Friday, 08.02.2019

- Topic 1: Dividend strategy - The harvest can be brought in

- Topic 2: Tesla - Profits rolling off the production line

Dividend strategy

The harvest can be brought in

While the turnaround of interest rates in the US is stagnating, there is still no sign of an end to the ultra-loose monetary policy here in Switzerland – the yields achievable on the CHF bond market are correspondingly poor. In strong contrast to this, the dividend yield of just over 3% being generated on the Swiss equity market is quite impressive. UBS CIO GWM believes that this discrepancy is an interesting proposition for investors in the medium term, particularly for those investors who focus on companies with high-quality distributions. This is exactly where the Dow Jones Switzerland Select Dividend 15 Index™ comes in. This benchmark systematically searches the domestic equity market for attractive dividend stocks. On the other hand, the UBS Global Quality Dividend Payers Total Return Index takes a global approach. Open End PERLES offer simple and cost-effective access to both strategies. The product (symbol: SWDIV) focusing on domestic stocks is denominated in Swiss francs, while the UBS Global Quality Dividend Payers Index is available in Swiss francs (symbol: DIVQC), euros (symbol: DIVQE) and US dollars (symbol: DIVQD).

According to UBS CIO GWM, Swiss companies currently have historically low levels of debt and are robustly profitable. Although the number of mergers and acquisitions is increasing both on a national and global level, experts are acting on the assumption that distribution rates will continue to remain high. According to CIO GWM, sustainability and the distribution yields are just some of the objective and common criteria in the search for attractive dividend stocks. In contrast, dividend growth is sometimes overlooked. However, analysts believe that companies that show high yields but lag behind in terms of profit and dividend growth are likely to underperform, especially in the current environment (Source: UBS CIO GWM, “Swiss high-quality dividends”, Equities, January 21, 2019).

With the Dow Jones Switzerland Select Dividend 15 Index™, dividend growth is one of the key selection criteria. This strategy examines profit sharing over a period of three years, with dividend yields and the return on equity also playing an important role, in addition to other parameters such as trading liquidity. The UBS Global Quality Dividend Payers Index takes an extremely similar approach, albeit with one major difference – UBS Research is responsible for the composition of the index. Every quarter, the analysts filter 30 value stocks out of an international universe of more than 3,300 equities. This evaluation takes into consideration both the interest rate applied to the distribution as well as the return on equity. The experts also focus on equities with sustainable revenue and earnings growth. In addition, the experts ensure that there is healthy diversification within the portfolio in terms of countries and sector allocation.Opportunities: The next dividend season will begin in the coming weeks and this issue is likely to be brought further into the spotlight. With Open End PERLES (symbol: SWDIV), investors can take up an early position in a selection of Swiss value stocks via the Dow Jones Switzerland Select Dividend 15 Index™. Should the international markets seem more appealing, investors can look to the UBS Global Quality Dividend Payers Index. With this benchmark, investors can choose between three different trading currencies (see right). In the interests of consistency, both benchmarks are total return indices. This means that any dividend payments are reflected in the calculation of each of the underlying assets.

Risks: Open End PERLES do not have capital protection. Losses will be made if the underlying index declines. The currency risk must also be taken into account, as the trading currency of some index constituents may differ from the trading currency of the certificate shown. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

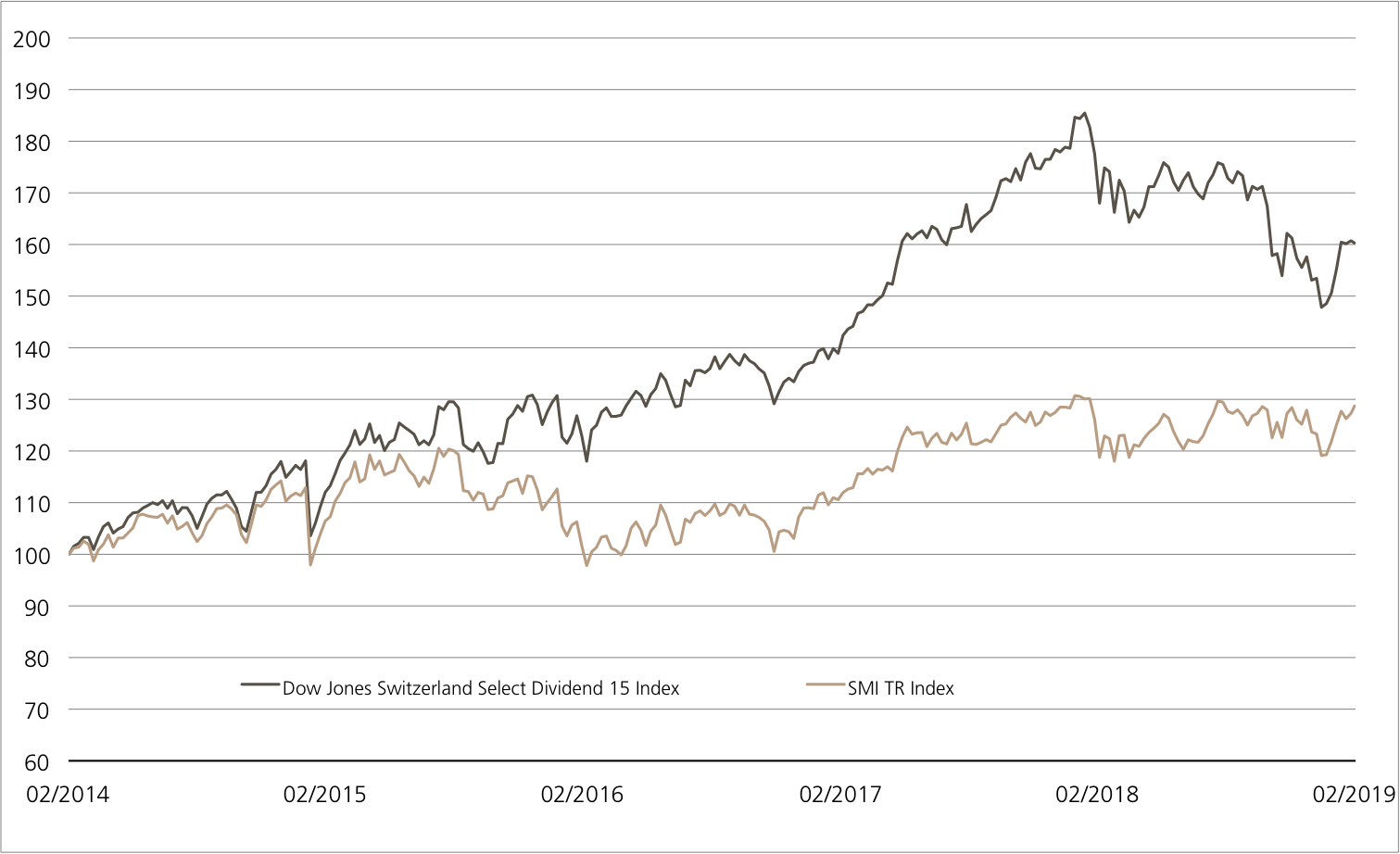

Dow Jones Switzerland Select Dividend 15 Index™ vs. SMI™ Index

(5 years; for illustrative purposes only; figures in %)

Searching specifically for attractive dividend stocks really pays off – historically, the Dow Jones Switzerland Select Dividend 15 Index™ has massively outperformed the SMI™.

Source: UBS AG, Bloomberg

As of 06.02.2019

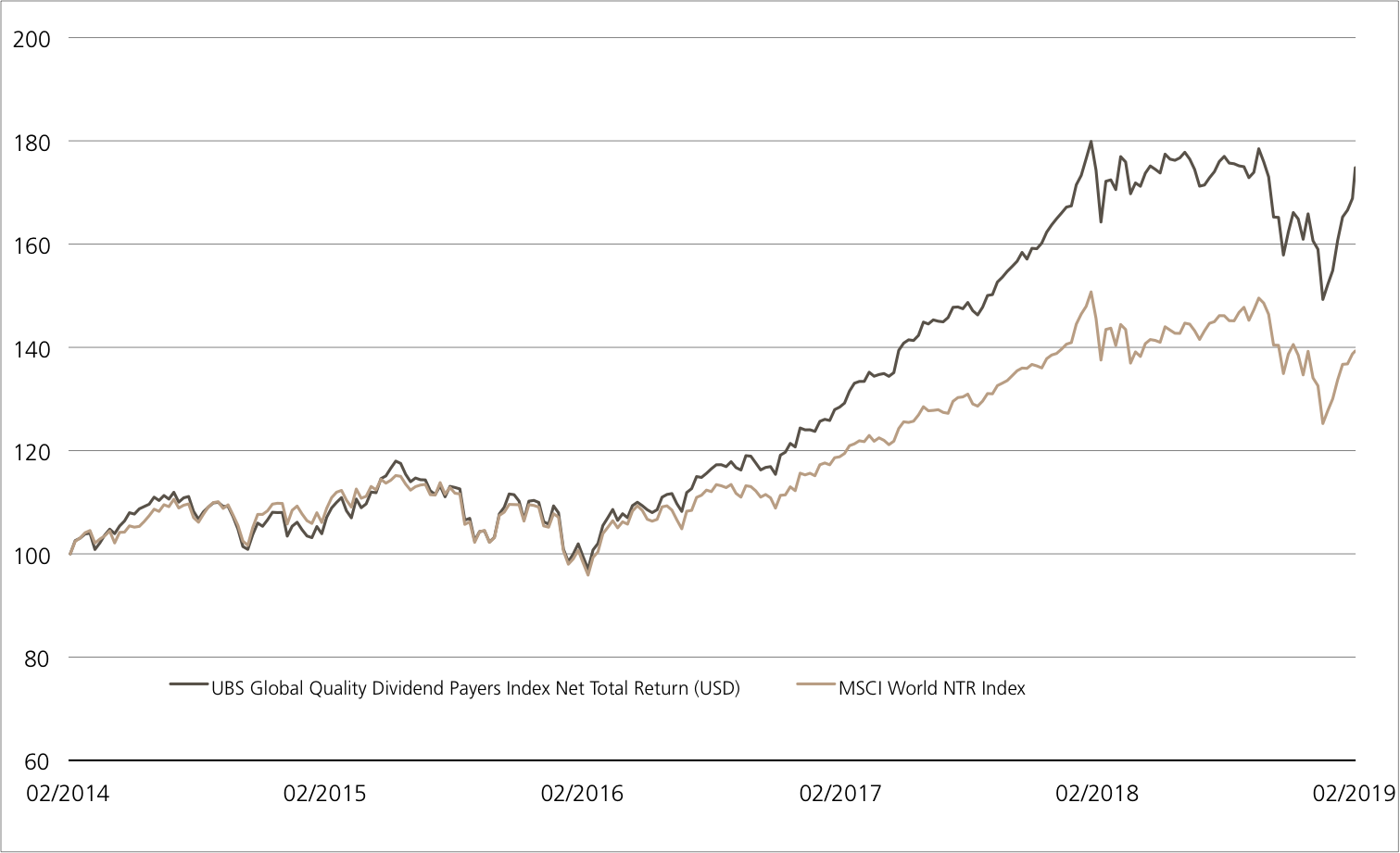

UBS Global Quality Dividend Payers Index vs. MSCI™ World Index

(five years, for illustrative purposes only, figures in %)¹

The UBS Global Quality Dividend Payers Index has also recorded higher returns than the broad equity market, with the benchmark increasingly outperforming the MSCI™ World Index since 2016. ¹) Please note that past performance is not an indication of future performance.

Source: UBS AG, Bloomberg

As of: 06.02.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

Open End PERLES on Dow Jones Switzerland Select Dividend 15 Index™

| Symbol | SWDIV |

| SVSP Name | Tracker Certificates |

| SPVSP Code | 1300 |

| Underlying | Dow Jones Switzerland Select Dividend 15 Total Return Index™ |

| Currency | CHF |

| Ratio | 10:1 |

| Administration fee | 0.40% p.a. |

| Expiry | Open End |

| Participation | 100% |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 207.80 / 209.10 |

Open End PERLES on UBS Global Quality Dividend Payers Net Total Return Index

| Symbol | DIVQC |

| Symbol | DIVQD |

| Symbol | DIVQE |

| SVSP Name | Tracker Certificates |

| SPVSP Code | 1300 |

| Ratio | 1:1 |

| Administration fee | 1.00% p.a. |

| Participation | 100% |

| Expiry | Open End |

| Issuer | UBS AG, London |

| Bid/Ask | CHF 266.01 / 268.70 USD 314.22 /317.39 EUR 377.75 / 380.50 |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 06.02.2019

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 9’143.00 Pt. | 2.0% |

| SLI™ | 1’415.70 Pt. | 1.5% |

| S&P 500™ | 2’731.61 Pt. | 1.9% |

| Euro STOXX 50™ | 3’212.75 Pt. | 1.6% |

| S&P™ BRIC 40 | 4’177.63 Pt. | 1.1% |

| CMCI™ Compos. | 913.51 Pt. | 0.8% |

| Gold (troy ounce) | 1’314.40 USD | -0.1% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

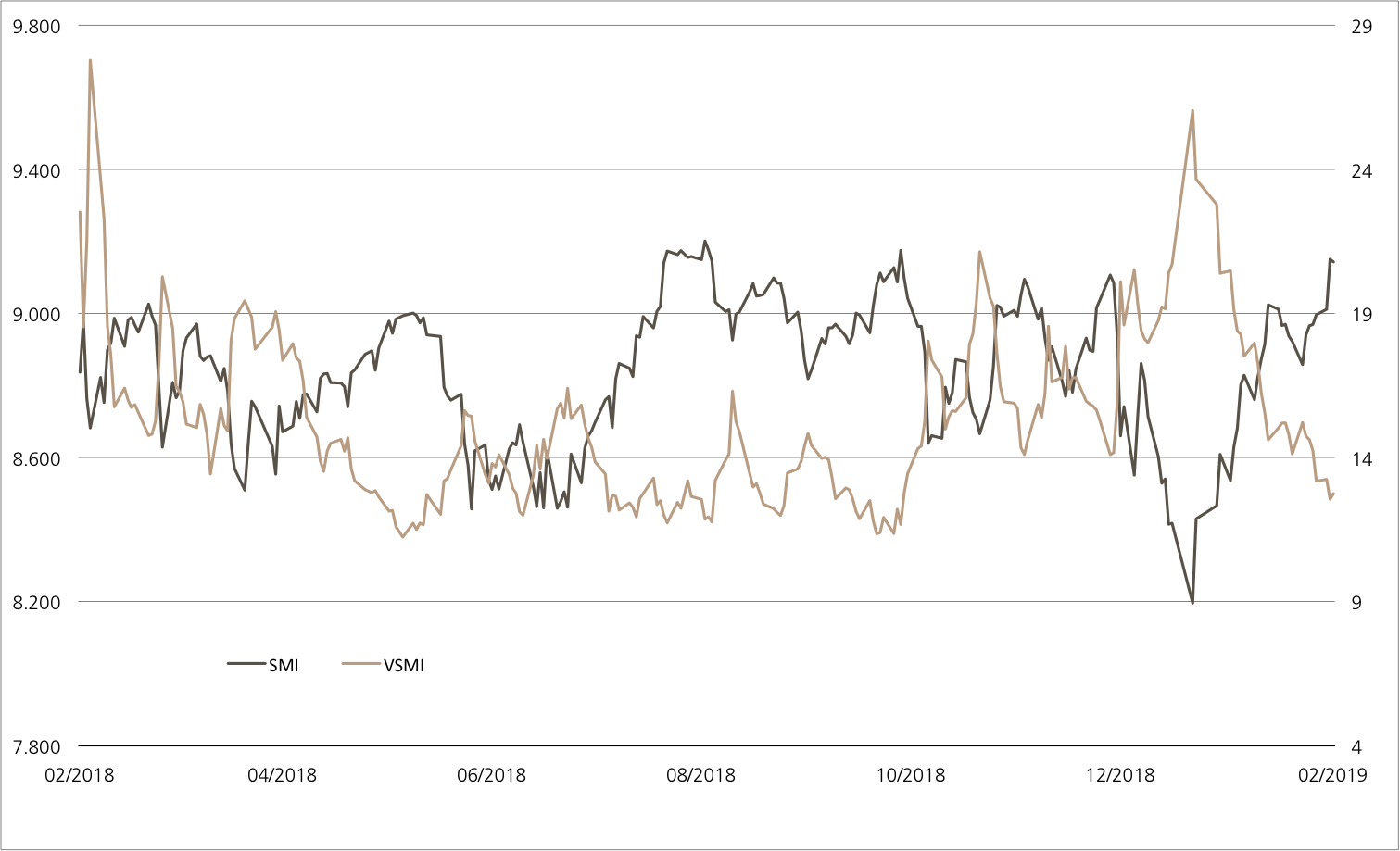

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 06.02.2019

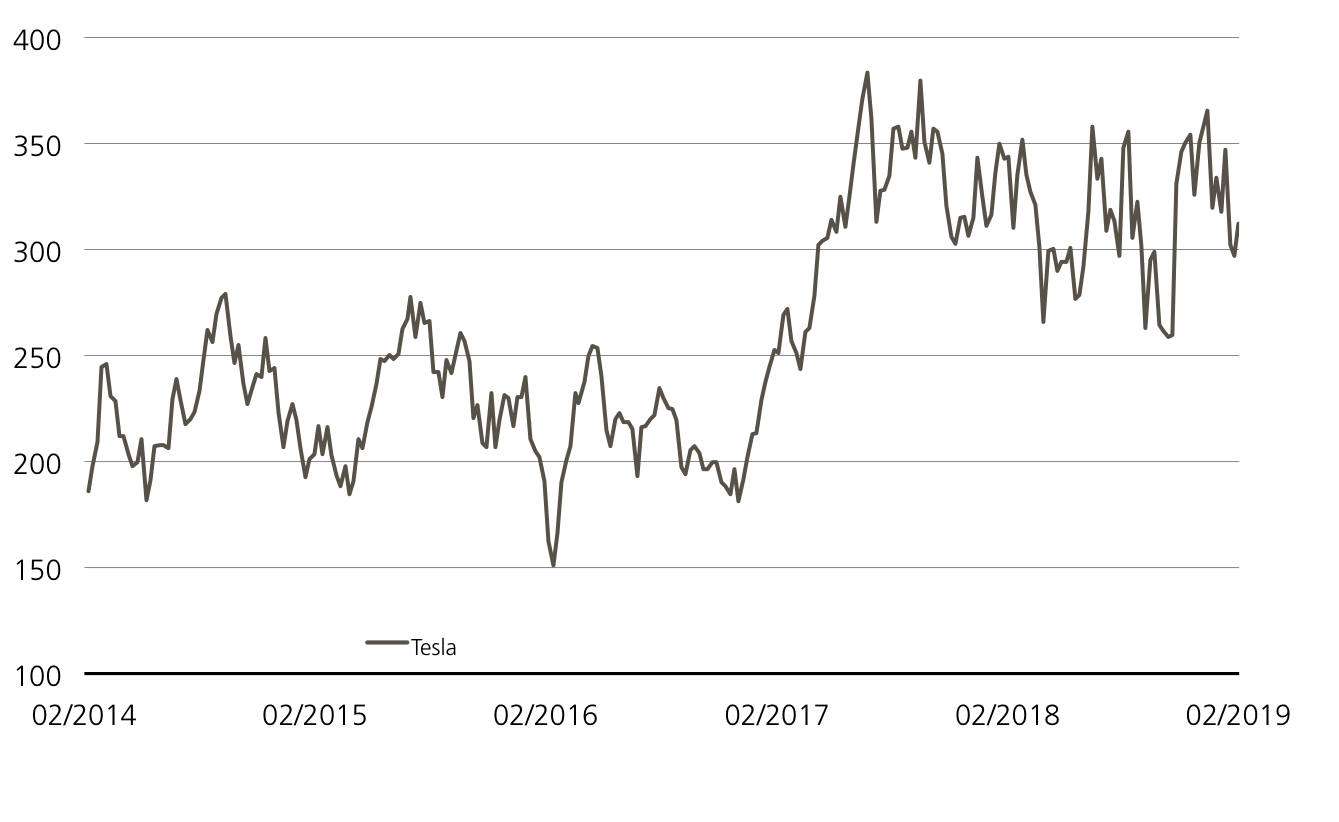

Tesla

Profits rolling off the production line

The balance sheets of US electric car pioneer Tesla have long been in the red. However, change has been afoot since the second half of 2018, with the California-based group posting a profit in two successive quarters. This positive trend looks set to continue, as company founder Elon Musk announced that the company would close each quarter in 2019 with a profit. The drivers behind this good performance include the Model 3 car, which the company has pinned its hopes on and is now scheduled to be available on European shores in February. There is, however, some bad news – the production target of more than 500,000 units per year that was previously promised to be met in 2018 will probably only be achieved between the fourth quarter of 2019 and the second quarter of 2020 (Source: Thomson Reuters media report, January 30, 2019). With the Kick-In GOAL (symbol: KCWSDU) on Tesla, great profits can also be made on a bumpy road. The product comes with a risk buffer of 42% and offers a potential return of 19.1%.

Despite these initial profits, Tesla can expect a fluctuating performance, both in its operational business and on the stock exchange. The US car manufacturer’s share has been yo-yoing between 280 and 380 US dollars for months. Although Tesla has kept to its promise of remaining in the black from a fundamental perspective, the CEO of the company Musk is still a long way from achieving his goal. There are many factors causing difficulties for the charismatic head of the company, chief among them being the trade dispute between China and the US. Tesla is now having to slash the price of the Model 3 so that it can offset the higher tariffs. In order to avoid such problems in the future, Tesla wants its manufacturing operations to be carried out directly in China. Production is set to commence in the Shanghai plant in the second half of this year, with the target of 3,000 Model 3 cars rolling off the production line every week (Source: Thomson Reuters media report, February 2, 2019). The US group is also introducing cost-cutting measures. “We have to mercilessly cut costs to ensure that we can build affordable cars and not go broke,» said CEO Elon Musk at an analysts’ conference held on January 31.

Opportunities: Despite the initial profits, Tesla will still have to battle against the odds. It could therefore be sensible to invest in the electric car manufacturer with conditional partial protection rather than directly in the share. The Kick-In GOAL (symbol: KCWSDU) offers a high potential return with a healthy risk buffer. The security issued in December 2018 has an annual coupon of 15%. As the Kick-In GOAL is listed under par, the annual return is currently 22.8%. The barrier currently stands at USD 181.53, i.e. 42% of the current price.

Risks: Kick-In GOALs do not have capital protection. If Tesla touches or falls below the kick-in level once during the term, the underlying stock has to be trading at least at the strike level on maturity. Otherwise, the amount repaid in cash will reflect the subscription ratio. In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the invested capital may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Tesla

Source: UBS AG, Bloomberg

As of: 06.02.2019

15.00% p.a. Kick-In GOAL on Tesla

| Symbol | KCWSDU |

| SVSP Name | Barrier Reverse Convertibles |

| SPVSP Code | 1230 |

| Underlyings | Tesla |

| Currency | USD |

| Coupon | 15.00% p.a. |

| Sideways return | 19.83% (23.82% p.a.) |

| Kick-In Level (Distance) |

USD 181.53 (43.06%) |

| Expiry | 05.12.2019 |

| Issuer | UBS AG, London |

| Bid/Ask | 92.72% / 93.72% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 06.02.2019

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.