Friday, 23.11.2018

- Topic 1: Consumption - The whole world is in a shopping frenzy

- Topic 2: Continental & Michelin - More than just black tires

Consumption

The whole world is in a shopping frenzy

The largest shopping event of the year traditionally begins in the US on Thanksgiving. “Black Friday” is not the only day that consumers will be spending billions of dollars again; «Cyber Monday» takes place just three days later and is set to be a huge day for the e-commerce industry. Business could be particularly profitable for Amazon; the company officially kicked off “Cyber Week” on 19 November with new bargains appearing on its site every day. With “Singles‘ Day” taking place on November 11 in the Middle Kingdom, Chinese Internet companies such as Alibaba are ahead of the Americans – not only in terms of time, but also in terms of volume. Department stores such as Walmart and Target, which also offer their products online, have now also recognized the potential offered by e-commerce. With the Kick-In GOALs in subscription on Alibaba, Amazon and eBay (symbol: KCWUDU) as well as on Target, Walmart and Macy’s (symbol: KCWLDU), investors can invest in the international trading giants with partial protection. In addition to high risk buffers of up to 50%, the products also offer double-digit percentage return opportunities.

The recent discount battle in China was a complete success. The world’s largest shopping event, Singles‘ Day, was a huge event. Regional giant Alibaba alone sold goods worth the equivalent of USD 30.7 billion during the 24-hour shopping party – a figure which is up 27% on the previous year. The Xinhua news agency reported that Amazon’s Chinese rival generated almost USD 1.5 billion in the first two minutes alone. This could potentially be a good indicator for the upcoming shopping marathon in the US. However, we do not expect the sales figures to be as high. According to the information provided by Adobe Digital Insights, goods worth USD 5 billion were sold on Black Friday last year, with Cyber Monday generating a further USD 6.6 billion. Although these shopping events in the US are not as significant as those in China, this is still an important time for companies. For example, the sales volume recorded by Amazon on Cyber Monday 2017 was not matched on any other day in the year.

The figures provided by eMarketer show how dominant Amazon is. The market researcher has calculated that the e-commerce giant accounts for 49.1% of all online retail spending in the country and 5% of all retail sales. In second place and languishing quite far behind is eBay, with a share of 6.6%. However, bricks and mortar department stores are also among the top ten. Walmart ranks fourth with a 3.7% share of the US e-commerce cake and Macy’s is in eighth position with 1.2%. (Source: eMarketer, July 2018) The world’s largest retailer Walmart is also doing well outside of Black Friday. In the third quarter, group sales increased by 1.4% in comparison with the previous year. For the current 2018/19 financial year (January 31), the company raised its forecast for adjusted earnings per share to USD 4.75 to 4.85 (previously USD 4.65 to 4.80). The forecast for the US business’ organic growth was also raised from “around” to “at least” 3%.Opportunities: Two new Kick-In GOALs provide investors with the opportunity to take up a promising position in the retail sector. The Kick-In GOAL on Alibaba, Amazon and eBay (symbol: KCWUDU) pays an annual coupon of 11%. The maximum return will be achieved if none of the underlyings fall below the barrier of 54% of their respective initial fixing values over the coming twelve months. The Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCWLDU) on Target, Walmart and Macy’s features even more attractive conditions, with a risk buffer of an impressive 50% and an annual coupon of 12%. Due to the early redemption function, the maximum term can be reduced to twelve months.

Risks: Kick-In GOALs do not have capital protection. If the underlyings equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

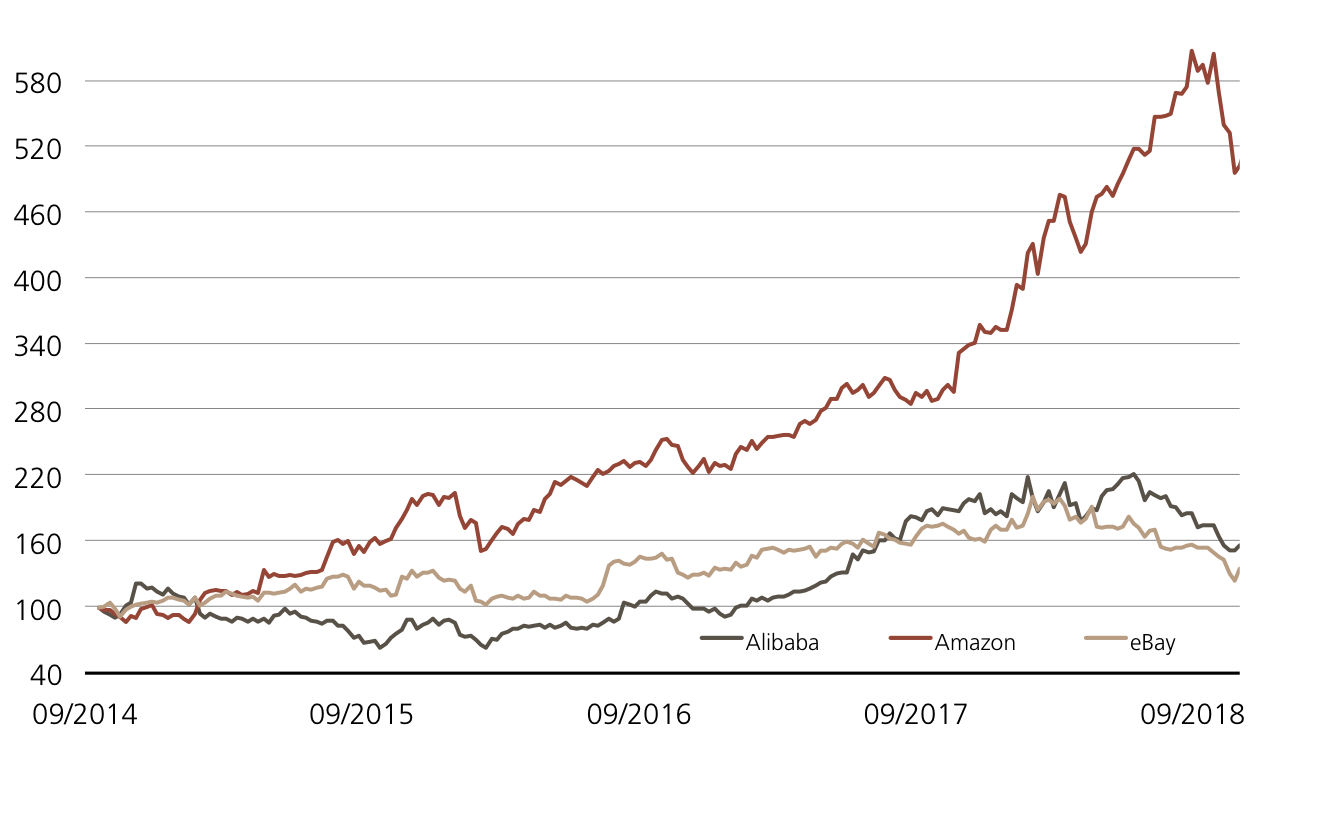

Alibaba vs. Amazon vs. eBay (since the Alibaba IPO on September 19, 2014)¹

In recent years, the Amazon share price has surpassed those of its competitors Alibaba and eBay. This year, the e-commerce giant even broke through the 1 trillion dollar mark in terms of market capitalization.

Source: UBS AG, Bloomberg

As of 21.11.2018

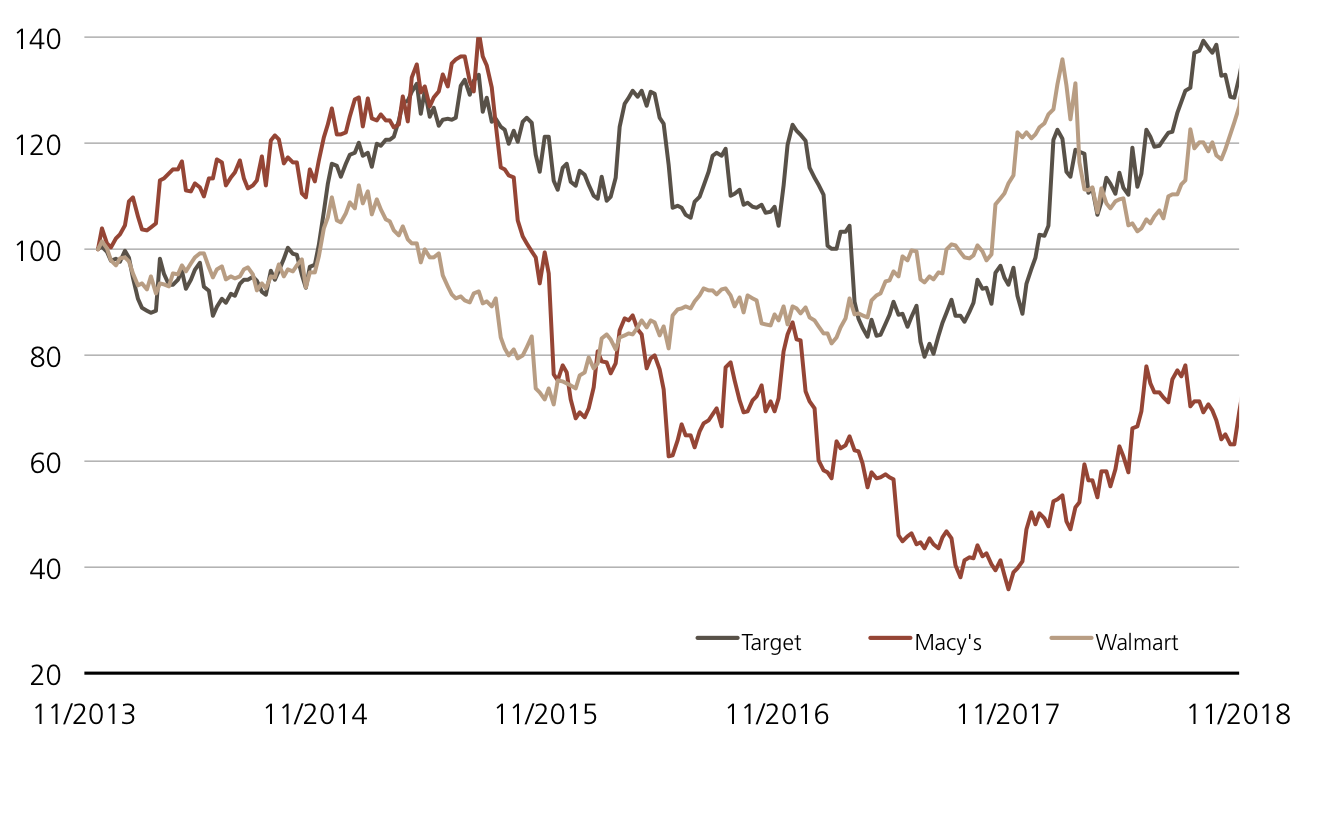

Target vs. Walmart vs. Macy’s (5 years)¹

While the Target and Walmart shares closed the selected five-year period positively, the Macy’s share suffered, falling by 35%.

Source: UBS AG, Bloomberg

As of: 21.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

12.00% p.a. ER Kick-In GOAL on Target, Walmart, Macy’s

| Symbol | KCWLDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | Target, Walmart, Macy’s |

| Currency | USD |

| Coupon | 12.00% p.a. |

| Kick-In Level | 50% |

| Expiry | 05.06.2020 |

| Issuer | UBS AG, London |

| Subscription until | 05.12.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 21.11.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’841.48 | -1.0% |

| SLI™ | 1’368.38 | -1.8% |

| S&P 500™ | 2’649.93 | -1.9% |

| Euro STOXX 50™ | 3’153.91 | -1.6% |

| S&P™ BRIC 40 | 3’853.70 | 1.1% |

| CMCI™ Compos. | 898.76 | -1.0% |

| Gold (troy ounce) | 1’228.00 USD | 1.5% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

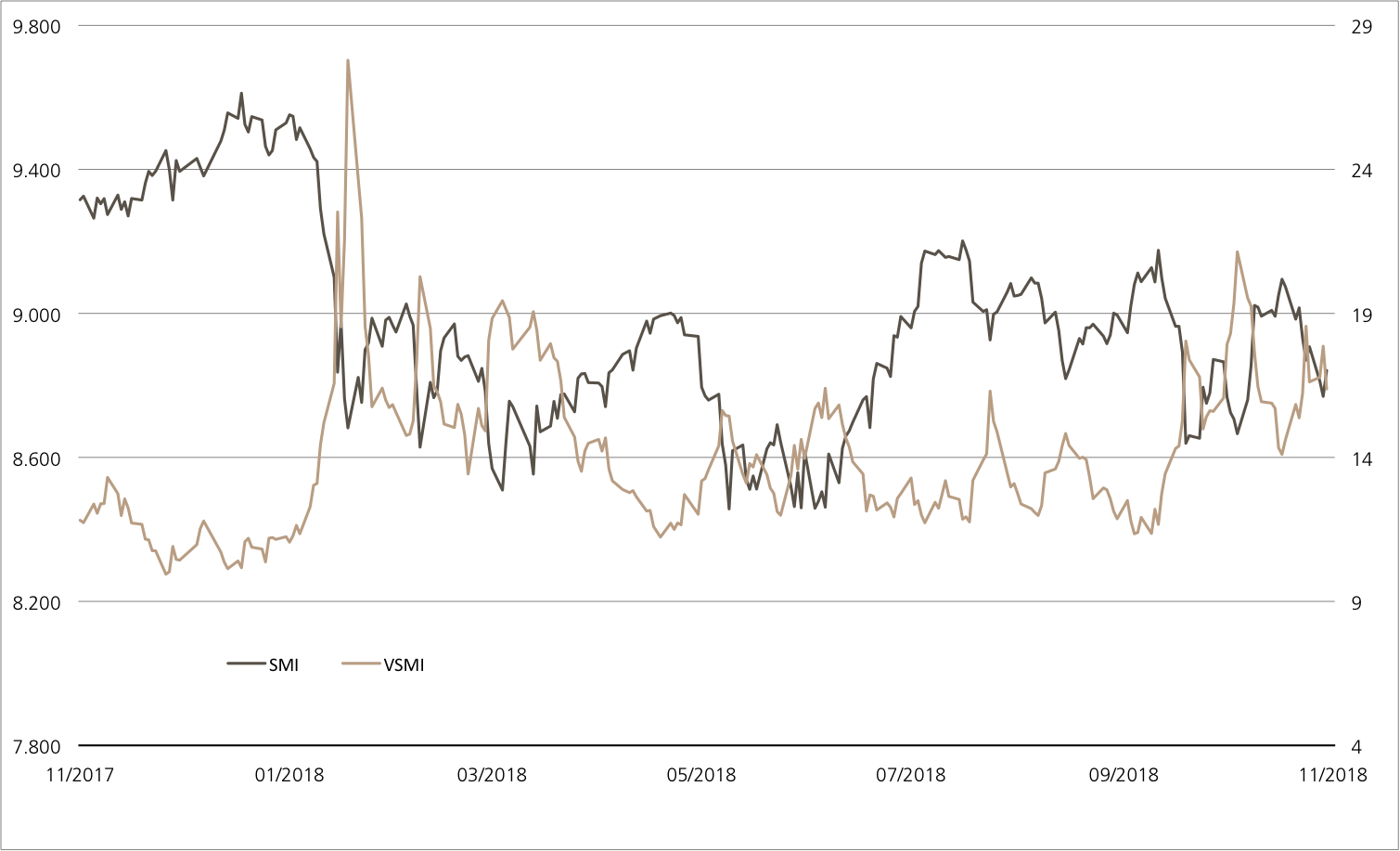

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 21.11.2018

Continental & Michelin

More than just black tires

Temperatures are dropping and the rain is turning into snow – the weather forecast is highlighting that it is high time for car drivers to fit their winter tires. This is a perfect time to take a closer look at tire manufacturers. The two largest producers in Europe are Michelin and Continental, with the French company being the undisputed number one. Unlike Michelin, Continental does not just focus on tires – it is also involved in future technologies such as e-mobility and autonomous driving. Michelin, on the other hand, concentrates its efforts on designing the car tires of the future, with energy efficiency and, above all, a smooth drive being top priorities. Investors can now add the two innovative automotive suppliers to their portfolios with just one investment. The Early Redemption Worst of Kick-In GOAL (symbol: KCVYDU) in subscription on Continental and Michelin comes with appealing conditions. If the barrier remains intact at 59% of the starting prices, the product will yield a maximum return of 7% p.a. in two years at the latest.

Continental’s mix of its tire business and new automotive technology has ensured growth in recent years. Although 2018 will be a year of transition – the forecast has already been reduced twice, partly due to the switch to the new emission regulations – CEO Elmar Degenhart is optimistic nevertheless. “Our sales growth and order intake for automotive electronics are a good sign in view of the weak market environment,” he said in response to the latest figures. The most profitable segment in the first nine months was once again the tire segment, with an operating return of 16.3%. “Thanks in part to the great performance of our winter tires, we expect to exceed last year’s record sales in Europe once again in 2018,” said CFO Wolfgang Schäfer confidently. (Source: Continental press release, November 8, 2018) UBS CIO WM Research currently considers Continental to be the preferred company in the sector; However, the analysts‘ verdict on competitor Michelin is also to “buy”. (Source: UBS WM Research, November 13, 2018)

Opportunities: Continental and Michelin are currently searching for ground on the stock market. For the Early Redemption Worst of Kick-In GOAL (symbol: KCVYDU) to be profitable, the two underlyings don’t have to make a turnaround. The product allows the underlyings to have a downward margin of almost 41% before the brakes are put on the potential maximum return of 7% p.a. The maximum term of two years can be shortened by a year due to the early redemption function.

Risks: This product does not have capital protection. If the underlyings equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

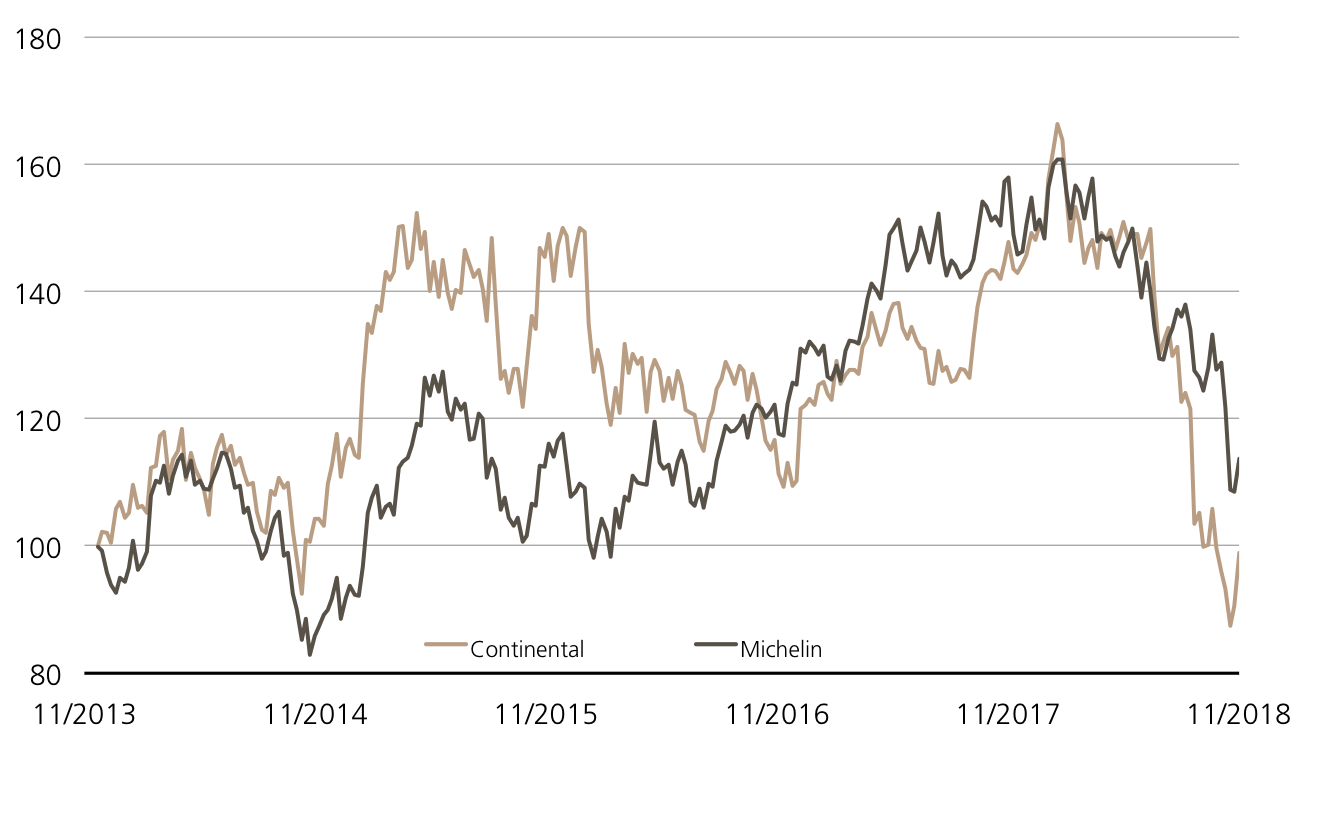

Continental vs. Michelin (5 years)¹

Source: UBS AG, Bloomberg

As of: 21.11.2018

7.00% p.a. ER Kick-In GOAL on Continental, Michelin

| Symbol | KCVYDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Continental, Michelin |

| Currency | EUR |

| Coupon | 7.00% p.a. |

| Kick-In Level | 59% |

| Expiry | 30.11.2020 |

| Issuer | UBS AG, London |

| Subscription until | 28.11.2018, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 21.11.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.