Friday, 07.12.2018

- Topic 1: The pharma industry - A healthy performance

- Topic 2: US technology - The battle for supremacy

The pharma industry

A healthy performance

In recent weeks and months, observers of the stock market will have noticed a certain change in investors’ preferred shares. Technology shares, which had been favorites among investors for a long time, have had to make way, as sectors considered defensive gained in popularity. This especially applies to the healthcare industry – the STOXX™ Europe 600 Health Care Net Return (NR) Index rose by 1.9% in November. With an ETT (symbol: ETHEA), investors can add this benchmark with strong momentum to their portfolios in an efficient and cost-effective manner. The Pharmaceutical powerhouses Bayer, GlaxoSmithKline and Novartis form the basis for an Early Redemption (ER) Kick-In GOAL (symbol: KCOCDU). The product is currently showing a positive minimum return of 12.3% p.a. This opportunity comes with a solid safety buffer of 26.5% – even with the current worst performer Bayer.

In view of the hectic stock market environment, the recent rotation in preferred sectors is not without warrant. The healthcare industry can certainly also offer operational momentum. A good example here is Novartis: Since Vasant Narasimhan assumed the position of CEO in February; he has set about repositioning the Basel-based group. The Harvard graduate is focusing on specialized, patient-oriented drugs and new treatment approaches, with the aim of developing platforms for cell therapy, gene therapy and radioligand therapy. Novartis strengthened the latter area in October with the USD 2.1 billion acquisition of Endocyte. The US biotech company is developing a type of nuclear medicine therapy for the treatment of prostate cancer. Narasimhan believes that the drug, which is due to be launched in 2021, will generate peak sales of more than one billion US dollars. New products, such as the heart medication Entresto or Cosentyx for psoriasis, have recently provided a boost to Novartis‘ business, as the Group recorded currency-adjusted sales growth of 6% in the third quarter of 2018.

As a result, management raised its forecast for the year as a whole. (Source: Thomson Reuters media report, October 18, 2018) Roche, the second-largest Group in terms of weighting in the STOXX™ Europe 600 Health Care Index, is also enjoying a tailwind. On December 4, the company presented positive study data for Venclexta in the treatment of blood cancer. In contrast, GlaxoSmithKline’s (GSK) takeover of US cancer specialist Tesaro was met with little enthusiasm. Obviously, the purchase price of USD 5.1 billion is too high for stock exchange speculators, with the GSK share falling significantly. (Source: Thomson Reuters media report, December 3, 2018).Opportunities: In spite of this, the STOXX™ Europe 600 Health Care Index is about to break out to the upside of the overriding downward trend. With the ETT (symbol: ETHEA), both a short-term trading strategy and a permanent buy-and-hold approach can be pursued – the product replicates the underlying assets completely. There are thus no management fees for this product.² For the ER Kick-In GOAL (symbol: KCOCDU), a stable performance from Bayer, GSK and Novartis would be enough to realize the positive minimum return of 12.3% p.a. Although the product is listed well below the issue price almost two months after the initial setting of the price, the barrier is still 26.5% – even for Bayer, currently the weakest share among the trio. Due to the integrated Early Redemption function, there is also the opportunity for early redemption plus the accrued coupon with this Kick-In GOAL.

Risks: The aforementioned products do not have capital protection. Should the underlying assets deliver a negative performance; the ETT will incur commensurate losses. If one of the underlyings in a Worst of Kick-In GOAL touches or falls below the respective kick-in level (barrier) and the early redemption feature does not apply, repayment at maturity may be in cash, reflecting the weakest performance of the trio from strike (but no more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

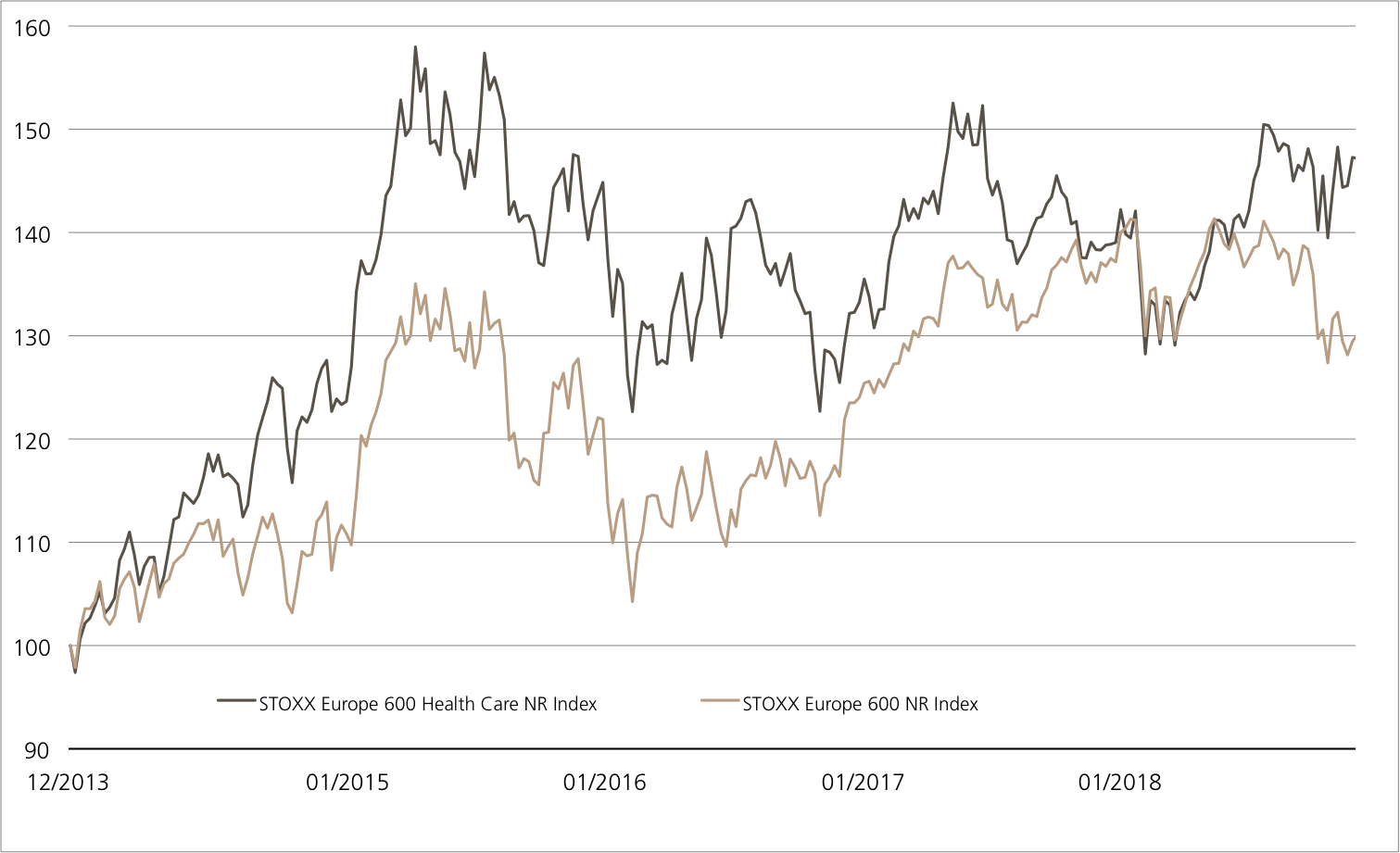

STOXX™ Europe 600 Health Care Net Return Index vs. STOXX™ Europe 600 Net Return Index 5 years¹

By mid-year, the STOXX™ Europe 600 Health Care Index had lost its lead over the market. The sector has, however, been outperforming the STOXX™ Europe 600 Index once again recently.

Source: UBS AG, Bloomberg

As of 05.12.2018

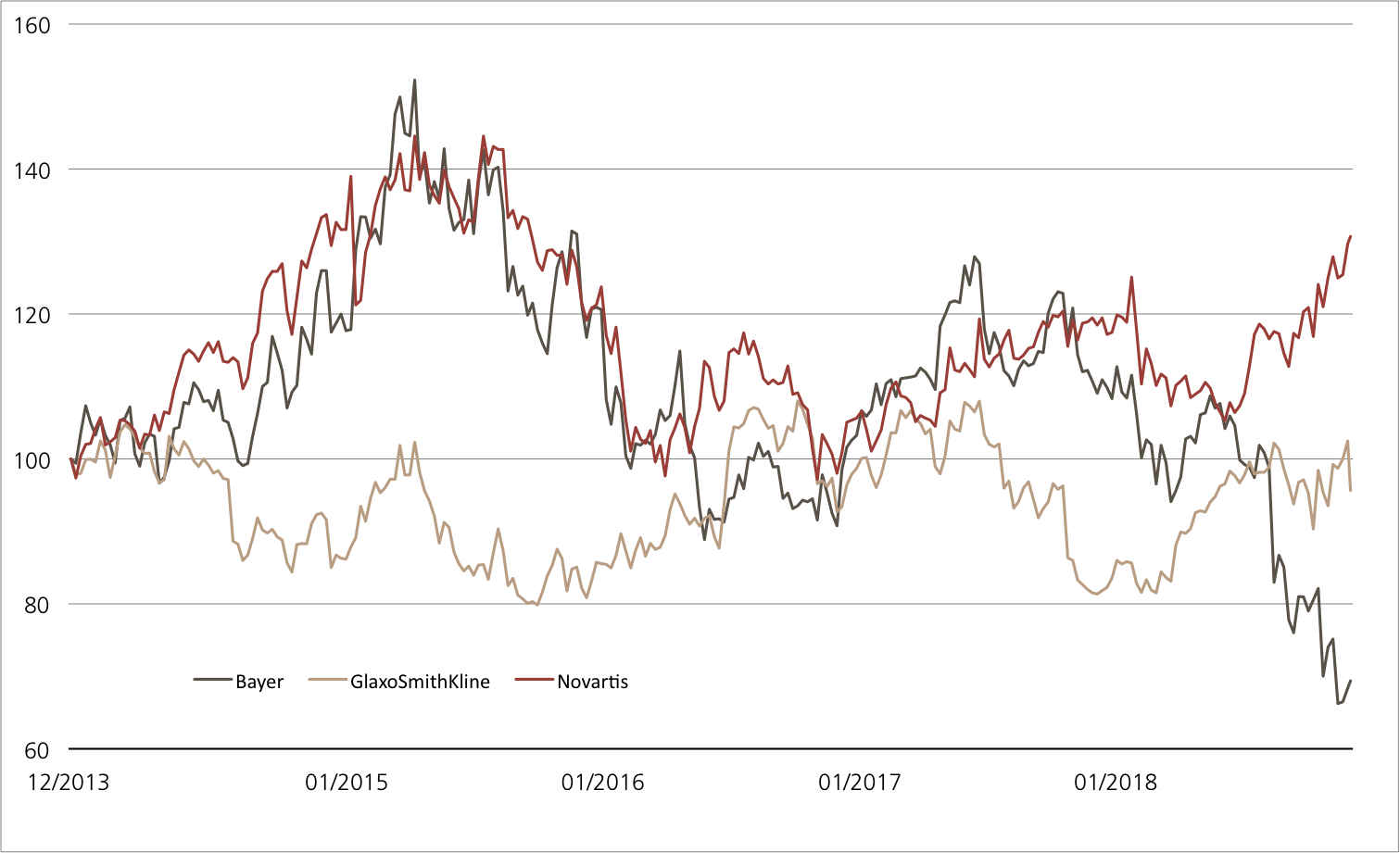

Bayer vs. GlaxoSmithKline vs. Novartis

(5 years; for illustrative purposes only; figures in %) ¹

Most recently, Novartis shares outperformed those of both competitors in a five-year comparison. While Bayer is only just below the break-even point, GlaxoSmithKline has been on a downward spiral since June 2017.

Source: UBS AG, Bloomberg

As of: 05.12.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETT on STOXX™ Europe 600 Health Care EUR Net Return Index

| Symbol | ETHEA |

| SVSP Name | Tracker-Zertifikat |

| SPVSP Code | 1300 |

| Underlying | STOXX™ Europe 600 Health Care EUR Net Return Index |

| Currency | EUR |

| Ratio | 1:1 |

| Administration fee | 0.00% p.a.² |

| Expiry | Open End |

| Participation | 100% |

| Issuer | UBS AG, London |

| Bid/Ask | EUR 1’1302.00 / 1’310.00 |

7.50% p.a. Early Redemption Kick-In GOAL on Bayer / GlaxoSmithKline / Novartis

| Symbol | KCOCDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | Bayer / GlaxoSmithKline / Novartis |

| Currency | CHF |

| Coupon | 7.50% p.a. |

| Sideways return | 24.50% (12.42% p.a.) |

| Kick-In Level (Distance) |

Bayer: EUR 48.0064 (26.83%) GSK: GBP 9.495 (34.91%) Novartis: 54.0928 (40.14%) |

| Expiry | 12.10.2020 |

| Issuer | UBS AG, London |

| Bid/Ask | 90.35% / 91.35% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 05.12.2018

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’939.96 | 0.5% |

| SLI™ | 1’377.32 | 0.0% |

| S&P 500™ | 2’700.06 | -1.6% |

| Euro STOXX 50™ | 3’150.27 | -0.6% |

| S&P™ BRIC 40 | 3’989.49 | 0.8% |

| CMCI™ Compos. | 898.60 | 2.0% |

| Gold (troy ounce) | 1’242,60 USD | 1.0% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

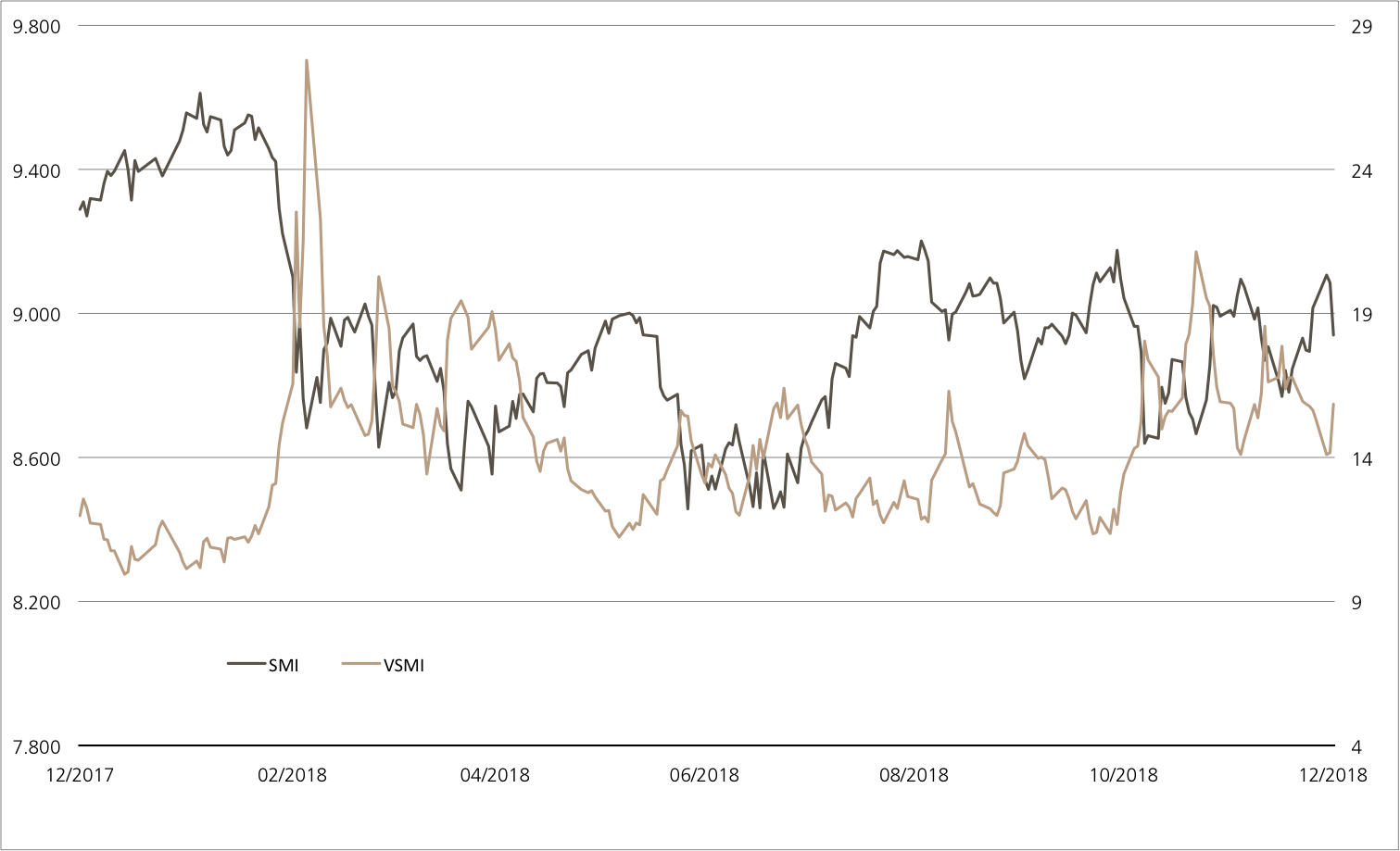

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 05.12.2018

US technology

The battle for supremacy

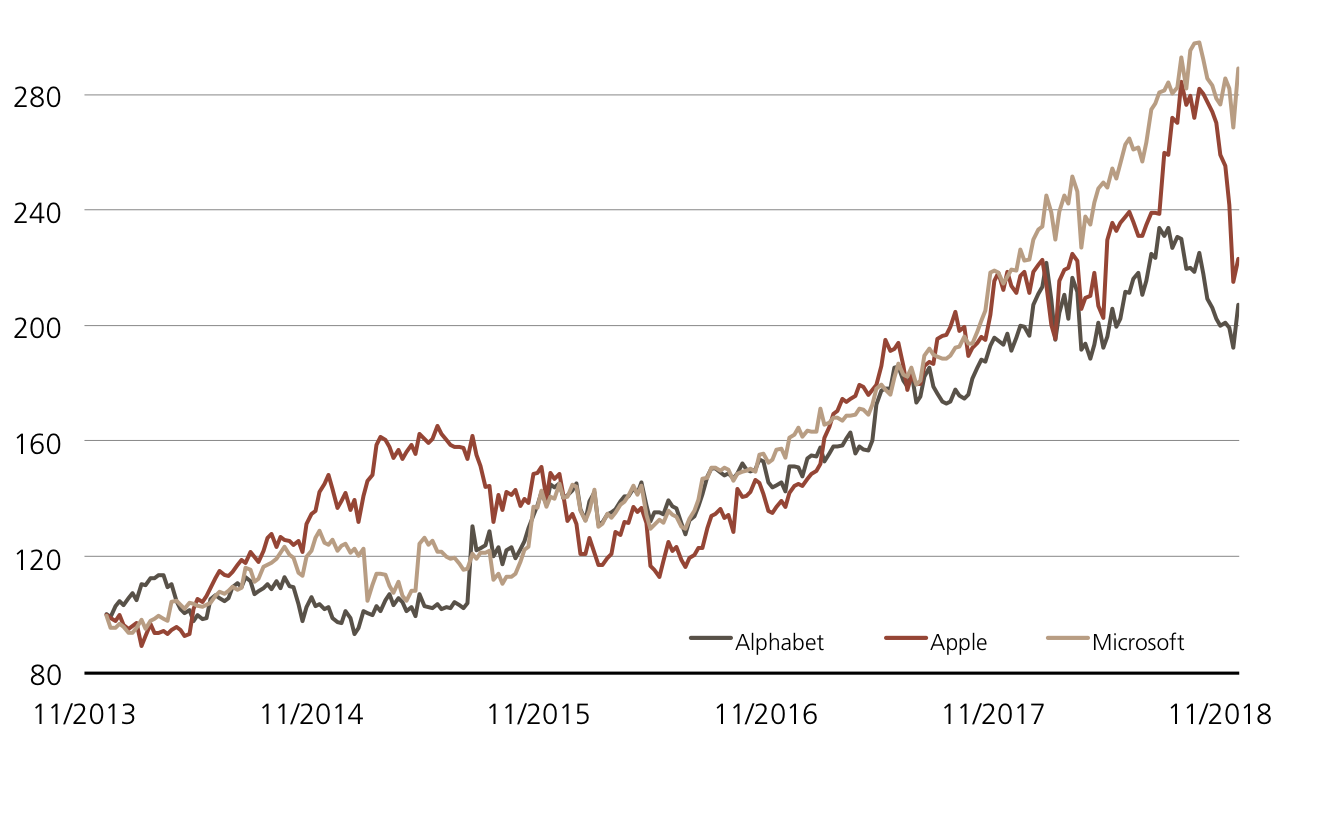

The battle for the crown of stock market heavyweight is in full swing. Amazon, Microsoft and Apple have recently been trading the position of most valuable company. The company sitting in fourth place –Alphabet – also has a good chance of stealing this crown. In terms of operations, Microsoft in particular is currently making positive headlines, as the veteran of the computer industry once again exceeded analysts‘ expectations in the past quarter. With positive growth of around 30% in 2018, the Microsoft share has also performed much more dynamically than its arch-rival Apple.¹ The Early Redemption (ER) Worst of Kick-In GOAL (symbol: KCTKDU) on Alphabet, Apple and Microsoft does not need any share price gains for a return to be delivered. The product issued at the beginning of November is currently offering a potential maximum return of 10.6% p.a. which is partly protected by a risk buffer of more than 30%.

For a long time, Microsoft was regarded as a “digital dinosaur” threatened with extinction. However, the CEO Satya Nadella, who has been in office since 2014, shook the dust off the company founded in 1975 and managed to turn the tide by focusing on the cloud. With its “Azure” cloud solution, the group has now risen to number two behind Amazon and even ahead of the Alphabet subsidiary Google. In the first quarter of the 2018/19 financial year alone, Azure has recorded growth of 76%. The group has also enjoyed success on the stock market. On November 28, Microsoft held the position as the world’s most valuable listed company for the first time since 2000 and at the same time dethroned Apple. Although the iPhone manufacturer is also doing well operationally, concerns have recently arisen on the stock market. Reports from suppliers suggest that sales of the current generation of iPhones are below expectations (source: Handelsblatt media report, December 1, 2018).

Opportunities: Even though the upward trend of tech shares has faltered somewhat recently, the industry giants Alphabet, Apple and Microsoft are still clearly up in comparison with the end of 2017.¹ Should the trio take their foot off the gas again, this would present no problems to the ER Worst of Kick-In GOAL (symbol: KCTKDU). The coupon of 9.50% will be paid out regardless of the performance of the shares. Currently, the maximum return is even higher, as the kick-in GOAL is listed below par. In order to achieve this maximum return, the barrier for the underlying assets must remain intact. Apple currently has the lowest buffer, standing at 31.8%. Should the three shares be at or above their starting price on one of the quarterly observation days (first date: November 7, 2019) the product will mature ahead of schedule due to the ER function.

Risks: ER Kick-In GOALs do not have capital protection. If the underlyings equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the three shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Alphabet Inc. A vs. Apple vs. Microsoft (5 years)¹

Source: UBS AG, Bloomberg

As of: 05.12.2018

9.50% p.a. ER Worst of Kick-In GOAL on Alphabet / Apple / Micorosoft

| Symbol | KCTKDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Alphabet Inc. A / Apple / Microsoft |

| Currency | USD |

| Coupon | 9.50% p.a. |

| Sideways return | 22.78% (11.40% p.a.) |

| Kick-In Level (Distance) | Alphabet: USD 664.944 (37.42%) Apple: USD 125.97 (28.71%) Microsoft: USD 67.176 (38.10%) |

| Expiry | 23.10.2020 |

| Issuer | UBS AG, London |

| Bid/Ask | 95.37% / 96.37% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 05.12.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.