Friday, 09.11.2018

- Topic 1: European industrials - A multifaceted sector

- Topic 2: Henkel/Beiersdorf/L’Oréal - Staying in step with consumers

European industrials

A multifaceted sector

UBS CIO GWM identifies the geopolitical uncertainty factors mainly responsible for the current weak performance of the stock markets in the European Monetary Union (EMU). Looking to the future, experts recommend a neutral weighting within the eurozone countries. Industrial equities are overweight in terms of sector allocation. The ETT (symbol: ETIND) on the STOXX™ Europe 600 Industrial Goods & Services Index allows for a corresponding weighting, as the open end product tracks the performance of the industry benchmark. In contrast, the Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCUGDU) is geared towards the Alstom, Siemens and thyssenkrupp equities delivering a relatively stable performance. Provided none of the industrials touch or fall below the barrier of 59% of their respective initial prices, investors will receive a maximum return of 7% upon maturity.

Bert Jansen, Strategist at UBS CIO GWM, notes that sector momentum has always been the main driver for eurozone equity markets in the past. He attests that it has always been more important than country-specific factors. According to Jansen, however, an exception to this rule is Italy, as the equity market in the southern European country is strongly geared to the financial sector. The country’s rather lax budgetary discipline is negatively impacting share prices accordingly. Since a large part of the negative sentiment is now likely to be priced in, Italy – like other EU members – will receive a neutral weighting in the country allocation. In terms of sectors, CIO GWM is pursuing a largely balanced mix of cyclical and non-cyclical sectors for the eurozone. An overweight is being maintained in the energy and industry sectors. (Source: UBS CIO GWM, UBS House View Weekly, Regional View Europe, October 29, 2018)

Naturally, the second sector has been particularly exposed to the trade dispute that has prevailed as one of the main factors for market uncertainty in 2018. It is therefore not surprising that the STOXX™ Europe 600 Industrial Goods & Services Index was included in the wave of sales in October. Fundamentally, however, the sector continues to grow. Despite a downward trend, the Purchasing Managers‘ Index for industry calculated by Markit, for example, remained above the expansionary threshold of 50 in September. In addition to the robust global economy, megatrends such as robotics and automation, energy efficiency and growing air traffic should play into the hands of the sector.Opportunities: The Exchange Traded Tracker (ETT) (symbol: ETIND) allows investors to diversify their positions. The underlying STOXX™ Europe 600 Industrial Goods & Services Index currently comprises 100 companies. In terms of weighting, Siemens leads the way. Besides the German group, Alstom is also on CIO GWM’s current most preferred list for European industrials. Together with thyssenkrupp, the duo forms the basis for a new ER Worst of Kick-In GOAL (symbol: KCUGDU). Investors can expect a fixed coupon payment of 7% p.a. with this issue. This return opportunity comes with a 41% safety buffer. As part of the early redemption function, the underlyings will be put to the test for the first time on November 14, 2019. Should the three shares close at or above their respective initial prices on this date or one of the other quarterly observation days, investors will receive the nominal amount plus the pro rata coupon early.

Risks: The aforementioned products do not have capital protection. Should the underlying assets deliver a negative performance, the ETT will incur commensurate losses. If the underlyings of the Kick-In GOAL touch or fall below the respective Kick-In Level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

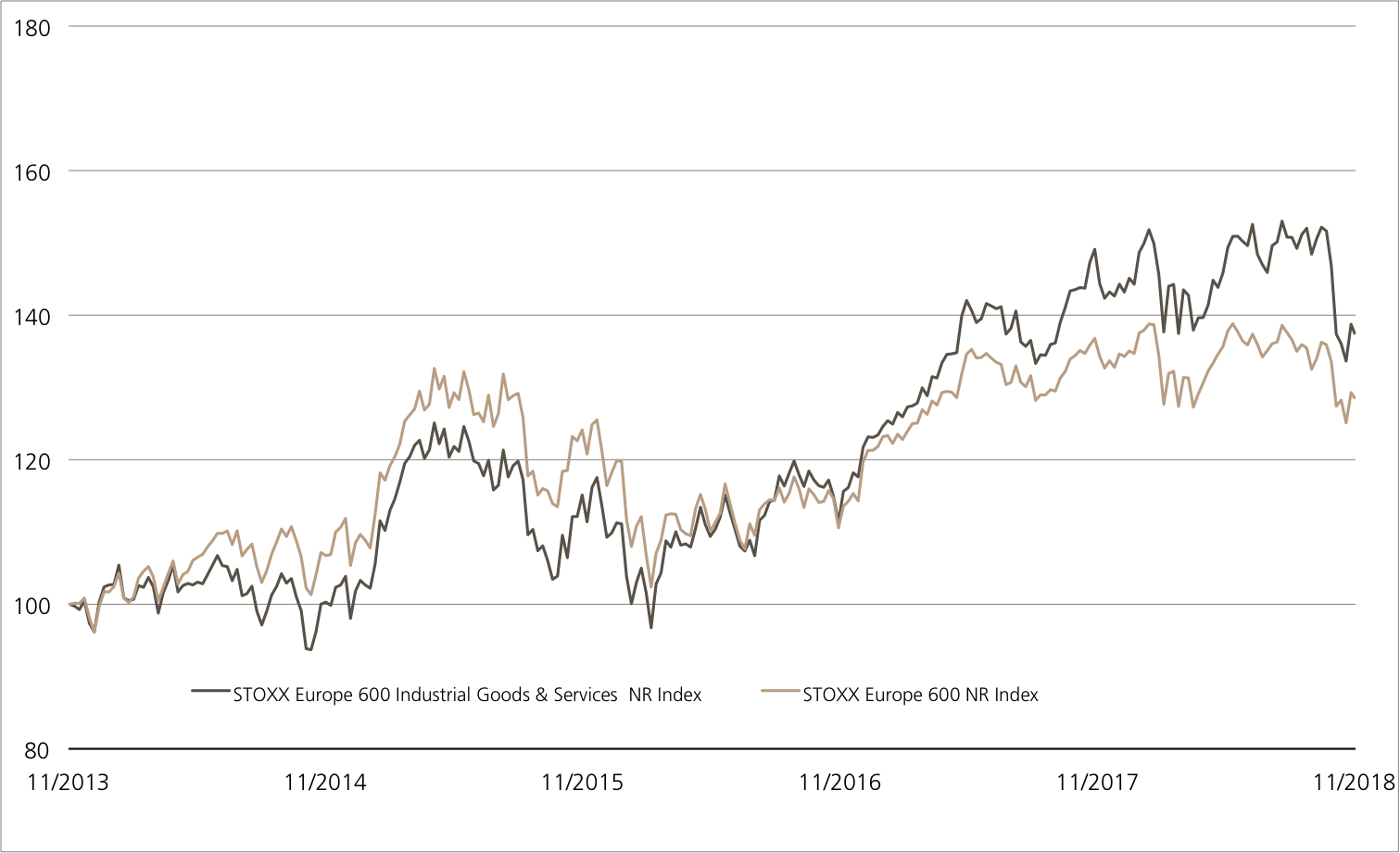

STOXX™ Europe 600 Industrial Goods & Services Index vs. STOXX™ Europe 600 Index 5 years¹

After the recent setback, Europe’s industrials have been unable to break out of their current sideways trend. However, the sector is still ahead of the general market.

Source: UBS AG, Bloomberg

As of 08.11.2018

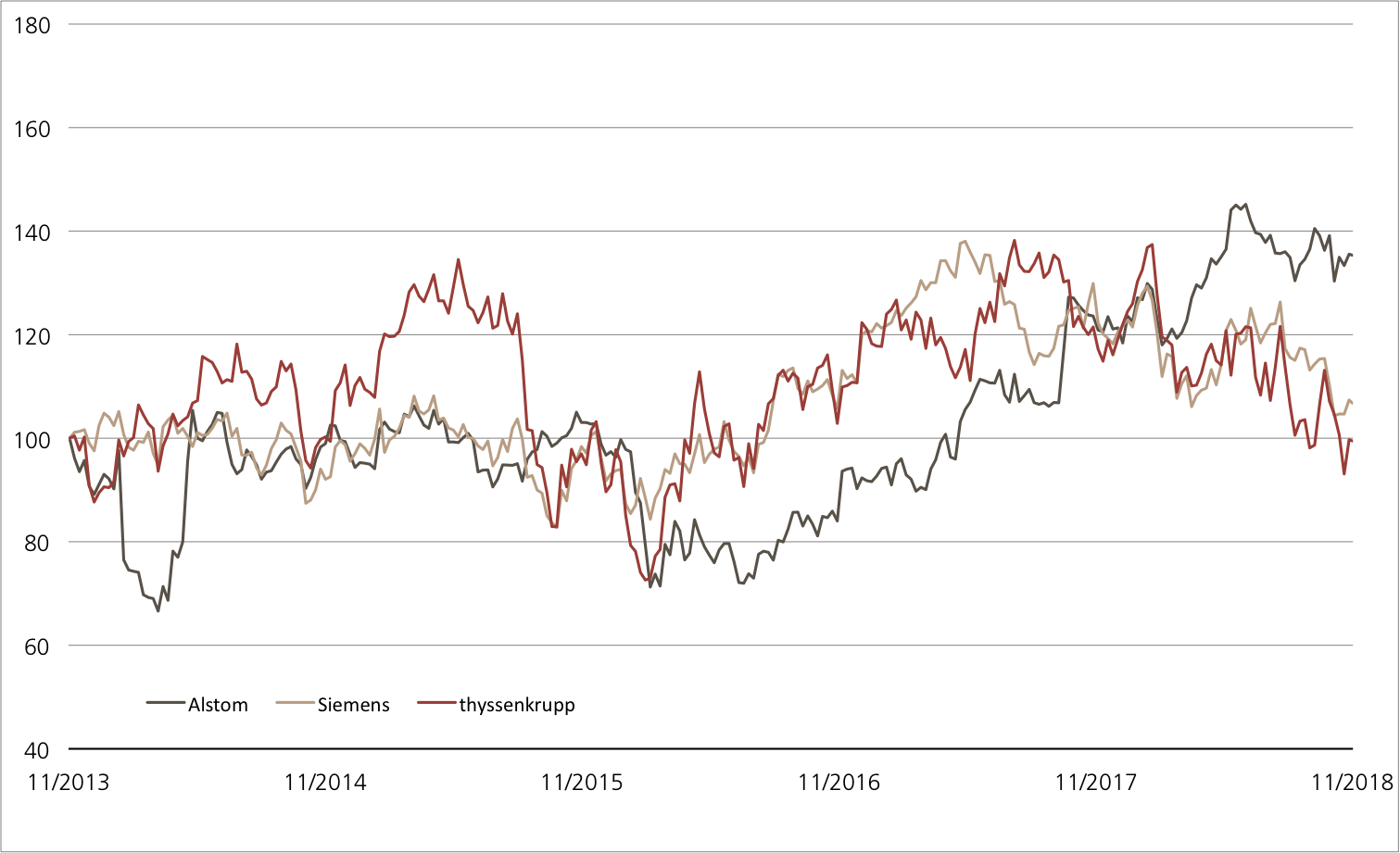

Alstom vs. Siemens vs. thyssenkrupp 5 years¹

Alstom is defying the difficult market environment. Thanks to its recent outperformance, the French industrial rocketed past the German large caps Siemens and thyssenkrupp in the five-year ranking.

Source: UBS AG, Bloomberg

As of: 08.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETT on STOXX™ Europe 600 Industrial Goods & Services NR Index

| Symbol | ETIND |

| SVSP Name | Tracker Certifikat |

| SPVSP Code | 1300 |

| Underlying | STOXX™ Europe 600 Industrial Goods & Services Net Return Index |

| Currency | EUR |

| Ratio | 1:1 |

| Administration fee | 0.00% p.a.² |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | EUR 922.50 / 927.50 |

7.00% p.a. ER Worst of Kick-In GOAL on Alstom / Siemens / thyssenkrupp

| Symbol | KCUGDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | Alstom / Siemens / thyssenkrupp |

| Currency | EUR |

| Coupon | 7.00% p.a. |

| Kick-In Level | 59.00% |

| Expiry | 15.05.2020 |

| Issuer | UBS AG, London |

| Subscription until | 14.11.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 08.11.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 9’050.53 | 0.3% |

| SLI™ | 1’425.81 | 0.4% |

| S&P 500™ | 2’813.89 | 3.8% |

| Euro STOXX 50™ | 3’246.66 | 1.5% |

| S&P™ BRIC 40 | 3’954.66 | 4.4% |

| CMCI™ Compos. | 928.33 | 0.0% |

| Gold (troy ounce) | 1’228.70 USD | 1.1% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

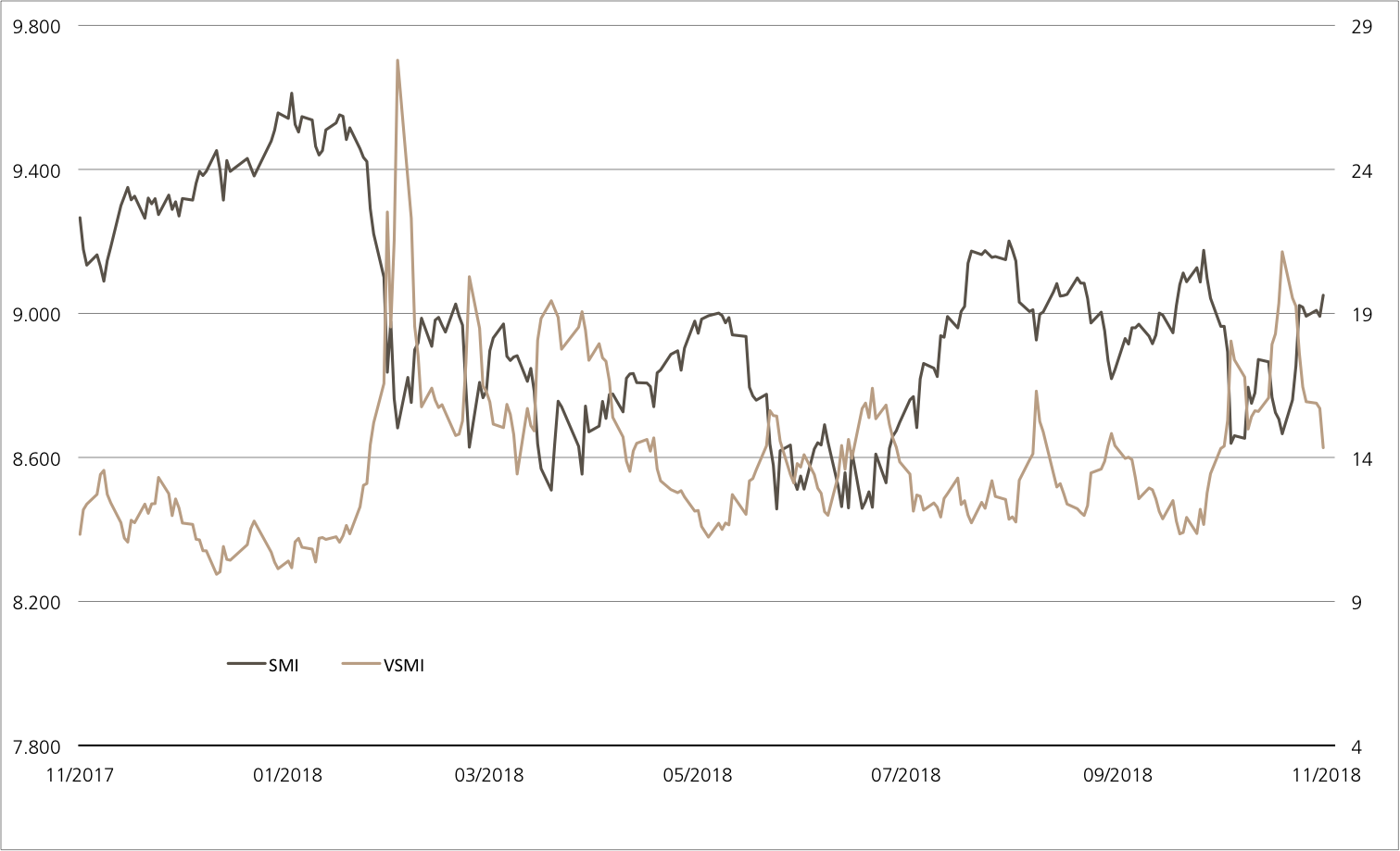

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 08.11.2018

Henkel/Beiersdorf/L’Oréal

Staying in step with consumers

With just a few weeks to go before Christmas, consumers around the globe are in a spending mood – in the US, consumer sentiment has recently reached its highest level since the turn of the millennium. The current indicators are likely to delight Henkel, Beiersdorf and L’Oréal. UBS is using the shares of the three leading consumer goods manufacturers as the underlyings for a new issue. The Callable Worst of Kick-In GOAL (symbol: KCUDDU) has a 6% annual coupon, while the barriers are set at 60% of each of the initial share prices.

The latest figures from L’Oréal show that consumers in Asia are also really in the mood to buy. In the second quarter of 2018, the French cosmetics manufacturer recorded sales growth of 7.5% on a comparable basis, which resulted in the company exceeding the average analysts‘ expectations. In Asia, demand was particularly strong for skincare products such as anti-aging creams. According to CEO Jean-Paul Agon, the group is growing rapidly, especially in China where the boom in luxury products persists. In this key segment, L’Oréal is represented by Yves Saint Laurent’s make-up products, among other items.

Beiersdorf published its quarterly figures on the same day as the French company. The cosmetics group increased sales organically 6% over the first nine months of 2018. The North Germans also enjoyed flourishing growth in the luxury segment, with sales of the La Prairie brand skyrocketing by 46.7%. Beiersdorf also recorded significant growth in the adhesives segment with the Tesa brand. (Source: Thomson Reuters media reports, October 30, 2018) Adhesives and sealants are also among Henkel’s core competencies. The DAX™ company is also active in the body care segment, as well as in detergents and cleaning agents. On November 15, investors can find out how Henkel has performed recently.

Opportunities: Should the Henkel, Beiersdorf and L’Oréal share prices largely remain stable, this should prove sufficient for the investment in the Callable Worst of Kick-In GOAL (symbol: KCUDDU) to pay off. All that is required is that none of the three shares touch or fall below the low barrier of 60% of the respective initial prices. Since the annual coupon of 6% is paid out in any case, the corresponding maximum return would then be achieved upon maturity. Please note that the issuer has a call option. If it makes use of this call option on one of the dates provided for this purpose, the pro rata coupon will be repaid early in addition to the nominal value.

Risks: Worst-of Kick-In GOALs do not have capital protection. If the underlyings of the Kick-In GOAL touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

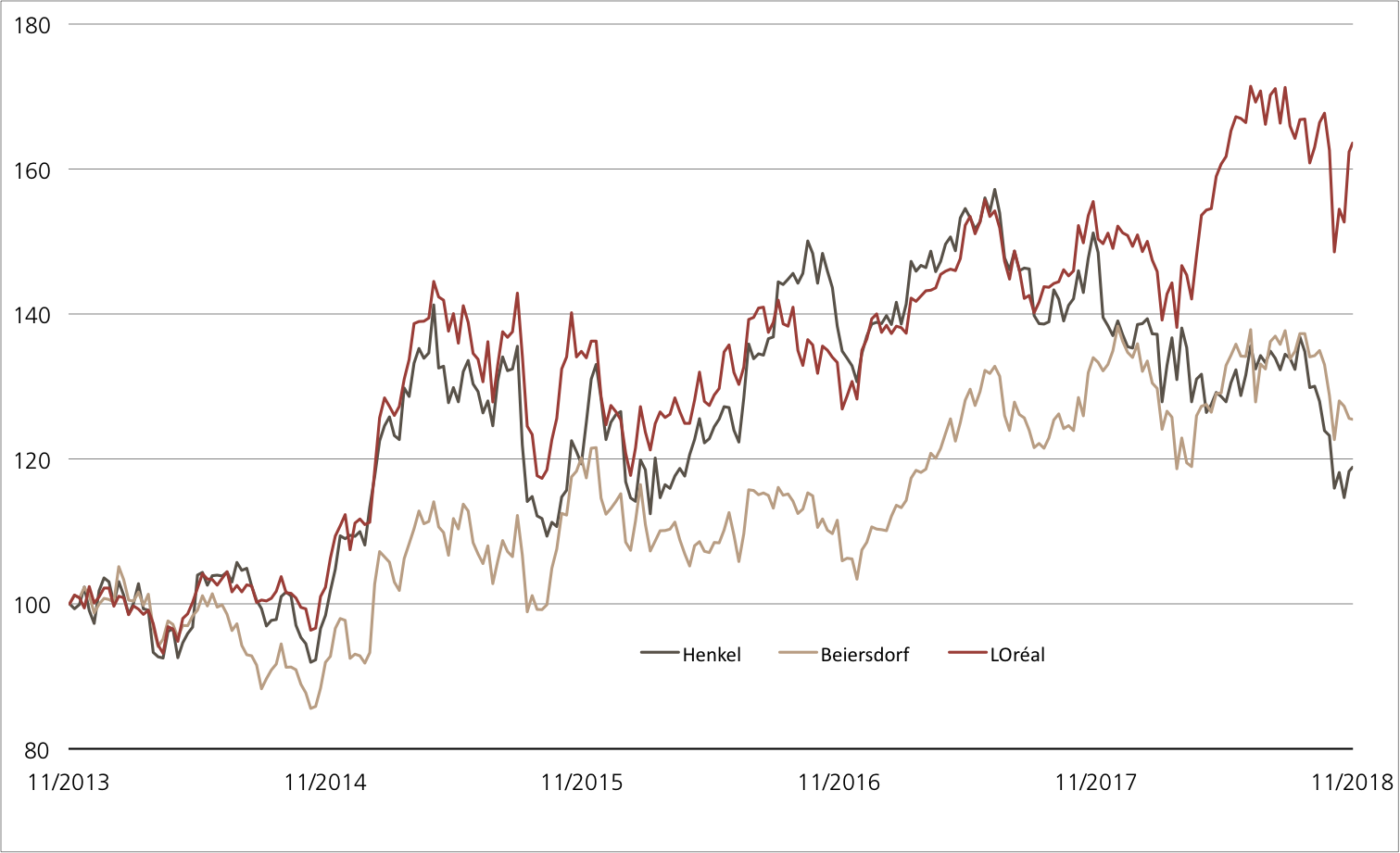

Henkel vs. Beiersdorf vs. Loréal five years¹

Source: UBS AG, Bloomberg

As of: 08.11.2018

6.00% p.a. Callable Worst of Kick-In GOAL on Henkel / Beiersdorf / L’Oréal

| Symbol | KCUDDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | Henkel / Beiersdorf / L’Oréal |

| Currency | EUR |

| Coupon | 6.00% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 16.11.2020 |

| Issuer | UBS AG, London |

| Subscription until | 14.11.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 08.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.