Friday, 19.10.2018

- Topic 1: Microchip equities - Opportunity to get involved in this sector thanks to the sell-off

- Topic 2: BMW & Tesla - Premium manufacturers revved up

Microchip equities

Opportunity to get involved in this sector thanks to the sell-off

There was recently a wave of sales in the microchip sector. The Philadelphia Semiconductor Index fell by more than 4% within a single week. Infineon was hit even harder, with the DAX equity declining by around twice as much in the same period. AMS has also been on the “to sell” list of stock exchange speculators for some time now, and the microchip specialist has lost more than a quarter of its market capitalization in the space of a month.¹ Following the general sell-off in the sector, it might now make sense to consider entering the market at this low base. In view of the uncertain situation on the stock markets, however, conditional partial protection is a must. The Double Coupon Kick-In GOAL (symbol: KCRRDU) in subscription on AMS, Infineon and Intel has attractive conditions. In addition to a risk buffer of 40% and a coupon of 10% p.a., the product also offers the additional opportunity of being able to double the return. For those who prefer a product with only one underlying, should take a look at the Early Redemption Kick-In GOAL (symbol: KCSEDU) on AMS, with which a coupon of 10% p.a. is possible within just two years.

Although semiconductor companies are currently exposed to severe fluctuations on the stock market, the industry continues to grow. According to the experts at IC Insights, the global microchip market is expected to grow by 14% to USD 509.1 billion this year, exceeding the half trillion US dollar mark for the very first time. In light of new technology trends such as Big Data, the Internet of Things (IoT) and artificial intelligence, the demand for microchips could continue to remain high. IC Insights estimates that the percentage of electronic products being fitted with semiconductors will increase from 28.8% in 2017 to 31.5% in 2022. (Source: IC Insights, July 18, 2018)

According to analysts at CIO WM, the healthy demand for semiconductors is already being reflected in the activities of the majority of the industry’s big players. Therefore, the experts currently classify the sector as “neutral”, highlighting Intel as their preferred company. The microchip giant is also heavily involved in future trends such as data centers and IoT. In the second quarter, the two segments grew by an estimable 27% and 22%, respectively. Intel expects record sales for the current financial year, thus making it the third year in a row in which they have done so. At Infineon, too, the signs continue to point to growth. In the wake of the recent share price fluctuation, the Germans confirmed their growth targets for 2018/19 (September 30). “We see no reason to question the outlook,” said an Infineon spokesperson (Source: Thomson Reuters media release, October 10, 2019). The Group expects sales to grow by 10%. Austria-based AMS, which is primarily known as an Apple supplier, is also growing strongly, but faces margin pressure. Even though UBS IB Research sees opportunities for AMS in 3D-sensor technology, the experts rate the equity as “Neutral” and have lowered the target price to CHF 65.Opportunities: In order to achieve a double-digit percentage return with the Early Redemption Kick-In GOAL (symbol: KCSEDU) on AMS, the equity does not need to grow. If the risk buffer of 40% is maintained, the maximum return of 10% p.a. will be paid out in just under a year. The new Double Coupon Kick-In GOAL (symbol: KCRRDU) on AMS, Infineon and Intel offers a lofty 20% return opportunity. If the three equities are at least level with or above the initial price upon maturity, the traditional coupon of 10% p.a. will be doubled. The barrier stands at a comfortable 40% of the initial fixing price.

Risks: Kick-In GOALs do not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

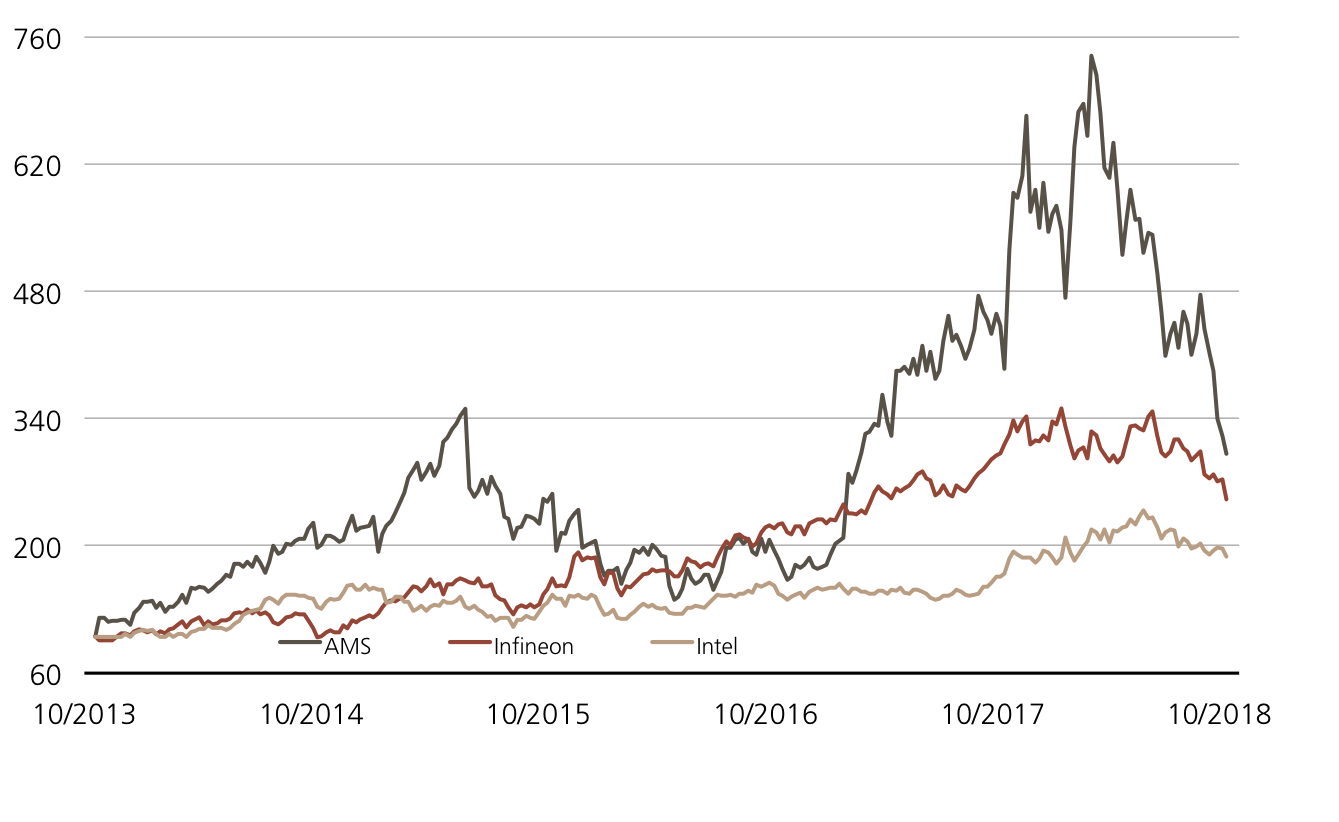

AMS vs. Infineon vs. Intel (5 years; for illustrative purposes only; figures in %)¹

The three microchip equities are ultimately showing clear upward growth over the next 5 years, with AMS faring the best. Nevertheless, the Apple supplier recently suffered significant losses.

Source: UBS AG, Bloomberg

As of 19.10.2018

AMS (5 years)¹

Austrian semiconductor manufacturer AMS has enjoyed a steep upward trend, which started some two years ago. A correction phase subsequently set in when prices rose above 100 francs.

Source: UBS AG, Bloomberg

As of: 19.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

10.00% p.a. Double Coupon Worst of Kick-In GOAL on AMS, Infineon, Intel

| Symbol | KCRRDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230, Variable Coupon |

| Underlying | AMS, Infineon, Intel |

| Currency | CHF (Quanto) |

| Coupon | 10.00% p.a. |

| Double Coupon Trigger Level | 100% |

| Kick-In Level | 60% |

| Expiry | 31.10.2019 |

| Issuer | UBS AG, London |

| Subscription until | 31.10.2018, 15:00 h |

10.00% p.a. ER Kick-In GOAL on AMS

| Symbol | KCSEDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230, Auto-Callable |

| Underlying | AMS |

| Currency | CHF |

| Coupon | 10.00% p.a. |

| Strike-Level | 100% |

| Kick-In Level | 60% |

| Expiry | 02.11.2020 |

| Issuer | UBS AG, London |

| Subscription until | 31.10.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 19.10.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’750.35 | -1.6% |

| SLI™ | 1’399.69 | -1.2% |

| S&P 500™ | 2’809.21 | 0.8% |

| Euro STOXX 50™ | 3’243.08 | -0.7% |

| S&P™ BRIC 40 | 3’868.91 | 1.0% |

| CMCI™ Compos. | 965.12 | 0.1% |

| Gold (troy ounce) | 1’227.40 | 2.8% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

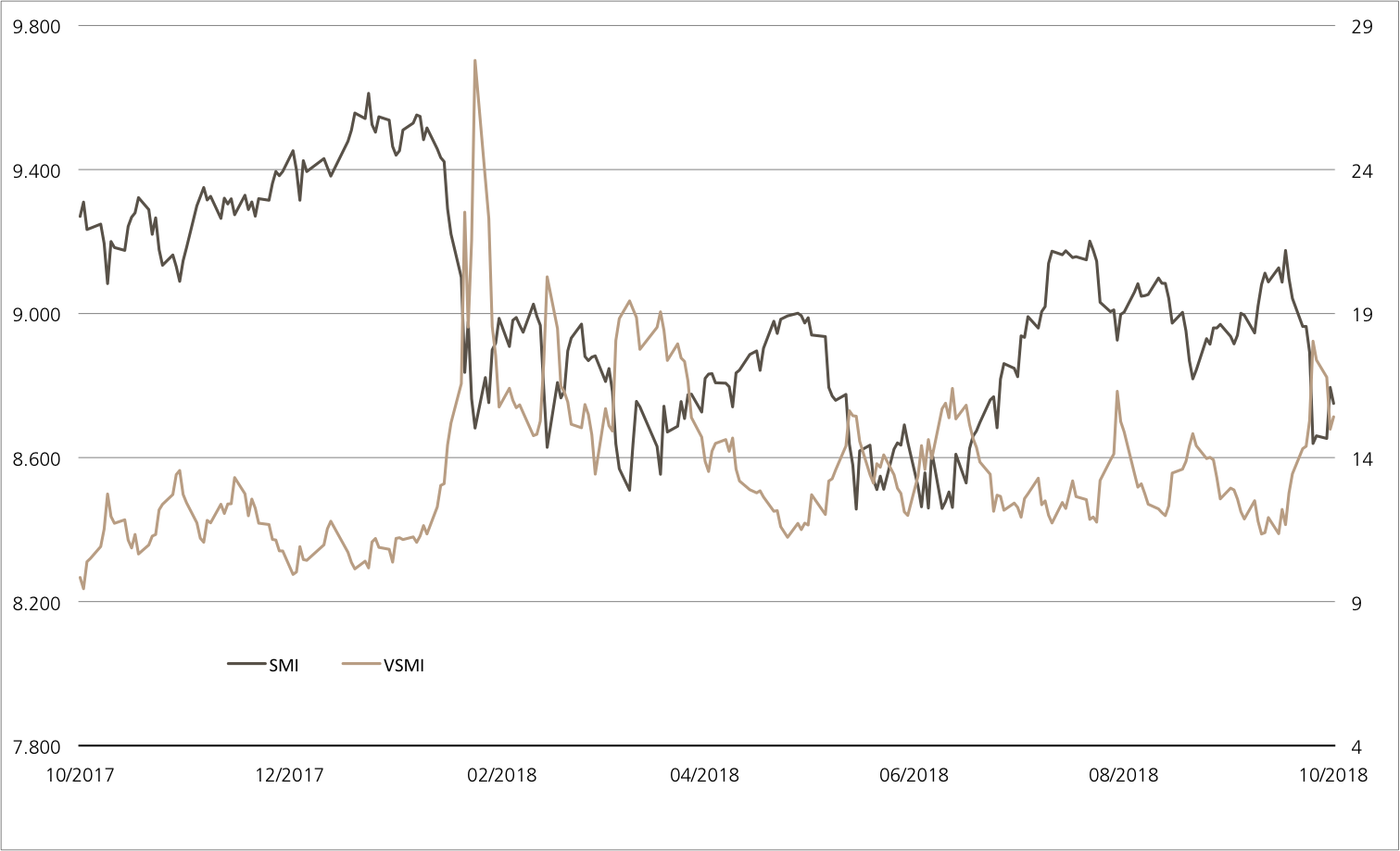

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 19.10.2018

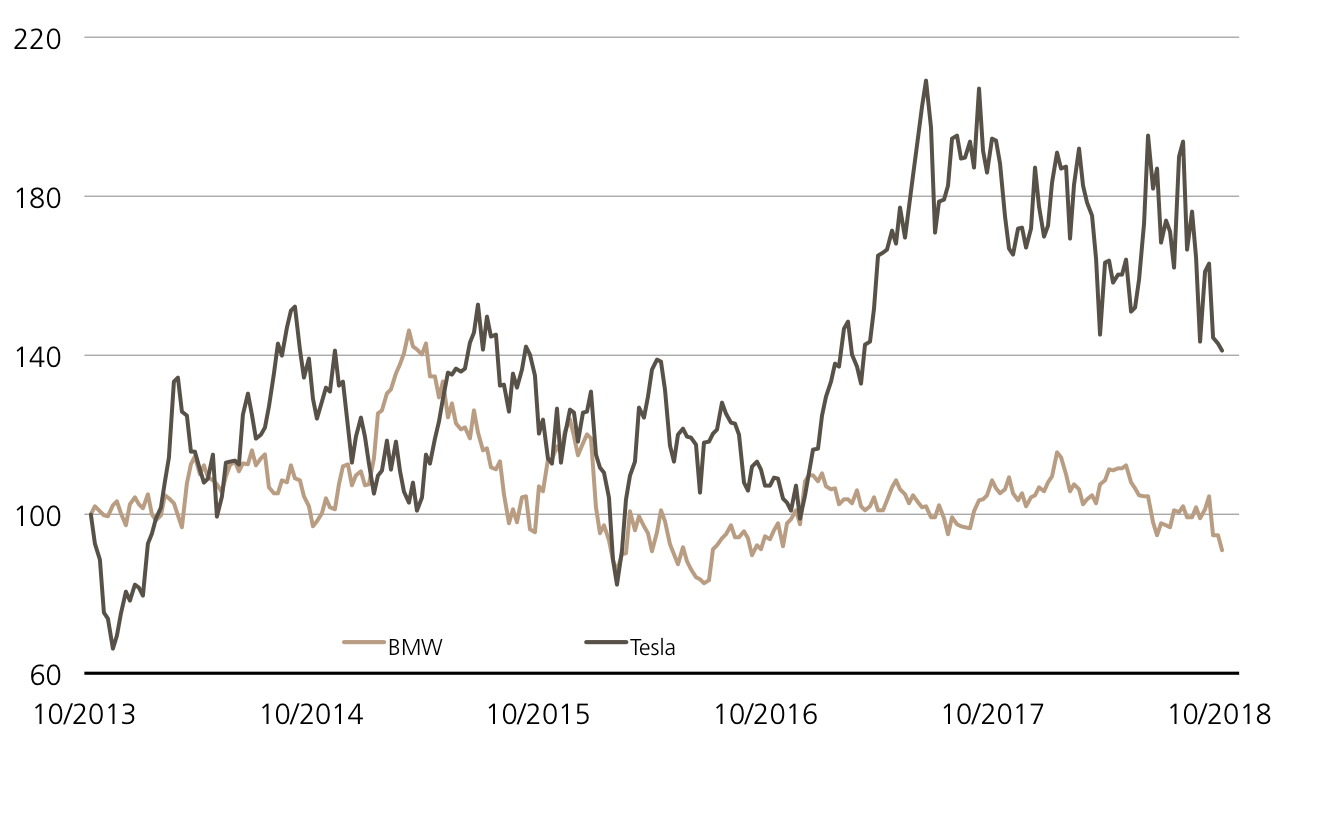

BMW & Tesla

Premium manufacturers revved up

The automotive industry is currently being hit from all sides. In addition to international risks as a result of the customs conflict and Brexit, regulators are also exerting pressure on manufacturers with new exhaust emission tests. Although day-to-day business is consequently suffering, the companies are not losing sight of their future opportunities. BMW made a massive statement of intent recently. The German firm was the first foreign car company to succeed in acquiring a majority stake in a Chinese joint venture. In contrast, Tesla is making headlines in the US thanks to its rising production figures. From July to September, 53,239 bodies of the Model 3 cars on which the company has pinned its hopes rolled off the production line – more than twice as many as in the second quarter. UBS is now packaging the two premium manufacturers into a Callable Worst of Kick-In GOAL (symbol: KCRQDU), offering amazing conditions. The barrier stands at 50% of the initial price and the coupon totals 20% p.a.

The charismatic boss of the electric car pioneer Tesla is always good for a surprise. Elon Musk is currently trying to retrofit the on-board computer in the Tesla to include a video game console. Although this is still a long way off from bearing fruit, investors are eagerly awaiting the figures for the third quarter. After a weak first half-year, Musk had promised “sustainably profitable” work from now on. Tesla will publish its interim report on October 30. Although remaining in the black is no problem for competitor BMW, the Munich-based company did scare off investors with a profit warning. Nevertheless, the car company has decided not to stick its head in the sand, but continue to put the pedal to the metal instead. For example, BMW is increasing its stake in the joint venture with its Chinese partner Brilliance by 25% to 75%, paying EUR 3.6 billion in return. We expect to be able to fully consolidate BMW Brilliance Automotive in the balance sheet from 2022 onwards,” said BMW CEO Harald Krüger. (Source: Thomson Reuters media report, October 11, 2018)

Opportunities: BMW and Tesla don’t have to switch to the fast lane for the new Callable Worst of Kick-In GOAL (symbol: KCRQDU) to be profitable. On the contrary: The two automotive equities have a downward margin of 50% before the brakes are put on the potential maximum return of 20% p.a. The maximum term of one year can be shortened by a maximum of half a year due to the callable function.

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

BMW vs. Tesla

(5 years; for illustrative purposes only; figures in %)¹

Source: UBS AG, Bloomberg

As of: 19.10.2018

20.00% p.a. Callable Worst of Kick-In GOAL on BMW and Tesla

| Symbol | KCRQDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230, Callable |

| Underlyings | BMW, Tesla |

| Currency | EUR (Quanto) |

| Coupon | 20.00% p.a. |

| Kick-In Level | 50.00% |

| Expiry | 24.10.2019 |

| Issuer | UBS AG, London |

| Subscription until | 24.10.2018 |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 19.10.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.