Weekly-Hits: DAX™ & SMI™-Schwergewichte

- Thema 1: DAX™ – Von Kursschwäche keine Spur

- Thema 2: SMI™-Schwergewichte – Ein Trio für alle Fälle

DAX™

Von Kursschwäche keine Spur

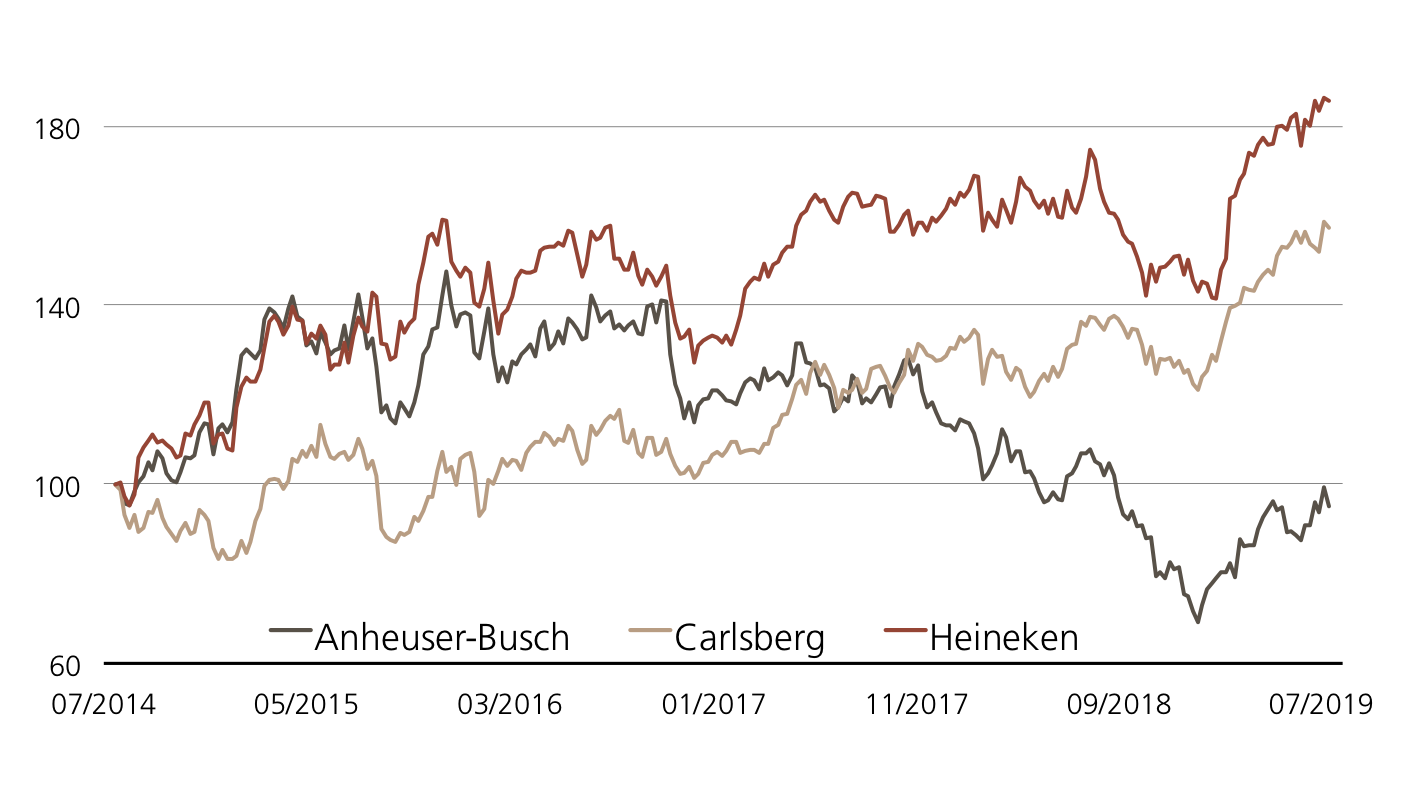

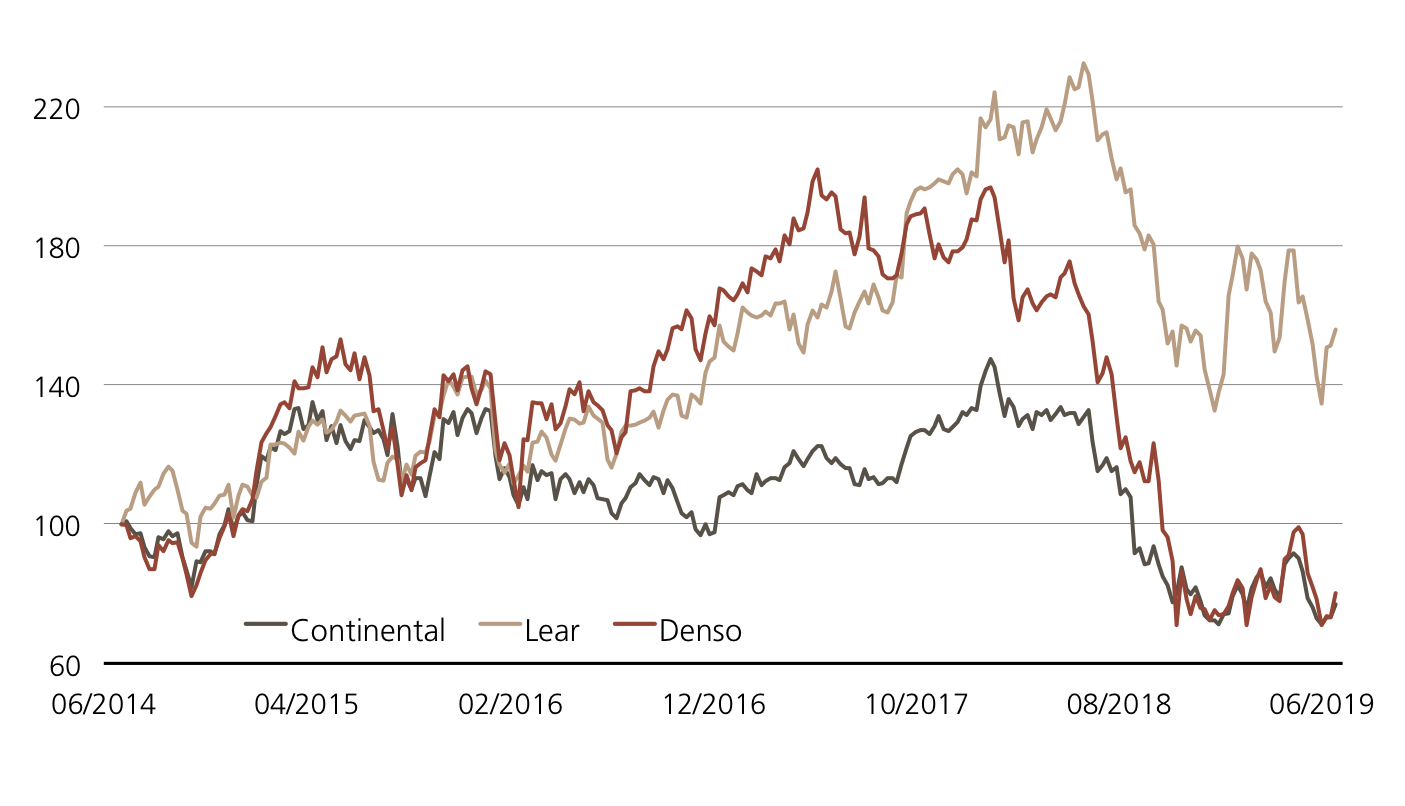

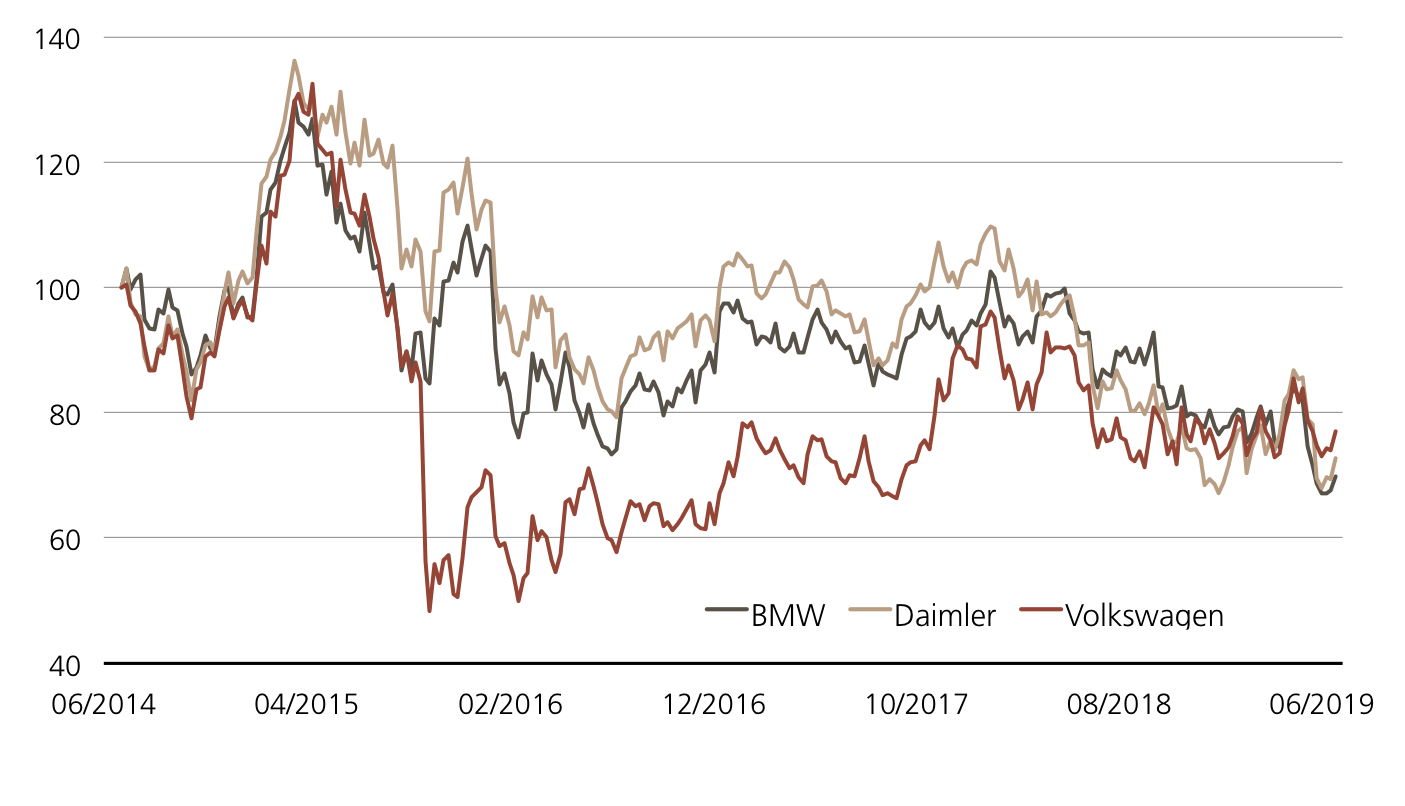

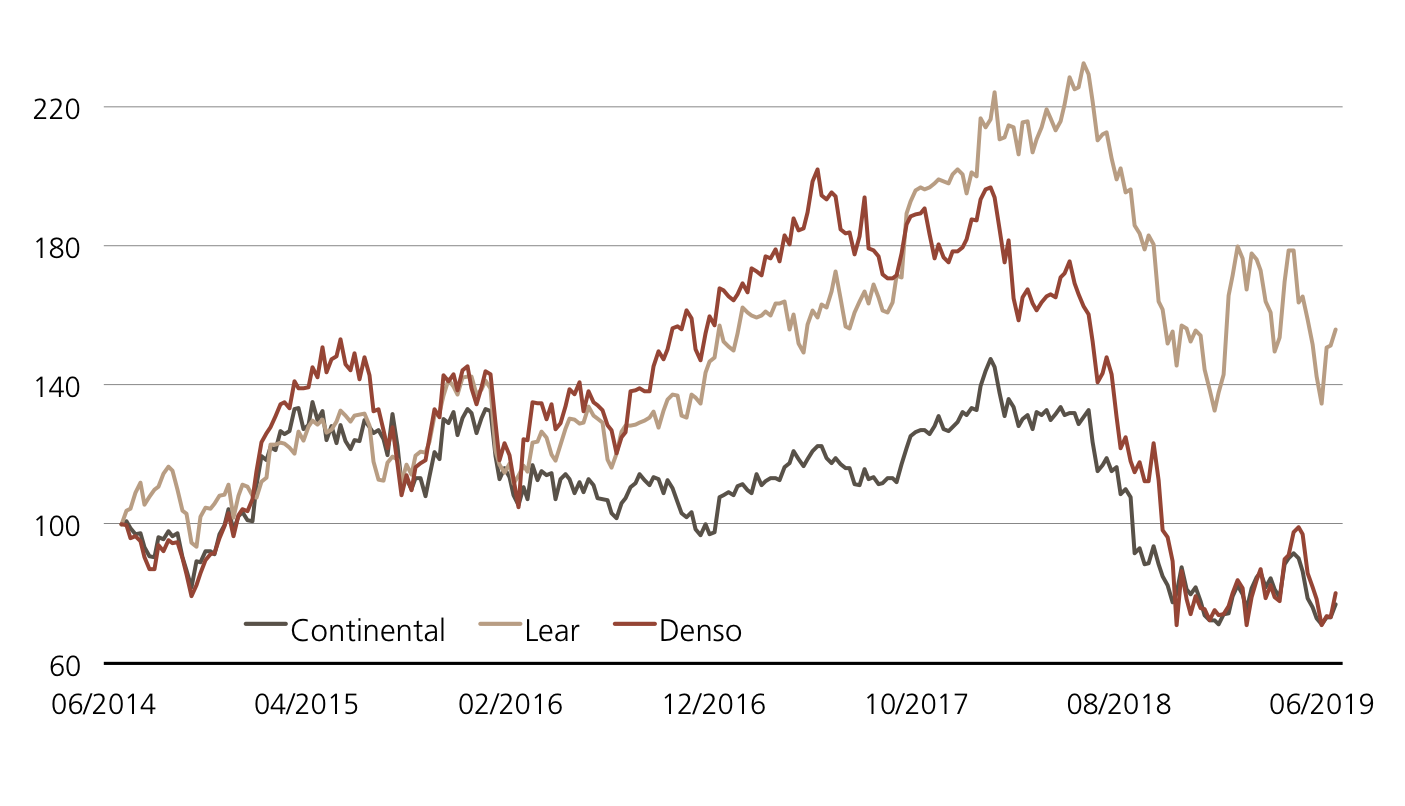

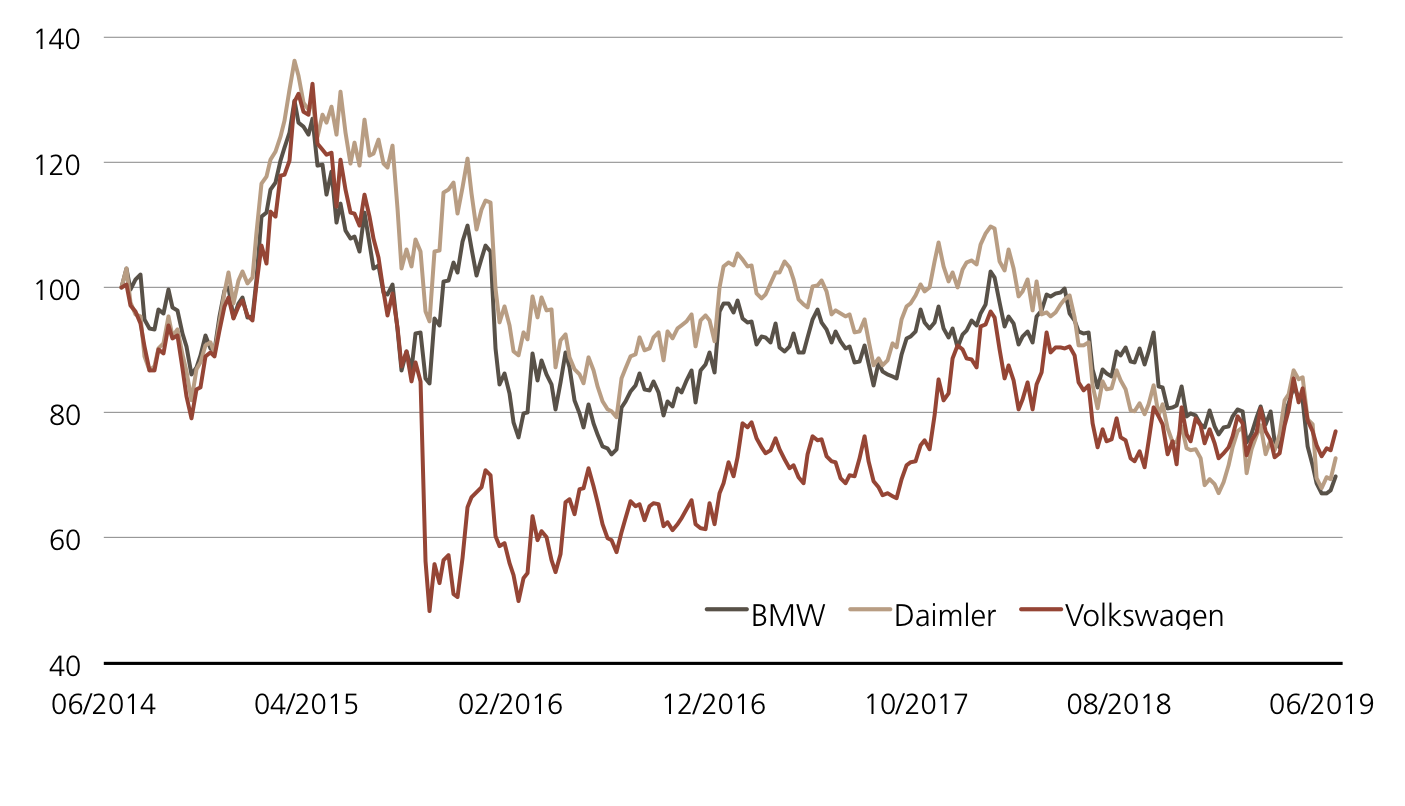

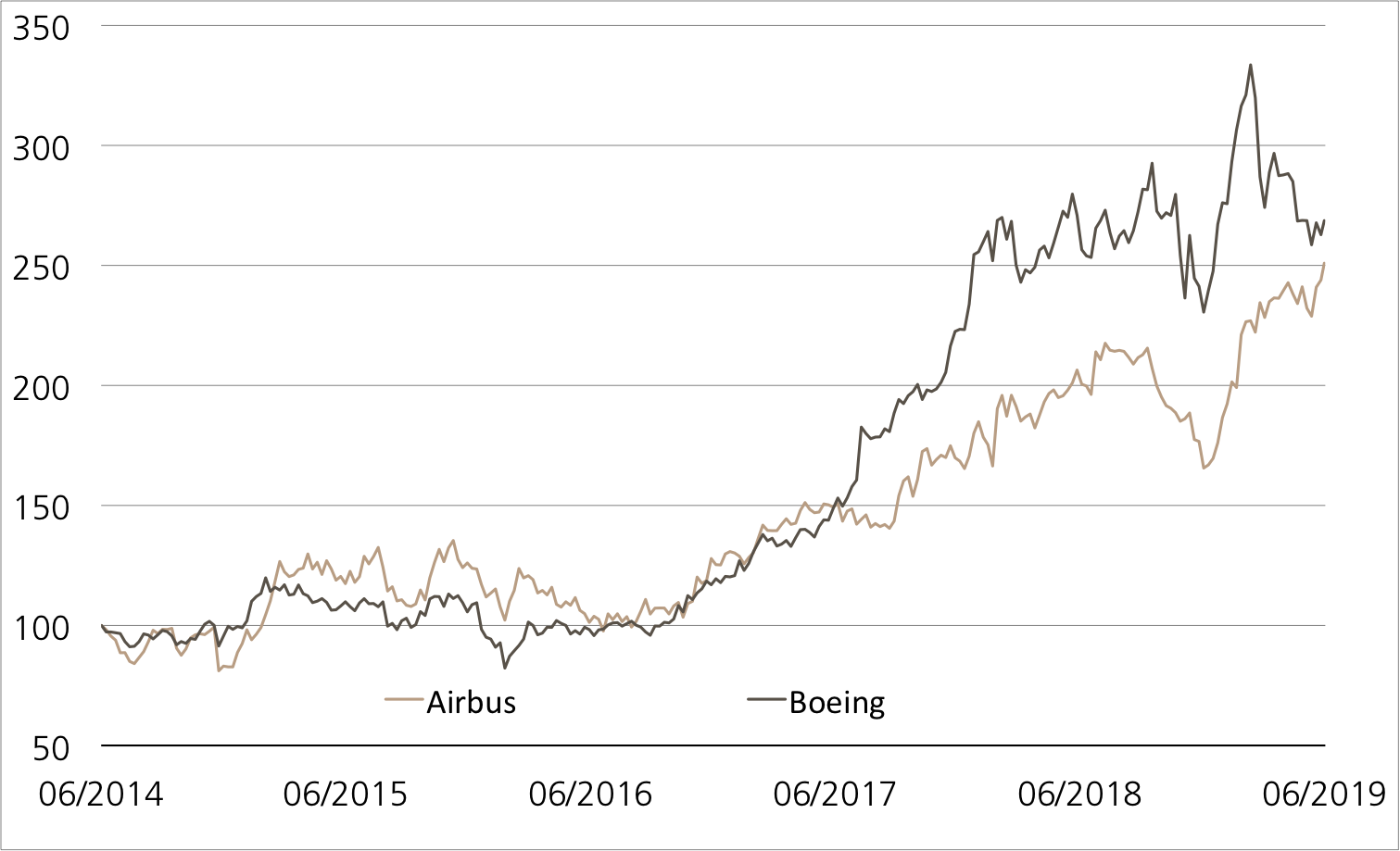

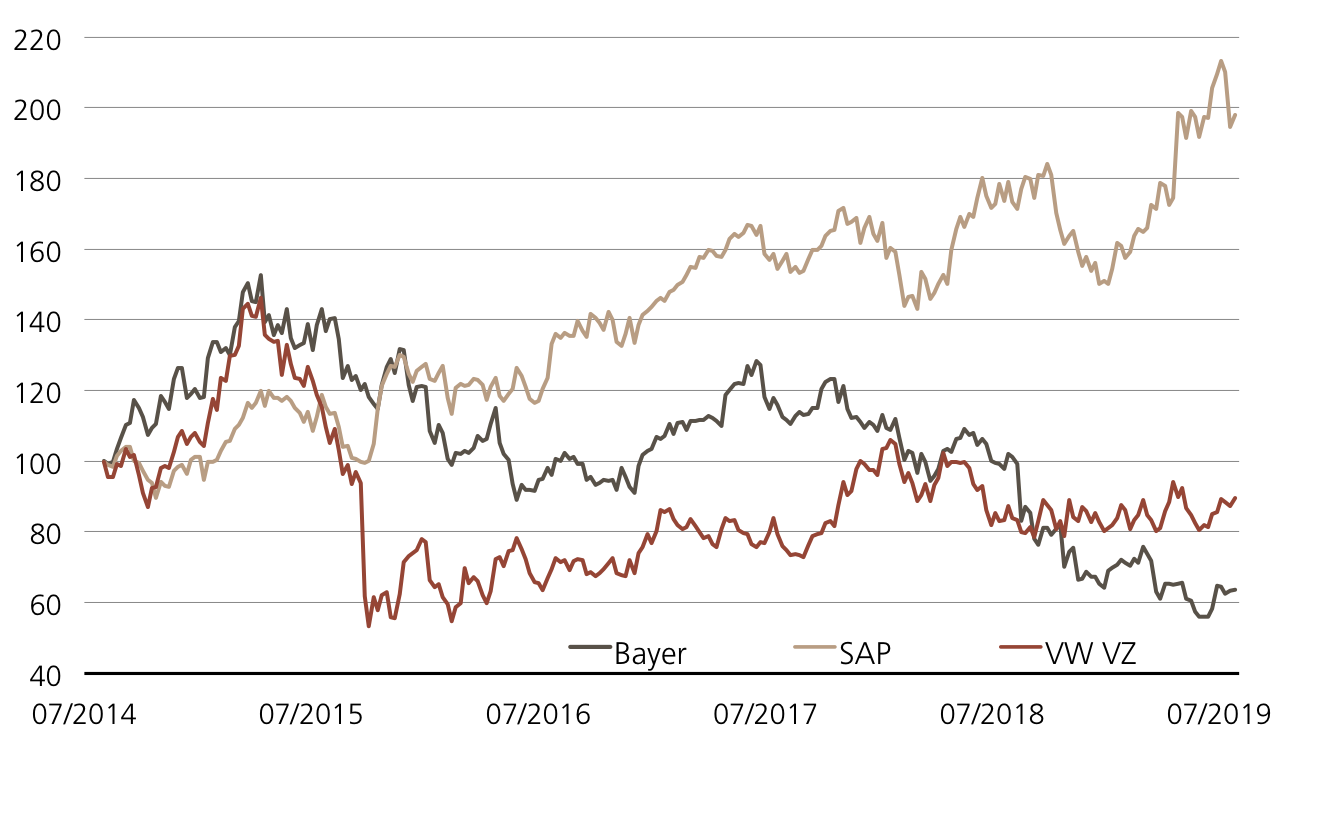

Ein Blick auf die jüngsten Zwischenberichte der deutschen Grosskonzerne könnte vermuten lassen, dass der Motor der grössten Volkswirtschaft der Eurozone stottert. Vor allem Chemieriese BASF schockte: Anstatt eines leichten Zuwachses des operativen Gewinns wird nun ein Einbruch bis zu 30 Prozent erwartet. Der Autokonzern Daimler wies für das zweite Quartal sogar einen Verlust von 1.6 Milliarden Euro aus und schraubt zum zweiten Mal innerhalb kürzester Zeit seine Prognose nach unten. Europas grösster Softwarekonzern SAP musste ebenfalls überraschend kleinere Brötchen backen. Der Gewinn ging um 19 Prozent zurück. Die zum Teil schwachen Zahlen aus der Industrie sowie der globale Handelskrieg verdirbt auch den Finanzmarktanalysten immer mehr die Stimmung. So reduzierten sich die ZEW-Konjunkturerwartungen im Juni von minus 21.1 auf minus 24.5 Punkte. (Quelle: ZEW Finanzmarktreport, Juli 2019) Auch das wichtigste deutscheKonjunkturbarometer, der ifo-Geschäftsklimaindex, ging zuletzt von 97.5 auf 95.7 Punkte zurück. (Quelle: ifo Institut, Pressemitteilung, 25.07.19)

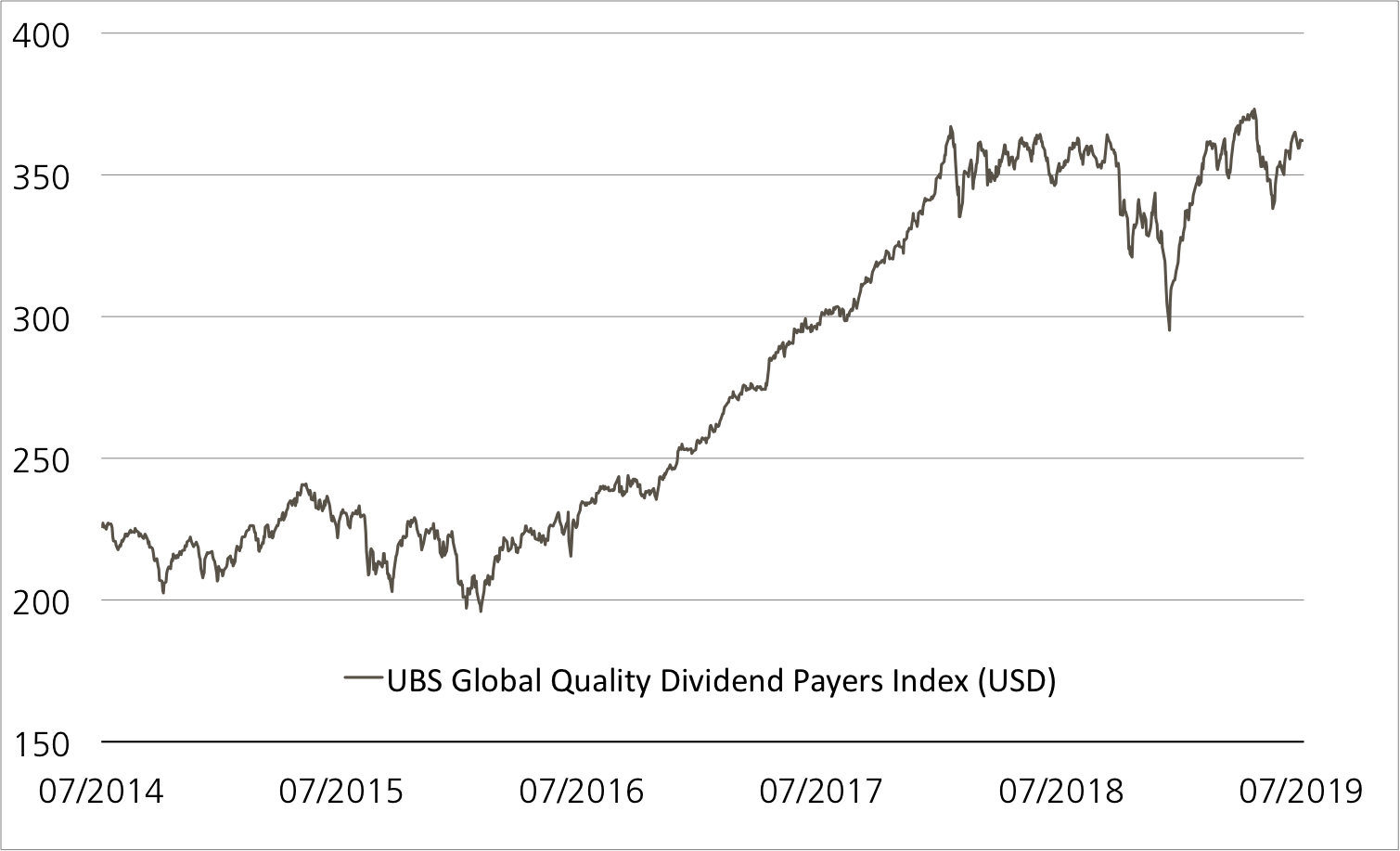

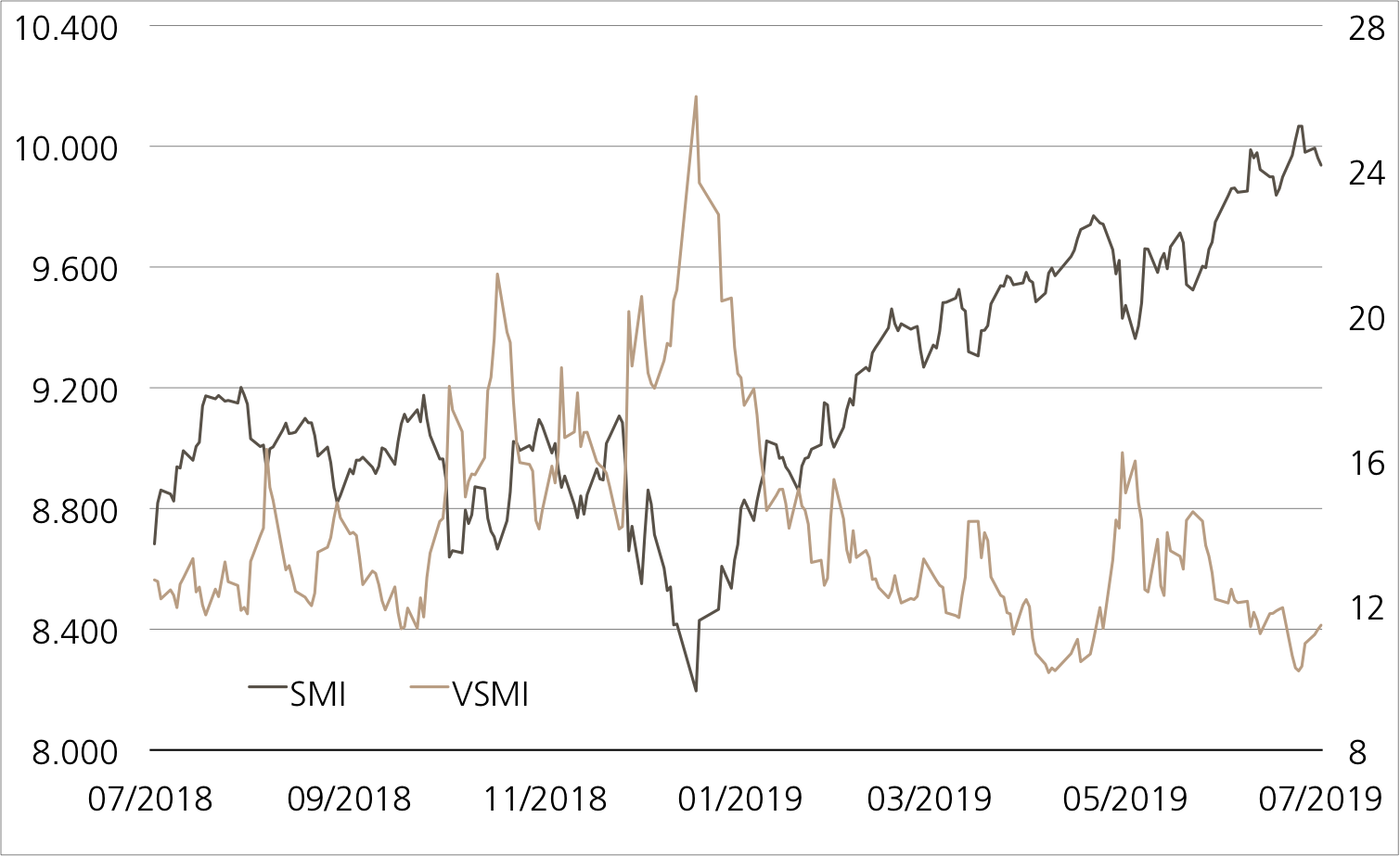

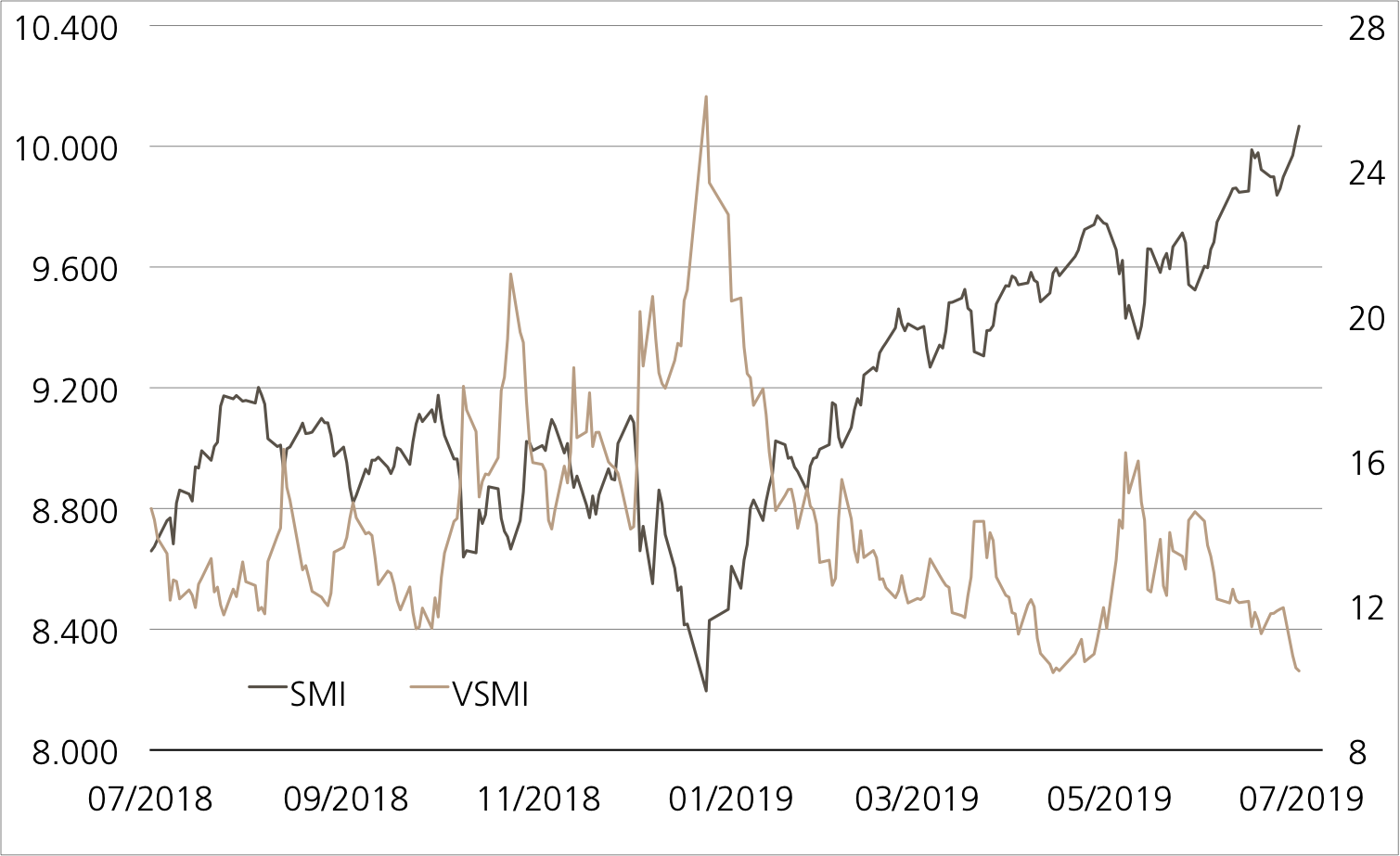

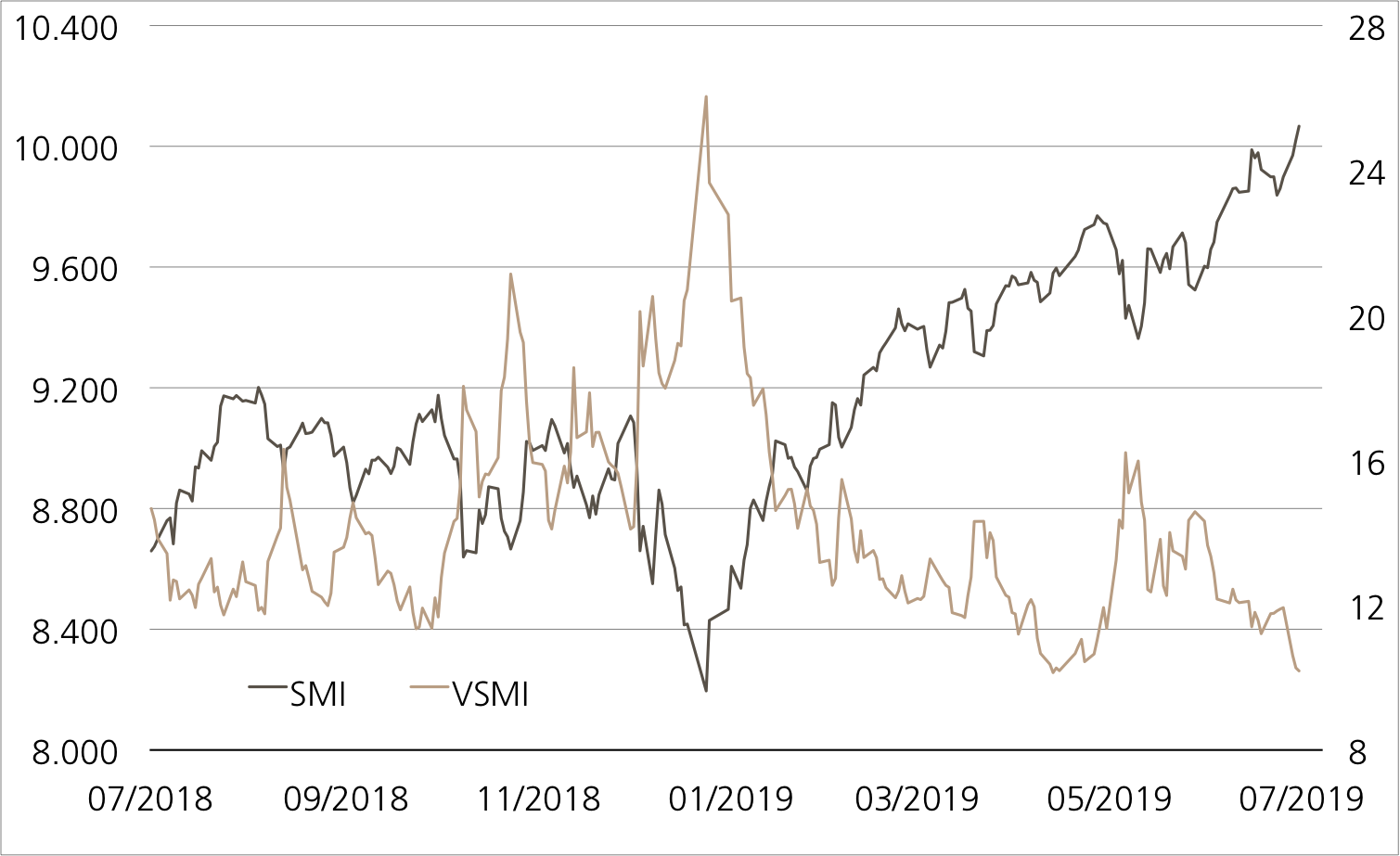

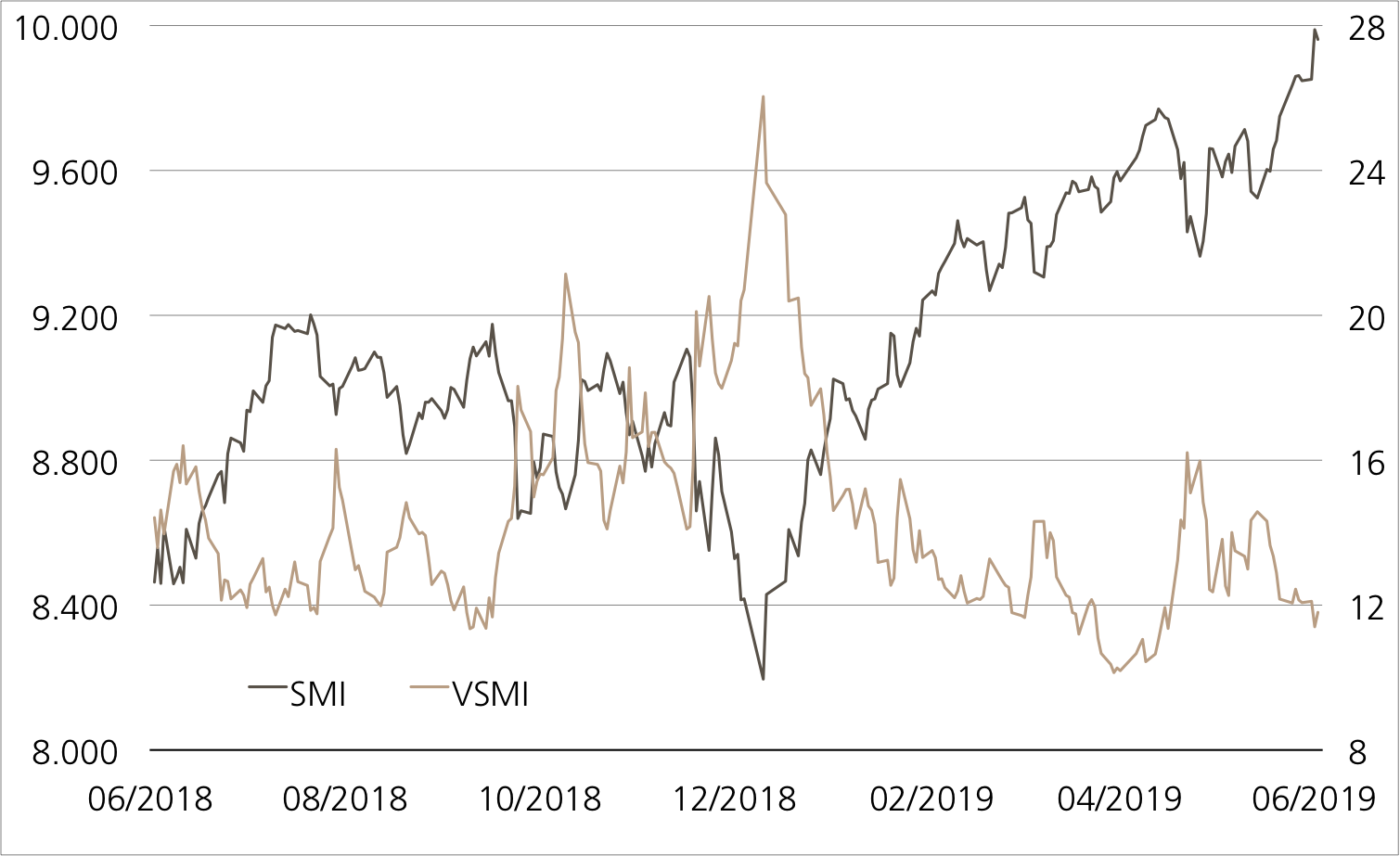

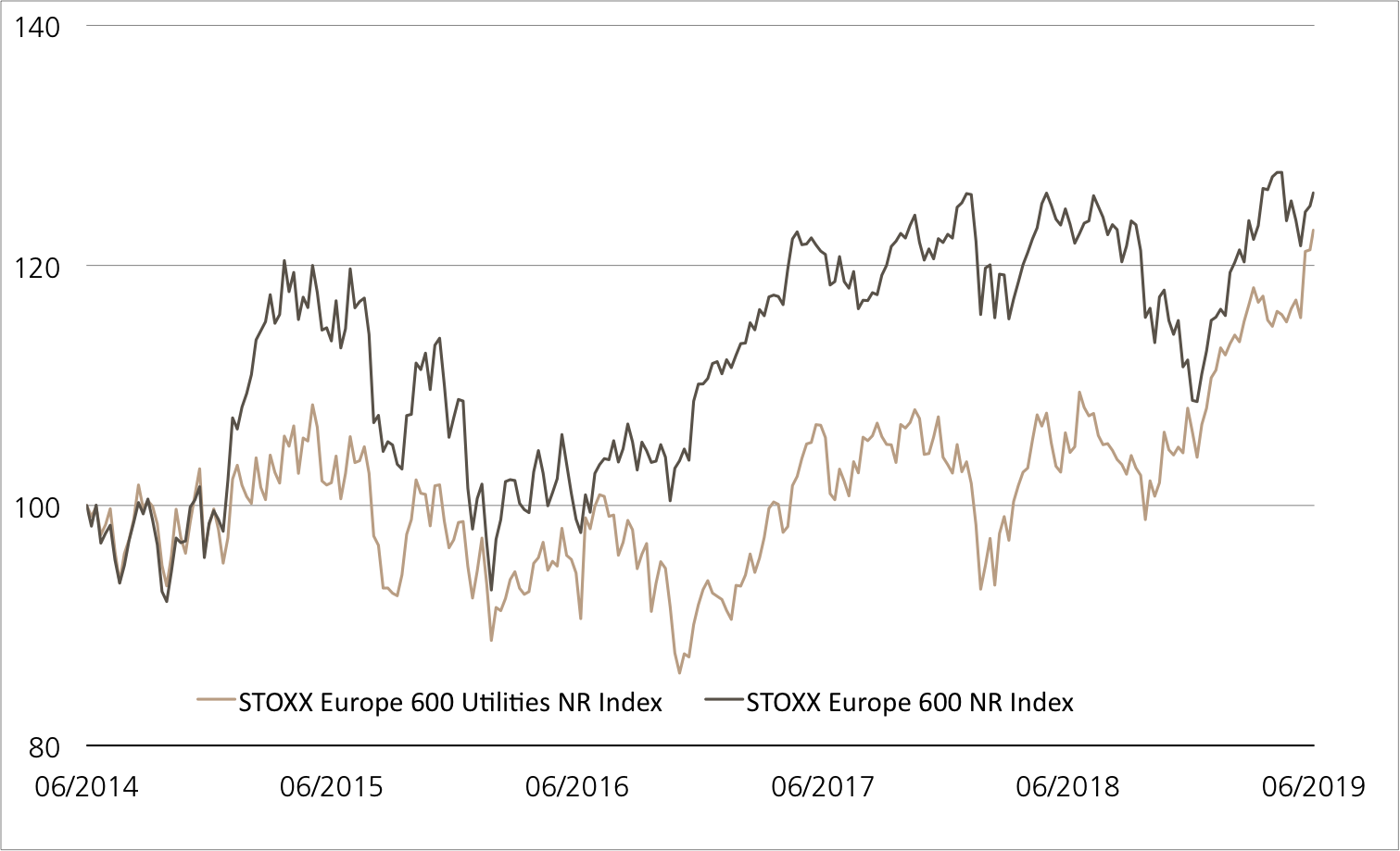

Angesichts der schwachen Konjunkturindikatoren scheint die deutsche Wirtschaft nicht so schnell wieder aus dem Formtief herauszufinden. Allerdings muss dies nicht mit Kurseinbrüchen am Aktienmarkt einhergehen. Es ist vor allem die Notenbankpolitik, welche die Anleger weiter hoffen lässt. Auf der jüngsten Sitzung der Europäischen Zentralbank liess Währungshüter Mario Draghi durchblicken, dass er im September den Geldhahn nochmal aufdrehen könnte. (Quelle: Thomson Reuters, Medienbericht, 25.07.19) Als eine der wenigen Alternativen zu den niedrigen Zinsen, selbst die Renditen der 20-jährigen Bundesanleihen liegen mittlerweile im negativen Bereich, gelten nach wie vor Aktien. Allein die Dividendenrendite beläuft sich beim DAX™ derzeit auf achtenswerte 3.20 Prozent.

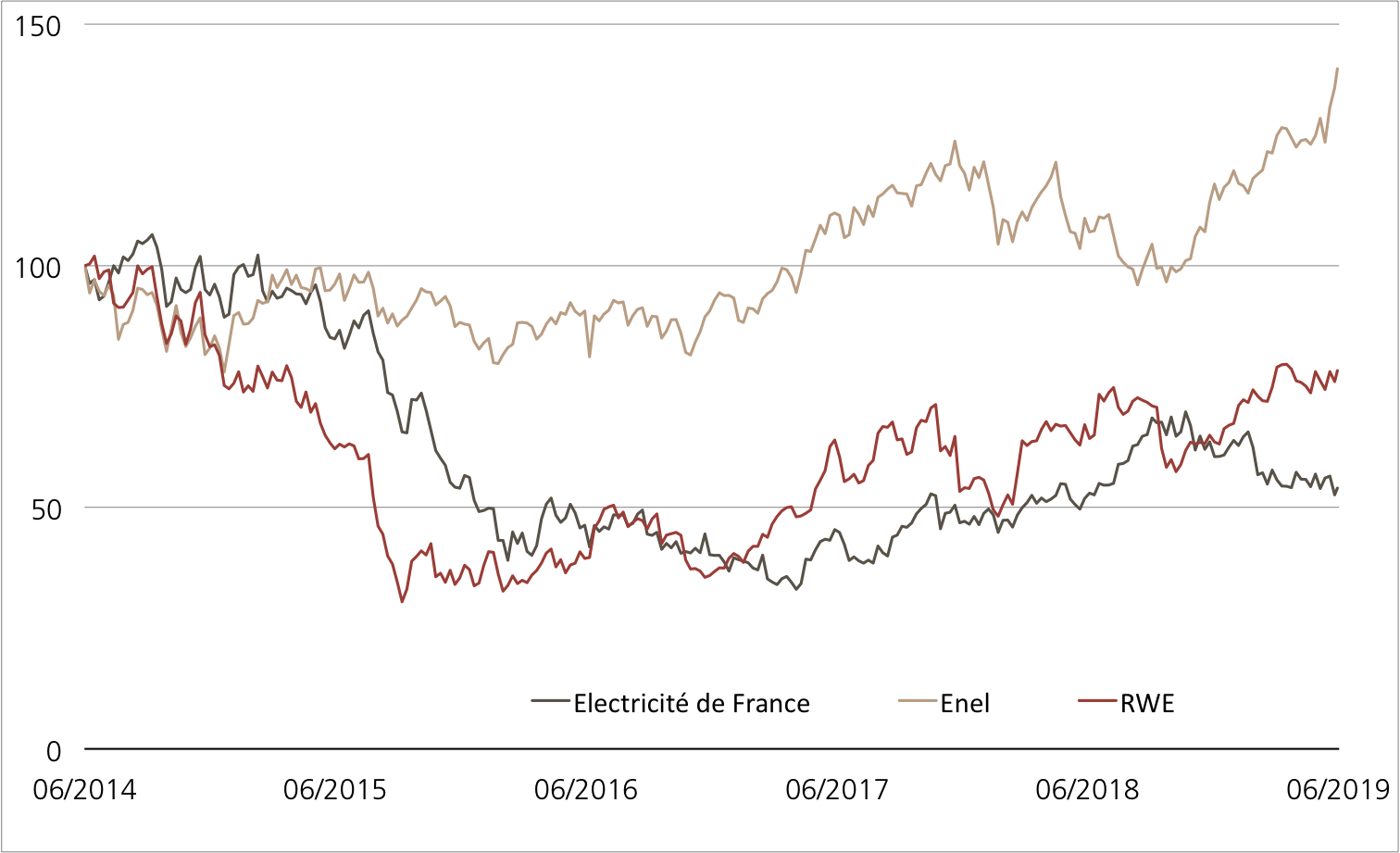

Chancen: Der ETT (Symbol: ETDAX) auf den DAX™ ermöglicht nicht nur einen direkten Zugang zu der Kursentwicklung der 30 deutschen Blue Chips, sondern auch deren Gewinnausschüttungen fliessen in die Performanceberechnung mit ein. Trotz dieses Vorteils fällt aktuell keine Verwaltungsgebühr an.² Konservative Anlegernaturen können auch mit Teilschutz im Nachbarland agieren. Eine Möglichkeit bietet der Kick-In GOAL (Symbol: KCMSDU) auf Bayer, SAP und Volkswagen. Apropos VW: Der Autokonzern konnte anders als Daimler mit seinem jüngsten Zwischenbericht überzeugen. Das schwächste Mitglied des Trios, Bayer, verfügt noch über einen Risikopuffer von 21.7 Prozent. Bleibt das Dreigespann während der Restlaufzeit von rund acht Monaten über der Barriere, erzielt das Produkt die Maximalrendite von 19.1 Prozent p.a.

Risiken:Die vorgestellten Produkte sind nicht kapitalgeschützt. Bei einem ETT kommt es zu Verlusten, sobald der zugrundeliegende Index unter dem Einstiegspreis zu liegen kommt. Notiert einer der Basiswerte des Kick-In GOALs während der Laufzeit einmal auf oder unter dem jeweiligen Kick-In Level, kann die Tilgung am Verfalltag durch Bartilgung entsprechend der (vom Strike aus) schwächsten Performance aus dem Trio erfolgen (höchstens jedoch zum Nominalwert zuzüglich Coupon). In diesem Fall sind Verluste wahrscheinlich. Zudem trägt der Anleger bei Strukturierten Produkten das Emittentenrisiko, so dass das eingesetzte Kapital – unabhängig von der Entwicklung der Basiswerte – im Falle einer Insolvenz der UBS AG verloren gehen kann.

²) Die Konditionen der ETTs werden jährlich überprüft und können mit einer Frist von 13 Monaten nach Bekanntgabe angepasst werden

| Remove | ||

|---|---|---|

| Symbol | KCMSDU | |

| SVSP Name | Barrier Reverse Convertible | |

| SVSP Code | 1230 | |

| Basiswerte | Bayer, SAP, Volkswagen VZ | |

| Handelswährung | EUR | |

| Coupon | 6.50% p.a. | |

| Seitwärtsrendite | 13.13% / 19.07% p.a. | |

| Kick-In Level (Abstand) |

Bayer: EUR 44.748 (21.71%) SAP: EUR 63.636 (44.45%) VW VZ: EUR 91.764 (39.53%) |

|

| Verfall | 03.04.2020 | |

| Emittentin | UBS AG, London | |

| Geld-/ Briefkurs | 91.15% / 92.15% | |

| Index | Stand | Woche¹ | |

|---|---|---|---|

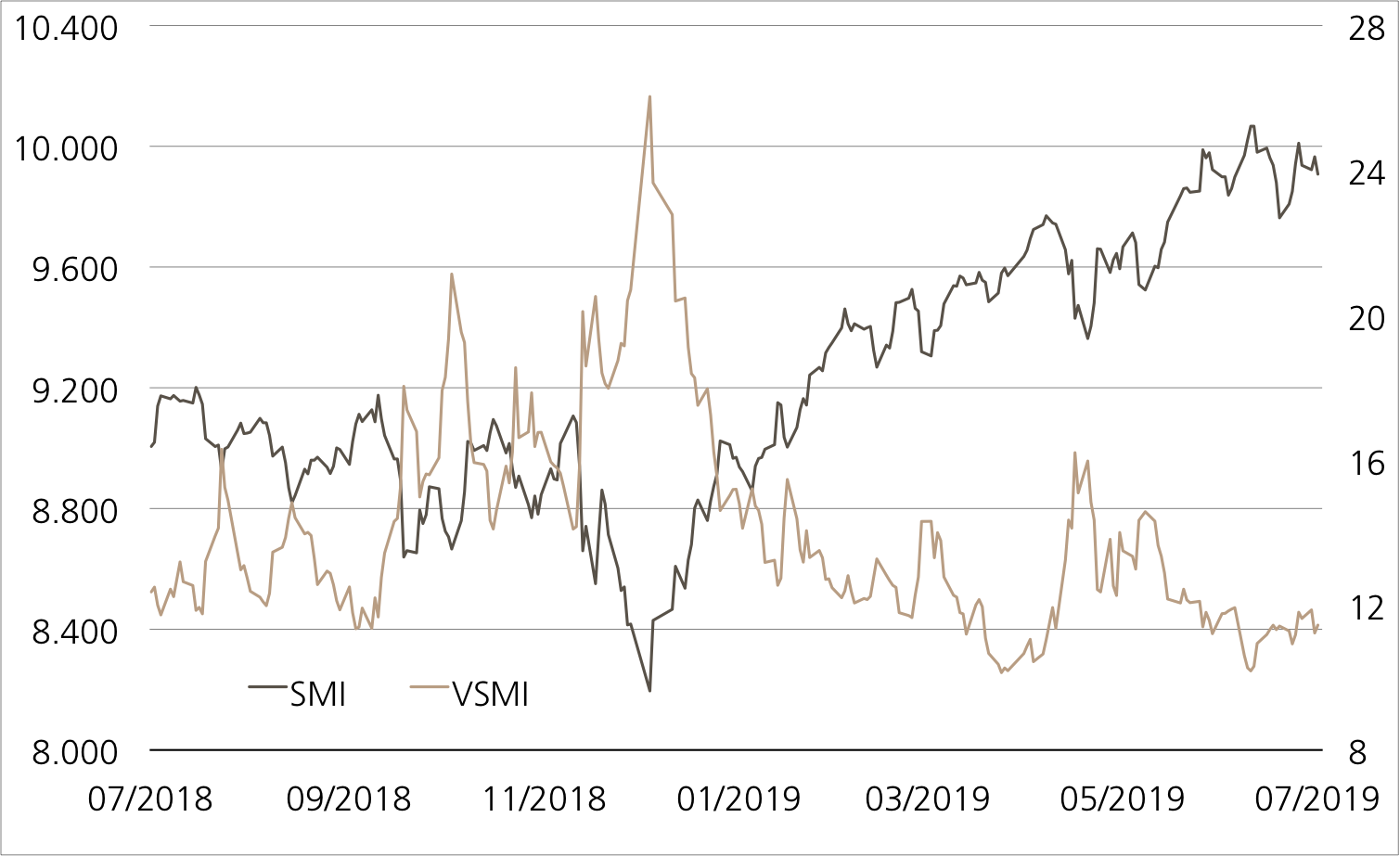

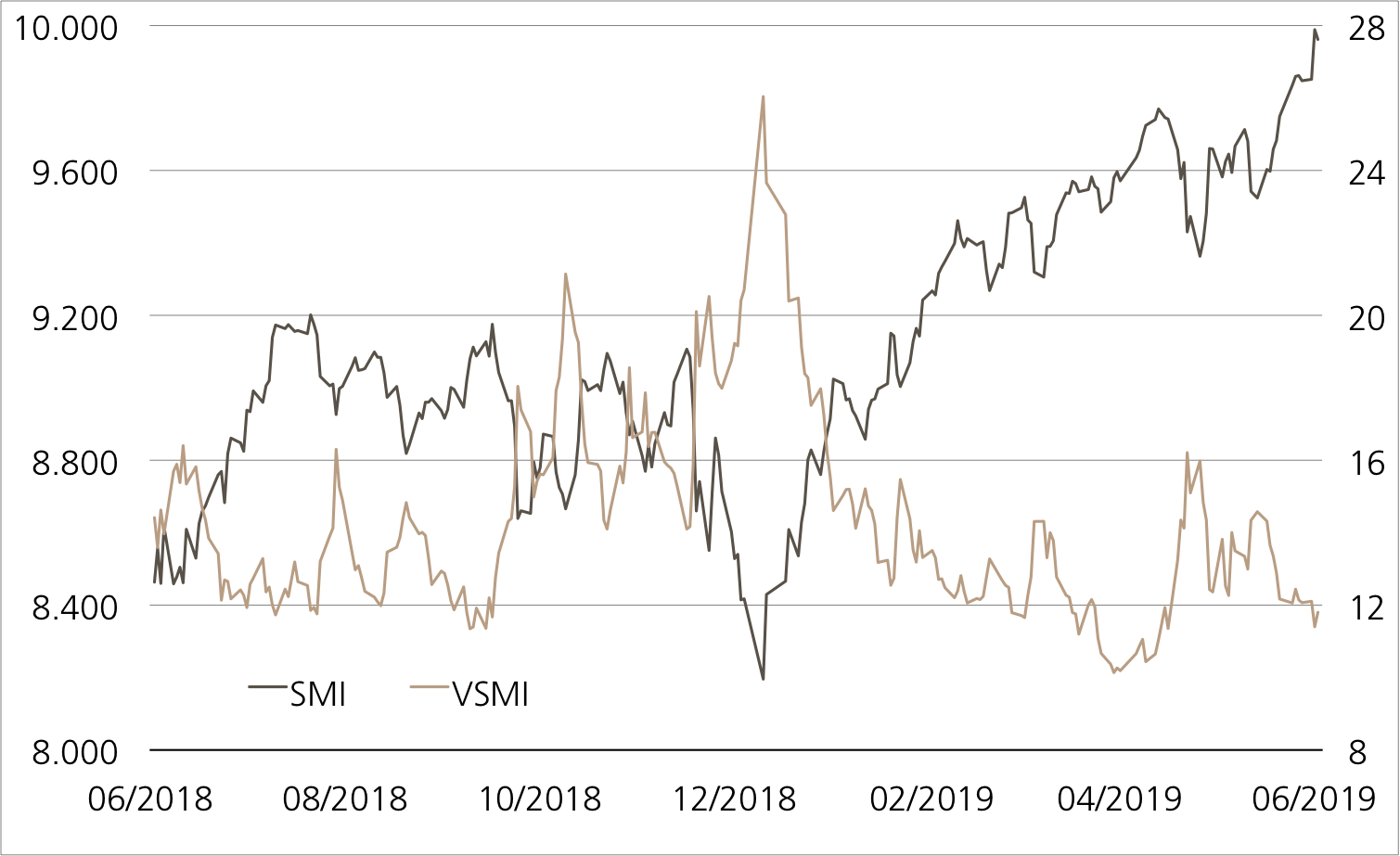

| SMI™ | 9’890.90 | -0.2% | |

| SLI™ | 1’517.46 | -0.6% | |

| S&P 500™ | 3’013.18 | -0.2% | |

| EURO STOXX 50™ | 3’462.85 | -2.0% | |

| S&P™ BRIC 40 | 4’313.14 | -1.0% | |

| CMCI™ Compos. | 905.20 | -0.1% | |

| Gold (Feinunze) | 1’441.80 | 1.3% | |

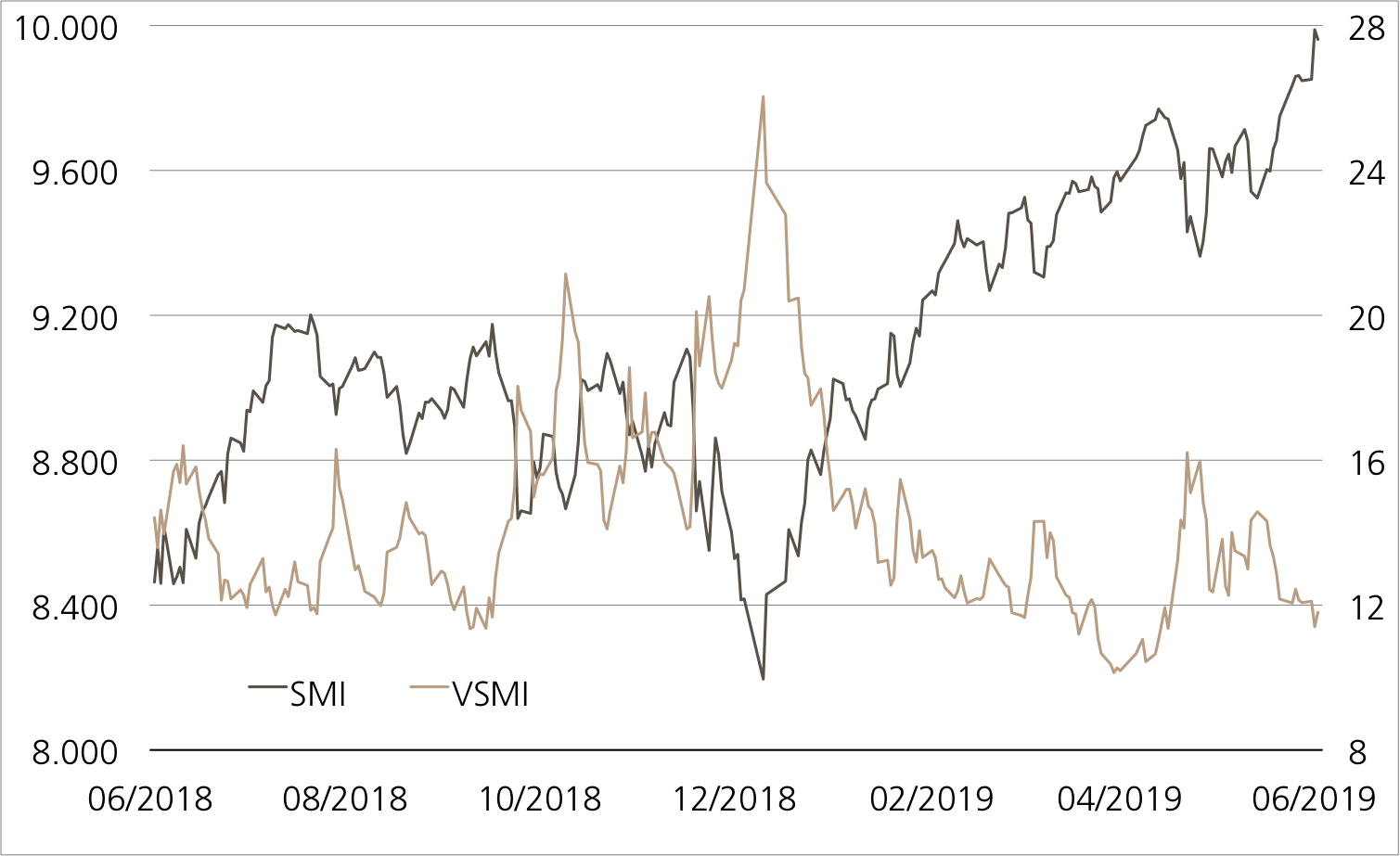

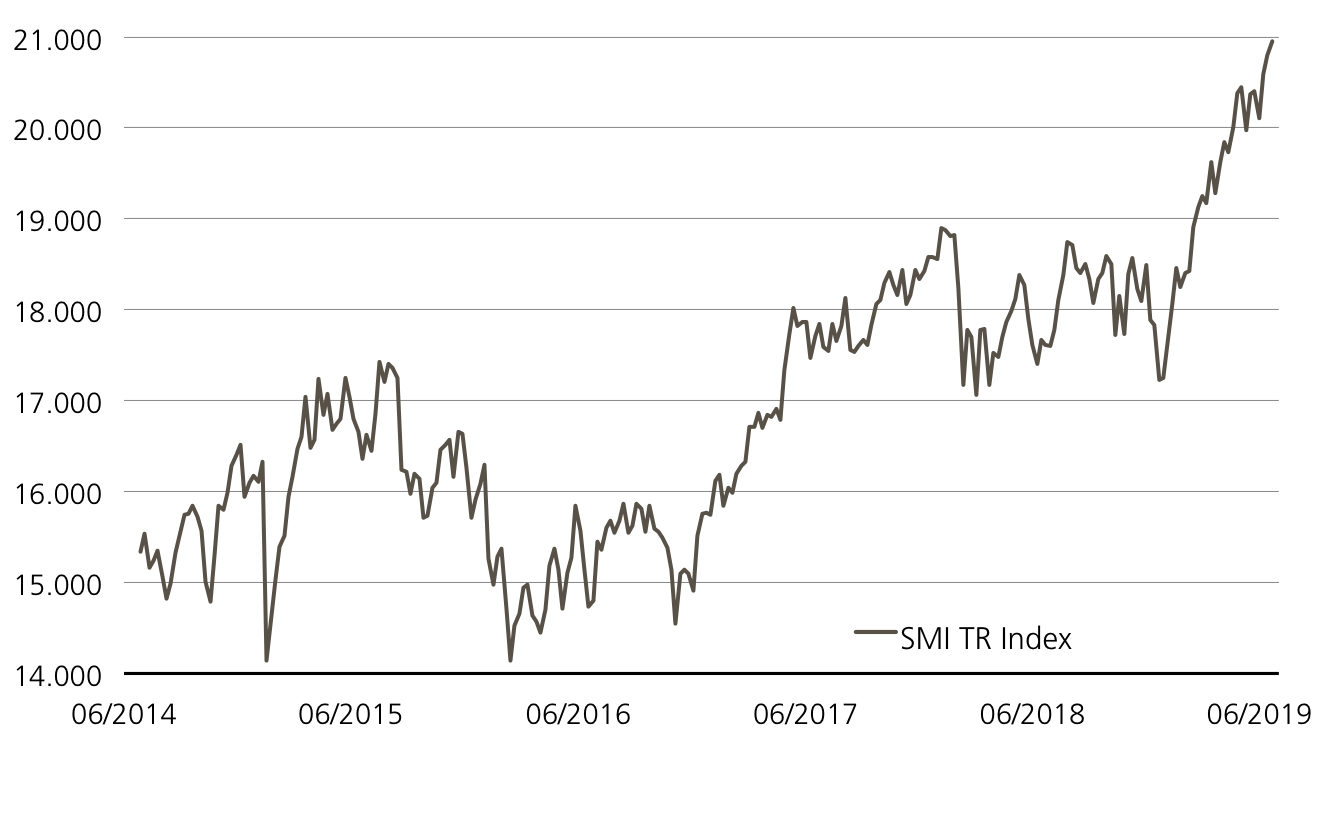

SMI™-Schwergewichte

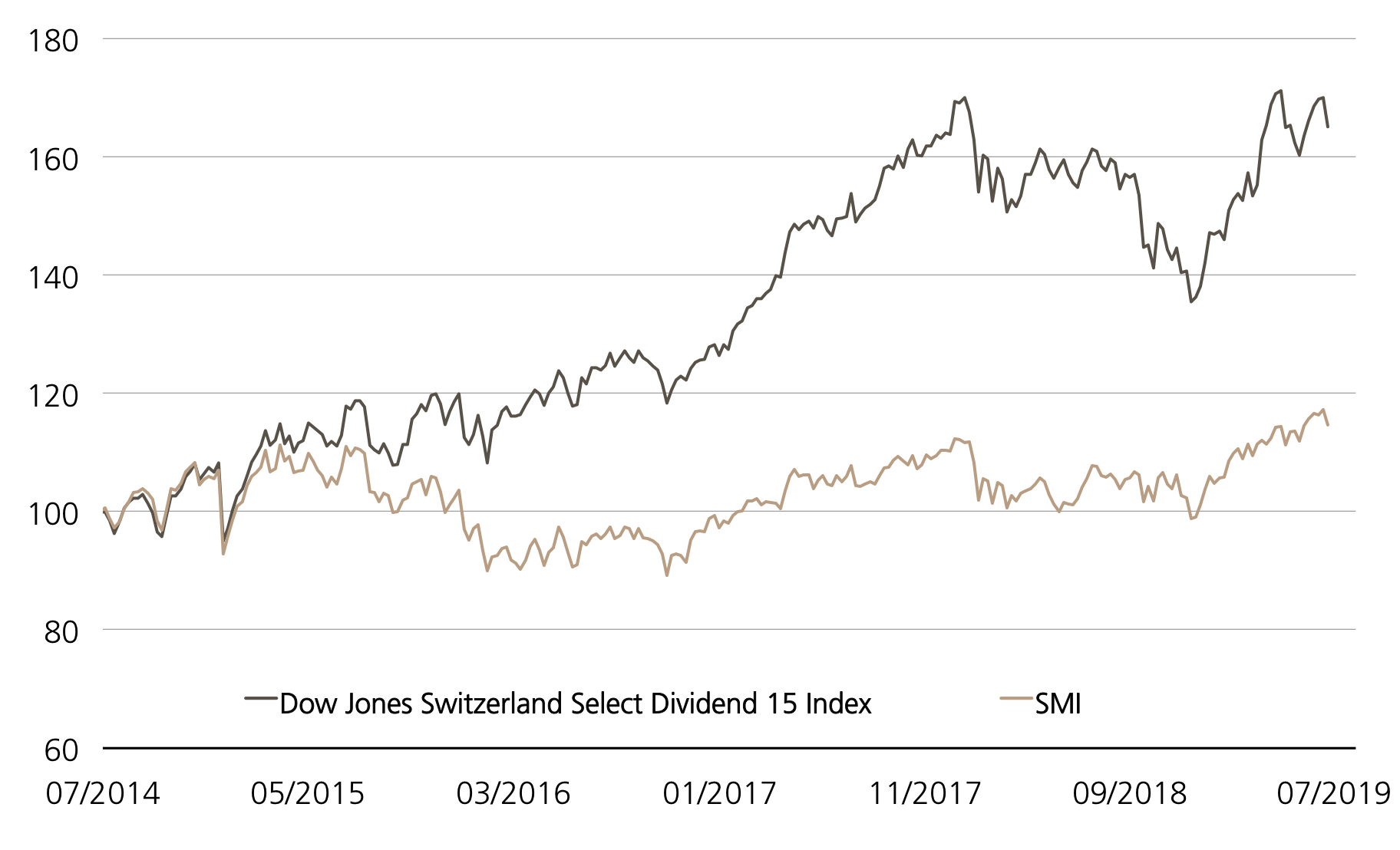

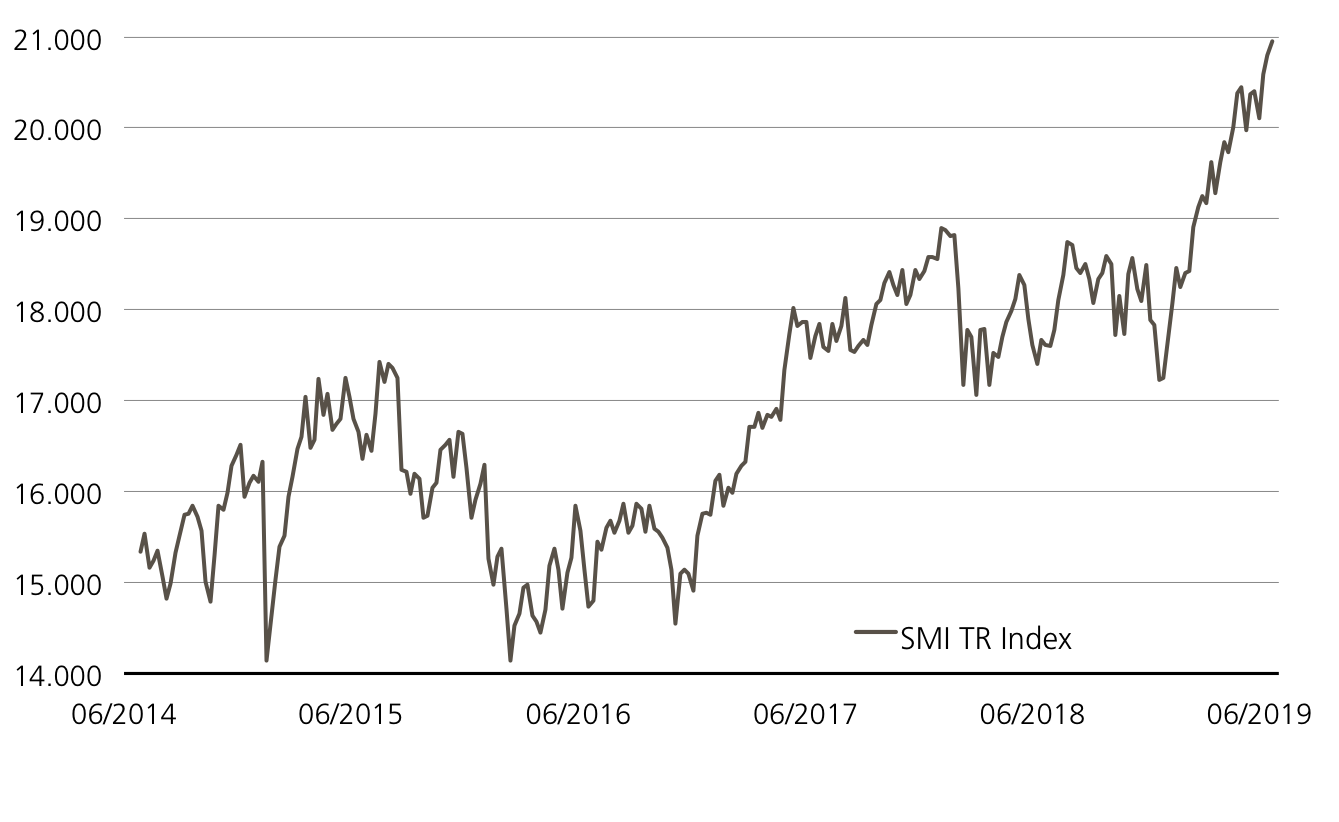

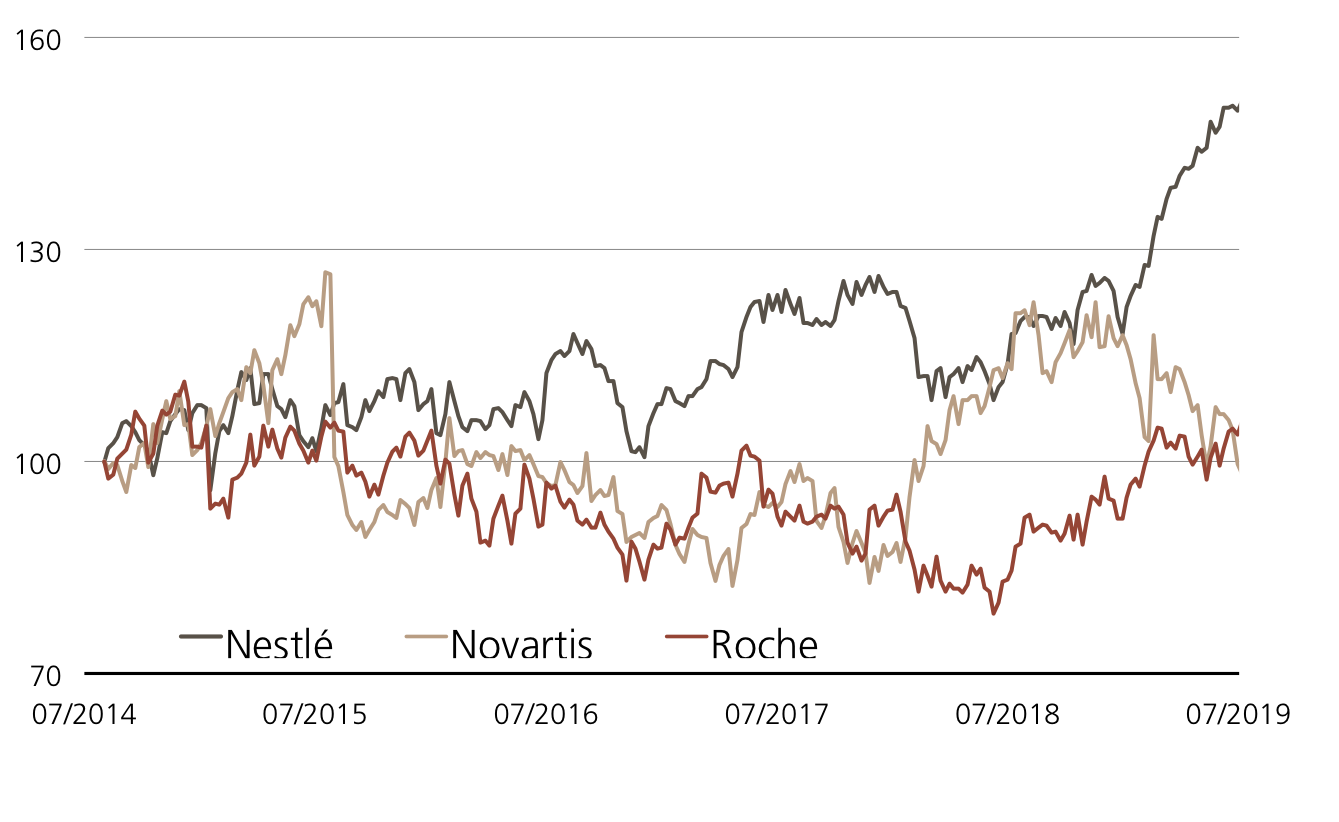

Ein Trio für alle Fälle

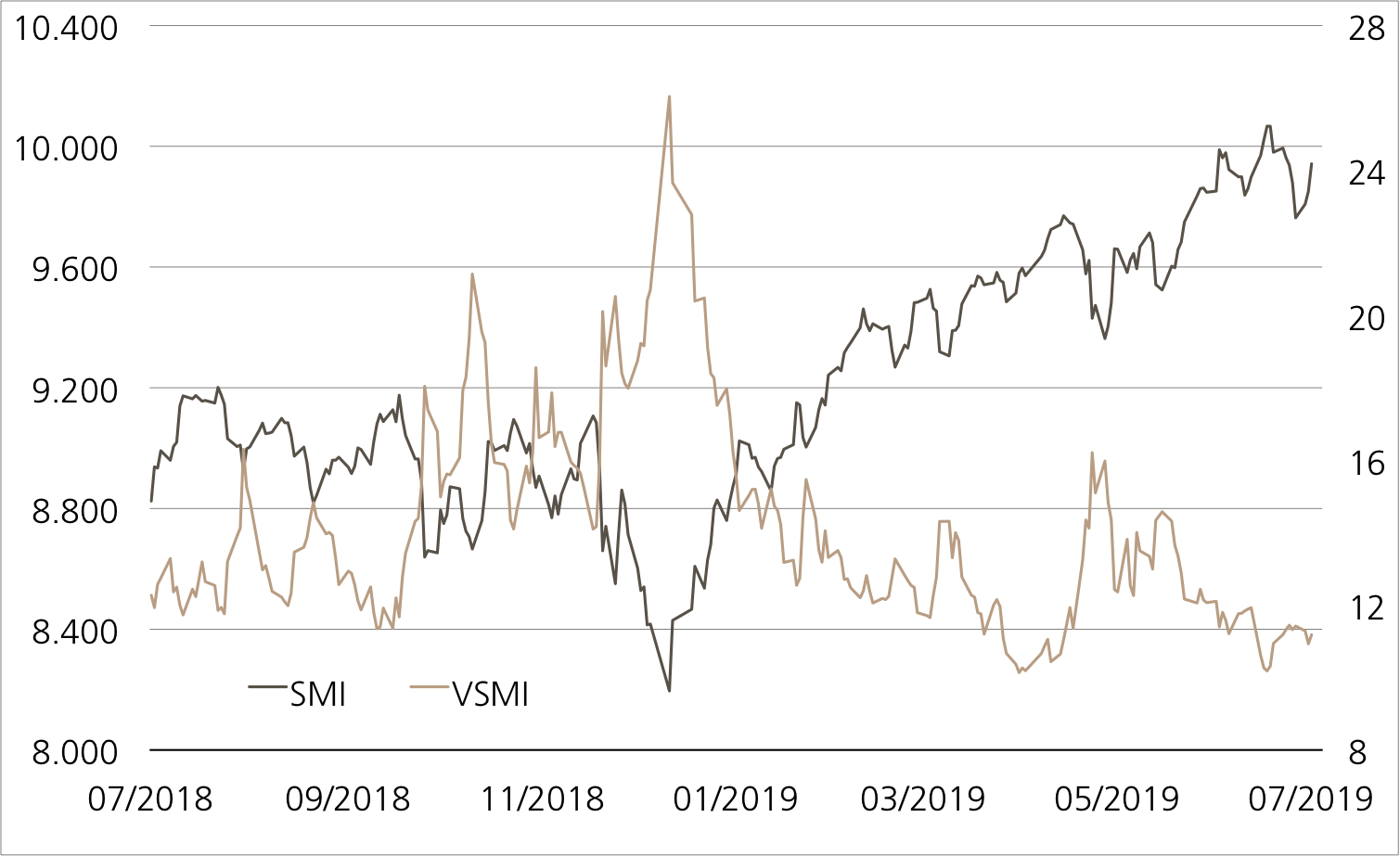

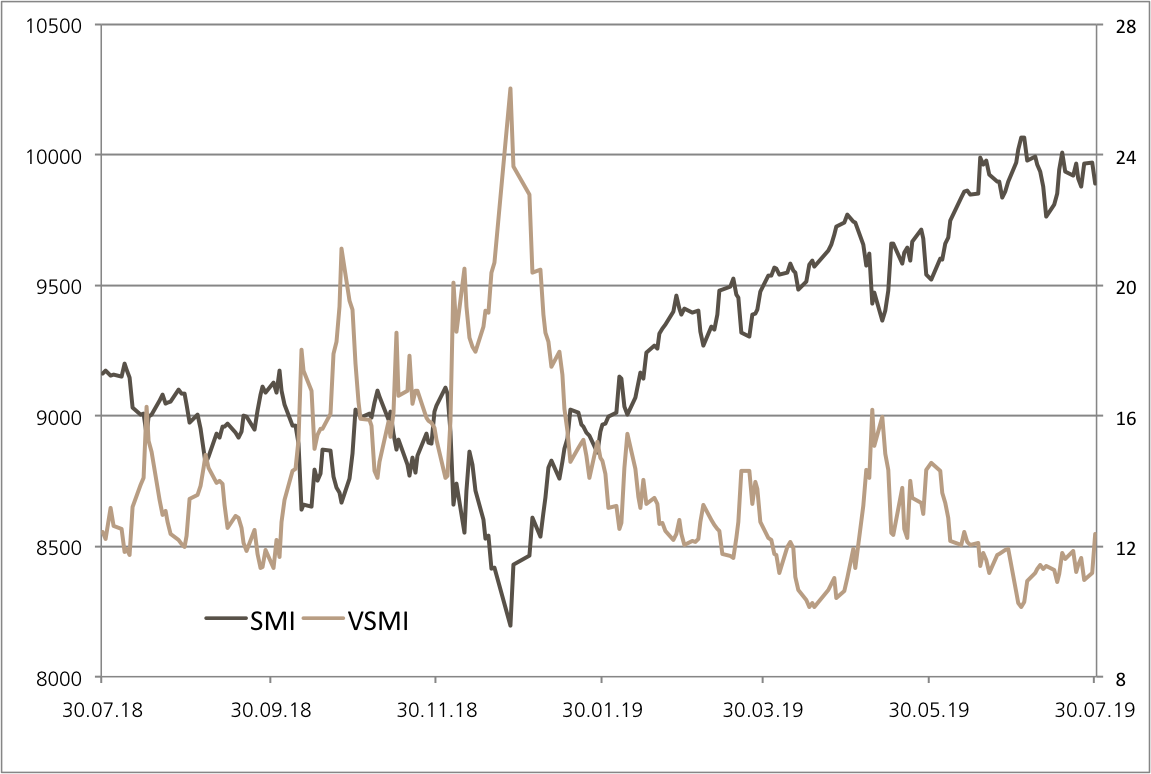

Chancen:Die Geschäfte laufen gut bei Nestlé, Novartis und Roche und folglich auch die Aktienkurse.¹ Der neue Callable Kick-In GOAL (Symbol: KDYYDU) zielt auf eine mögliche Verschnaufpause des Dreigespanns ab. Das Produkt räumt den Basiswerten nach unten knapp 30 Prozent Platz ein, ohne dass die maximale Gewinnchance von 5.75 Prozent p.a. in Gefahr gerät. Aufgrund der Callable-Funktion kann die Laufzeit von zwei Jahren um ein Jahr verkürzt werden.

Risiken:Das vorgestellte Produkt ist nicht kapitalgeschützt. Notiert einer der Basiswerte während der Laufzeit einmal auf oder unter dem jeweiligen Kick-In Level (Barriere) und kommt zudem das Callable Feature nicht zum tragen, kann die Tilgung am Verfalltag durch Lieferung einer vorab durch das Bezugsverhältnis fixierten Anzahl des Basiswertes mit der schlechtesten Wertentwicklung (vom Strike aus) erfolgen (höchstens jedoch zum Nominalwert zuzüglich Coupon). In diesem Fall sind Verluste wahrscheinlich. Zudem trägt der Anleger bei Strukturierten Produkten das Emittentenrisiko, so dass das eingesetzte Kapital – unabhängig von der Entwicklung der Basiswerte – im Falle einer Insolvenz der UBS AG verloren gehen kann.

5.75% p.a. Callable Kick-In GOAL auf Nestlé / Novartis / Roche

| Remove | ||

|---|---|---|

| Symbol | KDYYDU | |

| SVSP Name | Barrier Reverse Convertible | |

| SVSP Code | 1230, Callable | |

| Basiswert | Nestlé, Novartis, Roche | |

| Handelswährung | CHF | |

| Coupon | 5.75% p.a. | |

| Kick-In Level (Barriere) |

70.00% | |

| Verfall |

09.08.2021 | |

| Emittentin | UBS AG, London | |

| Zeichnung bis | 07.08.2019, 15:00 Uhr | |

Termsheet Weitere Produkte sowie Informationen zu Chancen und Risiken finden Sie unter: ubs.com/keyinvest Quelle: UBS AG Stand: 30.07.2019

²) Die Konditionen der ETTs werden jährlich überprüft und können mit einer Frist von 13 Monaten nach Bekanntgabe angepasst werden