Monday, 08.10.2018

- Topic 1: US tax reform – US companies flourishing

- Topic 2: Airbus/Boeing – Full-to-bursting order books

US tax reform

US companies flourishing

The US economy is buzzing. In the first quarter of 2018, the country’s gross domestic product (GDP) grew by 4.2% on an annualized basis. At the same time, the economy is more or less at full employment. One of the main drivers of this boom is the tax reform initiated at the start of the year. In December 2017, UBS launched the US Tax Reform Beneficiaries Basket to provide investors with an opportunity to participate in the benefits of the relief in a concentrated form. To date, the strategy behind the shares selected has been very successful. The PERLES (symbol: USTAXU) on the basket has gained 11.3% in value since the start of the year and is therefore outperforming the S&P 500™ index.

One of Donald Trump’s main promises that he made during his election campaign was the implementation of a large-scale tax reform. In the battle for the White House in 2016, the Republican candidate promised extensive relief for private households and businesses, true to the motto of “America first!”. Shortly before Christmas 2017 and about eleven months after taking office, Trump signed a package of laws that had been hotly contested in Washington and implemented the largest tax reform in the US in more than 30 years. This measure, one of the central elements of which was a significant reduction in corporate income tax, is now clearly taking effect. The reform is not only driving the US economy forward as a whole, it is also having a positive effect on company figures according to UBS CIO WM. The experts describe the relief as the “icing on the cake” in an already positive environment. In concrete terms, the reform could accelerate this year’s profit growth in the US by 8%. Overall, UBS CIO WM anticipates a profit increase of 18% for the current year. (Source: UBS CIO WM, «UBS House view Monthly Base», October 2018, 20.09.2018) What is certain is that the US equity market in general and the beneficiaries of the tax reform in particular are currently in strong demand among investors. While other important stock markets hardly made any headway in the first three quarters of 2018, the S&P 500™ continued its attempt to set new records. At the end of September 2018, the benchmark was up by just under 9%. Meanwhile, the US Tax Reform Beneficiaries Basket has increased in price by more than 11%.

UBS launched this selection last December, shortly before a decision had been made on the reform. The impetus to do so came from UBS Research. The in-house analysts were of the opinion at the time that the US tax reform had only been partially priced into share prices. As a result, they systematically searched for companies that could potentially profit from the reform. One of the main criterion for the composition of the basket was the influence of the reform on cash flow and its relation to the respective market capitalization. In order to ensure that the composition did not differ too much from that of the S&P 500™ index, the experts limited the number of shares per sector, resulting in a moderate overweight in companies that benefit the most.

For example, the relatively high proportion of healthcare and technology companies in the US Tax Reform Beneficiaries Basket has paid off to date. In addition to the tax reform, the friendly US consumer climate is playing into the hands of the technology sector. The same also applies to the retail sector. Kohl’s and Macy’s, among others, were considered from this sector of the economy – the shares of the two US department stores have to date risen by around 37% in 2018.

Opportunities: The tracker certificate (symbol: USTAXU) on the US Tax Reform Beneficiaries Basket is still in the first year of its seven-year term. Investors can therefore continue to be able to rely on the long-term effect of the US tax reform. The management fee for the participation product is 0.3% p.a. Any dividend payments distributed by the basket members are reinvested net in the share of the company paying out.

Risks: This product does not have capital protection. The PERLES will make a loss if the underlying basket decreases. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

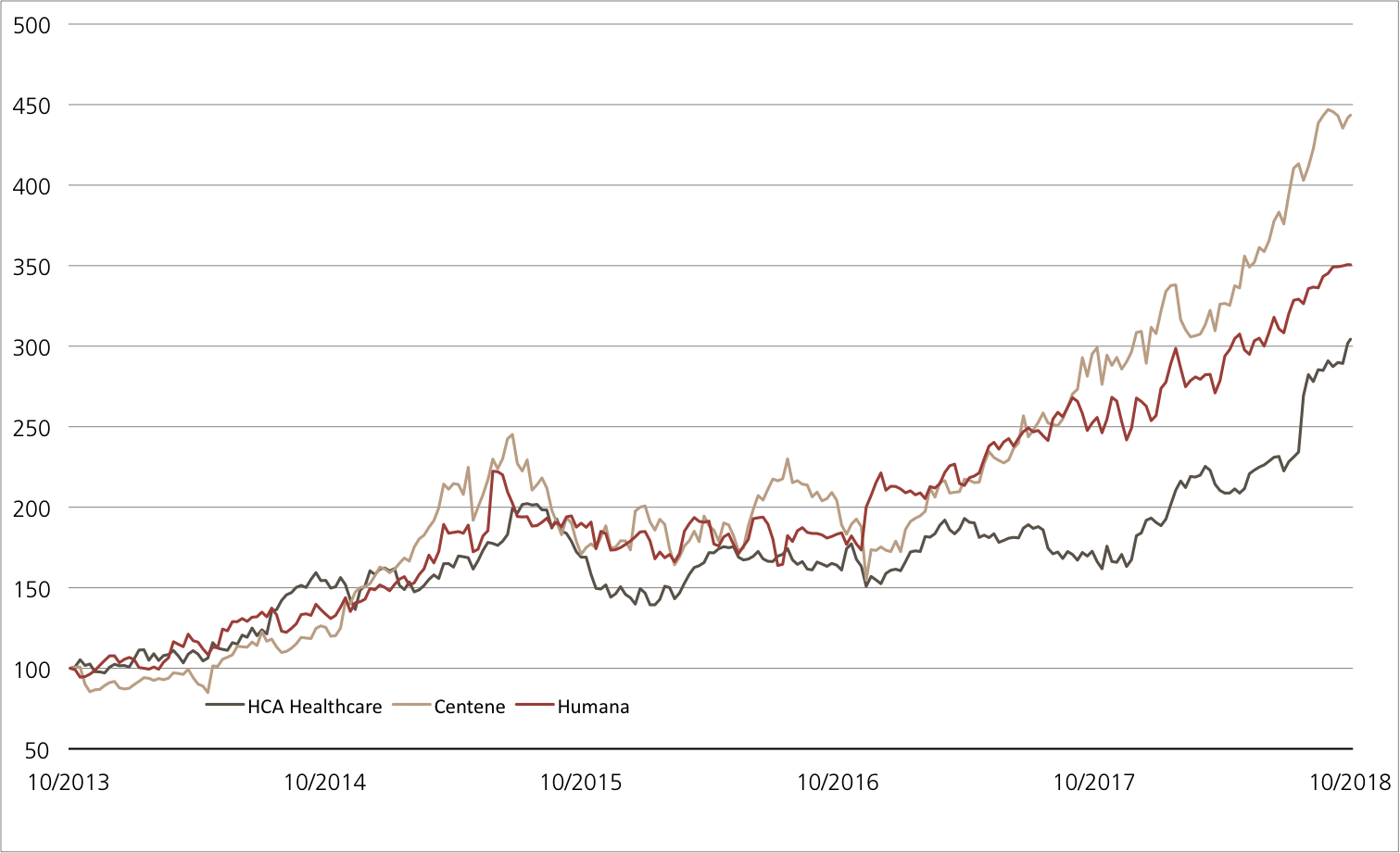

HCA Healthcare vs. Centene vs. Humana (5 years)¹

(for illustrative purposes only; figures in %)

The three healthcare companies HCA Healthcare, Centene and Humana are among the top performers in the US Tax Reform Beneficiaries Basket to date. The upward pace of the three shares increased once again in 2018.

Source: UBS AG, Bloomberg

As of 03.10.2018

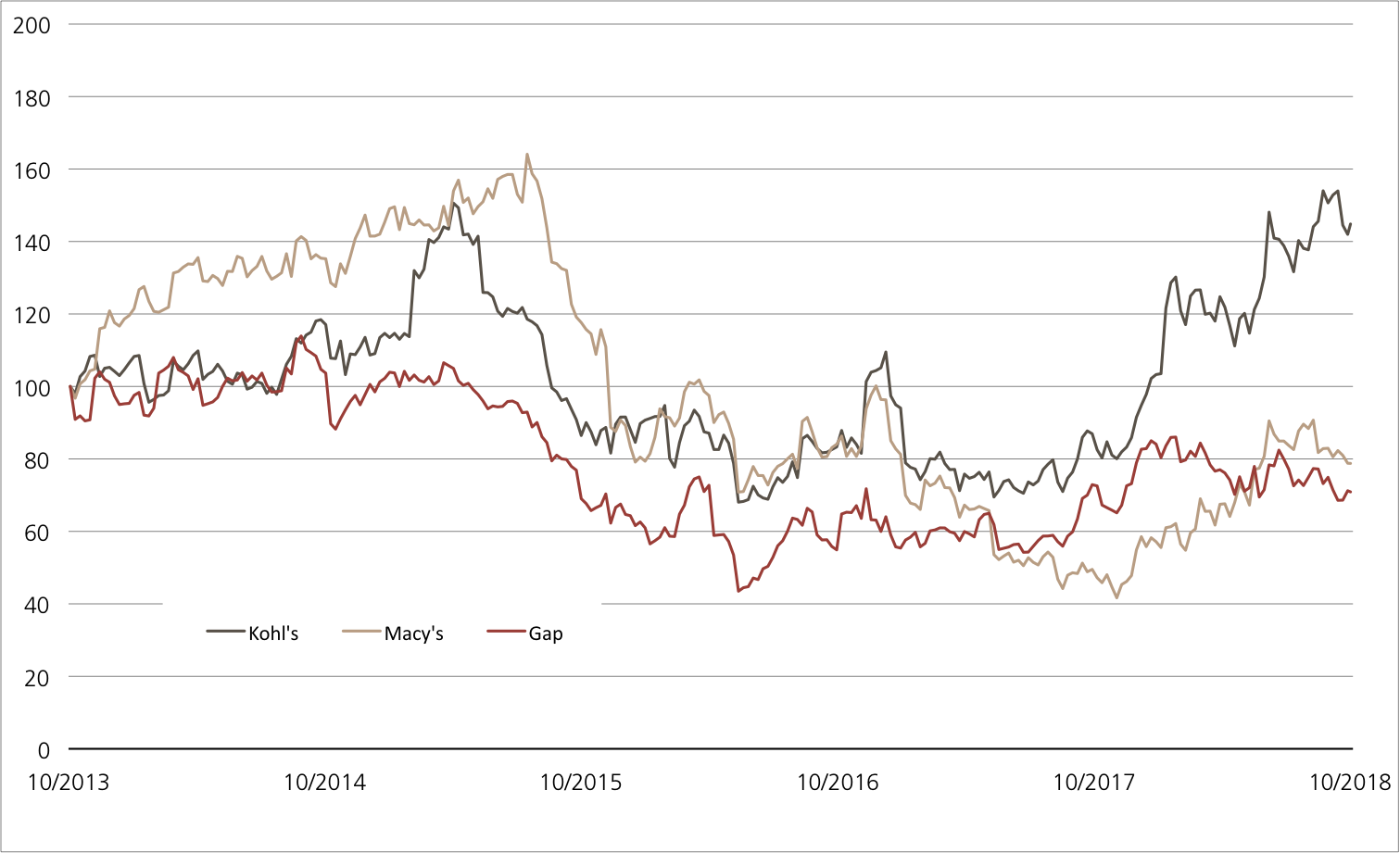

Kohl’s vs. Macy’s vs. Gap (5 years)¹

(for illustrative purposes only; figures in %)

The share prices of the two US retailers Kohl’s and Macy’s have rocketed following the introduction of the tax reform. In contrast, operational problems have put the brakes on the Gap fashion chain’s share performance.

Source: UBS AG, Bloomberg

As of: 03.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

PERLES on US Tax Reform Beneficiaries Basket

| Symbol | USTAXU |

| SVSP Name | Tracker-Certificate |

| SPVSP Code | 1300 |

| Underlying | US Tax Reform Beneficiaries Basket |

| Ratio | 1:1 |

| Currency | USD |

| Administration fee | 0.30% p.a. |

| Participation | 100% |

| Expiry | 20.10.2024 |

| Issuer | UBS AG, London |

| Bid/Ask | USD 1’135.00 / 1’145.00 |

US Tax Reform Beneficiaries Basket: Initial weighting by sector (as of: 04.12.2017)

| Technology | 18% |

| Finances | 16% |

| Healthcare | 16% |

| Non-basic consumer Goods | 14% |

| Industry | 12% |

| Basic consumer Goods | 10% |

| Other | 14% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 03.10.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 9’175.21 Pkt. | 1.0% |

| SLI™ | 1488.05 Pkt. | 0.0% |

| S&P 500™ | 2’925.51 Pkt. | 0.7% |

| Euro STOXX 50™ | 3’405.48 Pkt. | -0.8% |

| S&P™ BRIC 40 | 4’028.54 Pkt. | -0.7% |

| CMCI™ Compos. | 977.18 Pkt. | 3.6% |

| Gold (troy ounce) | 1’202.90 USD | 0.3% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

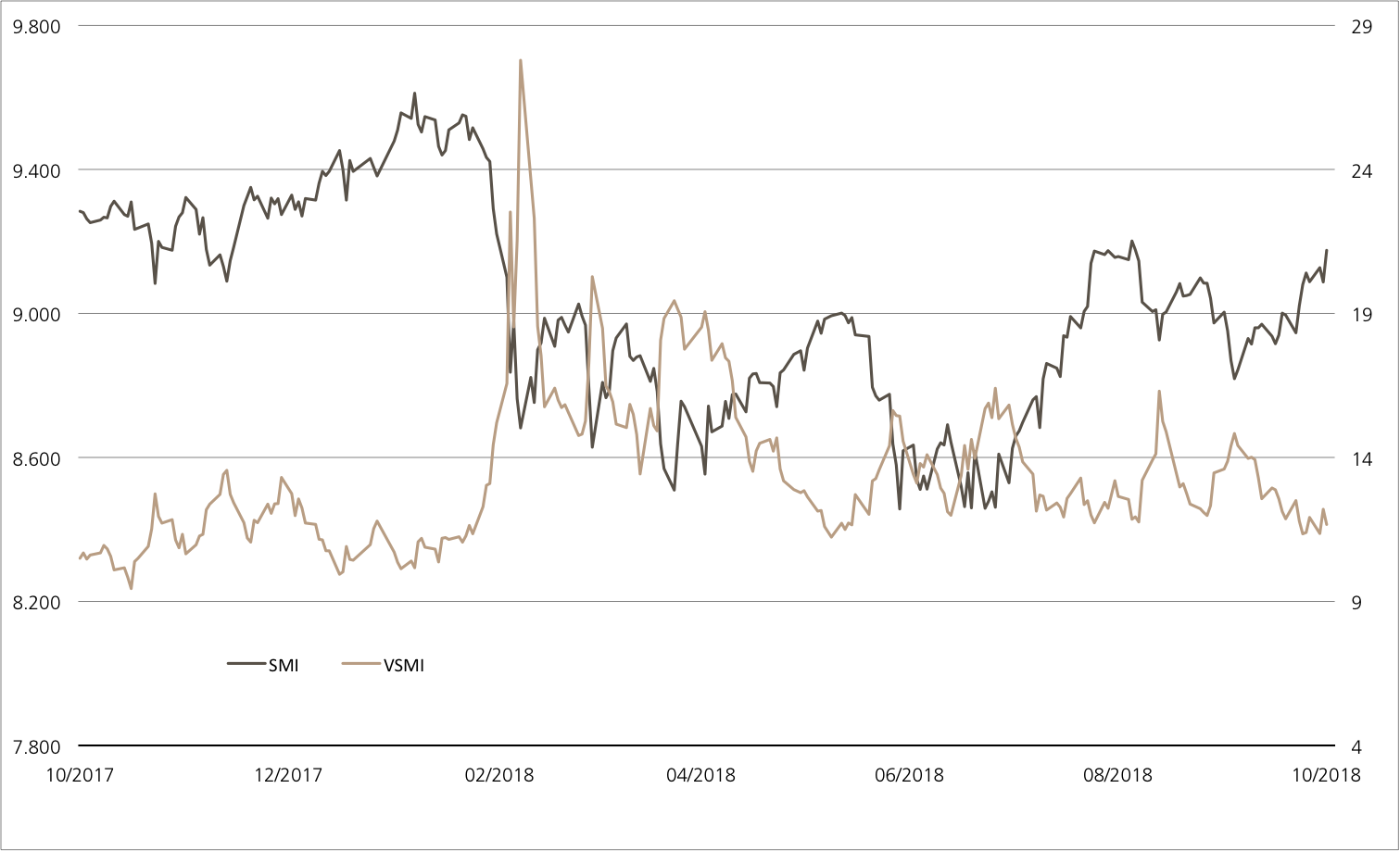

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 03.10.2018

Airbus/Boeing

Full-to-bursting order books

In the duel between the aircraft manufacturers Airbus and Boeing, the US industry leader has currently inched ahead by a nose. From January to August 2018, Boeing received net orders for 581 aircraft. In contrast, Airbus had to make do with just 219 net orders during this period. The most recent share price performance of the rivals reflects this. While the Airbus share is stagnating in the short term, the Boeing share has started the fourth quarter at a new all-time high.¹ UBS is now combining the two industry giants for an Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCOADU). Investors can expect a coupon payment of 7.5% p.a. here. Meanwhile, the underlyings have a safety cushion of 40% over the two-year term.

Despite the recent slump in orders, Airbus‘ order book remains full to bursting. At the end of August 2018, the Group reported that it had orders for a total of 7,415 aircraft. At current production rates, production will therefore be fully utilized for almost nine years. Lastly, Airbus secured an order from Europe’s largest airline. Lufthansa converted purchase options for 27 A320 neo and A321 neo aircraft into concrete orders. Ten of the fuel-efficient aircraft from this order will go into service for SWISS. (Source: Airbus press release, 01.10.2018) At Boeing, the legendary 737 is the absolute bestseller. From January to August 2018, almost three-quarters of orders were for the classic aircraft, with the 737 MAX being most in demand. According to Boeing, never before has an airplane sold as well as this ultra-modern model in the company’s history, which stretches back for more than 100 years. The company has revealed that approximately 4,700 orders have been placed for the 737 MAX from more than 100 customers. (Source: Boeing.com) Investors will find out how well the industry leader has performed on October 24 when Boeing publishes its figures for the third quarter. Six days later, Airbus will provide an insight into the company’s latest business developments.

Opportunities: Shortly before the earnings releases, UBS will issue the ER Worst of Kick-In GOAL (symbol: KCOADU) on Airbus and Boeing. A coupon of 7.50% p.a. is available on the two shares. The barriers are set at 60% of the starting level of the two shares. As long as none of the underlyings touch or fall below this level, the product will end with a maximum return in line with the coupon. There is also the opportunity for early redemption at 100% plus the accrued coupon. The Early Redemption feature will take effect if the Airbus and Boeing shares are level with or above the initial price on one of the quarterly observation days (first date: 19.10.2019).

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Airbus vs. Boeing (5 years)¹

(for illustrative purposes only; figures in %)

Source: UBS AG, Bloomberg

As of: 03.10.2018

7.50% p.a. Early Redemption Worst of Kick-In GOAL on Airbus / Boeing

| Symbol | KCOADU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Airbus / Boeing |

| Currency | EUR |

| Coupon | 7.50% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 12.10.2020 |

| Issuer | UBS AG, London |

| Subscription until | 10.10.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 03.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.