Auf einer Buckelpiste

13. Januar 2020 – UBS Thema im Fokus

Auf einer Buckelpiste

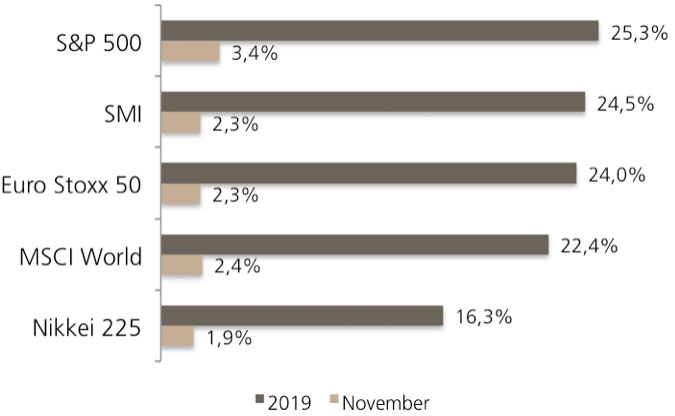

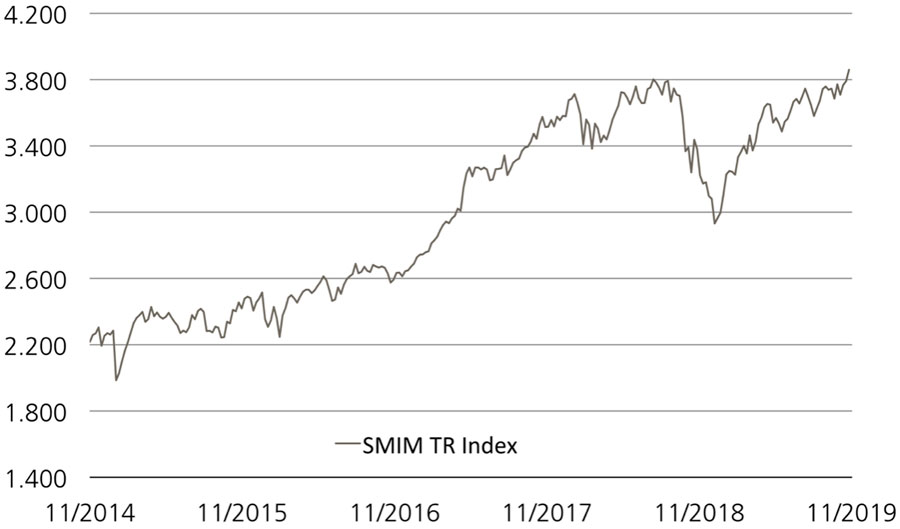

Der Skiweltcup gastiert derzeit im Berner Oberland. Am gestrigen Sonntag feierten Zehntausende in Adelboden den Slalom-Sieg von Daniel Yule. Er war der erste Swiss-Ski-Fahrer seit zwölf Jahren, der es am „Chuenisbärgli“ auf das Podest schaffte. Am kommenden Wochenende finden in Wengen die Lauberhornrennen statt. Deren Höhepunkt ist die Abfahrt am Samstag. Dann hängen weltweit Millionen Sportfans gebannt an den TV-Geräten, wenn die Athleten sich vor der imposanten Kulisse von Eiger, Mönch und Jungfrau die spektakuläre, knapp 4.5 Kilometer lange Strecke hinabstürzen. Einen durchaus holprigen Parcours hatten in den ersten beiden Wochen des Jahres auch die Aktienanleger zu absolvieren. Beispiel SMI™: Der heimische Leitindex schwankte seit Neujahr in einer Spanne von ziemlich genau 200 Punkten hin und her. Per Saldo kamen die 20 Large Caps bis dato nur minimal vom Fleck.¹

Startschuss für den Zahlenreigen

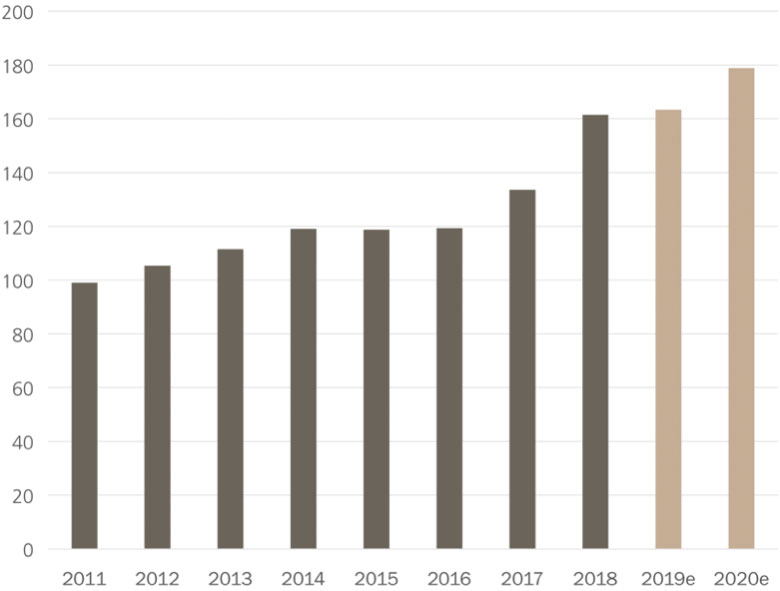

Nicht nur hier zu Lande, weltweit stehen die Börsen im Bann der Entwicklung im Nahen Osten. Nach den gegenseitigen Angriffen von Anfang Jahr zeichnete sich zwischen den USA und dem Iran zuletzt immerhin eine gewisse Deeskalation ab. Bleibt es dabei, könnten ab der neuen Woche die Fundamentaldaten verstärkt in den Fokus rücken. An der Wall Street nimmt die Berichtsaison ihren Lauf. Anfang Jahr gingen Analysten im Schnitt davon aus, dass die Mitglieder des S&P 500™ im vierten Quartal 2019 in Summe einen Gewinnrückgang von 1.5% verbucht haben. In den vergangenen Monaten haben die Experten an ihren Schätzungen den Rotstift angesetzt: Per Ende September lag der Konsens für die letzten drei Monate des vergangenen Jahres laut Factset noch bei einem Profitwachstum von 2.5%. Allerdings dürfte hier das letzte Wort noch nicht gesprochen sein. In der Vergangenheit ist es den US-Grosskonzernen häufig gelungen, die Erwartungen zu übertreffen. Der Datendienstleister hält es daher für möglich, dass die Gewinne im S&P™ Ende 2019 zugenommen haben. (Quelle: Factset, „Earnings Insights“, 03.01.2020)

Goldman Sachs lässt aufhorchen

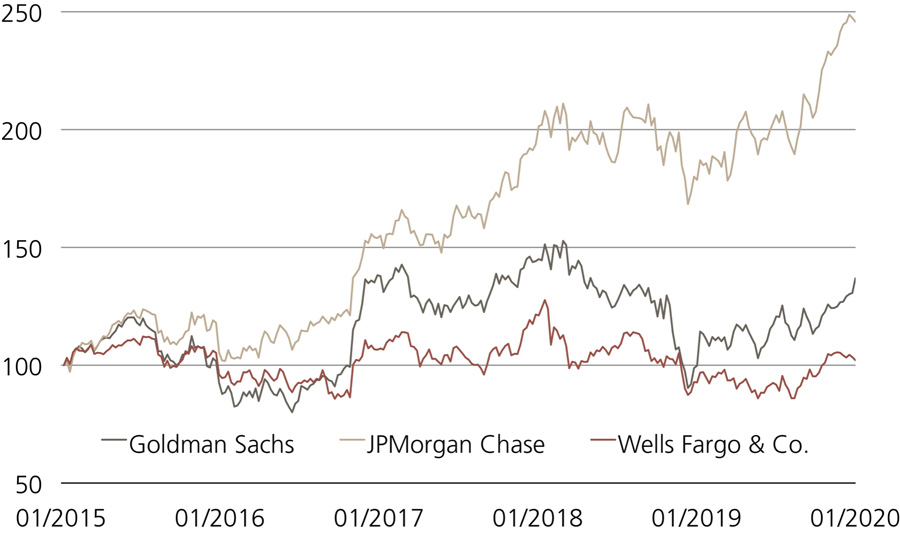

Traditionell melden sich zu Beginn der „Earnings Season“ die Banken zu Wort. Mit JPMorgan Chase, Wells Fargo, Citigroup und Goldman Sachs stehen morgen und am Mittwoch die Zwischenberichte von vier prominenten US-Branchenvertretern auf der Agenda. Aus dem Quartett liess zu Beginn des neuen Jahres Goldman Sachs aufhorchen. Für das Branchenschwergewicht steht im Januar bereits ein Kursplus von 5.4 Prozent zu Buche.¹ Mit der Ankündigung einer Neustrukturierung der einzelnen Segmente sorgte Goldman Sachs für Kauflaune. Auf diese Weise erhalten Investoren erstmals Einblick in die Ergebnisse des Privatkundenbereichs. Für zusätzliche Transparenz könnte CEO David Solomon am 29. Januar an einem Investorentag sorgen. Das US-Institut richtet zum ersten Mal in seiner 150-jährigen Geschichte eine solche Kapitalmarktveranstaltung aus. (Quelle: Thomson Reuters, Medienbericht, 07.01.2020)

Zusammen mit JPMorgan Chase und Wells Fargo fungiert die Goldman Sachs-Aktie als Basiswert für einen Early Redemption Kick-In GOAL (Symbol: KCGQDU). Aktuell zeigt das Produkt eine Seitwärtsrendite von 9.92 Prozent p.a. Diese Chance geht selbst beim Worst Performer – Wells Fargo – mit einem Barriereabstand von 32.38 Prozent einher.

Handelsdeal vor der Unterzeichnung

Im Blick sollten Investoren in den kommenden Tagen auch Washington D.C. behalten. Das gilt nicht nur wegen dem Iran-Konflikt. Am Mittwoch könnte in der US-Hauptstadt die Handelsvereinbarung zwischen den USA und China unterzeichnet werden. Peking schickt Vizeregierungschef Liu He in die Staaten, um die im Dezember erreichte Teileinigung zu ratifizieren. Eine zentrale Komponente der Vereinbarung sind Zollsenkungen. Ausserdem soll China zugesagt haben, mehr Agrarprodukte und andere Waren aus den USA zu importieren. (Quelle: Thomson Reuters, Medienbericht, 10.01.2020)

US-Konsumenten im Fokus

Ob und inwieweit der Handelskonflikt respektive die Aussicht auf dessen Lösung Ende 2019 Einfluss auf die Konjunktur genommen haben, werden verschiedene Indikatoren zeigen. In den USA steht dabei vor allem der private Konsum im Fokus. Am Dienstagnachmittag unserer Zeit werden die Verbraucherpreise für Dezember publiziert. Genau 48 Stunden später laufen die Detailhandelsumsätze für den Weihnachtsmonat über den Ticker, bevor am Freitag die Universität Michigan ihr viel beachtetes Verbrauchervertrauen publiziert.

Der US-Arbeitsmarkt hat Ende Jahr etwas an Schwung verloren. Im Dezember entstanden ausserhalb der Landwirtschaft 145’000 neue Stellen. Analysten hatten im Schnitt mit 164’000 zusätzlichen Jobs gerechnet. Angesichts einer stabilen Arbeitslosenquote von 3.5 Prozent herrscht in den Staaten de facto jedoch weiterhin Vollbeschäftigung. Hinter dieses zentrale Ziel kann das Fed also einen Haken setzen. (Quelle: Thomson Reuters, Medienbericht, 10.01.2020) Übrigens: Die US-Notenbank rückt genauso wie die EZB in der zweiten Januar-Hälfte in den Fokus. Dann stehen die nächsten geldpolitischen Sitzungen der beiden Institutionen an.

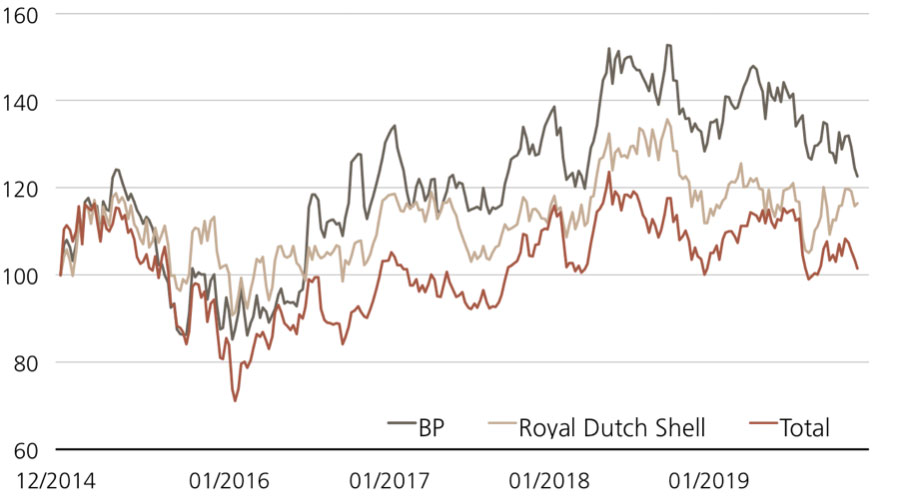

Goldman Sachs vs. JPMorgan Chase vs. Wells Fargo & Co.

(5 Jahre, nur zu illustrativen Zwecken, Angaben in %)¹

¹) Bitte beachten Sie, dass vergangene Wertentwicklungen keine Indikationen für künftige Wertentwicklungen sind.

Stand: 10.01.2020; Quelle: Bloomberg

Wichtige Wirtschafts- und Unternehmenstermine

|

Datum |

Uhrzeit |

Land |

Ereignis |

|

14.01.2020 |

k.A. |

DE |

Südzucker Quartalszahlen |

|

14.01.2020 |

07:00 |

DE |

HELLA Quartalszahlen |

|

14.01.2020 |

14:30 |

US |

Konsumentenpreise Dezember |

|

14.01.2020 |

14:30 |

US |

Wells Fargo Quartalszahlen |

|

14.01.2020 |

14:30 |

US |

J.P. Morgan Chase Quartalszahlen |

|

14.01.2020 |

14:30 |

US |

Citigroup Quartalszahlen |

|

14.01.2020 |

14:30 |

US |

Delta Air Lines Quartalszahlen |

|

14.01.2020 |

14:55 |

US |

Redbook |

|

15.01.2020 |

08:00 |

DE |

BIP 2019 |

|

15.01.2020 |

11:00 |

EZ |

Industrieproduktion November |

|

15.01.2020 |

11:00 |

EZ |

Handelsbilanz November |

|

15.01.2020 |

14:30 |

US |

Goldman Sachs Quartalszahlen |

|

15.01.2020 |

14:30 |

US |

United Health Quartalszahlen |

|

15.01.2020 |

14:30 |

US |

BlackRock Quartalszahlen |

|

15.01.2020 |

16:30 |

US |

Rohöl-Lagerbestände Vorwoche |

|

15.01.2020 |

20:00 |

US |

Beige Book |

|

15.01.2020 |

22:00 |

US |

Alcoa Quartalszahlen |

|

16.01.2020 |

08:00 |

DE |

KFZ-Neuzulassungen Dezember |

|

16.01.2020 |

14:30 |

US |

Detailhandelsumsätze Dezember |

|

16.01.2020 |

14:30 |

US |

Philly Fed Index Januar |

|

16.01.2020 |

14:30 |

US |

Morgan Stanley Quartalszahlen |

|

17.01.2020 |

08:30 |

CH |

Produzenten-/Importpreise Dezember |

|

17.01.2020 |

11:00 |

EZ |

Verbraucherpreise Dezember |

|

17.01.2020 |

16:00 |

US |

Uni Michigan Verbrauchervertrauen Januar |

Stand: 13.01.2020; Quelle: Thomson Reuters

Weitere Blogeinträge:

Das nächste Staccato

Follow us on LinkedIn 18. März 2024 Das nächste Staccato Die Bank of Japan (BoJ) residiert in einem neobarocken Gebäude im Herzen von Tokio. Am morgigen Dienstag könnte dort [...]

Zinsdebatte und kein Ende

Follow us on LinkedIn 11. März 2024 Zinsdebatte und kein Ende Wohin man an den Märkten auch blickt, die Bullen scheinen das Sagen zu haben. Wall Street, Nikkei, Gold [...]

Währungshüter im Fokus

Follow us on LinkedIn 04. März 2024 Währungshüter im Fokus Die Teuerung in der Eurozone gibt weiter nach. Laut vorläufigen Berechnungen lagen die Konsumentenpreise im Februar 2024 um 2.6 [...]