Friday, 18.01.2019

- Topic 1: Gold - An increase in the need for protection

- Topic 2: Airbus/Boeing - A transatlantic duel

Gold

An increase in the need for protection

The British House of Commons has rejected the Brexit agreement negotiated with Brussels by Prime Minister Theresa May. Although the Prime Minister is now working on a “Plan B”, the risk of a “no deal” Brexit has increased. It therefore comes as no surprise that investors are increasingly turning to the crisis currency of gold (the gold price has risen by 3.7% since December 10, 2018).¹ The ETC (symbol: CGCCIU) offers transparent and efficient access to the most important precious metal. The product tracks the performance of the UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index. The main parties benefitting from the increasing gold prices are precious metal producers such as Kinross Gold, Freeport-McMoRan and Barrick Gold. This trio forms the basis for an Early Redemption (ER) Kick-In GOAL (symbol: KDAIDU). Investors can expect a coupon payment of 14% p.a. with this subscription product. In addition, the three shares prone to fluctuations have low barriers of 50% of the initial price level.

While only 202 MPs voted for the Brexit deal, a clear majority of 432 MPs rejected it. After the vote in the House of Commons, Theresa May nevertheless came out fighting and announced a plan for how to proceed next. However, we may not see this plan in action, as the leader of the opposition Jeremy Corbyn called for a vote of no-confidence (source: Thomson Reuters media report, January 16, 2019). In any case, the gold price initially showed little reaction to the crushing defeat suffered by the British government. However, the precious metal had grown considerably more expensive in the run-up to the vote, with its value increasing by 6.1% over three months.¹ In addition to the Brexit turbulence, the tariff dispute between the US and China has seen investors head to the safe haven offered by gold.

Especially as the unresolved spat is having a noticeable impact on the real economy. One such example is that in December, China reported a 7.6% decline in imports in comparison with the previous year. At the same time, exports also fell by 4.4%. Analysts had expected growth for both indicators (source: Thomson Reuters media report, January 15, 2019). In the wake of rising precious metal prices, shares in the mining sector have provided a sign of life. In addition, a takeover has made the industry sit up and take notice, with US company Newmont Mining buying its Canadian competitor Goldcorp for USD 10 billion. If the deal actually comes to pass, this merger would see the creation of the world’s largest gold company. Back in September 2018, Barrick Gold merged with Randgold Resources, a deal that saw the company’s market value rise by USD 6.1 billion (source: Thomson Reuters media report, January 14, 2019).Opportunities: With the ETT (symbol: CGCCIU) on the UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index, investors can add the crisis currency to their portfolios simply and cost-effectively. The underlying assets and product are denominated in Swiss francs. Any fluctuations in the exchange rate between the Swiss franc and the commodity currency, the US dollar, are hedged on a monthly basis. The Early Redemption Kick-In GOAL (symbol: KDAIDU) on Kinross Gold, Freeport-McMoRan and Barrick Gold provides investors with a partially protected position in the mining sector. Provided that none of the underlyings touch or fall below the barrier of 50%, the product will pay a return of 14% p.a. on the maturity date. Investors may also be able to get their hands on this return at a much earlier date. Thanks to the Early Redemption function, the term can be shortened.

Risks: The aforementioned products do not have capital protection. The ETC will make a loss if the underlying index decreases. If the underlying assets for the ER Kick-In GOAL equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on maturity may be in cash, reflecting the worst performance of the underlyings (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

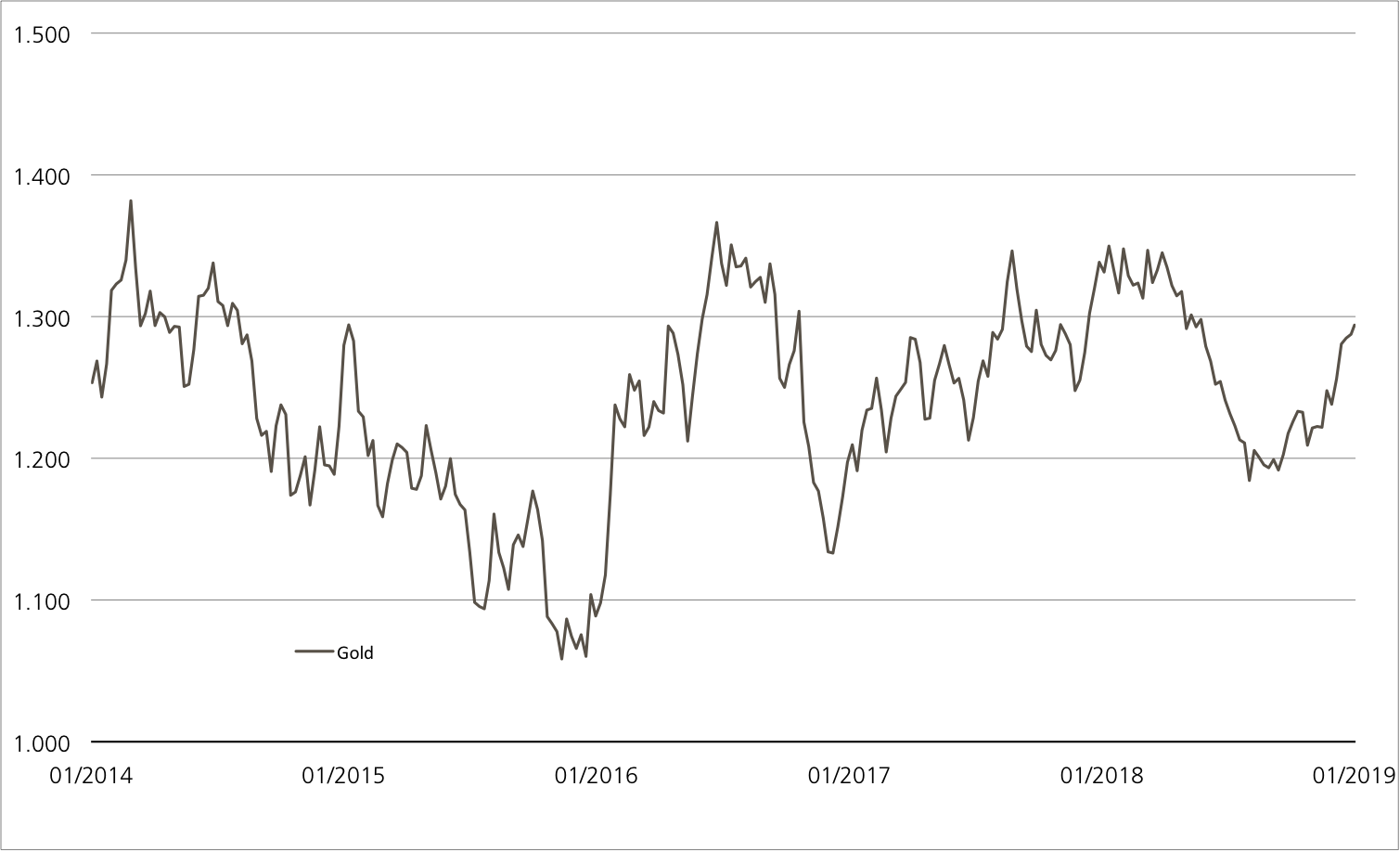

Gold (in US dollars per fine ounce) 5 years¹

Gold has been trending upwards strongly for around three years. While experiencing huge fluctuations, the troy ounce rose in price from less than USD 1,100 to just under USD 1,300.

Source: UBS AG, Bloomberg

As of 16.01.2019

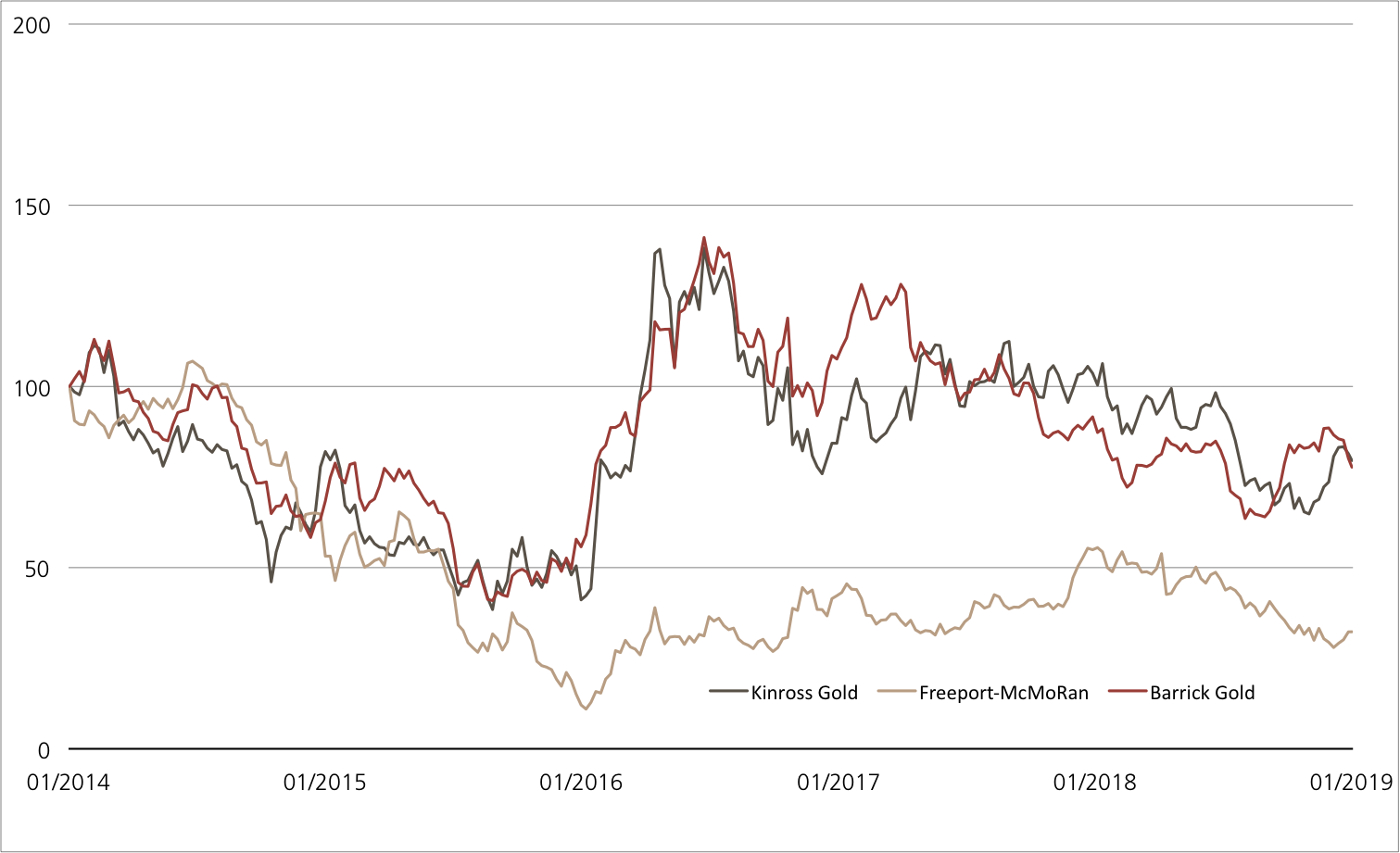

Kinross Gold vs. Freeport-McMoRan vs. Barrick Gold

(five years, for illustrative purposes only, figures in %)¹

The gold sector has had quite a hard time with investors in recent years. All the same, the prices of shares in Kinross Gold,

Freeport-McMoRan and Barrick Gold have stabilized somewhat.

Source: UBS AG, Bloomberg

As of: 16.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

ETC on UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index

| Symbol | CGCCIU |

| SVSP Name | Tracker Certificates |

| SPVSP Code | 1300 |

| Underlying | UBS Bloomberg CMCI Gold CHF Monthly Hedged TR Index |

| Currency | CHF |

| Ratio | 10:1 |

| Administration fee | 0.38% p.a. |

| Expiry | Open End |

| Participation | 100% |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 77.70 / 78.05 |

14.00% p.a. Early Redemption Worst of Kick-In GOAL on Kinross Gold / FreeportMcRoran / Goldstone

| Symbol | KDAIDU |

| SVSP Name | Barrier Reverse Convertibles |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlying | Kinross Gold / Freeport-McMoRan / Barrick Gold |

| Currency | USD |

| Coupon | 14.00% p.a. |

| Kick-In Level |

50% |

| Expiry | 30.01.2020 |

| Issuer | UBS AG, London |

| Subscription until | 30.01.2019, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 16.01.2019

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’873.77 | 2.1% |

| SLI™ | 1’374.48 | 2.4% |

| S&P 500™ | 2’616.10 | 1.2% |

| Euro STOXX 50™ | 3’077.22 | 0.2% |

| S&P™ BRIC 40 | 4’012.62 | 1.0% |

| CMCI™ Compos. | 893.02 | -0.2% |

| Gold (troy ounce) | 1’293.80 USD | 0.1% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

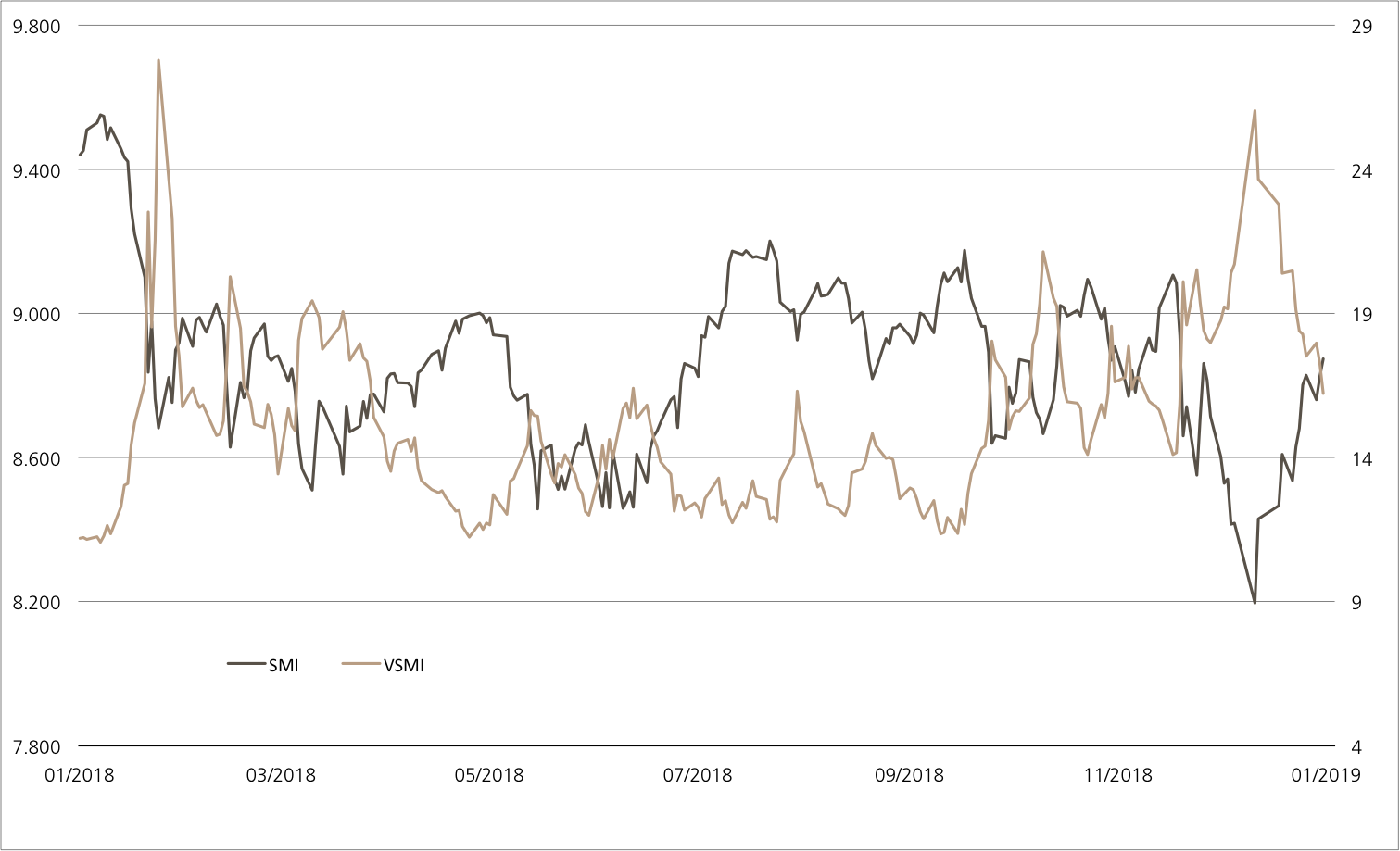

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 16.01.2019

Airbus/Boeing

A transatlantic duel

The year had barely come to a close when the two largest aircraft manufacturers in the world presented their operating balance sheets. In 2018, Boeing supplied a total of 806 aircraft and in doing slightly outperformed Airbus, with its rival delivering 800 aircraft to airline and leasing companies. Boeing also led the race on the stock exchange in 2018. As a result, the Dow Jones™ stock thus extended its longer-term lead over Airbus (see chart).¹ With a new Early Redemption (ER) Kick-In GOAL (symbol: KCZHDU), investors are counting on the two large caps to be able to maintain their current altitude on the market and avoid too much turbulence during the term. The annual coupon of 9% comes with a safety buffer of 40%.

Following a strong end to the year, Airbus has succeeded in meeting its own delivery target for 2018 with pinpoint accuracy. Due to problems with the supply of engines, there had been doubts that this forecast would be met in recent months. Despite all the cries of the naysayers, the European group has increased deliveries for the 16th year in a row. Airbus also posted another record year in 2018 with year-on-year growth of 11%. During this time, however, there was a decline in new orders. The company recorded 747 net orders, compared with 1,109 in the previous year. Nevertheless, a record-high order backlog of 7,577 commercial aircraft had piled up at the end of 2018 (source: Airbus media release, January 9, 2019).

By delivering 806 jet aircraft, Boeing also set a new record in 2018, which saw the Seattle-based group enjoying year-on-year growth of 5.6%. At the same time, the company received orders for a net total of 893 aircraft with a total value of USD 143.7 billion. The 737 MAX remains Boeing’s best-selling product, with 675 net orders being placed for this model in 2018. In December, the program hit the 5,000 net orders mark (source: Boeing media release, January 8, 2019).Opportunities: UBS has combined the shares in the aircraft manufacturers, both of which have been rated as «Buy” by UBS’ inhouse research department, as the underlying assets for an ER Kick-In GOAL (symbol: KCZHDU). A coupon of 9% p.a. is available on the two shares. This return opportunity comes with a barrier of a low 60% of the starting price. The Early Redemption function makes it possible for the maximum return to be paid out early. This requires that both shares close at or above their respective initial prices on one of the observation days.

Risks: This product does not have capital protection. If the underlyings equal or fall below the respective kick-in level (barrier) and the early redemption feature does not apply, the amount repaid on the date of maturity may be in cash, reflecting the worst performance of the two shares (but not more than nominal value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Airbus vs. Boeing

(five years, for illustrative purposes only, figures in %)¹

Source: UBS AG, Bloomberg

As of: 16.01.2019

9.00% p.a. Early Redemption Worst of Kick-In GOAL on Airbus / Boeing

| Symbol | KCZHDU |

| SVSP Name | Barrier Reverse Convertibles |

| SPVSP Code | 1230 (Auto-Callable) |

| Underlyings | Airbus / Boeing |

| Currency | EUR |

| Coupon | 9.00% p.a. |

| Kick-In Level | 60% |

| Expiry | 25.01.2021 |

| Issuer | UBS AG, London |

| Subscription until | 23.01.2019, 15:00 h |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 16.01.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.