Währungshüter bleiben im Rampenlicht

16. September 2019 – UBS Wochenkommentar Rück-/Ausblick

Währungshüter bleiben im Rampenlicht

Einer der drei Protagonisten, welcher in diesen Tagen das ganze Interesses des Börsenpublikums auf sich zieht, hat seine Karten bereits aufgedeckt. Der Chef-Notenbanker der Eurozone, Mario Draghi, entschied am vergangenen Donnerstag über die künftige Geldpolitik im gemeinschaftlichen Währungsraum. Fed-Vorsitzender Jerome Powell und SNB-Oberhaupt Thomas Jordan werden diese Woche nachziehen und ihre Beschlüsse offenlegen.

Die EZB legt vor…

Es war nicht der ganz grosse Wurf, den der scheidende EZB-Chef Mario Draghi am 12. September machte. Reichten die Spekulationen im Vorfeld hin bis zu einem «Helikoptergeld», waren die dann angekündigten Massnahmen eher dosiert. Die Europäische Zentralbank (EZB) hob zum einen die Strafzinsen für Banken an und nimmt zum anderen die Anleihenkäufe wieder auf. Im Detail wurde der sogenannte Einlagensatz wie vom Gros der Ökonomen erwartet von minus 0.4 Prozent auf minus 0.5 Prozent gesenkt. Und die im Dezember 2018 beendeten Anleihenkäufe werden wieder ab dem 1. November starten. Die EZB möchte monatlich Papiere für 20 Milliarden Euro erwerben. (Quelle: Thomson Reuters, Medienbericht, 12.09.2019)

Die Börsen reagierten mit Aufschlägen auf die Entscheidung von Mario Draghi. Selbst die Banken, die mit höheren Strafzinsen rechnen müssen, wenn sie bei der Notenbank überschüssige Gelder parken, gingen mit positiven Vorzeichen aus dem Handel.* Der Grund: Wegen eines Staffelzinses wird nur für ein Teil der überschüssigen Liquidität der Institute mit einem Strafzins belegt. Damit werden einige Banken sogar entlastet. Beispielsweise taxiert der Branchenverband BdB die Einsparungen durch den Staffelzins für die deutschen Geldhäuser auf 500 Millionen Euro. (Quelle: Thomson Reuters, Medienbericht, 13.09.2019)

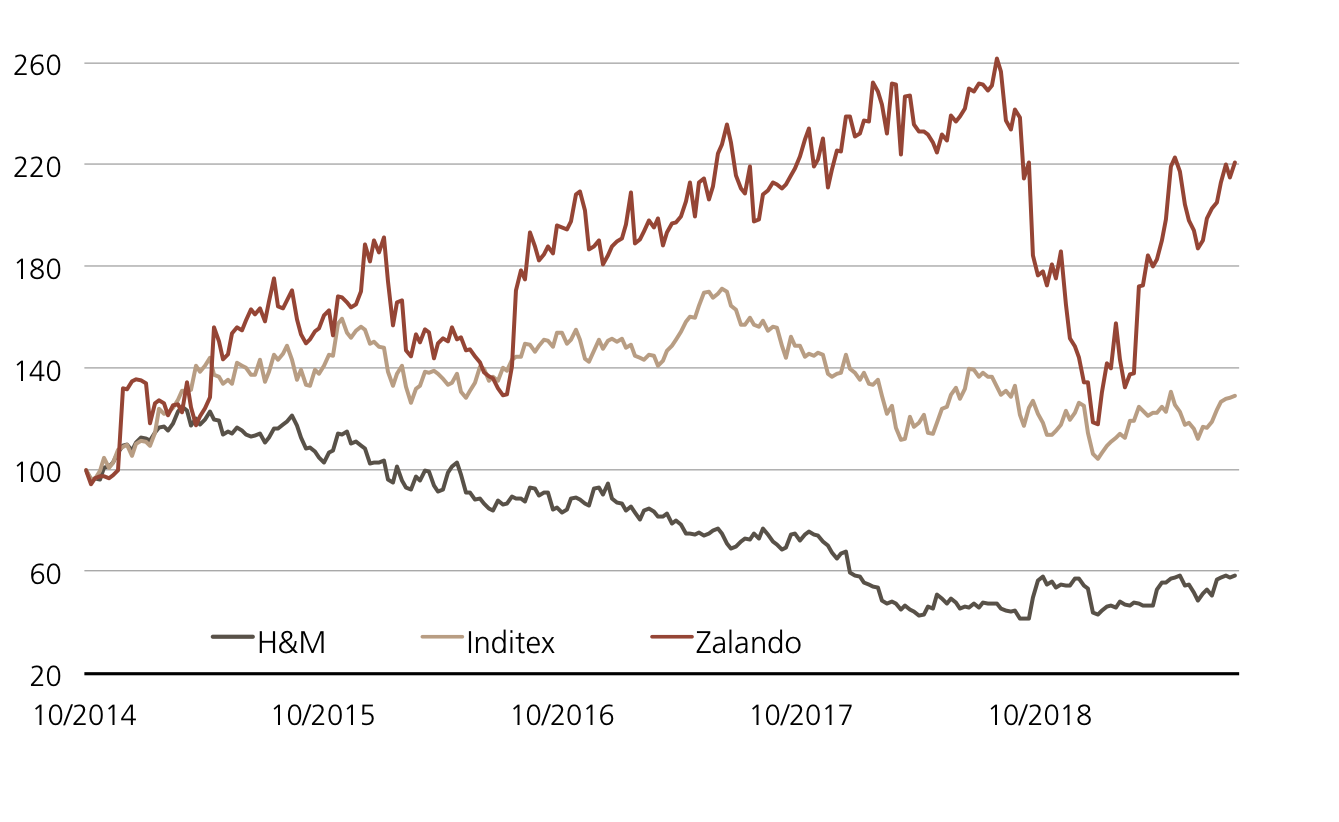

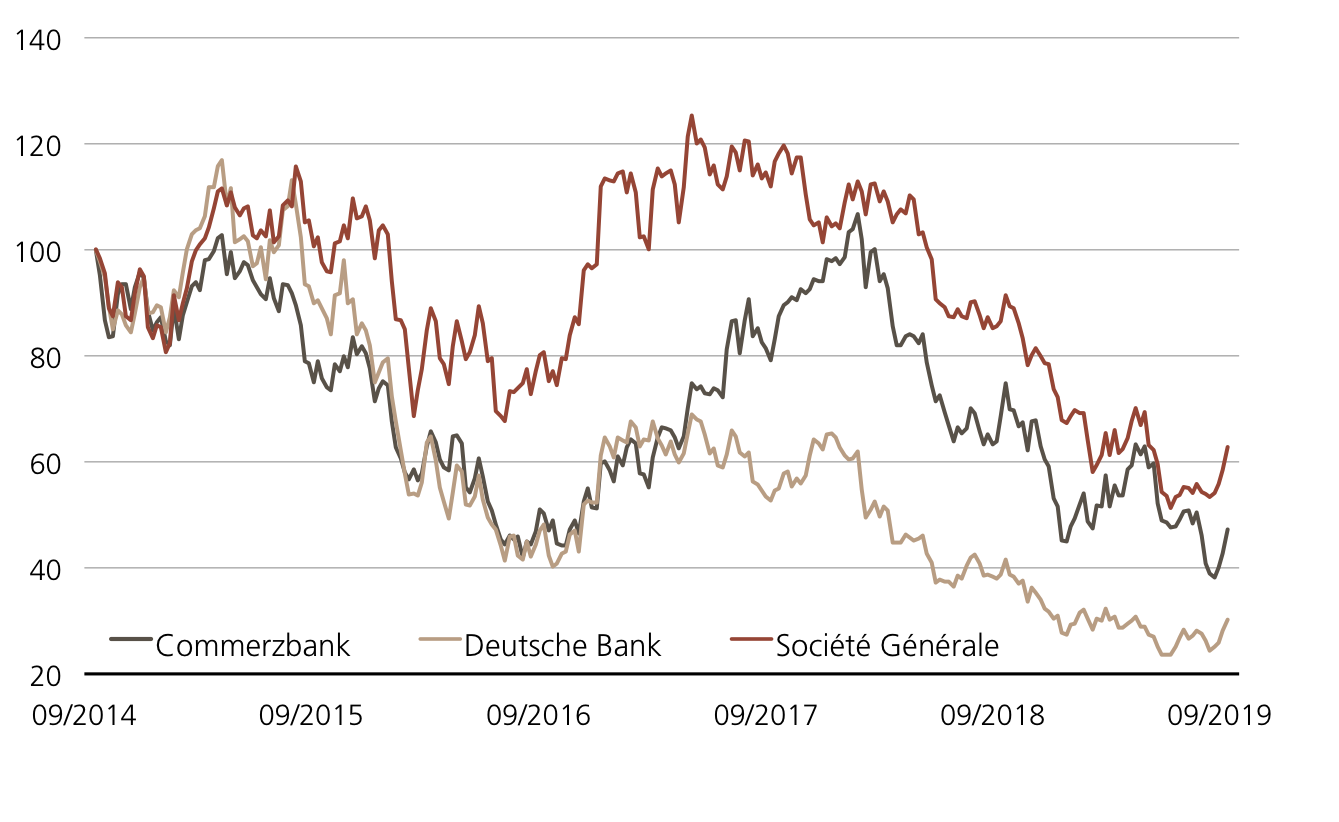

Eine bedingt teilgeschützte Möglichkeit in Bank-Aktien zu investieren, bietet der noch bis 18. September in Zeichnung stehende Callable Kick-In GOAL (Symbol: KEEXDU) auf Commerzbank, Deutsche Bank und Société Générale. Das Produkt ist mit einem Coupon von 12.75 Prozent p.a. sowie einem Risikopuffer von 40 Prozent ausgestattet. ¹)

…weitere Notenbanken folgen

Auch diese Woche konzentriert sich die Aufmerksamkeit der Investoren auf Notenbank-Entscheidungen. Hierzulande wird am Donnerstag die SNB über ihre weitere Geldpolitik beraten. Chef Tomas Jordan versucht sich seit Jahren gegen die Aufwertung des Schweizer Frankens zu stemmen. Nach dem Zinsentscheid der EZB verlor der Euro zum Franken deutlich an Wert. Ausgehend von rund 1.0920 tauchte die europäische Gemeinschaftswährung auf 1.0850 Franken ab. Danach kam es allerdings zu einem ordentlichen Rebound, welcher das FX-Duo auf 1.0960 Franken hoch katapultierte.* Wie dem auch sei, am Donnerstag wird Notenbankchef Thomas Jordan wahrscheinlich handeln. Marktteilnehmer erwarten von der SNB mehrheitlich eine Zinssenkung um gut zehn Basispunkte. Aktuell liegt der Leitzinssatz bei minus 0.75 Prozent und die Sichteinlagen der Banken bei der SNB werden mit 0.75 Prozent belastet. (Quelle: Thomson Reuters, Medienbericht, 12.09.2019)

Am Mittwoch, und damit einen Tag vor der vierteljährlichen Lagebeurteilung der SNB, kommt das Fed zusammen. Auch hier geht das Gros der Experten davon aus, dass die US-Notenbank am 18. September den Geldhahn weiter aufdrehen wird. Laut dem CME FedWatch Tool wird der Leitzins mit einer Wahrscheinlichkeit von 84.2 Prozent auf eine Spanne von 1.75 bis 2.00 Prozent gesenkt. (Quelle: CME Group, FedWatch Tool, 16.09.2019) Zuletzt hatte Powell Ende Juli den geldpolitischen Schlüsselsatz um einen Viertelpunkt auf 2.0 bis 2.25 Prozent zurückgedreht. (Quelle: Federal Reserve, FOMC-Statement, 31.07.2019)

Brexit-Diskussionen setzen sich fort

Nicht zuletzt wird auch noch die Bank of England inmitten der Brexit-Diskussionen diese Woche (19. September) über ihre Geldpolitik beraten. Börsianer erwarten hier allerdings keine Veränderungen. (Quelle: Thomson Reuters, Medienbericht, 13.09.2019) Noch bevor die Währungshüter zusammensitzen werden, macht sich Premierminister Boris Johnson auf den Weg zu einem Treffen mit dem EU-Kommissionschef Jean-Claude Juncker. Für das für diesen Montag geplante Treffen (nach Redaktionsschluss) zeigte sich Johnson im Vorfeld optimistisch: «Es werden grosse Fortschritte erzielt». Zudem soll in der neuen Woche der Oberste Gerichtshof des Königreichs darüber entscheiden, ob die von Premierminister Johnson verordnete Zwangspause für das Parlament rechtens war. Das höchste schottische Gericht wertete die Suspendierung als illegal. (Quelle: Thomson Reuters, Medienbericht, 15.09.2019)

Commerzbank vs. Deutsche Bank vs. Société Générale (5 Jahre)*

Quelle: Thomson Reuters, 13.09.2019

*Bitte beachten Sie, dass vergangene Wertentwicklungen keine Indikationen für künftige Wertentwicklungen sind.

Wichtige Termine

| Datum | Zeit | Land | Ereignis |

| 17.09.2019 | 07:45 | CH | SECO Konjunkturprognose |

| 17.09.2019 | 11:00 | EZ | ZEW-Umfrage Konjunkturerwartungen |

| 17.09.2019 | 15:15 | US | Industrieproduktion |

| 18.09.2019 | 10:30 | GB | Einzelhandelspreisindex |

| 18.09.2019 | 10:30 | GB | Verbraucherpreisindex |

| 18.09.2019 | 11:00 | EZ | Verbraucherpreisindex |

| 18.09.2019 | 20:00 | US | Fed Zinssatzentscheidung |

| 19.09.2019 | 04:00 | JP | BoJ Zinssatzentscheidung |

| 19.09.2019 | 08:00 | CH | Handelsbilanz |

| 19.09.2019 | 09:30 | CH | SNB Zinssatzentscheidung |

| 19.09.2019 | 13:00 | GB | BoE Zinssatzentscheidung |

| 19.09.2019 | 14:30 | US | Erstanträge Arbeitslosenunterstützung |

| 19.09.2019 | 14:30 | US | Philly-Fed-Herstellungsindex |

Quelle: Thomson Reuters, 13.09.2019

¹) Risiken:

Kick-In GOALs sind nicht kapitalgeschützt. Notiert einer der Basiswerte während der Laufzeit einmal auf oder unter dem jeweiligen Kick-In Level (Barriere) und kommt zudem das Callable Feature nicht zum tragen, kann die Tilgung am Verfalltag durch Bartilgung entsprechend der (vom Strike aus) schwächsten Performance aus dem Trio erfolgen (höchstens jedoch zum Nominalwert zuzüglich Coupon). In diesem Fall sind Verluste wahrscheinlich. Zudem trägt der Anleger bei Strukturierten Produkten das Emittentenrisiko, so dass das eingesetzte Kapital – unabhängig von der Entwicklung des Basiswertes – im Falle einer Insolvenz der UBS AG verloren gehen kann.

Weitere Blogeinträge:

Währungshüter im Fokus

Follow us on LinkedIn 04. März 2024 Währungshüter im Fokus Die Teuerung in der Eurozone gibt weiter nach. Laut vorläufigen Berechnungen lagen die Konsumentenpreise im Februar 2024 um 2.6 [...]

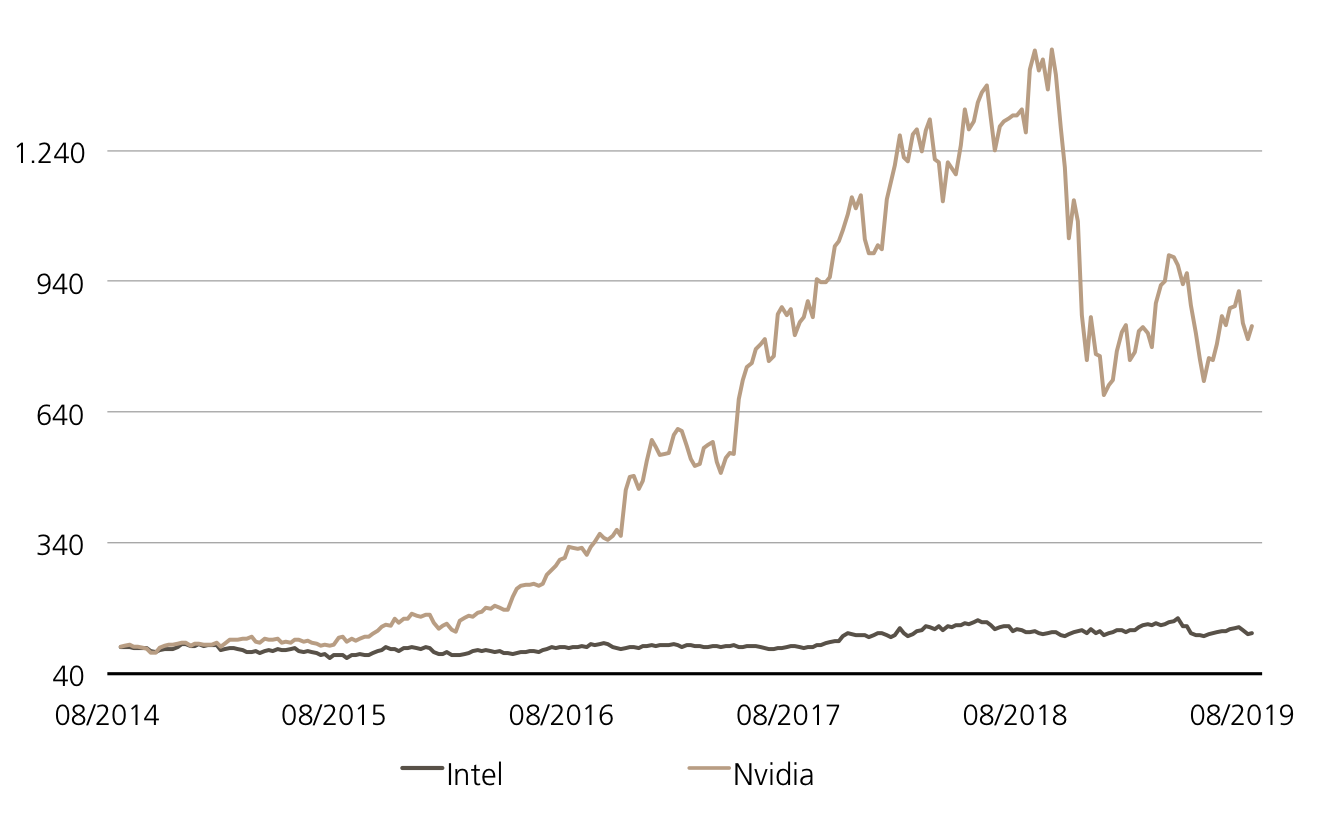

Globale KI-Rekordjagd

Follow us on LinkedIn 26. Februar 2024 Globale KI-Rekordjagd Frankfurt, Paris, New York, Tokio: Rund um den Globus ertönten in der vergangenen Woche die Rekordglocken. Während die Börsen in [...]

Aufgeschoben ist nicht aufgehoben

Follow us on LinkedIn 19. Februar 2024 Aufgeschoben ist nicht aufgehoben Seit Monaten gibt es ein übergeordnetes Thema an den Börsen: Zinssenkungen. Allerdings scheint sich das erhoffte [...]