Friday, 11.01.2019

- Topic 1: Automotive industry - Given a polish

- Topic 2: Biotech sector - Wave of acquisitions set to continue

Automotive industry

Given a polish

With jubilant highs and sorry lows, the automotive industry has endured a rollercoaster of emotions in recent months. Although the prospects of autonomous technology, digital networking and innovative engines have been a ray of light for the industry, economic uncertainty and trade conflicts are providing a much gloomier picture. There has been a prevailing sense of concern over the past year and prices have hit rock bottom¹. It is, however, still unclear whether the sector will experience a change in direction in 2019. At the upcoming Detroit Motor Show, automotive groups will be revealing what they have to offer under the hoods of their vehicles. The ETT on the STOXX™ Europe 600 Automobiles & Parts NR Index (symbol: ETAUT) provides investors with the opportunity to participate in the sector in a diversified manner and without having to pay any fees.² A viable alternative is also presented in the form of the new IC Kick-In GOAL (symbol: KCZTDU) on BMW, Daimler and VW. The product has a buffer of 40% as well as an annual coupon of 10%.

In order to make an impression with those in attendance, the manufacturers polished their cars at the beginning of the year and will present the highlights of their product ranges at various trade fairs. Traditionally, the North American International Auto Show (NAIAS) announces the start of the year for the automotive industry – and has done so since 1907. However, this is the last time the Detroit show will take place in January. From 2020 onwards, the NAIAS will be a summer event held in July. The trade fair opens its gates on January 14 this year, with numerous innovations at which guests can marvel. The organizers expect more than 30 new models to make their debut, with the American automotive groups taking center stage. Ford will enter the race with, among other vehicles, the 700-horsepower Shelby GT500 and Fiat-Chrysler will showcase a new Ram Heavy Duty pickup with LED lights. But it’s not just the US brands that want to impress the domestic audience; European manufacturers will also be showing what they have to offer in Detroit. For example, Volkswagen will unveil the US Passat as its latest sedan model.

While VW will be travelling to cold Detroit, its competitors BMW and Daimler prefer to make an appearance at the CES in Las Vegas. Although the Consumer Electronics Show is not really a motor show, an increasing number of car makers are making the journey to the desert city. From January 8–12, the manufacturers will be primarily presenting their technological concepts at the show. While BMW will be showcasing a self-driving motorcycle, Mercedes-Benz will be giving the CLA its world premiere. The model comes equipped with a number of assistance systems, such as gesture controls. As far as US vehicle sales are concerned, Daimler has recently been in pole position. With 315,959 vehicles sold in 2018, the brand once again took first place among the most sold luxury vehicles in the USA. BMW is not far behind in second place and is catching up: While Daimler experienced a 6.3% decline in the number of cars sold, the Bavarian company recorded an increase of 1.7% (source: Manager Magazin media report, January 4, 2019).Opportunities: The car world is facing upheaval. This presents risks (billion-dollar investments) as well as opportunities (product innovations). Should you feel that there will be a change in direction in 2019 – the STOXX™ Europe 600 Automobiles & Parts Index fell by 28% last year– you can implement a long strategy with the ETT (symbol: ETAUT).¹ The product offers full participation, taking into account the net distributions of the 16 members. This is a factor not to be underestimated, as the dividend yield of the index stands at 2.5%. There is no annual fee.² With the new IC Kick- In GOAL (symbol: KCZTDU), investments can be made in the index heavyweights BMW, Daimler and VW with an “airbag”. The product has a comfortable risk buffer of 40% and an attractive annual coupon of 10%.

Risks: The aforementioned products do not have capital protection. Should the underlying assets deliver a negative performance, the ETT will incur commensurate losses. If the underlying assets for the Worst of Kick-In GOALS equal or fall below the respective kick-in level (barrier) and the issuer callable feature does not apply, the amount repaid on maturity may be in cash, reflecting the worst performance of the three shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

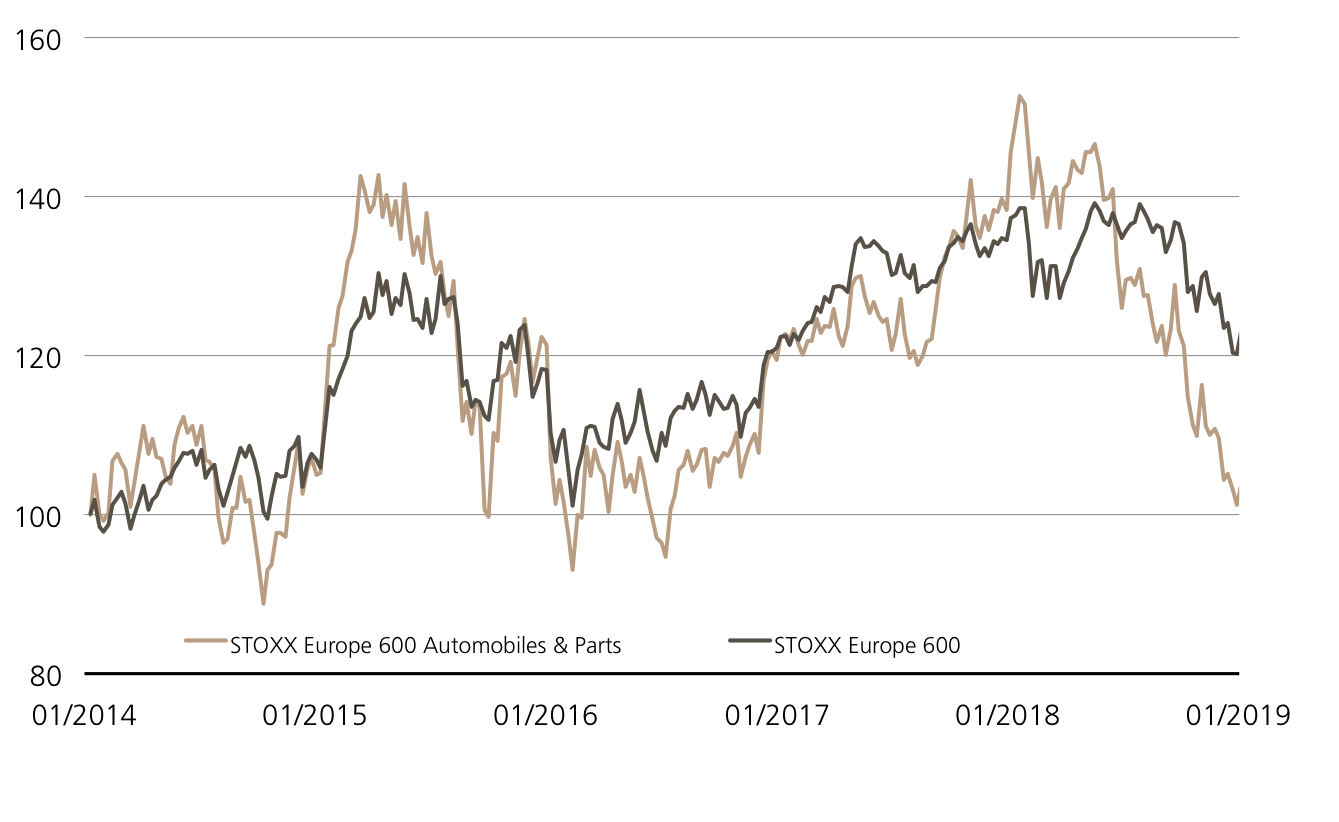

STOXX™ Europe 600 Automobiles & Parts NR Index vs. STOXX™ Europe 600 NR Index

(five years, for illustrative purposes only, figures in %)¹

“Nothing gained, nothing lost” – this figure of speech holds true for the five-year trend of the STOXX™ Europe 600 Automobiles & Parts Index. Meanwhile, the broad STOXX™ Europe 600 Index rose by 20%.

Source: UBS AG, Bloomberg

As of 10.01.2019

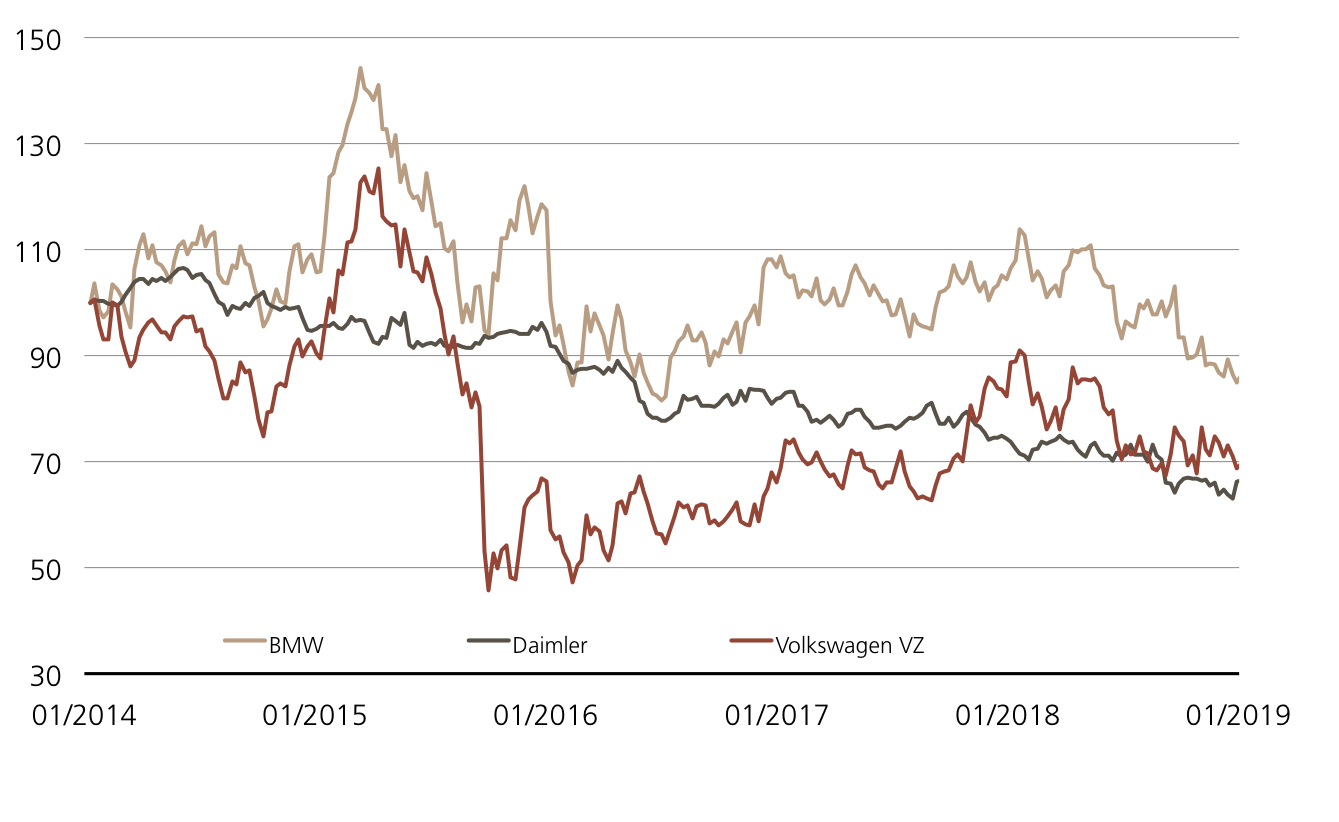

BMW vs. Daimler vs. Volkswagen VZ

(five years, for illustrative purposes only, figures in %)¹

The shares of BMW, Daimler and Volkswagen are showing clear signs of slowing down in the five-year chart. Over the past two years, the shares in the three German automotive companies have at least moved sideways.

Source: UBS AG, Bloomberg

As of: 10.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETT on STOXX™ Europe 600 Automobiles & Parts NR Index

| Symbol | ETAUT |

| SVSP Name | Tracker Certificates |

| SPVSP Code | 1300 |

| Underlying | STOXX™ Europe 600 Automobiles & Parts EUR Net Return Index |

| Currency | EUR |

| Ratio | 1:1 |

| Administration fee | 0.00% p.a.² |

| Expiry | Open End |

| Participation | 100% |

| Issuer | UBS AG, London |

| Bid/Ask | EUR 812.00 / 816.50 |

10.00% p.a. IC Worst of Kick-In GOAL on BMW / Daimler / Volkswagen

| Symbol | KCZTDU |

| SVSP Name | Barrier Reverse Convertibl |

| SPVSP Code | 1230 (Callable) |

| Underlying | BMW / Daimler / Volkswagen |

| Currency | EUR |

| Coupon | 10.00% p.a. |

| Kick-In Level |

60% |

| Expiry | 23.07.2020 |

| Issuer | UBS AG, London |

| Subscription until | 23.01.2019, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 10.01.2019

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’687.71 | 3.1% |

| SLI™ | 1’342.15 | 3.6% |

| S&P 500™ | 2’584.96 | 3.0% |

| Euro STOXX 50™ | 3’070.24 | 2.6% |

| S&P™ BRIC 40 | 3’970.99 | 5.8% |

| CMCI™ Compos. | 894.73 | 5.0% |

| Gold (troy ounce) | 1292.00 USD | 0.6% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

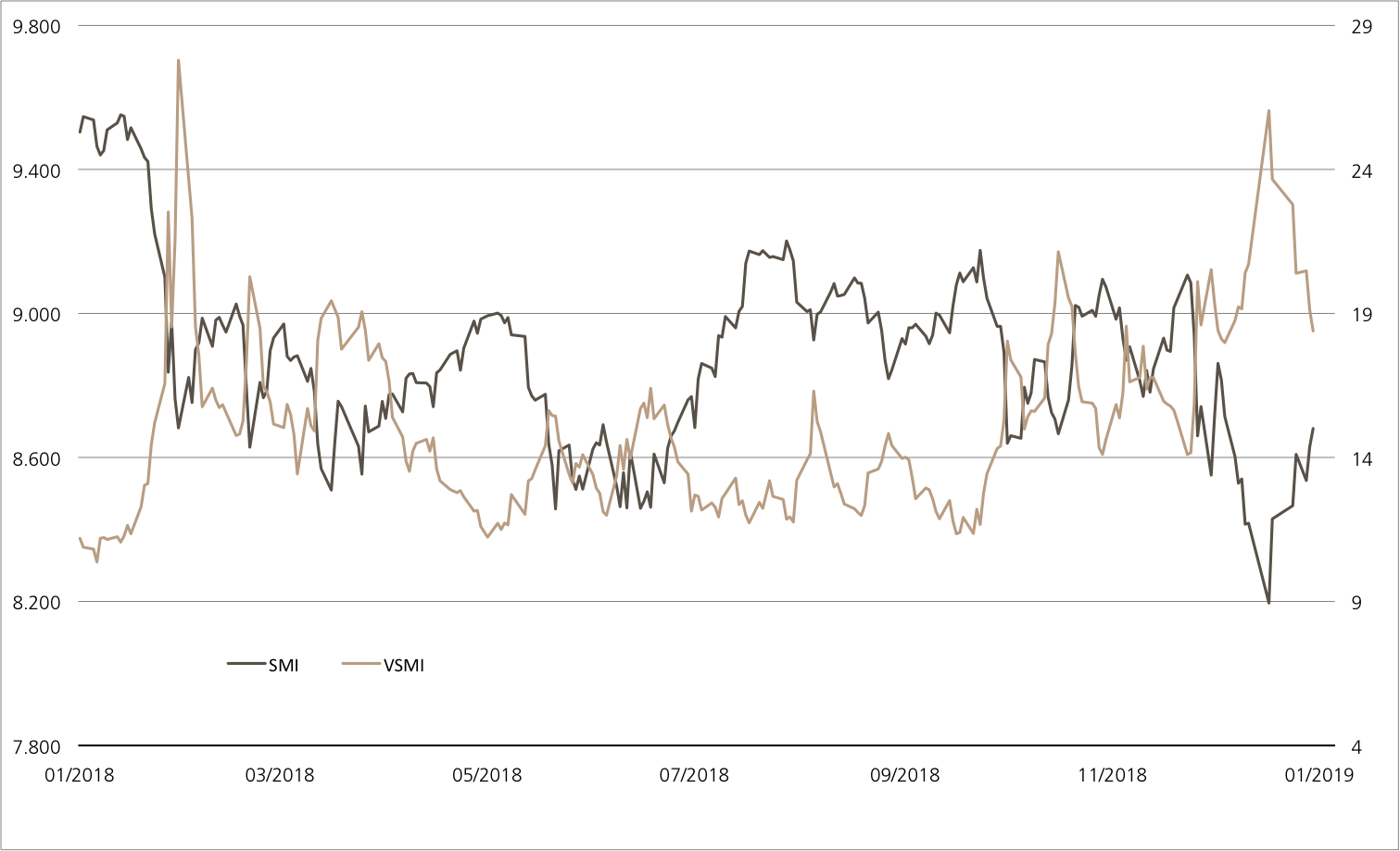

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 10.01.2019

Biotech sector

Wave of acquisitions set to continue

The new year began with a bang on Wall Street, as pharmaceutical giant Bristol-Myers Squib submitted a USD 74 billion takeover bid for the Celgene biotech group on January 3. And just a few days later, Eli Lilly added to the wave of takeovers in the sector. The American company is courting Loxo Oncology with an USD 8 billion cash offer. In the wake of both deals, the kick-in GOAL (symbol: KCFZDU) on Celgene, Amgen and Johnson & Johnson also experienced a lively start to the year.¹ Notwithstanding the gains, the product offers the prospect of a minimum return of 10.4% p.a. Even with the current worst performer (Celgene), this attractive opportunity comes with a barrier of 37.5%.

Together with Celgene, Bristol-Myers Squib will soon be launching a series of blockbusters on the market. Specifically, six new drugs with a sales potential of more than USD 15 billion are to be launched in the near future. One of the key aspects in the planned merger is cancer immunotherapy. Celgene boosted its expertise in this field of treatment last year with the USD 9 billion acquisition of Juno Therapeutics (source: Thomson Reuters media report, January 3, 2019).

Oncology has always played an important role in Amgen’s business. As recently as in December of last year, the biotech giant announced its strategic collaboration in the field of immunotherapy with Swiss company Molecular Partners. The transatlantic alliance will focus on the clinical development and commercialization of “MP0310”. The aim of this active ingredient is to activate the immune cells in a tumor (source: Thomson Reuters media report, December 19, 2018). Oncology has recently emerged as a growth driver for the Johnson & Johnson healthcare company. One example of this is Zytiga, an active ingredient used to treat prostate cancer. Together with other products, it generated an operating sales growth of 8.2% for the company’s Pharmaceuticals division in the third quarter of 2018 (source: Johnson & Johnson media release, October 16, 2018).Opportunities: Should the share prices of Amgen, Celgene and Johnson

& Johnson remain more or less stable over the next seven months, a minimum annual yield of 10.4% can be achieved with the Kick-In GOAL (symbol: KCFZDU). This will require that none of the three underlyings touch or fall below the barrier before the maturity date in August. In contrast to when the shares were issued, Celgene currently has the weakest price performance. Nevertheless, the Nasdaq 100™ member still has a safety buffer of 37.5%.

Risks: Kick-In GOALs do not have capital protection. If one of the underlyings equals or falls below the respective kick-in level (barrier) during the term, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the three shares from the strike price (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

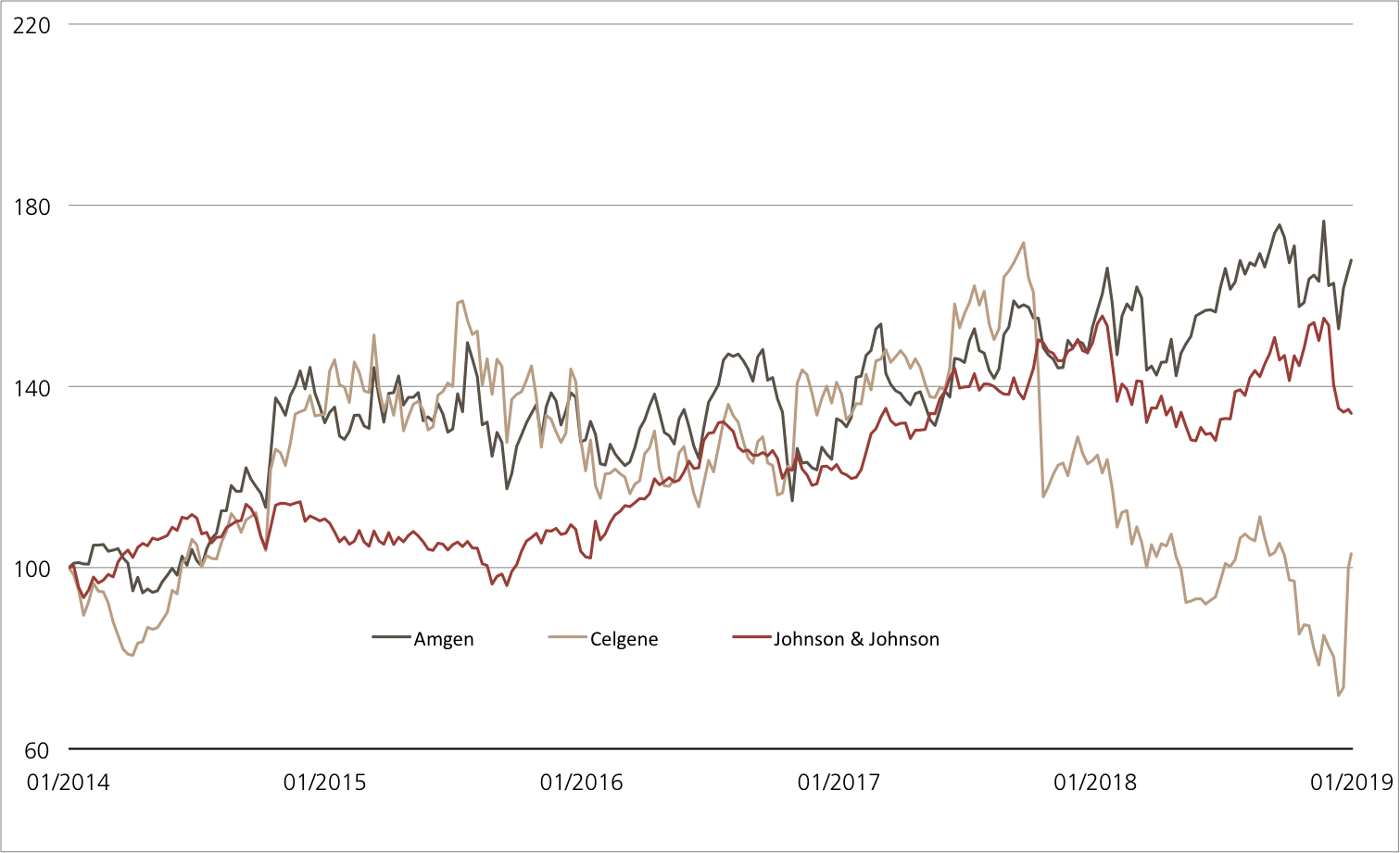

Amgen vs. Celgene vs. Johnson & Johnson

(five years, for illustrative purposes only, figures in %)¹

Source: UBS AG, Bloomberg

As of: 10.01.2019

6.50% p.a. Kick-In GOAL on Amgen / Celgene / Johnson & Johnson

| Symbol | KCFZDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 |

| Underlyings | Amgen / Celgene Corporation / Johnson & Johnson |

| Currency | USD |

| Coupon | 6.50% p.a. |

| Sideways return | 6.48% (10.38% p.a.) |

| Kick-In Level (Distance) | Amgen: USD 118.704 (41.10%) Celgene: USD 54.384 (37.45%) Johnson & Johnson: USD 80.766 (37.50%) |

| Expiry | 22.08.2019 |

| Issuer | UBS AG, London |

| Bid/Ask | 96.61% / 97.64% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 10.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.