Weekly-Hits edition of 21.09.2018

Friday, 20.09.2018

- Topic 1: Electric Car Beneficiaries Basket - Charged for the future

- Topic 2: Richemont/LVMH/Swatch - Attractive risk-reward profile

Electric Car Beneficiaries Basket

Charged for the future

At the dawn of a new era marked by the change from the gasoline engine to electric cars, many people are wondering what the car of tomorrow will look like. The German premium manufacturer BMW recently provided an answer to this question with the unveiling of the iNext, a new self-driving electric car. The car is scheduled to enter series production from 2021 onwards. Nevertheless, it is not just manufacturers who are vying for pole position in this new sector; suppliers and the IT industry also have high hopes for the future innovations on four wheels. For example, chip manufacturer Infineon has long been following the trend of autonomous driving and driver assistance systems as well as e-mobility. Investors now have the opportunity to diversify and participate in the growth opportunities offered by the trend toward electric vehicles in the automotive industry. The PERLES on the “Electric Car Beneficiaries Basket” (symbol: ECARSU) fully participates in the performance of the share basket. The only deduction is an annual management fee of 0.5%. In return, any net dividends are reinvested in the basket members.

Although the electric car has not yet become a staple product, it has enjoyed enormous growth. The best example of this is China, which is by far the world’s foremost pioneer in terms of e-mobility. In the first half of 2018, around 412,000 electric cars were sold in the Middle Kingdom, more than twice as many as in the previous year. In the US, the world’s second-largest market for electric cars, the growth rate stood unmoving at 34%. According to the experts at the Center of Automotive Management (CAM), electric cars will gradually take over the roads. In 2020, they anticipate a global market share of 6%, which is expected to increase to 25% by 2025 and even to 40% by 2030. (Source: www.auto-institut.de) It is not only manufacturers who are wanting to get on-board with this trend – suppliers and IT corporations are also muscling in. For example, Continental has numerous technical products focused on e-mobility in the pipeline. These include the “New Wheel Concept”. By utilizing the strong braking effect in the energy recovery system, electric vehicles can move through city traffic almost without using the brakes. Automotive supplier, Aptiv – a spin-off of Delphi Automotive – already has a fleet of 30 self-driving vehicles in operation in the Lyft carpool network in Las Vegas.

The chip industry is also experiencing demand for the digitization of automobiles. The experts at Mordor Intelligence predict that the automotive semiconductor market will expand from USD 34.6 billion in 2017 to USD 92.9 billion in 2023 with an average annual growth rate of 17.9%. One of the beneficiaries of this trend is the previously mentioned Infineon. UBS experts believe the German semiconductor manufacturer to be well positioned in both silicon and silicon carbide technology. (Source: UBS CIO WM, Semis: Who’s powering Tesla’s Model 3?, 15.08.2018)

Opportunities: The primary research experts at the UBS Evidence Lab attempted to identify the winners in the electric car trend, breaking down electric vehicles into their component parts. In the end, a committee of experts filtered out eight promising groups from the supplier industry and the IT industry. Based on these results the “Electric Car Beneficiaries Basket” has been combined. With the PERLES (symbol: ECARSU) on the new share basket, investors now have the opportunity to make a diversified investment in this future-oriented area. The product currently in subscription tracks the performance of the underlying basket – after the deduction of the annual management fee of 0.5%. The net dividends are reinvested in the basket. The security matures after seven years. However, the issuer has the option of extending the term by a further seven years.

Risks: PERLES do not have capital protection. If the underlying asset records a negative performance, this would therefore result in commensurate losses in the structured product. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

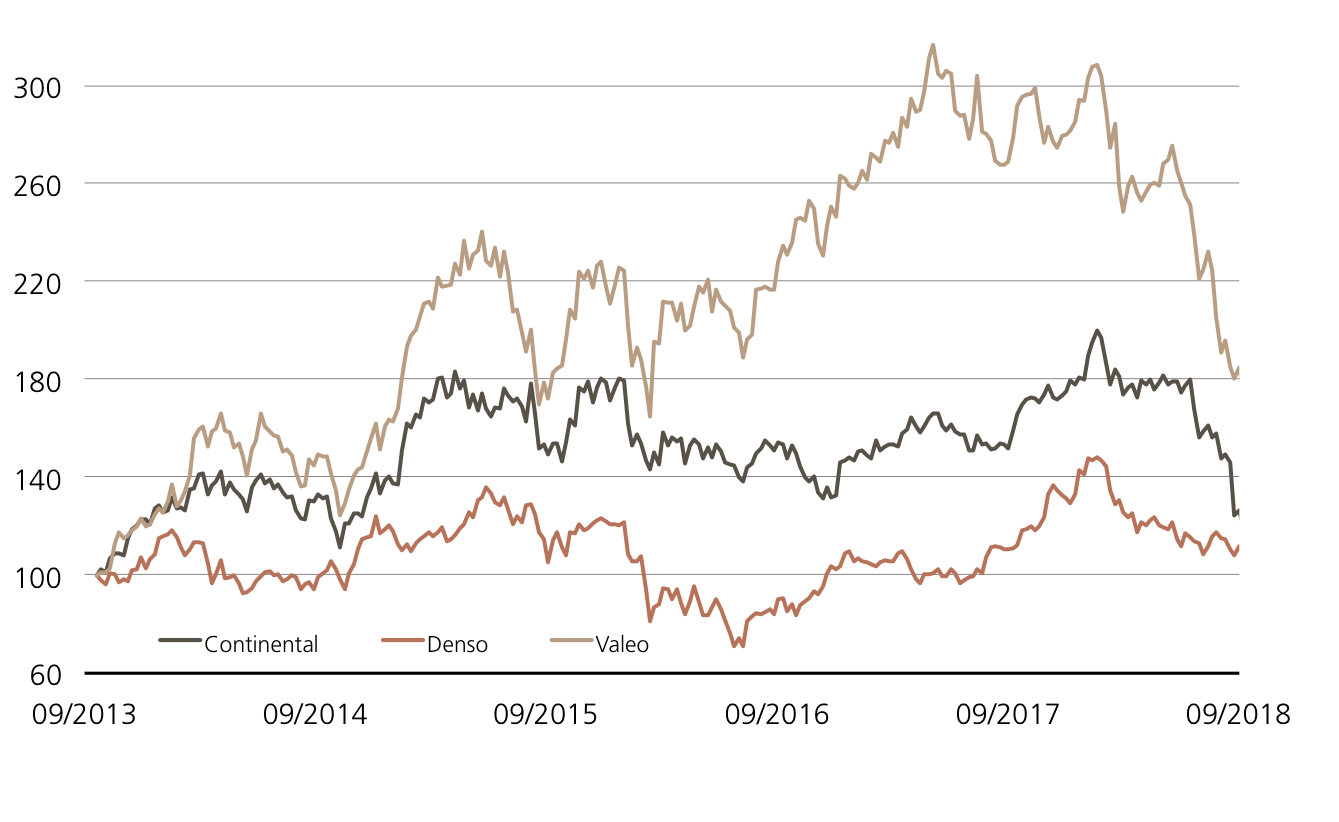

Continental vs. Denso vs. Valeo (5 years)¹

Continental, Denso and Valeo – the three automotive suppliers for the Electric Car Beneficiaries Basket show positive development on a five-year basis. The French company, Valeo, recorded the largest growth.

Source: UBS AG, Bloomberg

As of 20.09.2018

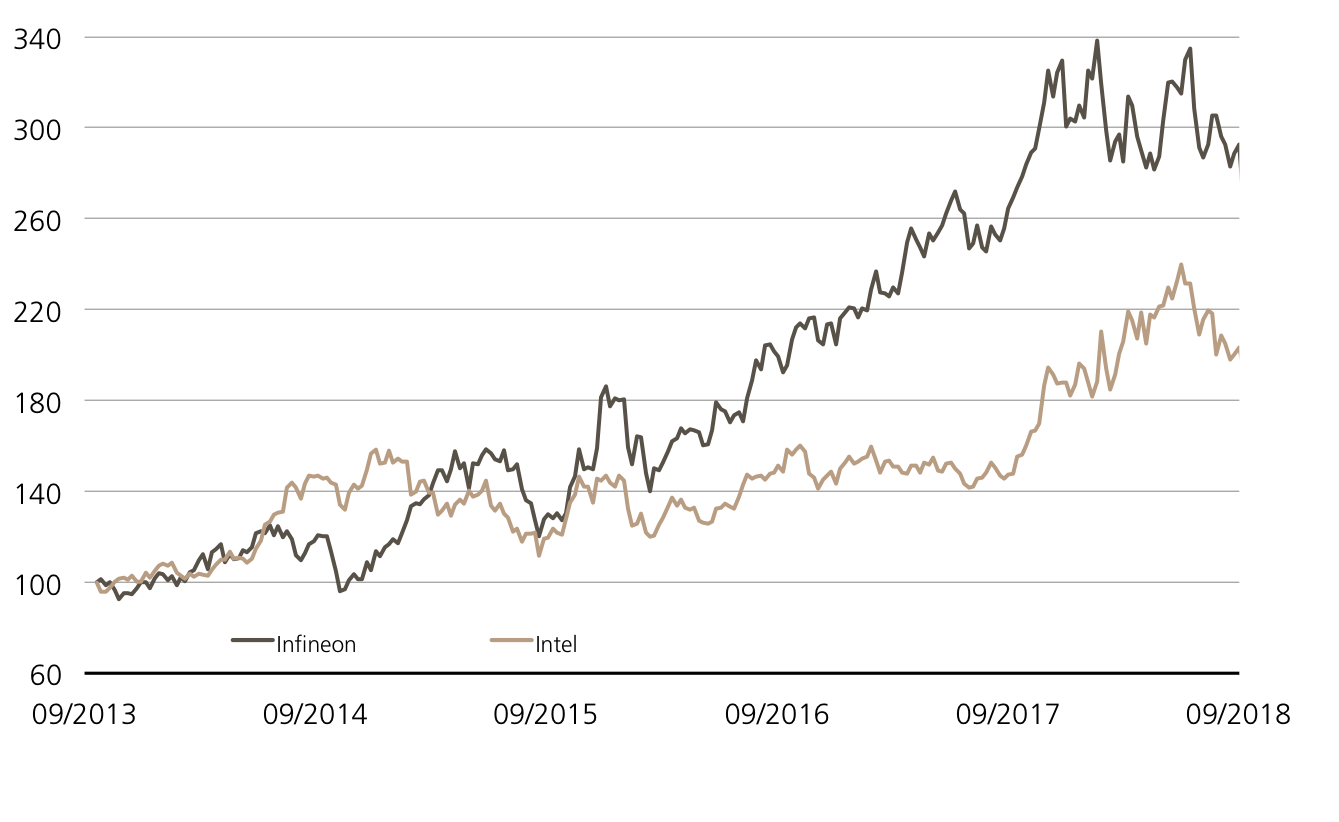

Infineon vs. Intel (5 years)¹

Semiconductors are playing an increasingly important role in the automotive industry. The two giants in the world of chip manufacturing, Infineon and Intel, are thus included in the Electric Car Beneficiaries Basket. Both shares are trending upwards.

Source: UBS AG, Bloomberg

As of: 20.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.

PERLES on Electric Car Beneficiaries Basket

| Symbol | ECARSU |

| SVSP Name | Tracker-Certificate |

| SPVSP Code | 1300 |

| Underlying | Electric Car Beneficiaries Basket |

| Ratio | 1:1 |

| Currency | CHF |

| Administration fee | 0.50% p.a. |

| Participation | 100% |

| Expiry | 26.09.2025 |

| Issuer | UBS AG, London |

| Subscription until | 27.09.2018, 15:00h |

Starting composition and weighting of the Electric Car Beneficiaries Baskets

| Continental AG | 12.50% |

| Denso Corp | 12.50% |

| VALEO SA | 12.50% |

| Aptiv PLC | 12.50% |

| Lear Corp | 12.50% |

| Tenneco Inc | 12.50% |

| Infineon Tec. AG | 12.50% |

| Intel Corp | 12.50% |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 20.09.2018

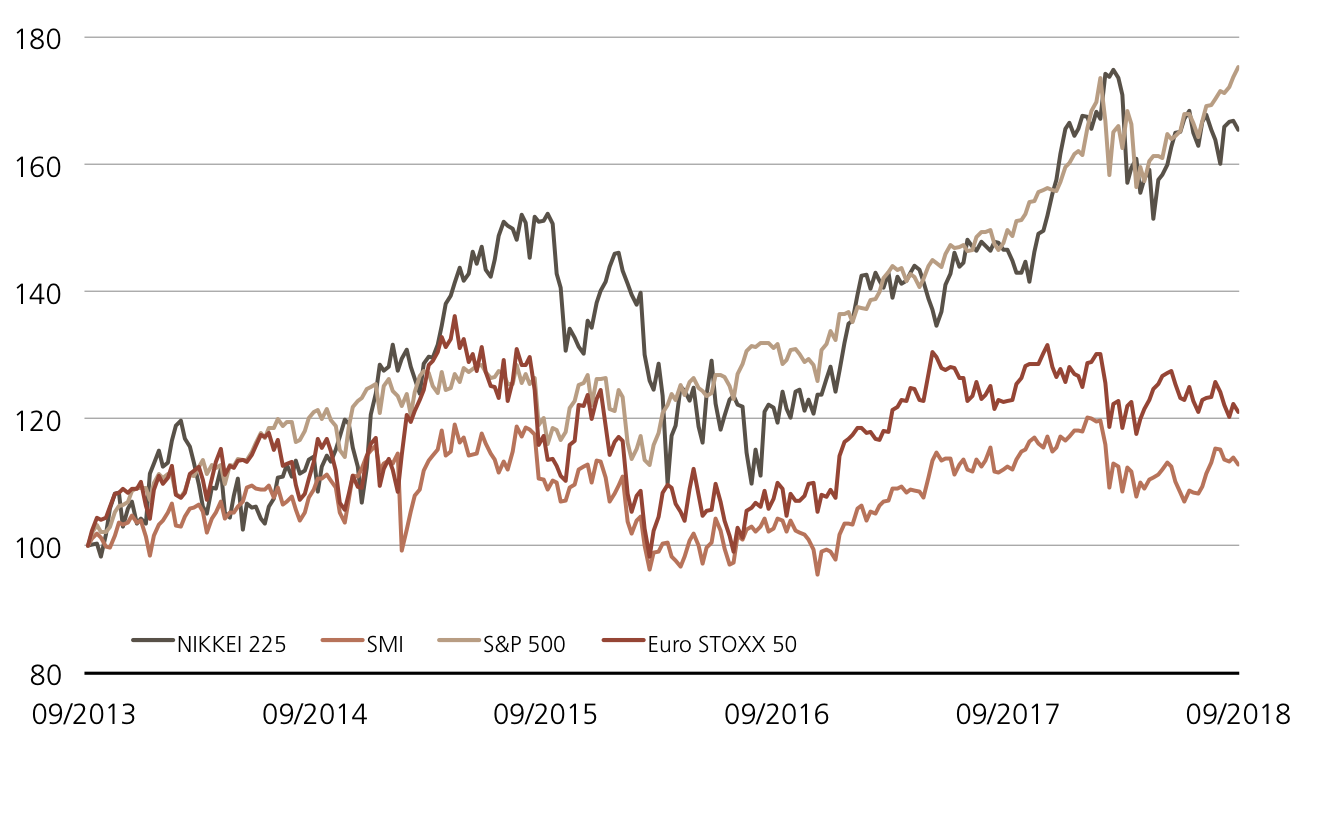

Market overview

| Index | Quotation | Week¹ |

| SMI™ | 8’939.85 | -0.2% |

| SLI™ | 1’465.10 | 0.2% |

| S&P 500™ | 2’907.95 | 0.7% |

| Euro STOXX 50™ | 3’368.56 | 1.3% |

| S&P™ BRIC 40 | 3’972.45 | 3.6% |

| CMCI™ Compos. | 930.19 | -0.4% |

| Gold (troy ounce) | 1’208.30 | -0.2% |

¹ Change based on the closing price of the previous day compared to the closing price a week ago.

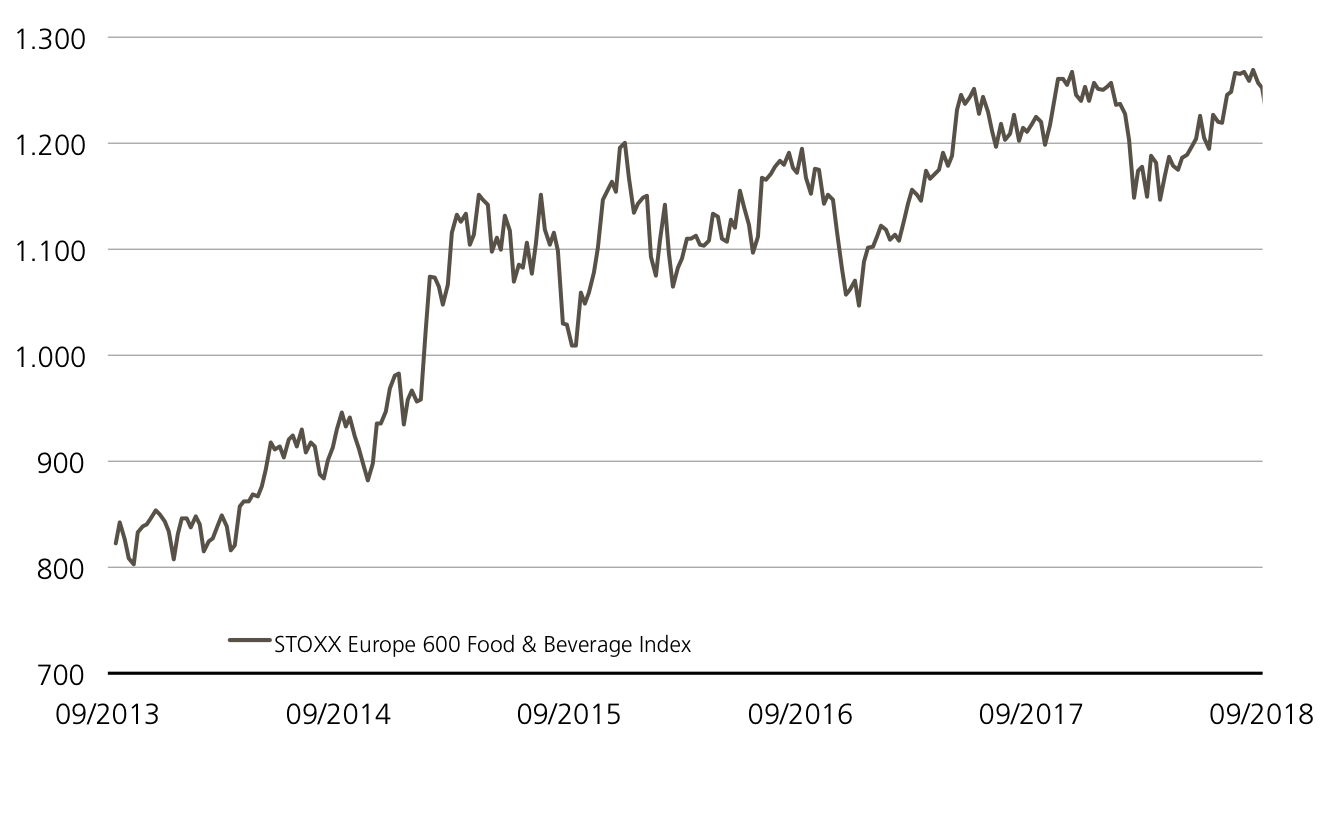

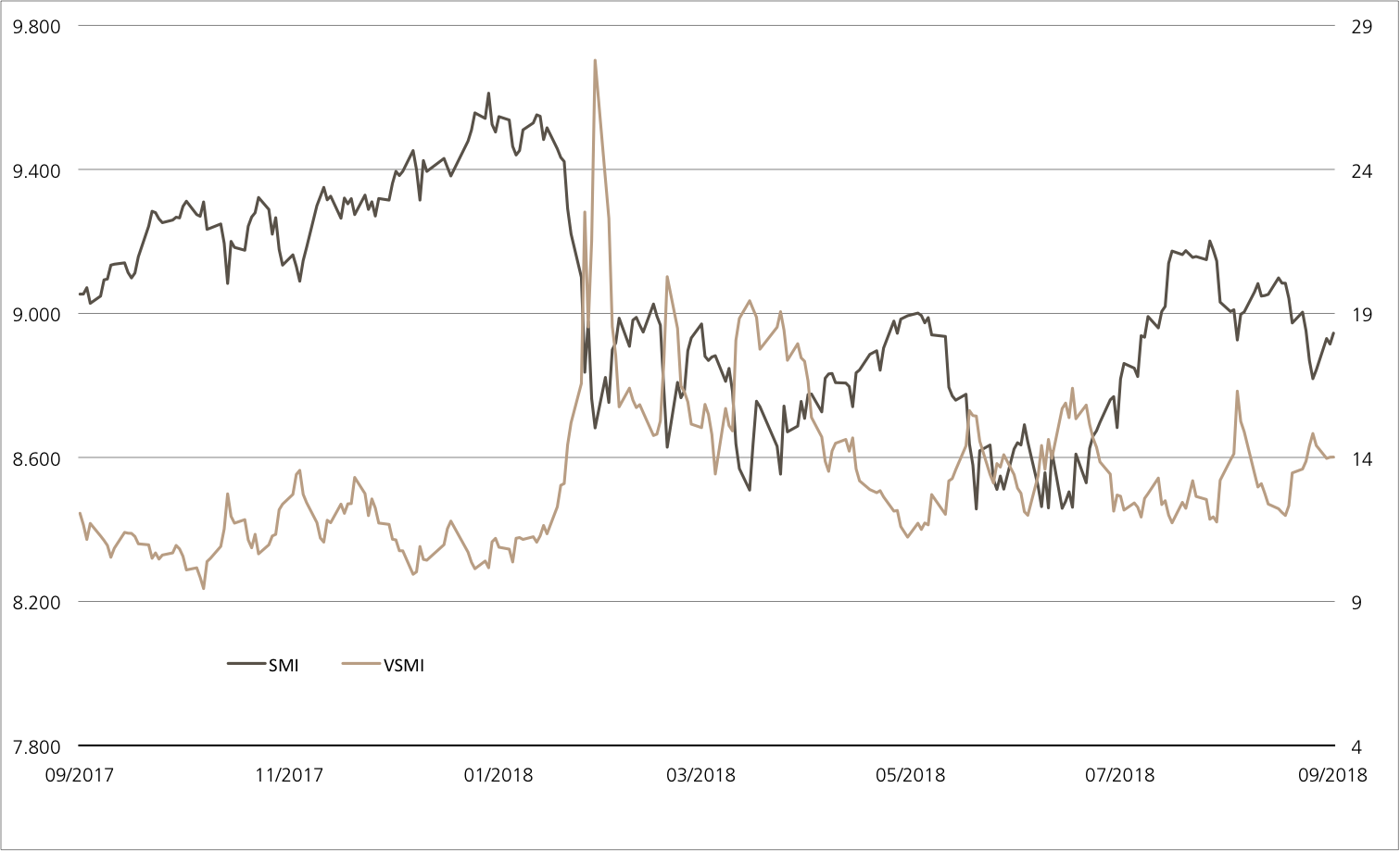

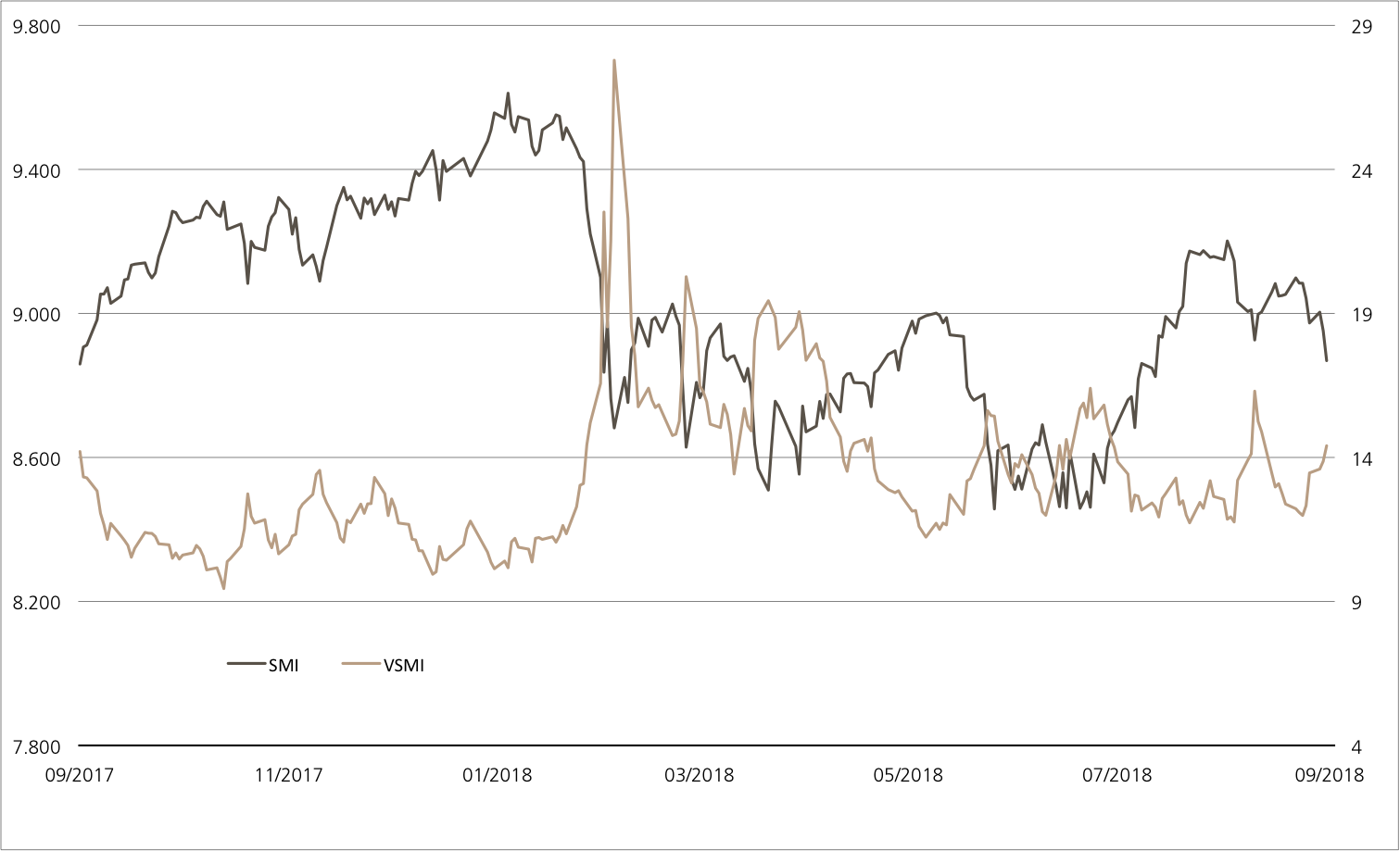

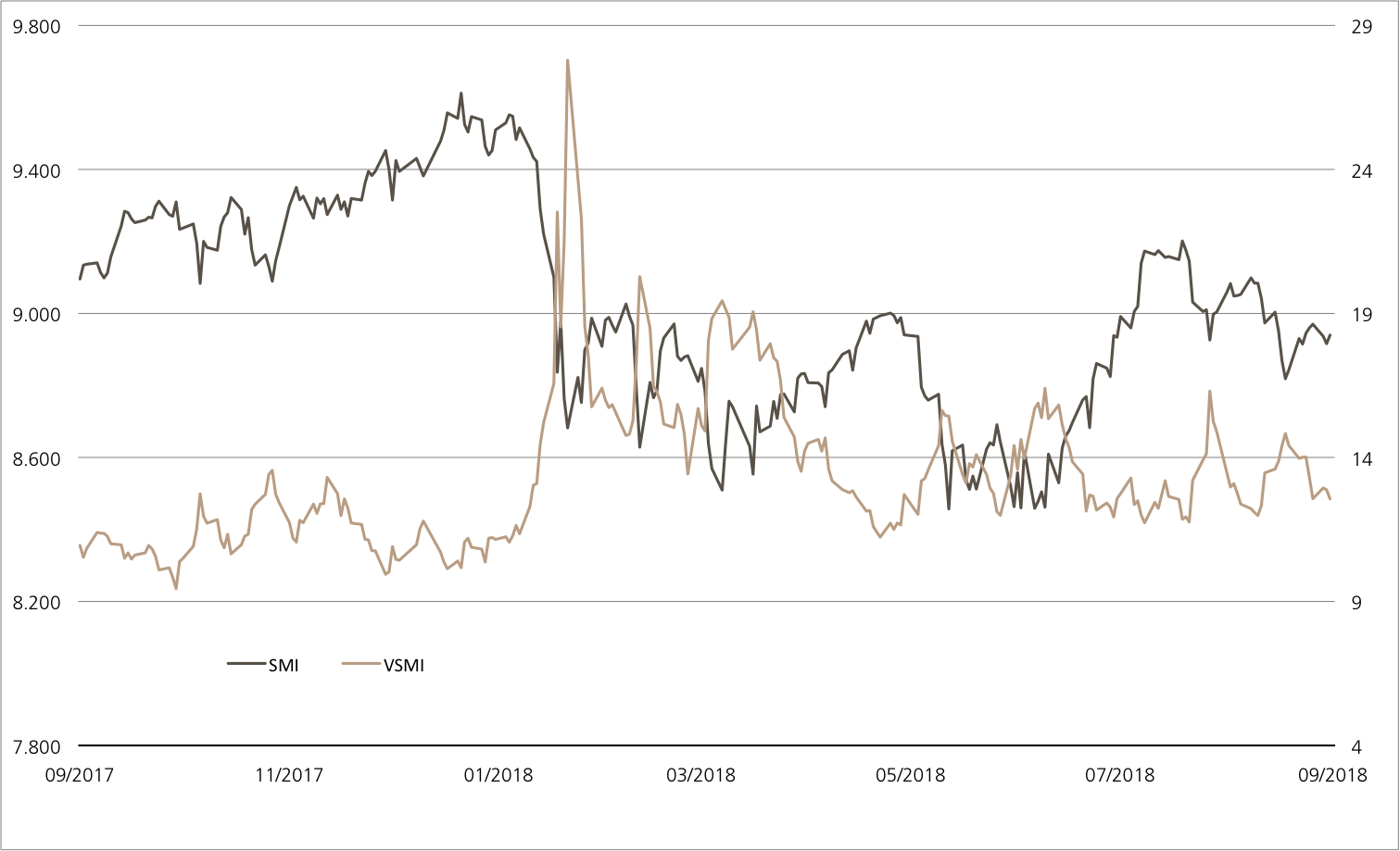

SMI™ vs. VSMI™ 1 year

The VSMI™ Index is calculated since 2005. It shows the volatility of the stocks within the SMI™ index. A portfolio which reacts only to changes in volatility instead of volatility itself is relevant for the calculation. Thereby, the VSMI™ methodology uses the squared volatility, known as variance, of the SMI options with remaining time to expiry of 30 days traded at the Eurex.

Source: UBS AG, Bloomberg

As of: 20.09.2018

Richemont/LVMH/Swatch

Attractive risk-reward profile

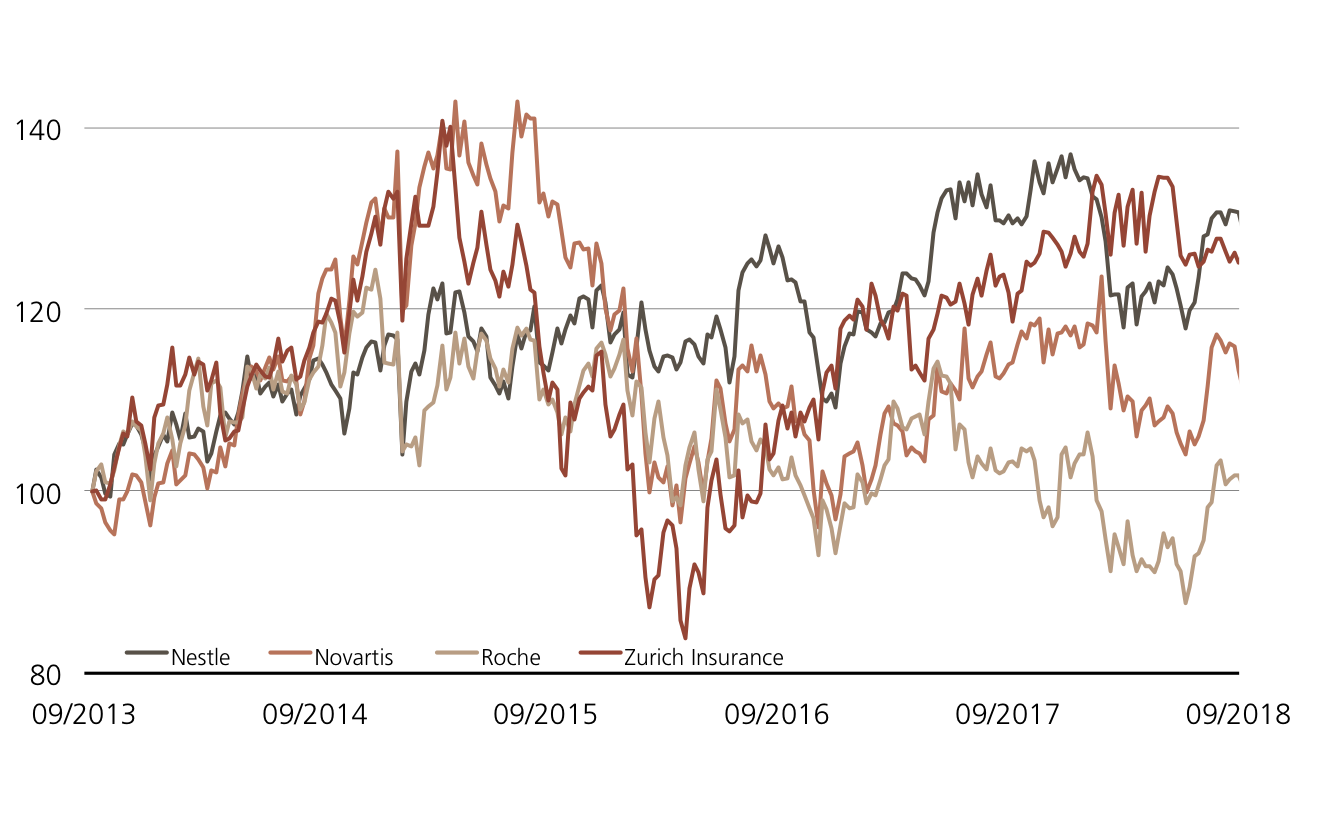

Suppliers of luxury goods are currently operating in a favorable environment: In addition to strong equity markets, UBS CIO WM believes that rising real estate prices and a growing middle class, particularly in Asia, are playing into the hands of the sector. However, the simmering trade dispute represents a threat to the entire consumer goods industry and thus also for the luxury segment. In this respect, a partially protected positioning might be interesting for investors. The new Callable Kick-In GOAL on Richemont, LVMH and Swatch (symbol: KCMHDU) offers a safety buffer of 40%. Provided that none of the three luxury equities impinge on this buffer during the two-year term, the product will yield the maximum return of 7.00% p.a. upon maturity.

UBS CIO WM assumes that the factors outlined above will remain robust for the time being. In addition, China is likely to remain a growth driver for the luxury sector in the medium term. In parallel to this, the watch market should experience a healthy revival. However, analysts also stress that political uncertainties could negatively impact the economic climate and consumer confidence. UBS CIO WM currently prefers luxury companies with good organic growth prospects or the potential for successful restructuring, as well as attractive valuations. (Source: UBS CIO WM European Consumer Discretionary, Equity preferences, 28.08.2018) The latest figures from LVMH provide evidence of the positive industry environment. The French group enjoyed a 28% increase in profits in the first six months of 2018 and thus exceeded analysts’ expectations. There has been great demand for the luxury watches, clothing and high-priced jewelry sold by this industry giant, particularly in China. (Source: Thomson Reuters media report, 24.07.2018)

Opportunities: Together with the two Swiss watch manufacturers Richemont and Swatch, LVMH acts as the underlying for a new Callable Kick-In GOAL (symbol: KCMHDU). Irrespective of the performance of the three equities, the new issue will pay out a coupon of 7% p.a. This return opportunity enjoys low barriers of 60% of the initial price level. Please note that an early redemption including a proportionate coupon amount is possible with this Kick-In GOAL. The issuer is entitled to cancel the product for the first time on September 26, 2019, and subsequently every three months thereafter.

Risks: This product does not have capital protection. If the underlyings touch or fall below the respective Kick-In Level (barrier) and the callable feature does not apply, the amount repaid on the maturity date is reflecting the worst performance of the underlyings (but not more than notional value plus coupon). In this case, it is likely that losses will be incurred. Investors in structured products are also exposed to issuer risk, which means that the capital invested may be lost if UBS AG becomes insolvent, regardless of the performance of the underlying.

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

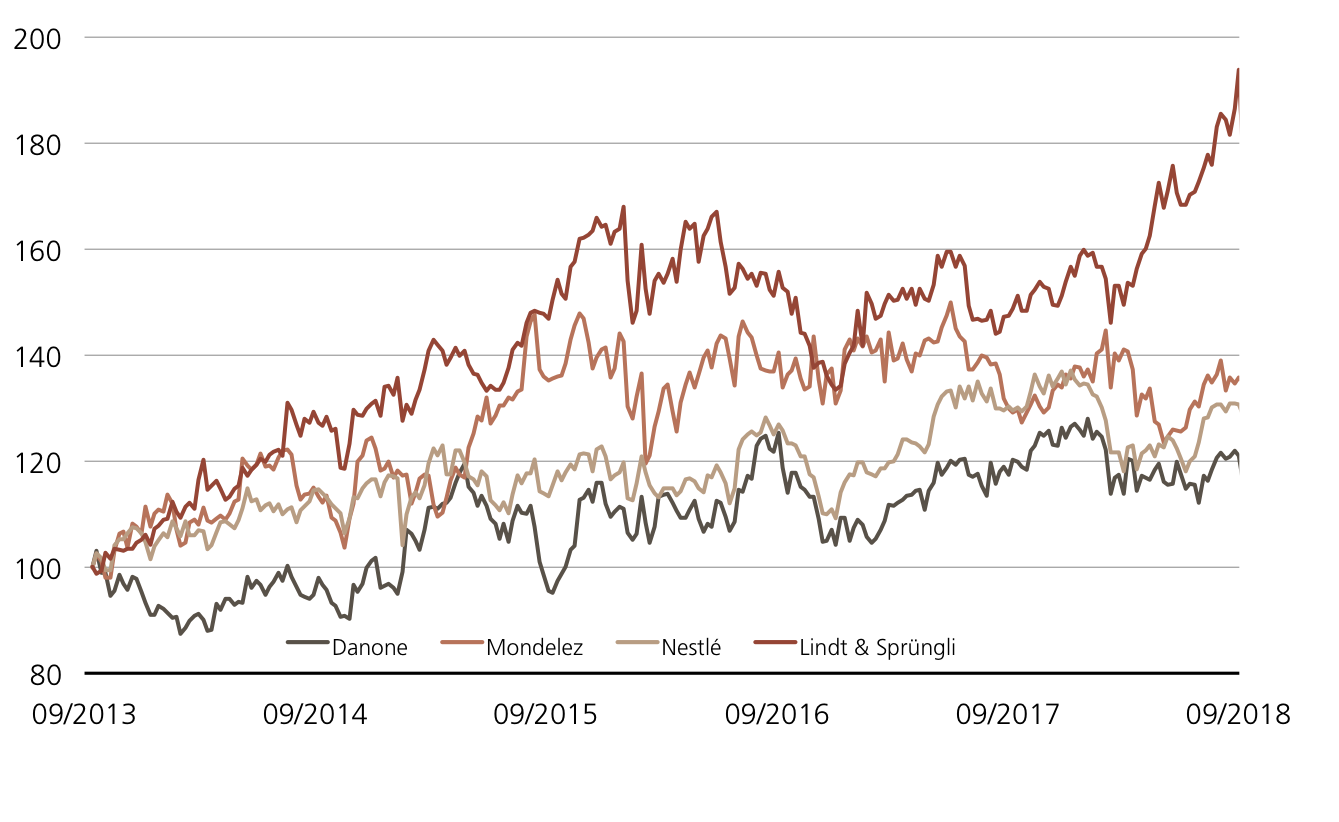

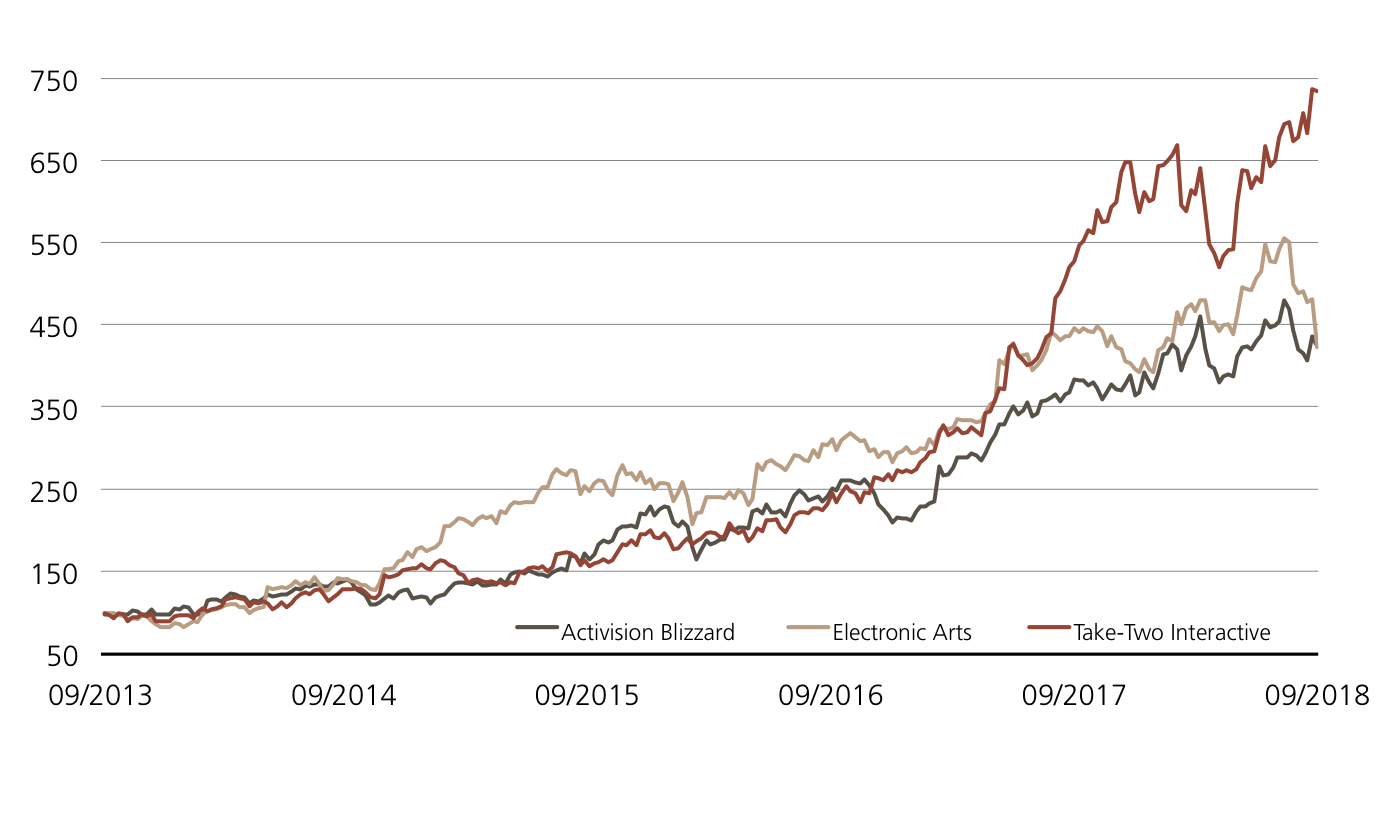

Richemont vs. LVMH vs. Swatch (5 years)¹

Source: UBS AG, Bloomberg

As of: 20.09.2018

7.00% p.a. Callable Kick-In GOAL on Richemont/ LVMH/ Swatch

| Symbol | KCMHDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Callable) |

| Underlyings | Richemont / LVMH / Swatch |

| Currency | CHF (Quanto) |

| Coupon | 7.00% p.a. |

| Kick-In Level | 60.00% |

| Expiry | 28.09.2020 |

| Issuer | UBS AG, London |

| Subscription until | 26.09.2018, 15:00 Uhr |

More UBS products and further information on the risks and opportunities are available at ubs.com/keyinvest.

Source: UBS AG, Bloomberg

As of: 20.09.2018

¹) Please be aware that past performance does not indicate future results.

²) The conditions of ETTs are reviewed on a yearly basis and can be adjusted with a deadline of 13 months after the announcement.