% |

| Gold (troy ounce) | 1’315.50 USD | 2.5% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

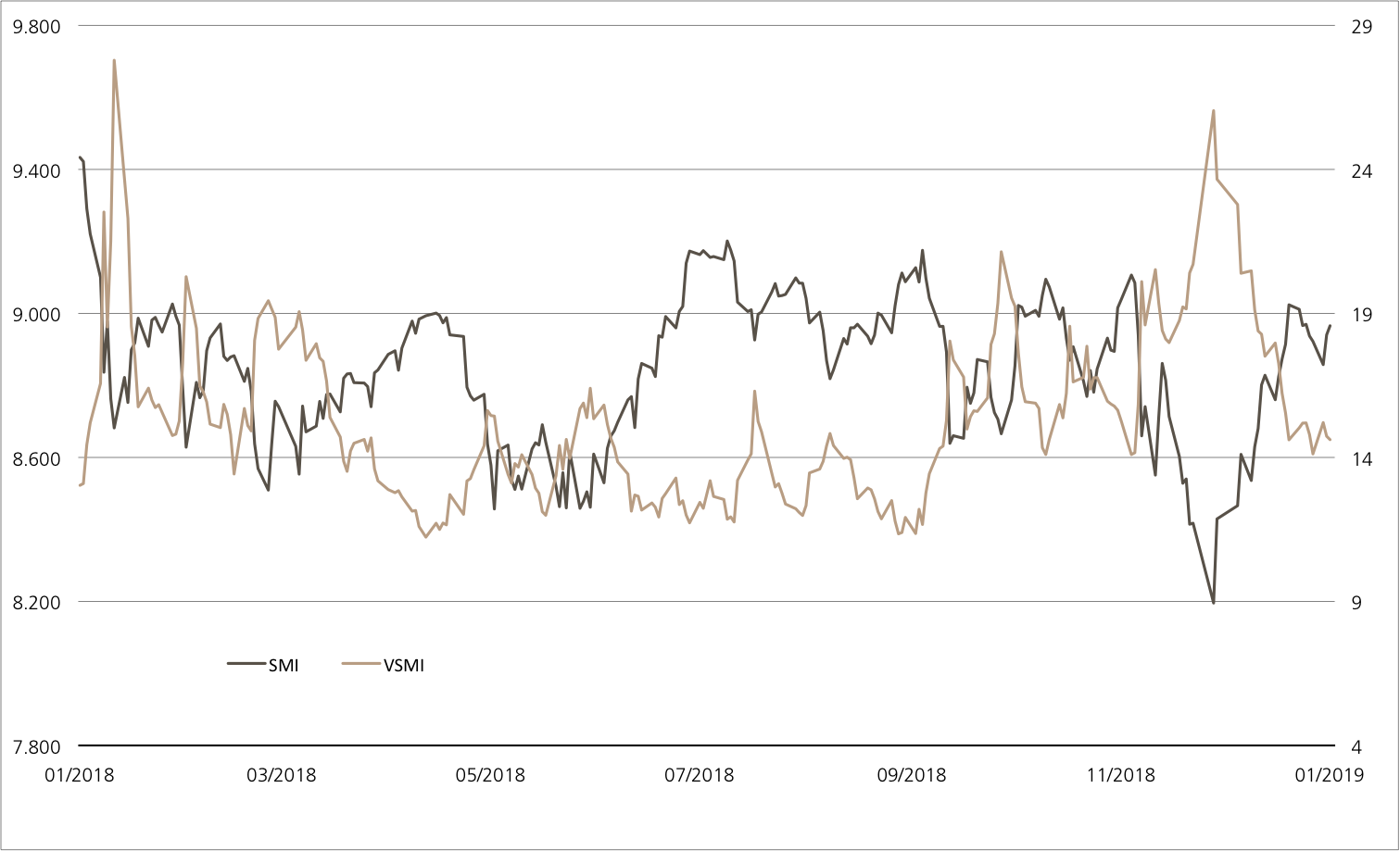

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 30.01.2019

BP / Total / Royal Dutch Shell

Integrated oil companies post their results

With the reporting season coming up soon, the focus will be on the major European oil and gas companies. Royal Dutch Shell announced its results yesterday morning (after we had gone to press), and BP is due to report on Tuesday, 5 February. Two days later, Total will follow suit. UBS combines the three European integrated oil stocks as underlyings for an Issuer Callable Worst of Kick-In GOAL (symbol: KDCLDU). Regardless of how the stock prices of the trio perform, investors can expect a coupon payment of 6.00% p.a. from the product. Each underlying has a price cushion of 40% at the initial fixing.

Figures from the oil and gas companies are being eagerly awaited, not least because the price of fuel moved down sharply at the start of the fourth quarter 2018. For example: on 3 October 2018, Brent cost USD 86.74, the highest price in four years. The correction that followed took the price down by up to 42% by the end of December.¹ The change in direction was driven by a completely different situation in the market: whereas global oil production had still been unable to meet demand in the third quarter, the last three months of 2018 saw a considerable surplus. Experts see this persisting in the new year. (Source: Thomson Reuters, 25.01.2019)

The result announcements will show how well the oil and gas sector is coping with the change in fundamentals. Cost cutting and higher prices have allowed the integrated operators to cash in mightily in the past few years. For example, Royal Dutch Shell: the largest stock in the sector by market capitalization in Europe reported operating cash flow of USD 14.7 billion in the third quarter of 2018. CEO Ben Beurden spoke of one of the best quarters in the company’s history. (Source: Royal Dutch Shell, announcement, 01.11.2018) The sector allows shareholders to participate in the success of the business through dividends and share buybacks.Opportunities: Even if the stock prices of BP, Total and Royal Dutch Shell don’t budge in the next 18 months, the IC Worst-of Kick-In GOAL (Symbol: KDCLDU) offers an attractive minimum return of 6.00% p.a. This assumes that none of the underlyings touches or falls below the low barrier of 60% of the starting level. The issuer has a right of termination. If it makes use of the issuer-call feature on one of the two exercise dates (06.02.2020 and 06.05.2020), investors receive the full nominal and pro-rata coupon repaid early.

Risks: Worst-of Kick-In GOALs do not have capital protection. If one of the underlyings touches or falls below the respective kick-in level (barrier) and the issuer-call feature is not exercised, repayment at maturity will be in cash in line with the weakest performance of the trio (from the strike), but no more than nominal plus coupon. In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

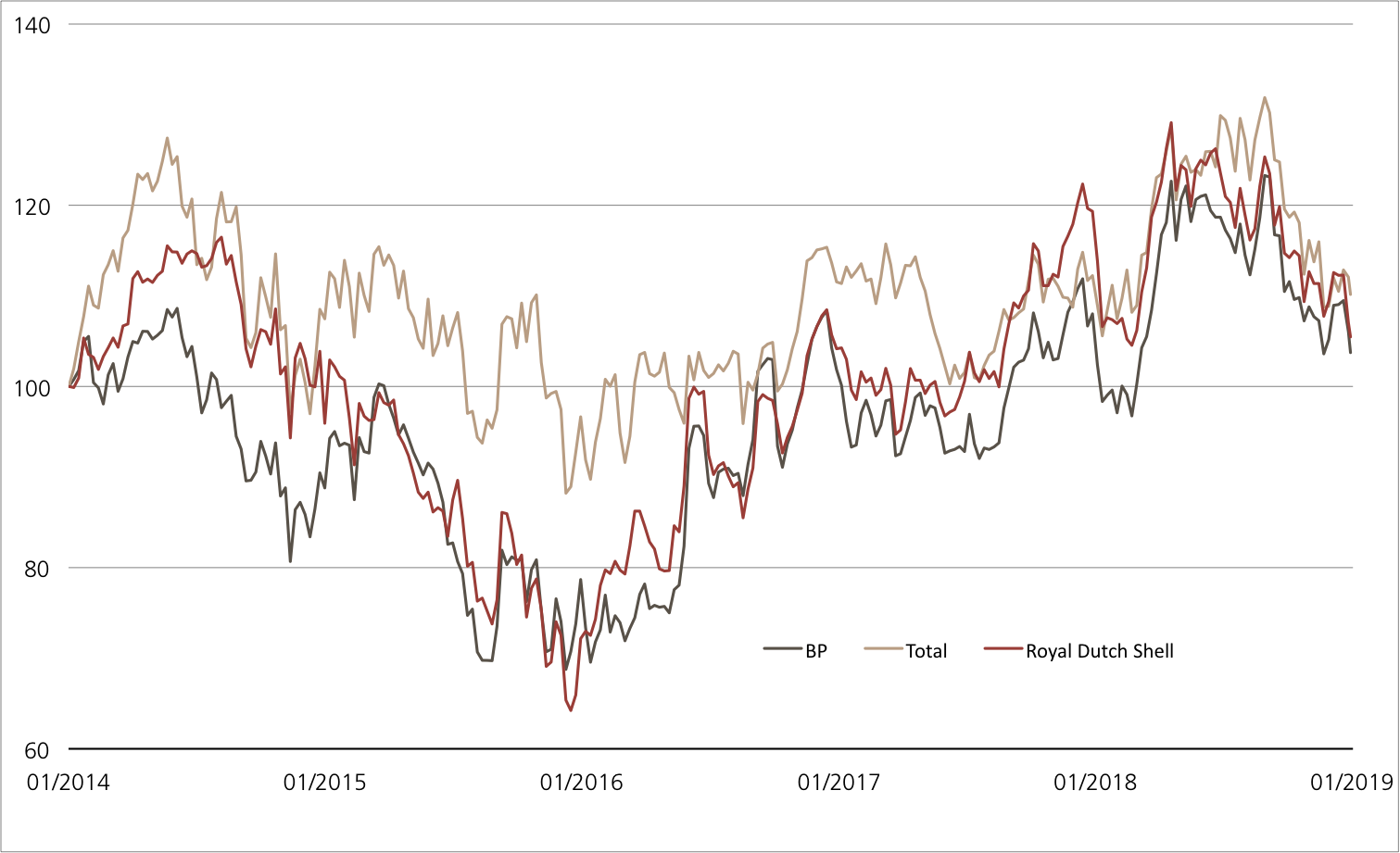

BP vs. Total vs. Royal Dutch Shell

(five years, for illustrative purposes only, figures in %)¹

Source: UBS AG, Bloomberg

As of: 30.01.2019

6.00% p.a. IC Worst of Kick-In GOAL on BP / Total / Royal Dutch Shell /

| Symbol | KDCLDU |

| SVSP Name | Barrier Reverse Convertibles |

| SPVSP Code | 1230 (Callable) |

| Underlyings | BP / Total / Royal Dutch Shell |

| Currency | CHF |

| Coupon | 6.00% p.a. |

| Kick-In Level |

60% |

| Expiry | 06.08.2020 |

| Issuer | UBS AG, London |

| Subscription until | 06.02.2019, 15:00 Uhr |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 30.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.