Die Wochen der Wahrheit

16. Juli 2019 – UBS Wochenkommentar Rück-/Ausblick

Die Wochen der Wahrheit

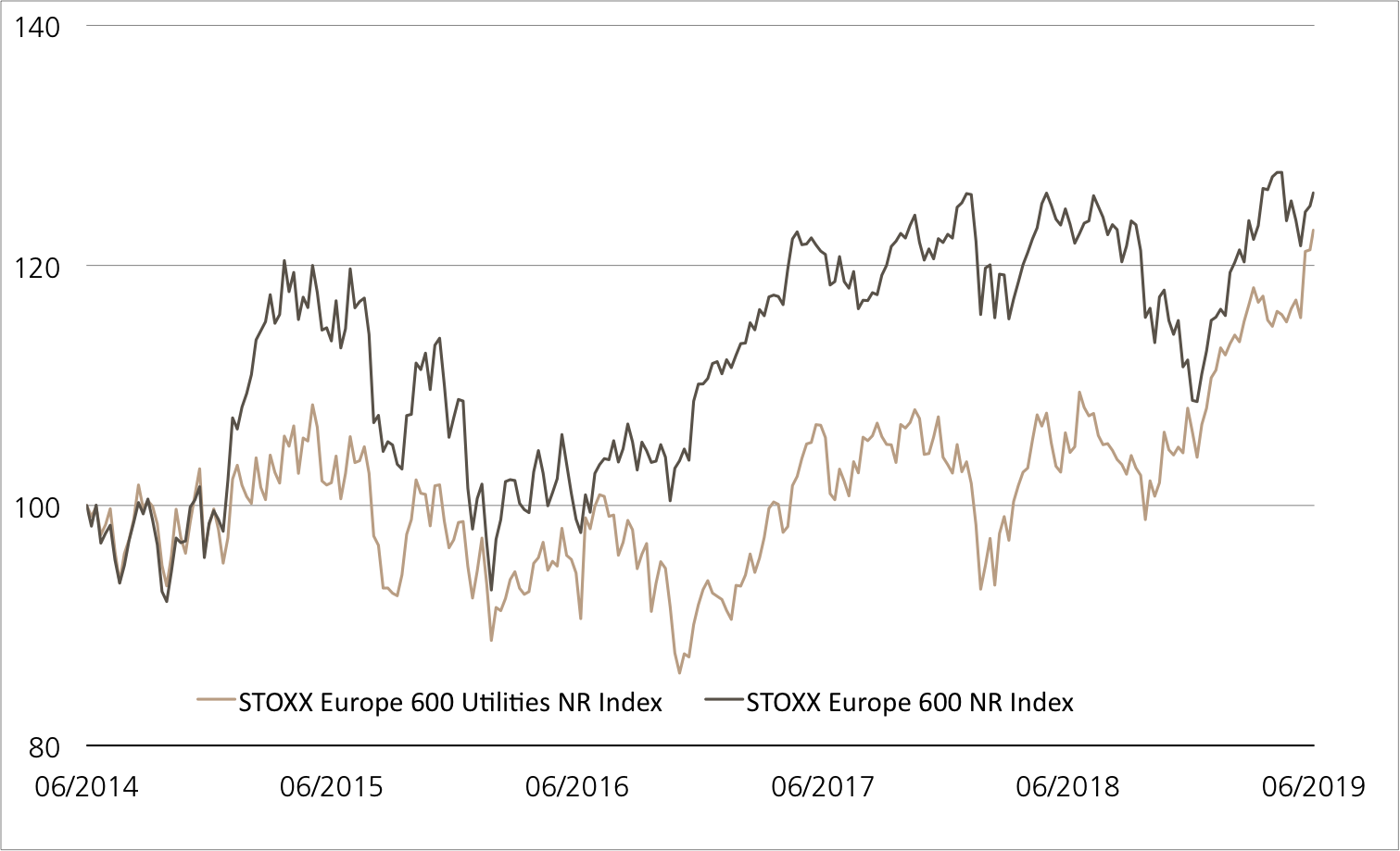

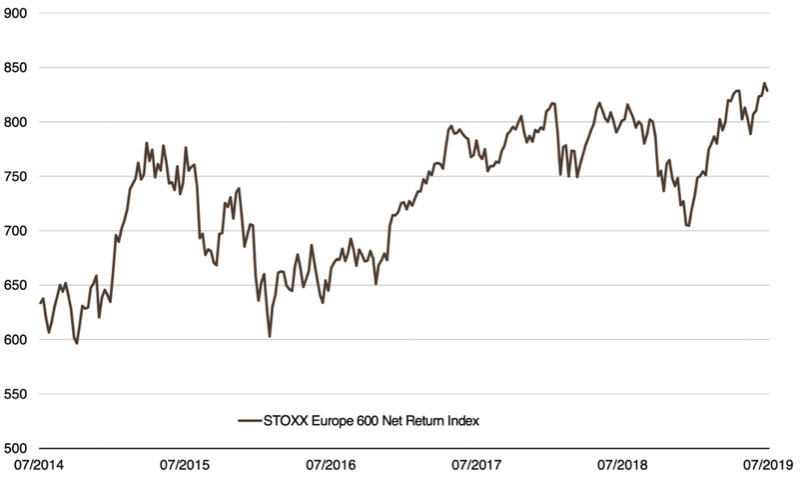

An den kommenden Tagen nimmt die Quartalssaison in Europa Fahrt auch. Im Vorfeld schraubten Analysten ihre Erwartungen deutlich zurück, nachdem einige prominente Unternehmen die Märkte mit Gewinnwarnungen geschockt hatten. Der Stimmung unter den Investoren konnte das offenbar keinen Abbruch tun: Zum Start in den Zahlenreigen notiert der STOXXTM Europe 600 Net Return (NR) Index auf Rekordniveau.¹

Nestlé, Novartis und Roche sind nicht nur am Schweizer Aktienmarkt das Mass aller Dinge. Das Trio zählt auch europaweit zu den absoluten Börsenschwergewichten. Per Mitte Jahr führten die drei Konzerne das Gewichtungsranking des STOXXTM Europe 600 Index an. Entsprechend gross dürfte die Aufmerksamkeit sein, wenn die heimischen Large Caps demnächst ihre Zwischenberichte vorlegen. Den Anfang macht Novartis bereits an diesem Donnerstag, 18. Juli: Der Pharmakonzern präsentiert die Resultate für das zweite Quartal 2019. Ausserdem äussert sich das Management ab 14:00 Uhr an einem Webcast zum jüngsten Geschäftsverlauf sowie den weiteren Aussichten. Zeitgleich startet die Telefonkonferenz von SAP. Der Softwarekonzern zählt in Europa traditionell zu den ersten Unternehmen, die sich im Rahmen der Berichtssaison zu Wort melden.

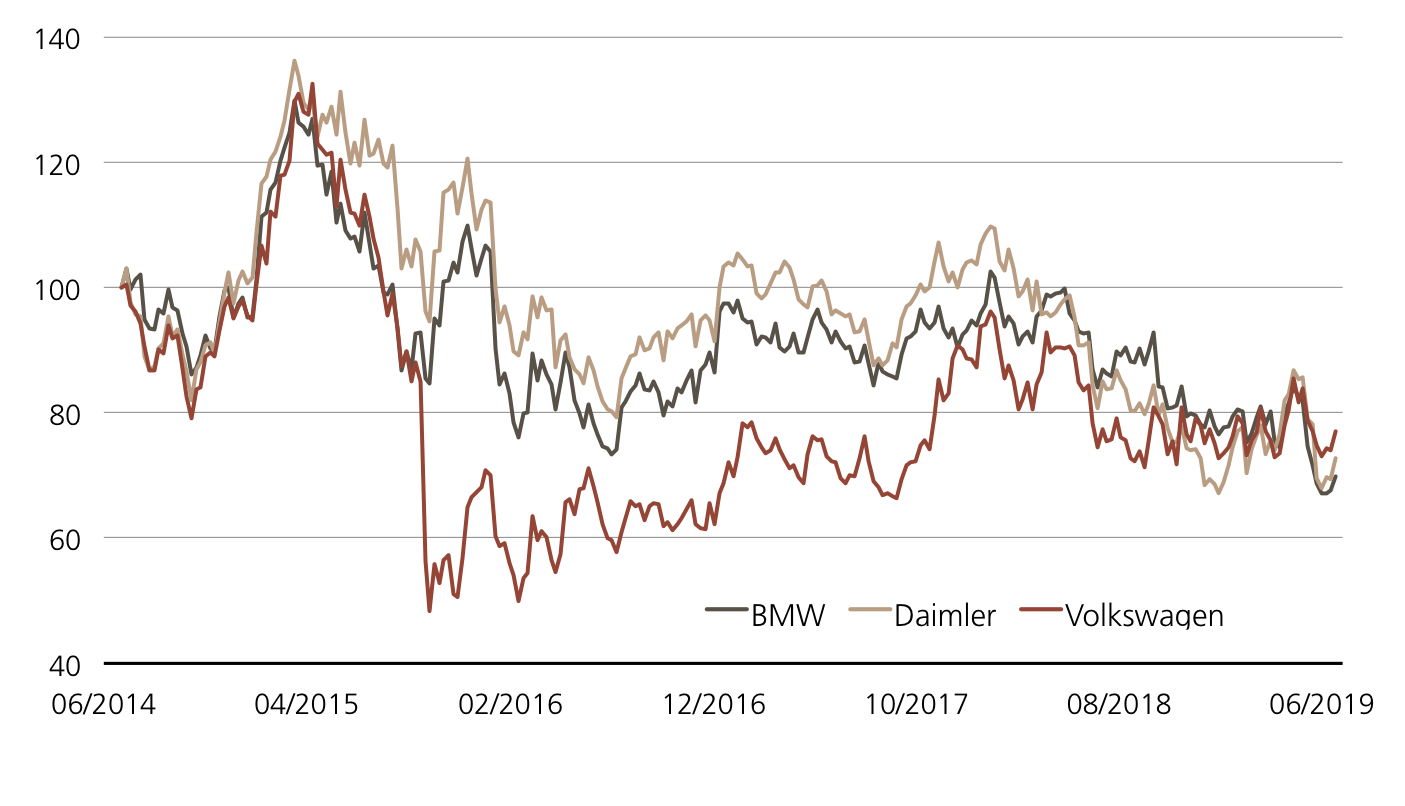

DAX™-Trio muss Ziele kappen

Vor der anstehenden Zahlenflut ist die Spannung unter den Investoren besonders gross. Schliesslich mussten zuletzt eine Reihe von Unternehmen ihre Prognosen nach unten anpassen. Gleich drei DAX™-Mitglieder liessen mit Gewinnwarnungen aufhorchen. Nach der Swiss-Mutter Lufthansa und dem Chemiekonzern BASF musste auch noch Daimler die bisherige Zielsetzung über Bord werfen. Der Stuttgarter Autobauer hat damit die vierte Gewinnwarnung innert 13 Monaten vorgelegt. Zwischen den beiden jüngsten Anpassungen lagen keine drei Wochen. Neuerdings rechnet CEO Ola Källenius beim Ergebnis vor Steuern und Zinsen mit einem deutlichen Rückgang. Ende Juni hatte der Schwede noch ein stabiles Ebit für möglich gehalten. Doch nun schlagen die Abgasaffäre, der Rückruf von Airbags, Anlaufschwierigkeiten bei neuen Modellen sowie der schwächelnde Automarkt deutlich stärker zu Buche. (Quelle: Thomson Reuters, Medienbericht, 12.07.2019)

Analysten setzen den Rotstift an

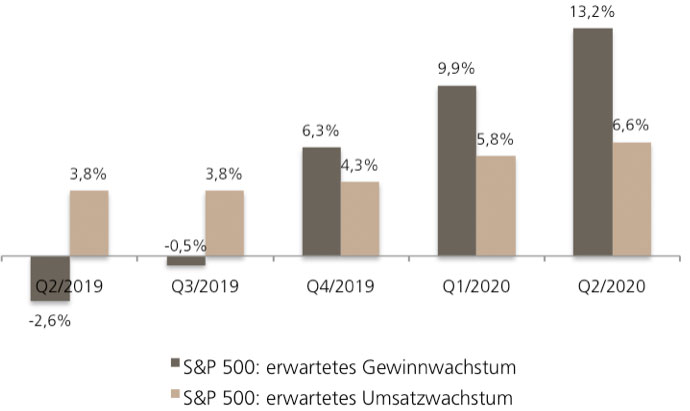

Schon vor den jüngsten Gewinnwarnungen hatten Analysten damit begonnen, ihre Erwartungen nach unten anzupassen. Laut I/B/E/S Refinitiv ging der Konsens am 9. Juli 2019 davon aus, dass die Mitglieder des STOXX™ Europe 600 Index ihren Profit im zweiten Quartal um 0.8 Prozent gesteigert haben. Eine Woche zuvor trauten die Experten den 600 Unternehmen noch ein durchschnittliches Wachstum von 1.8 Prozent zu. Anfang Mai lag der Konsens sogar bei einem Ergebnisplus von 3.6 Prozent. Zum Vergleich: Im zweiten Quartal des vergangenen Jahres hatten die Indexmitglieder ihre Gewinne noch um annähernd einen Zehntel verbessert. (Quelle: Thomson Reuters, Medienbericht, 09.07.2019)

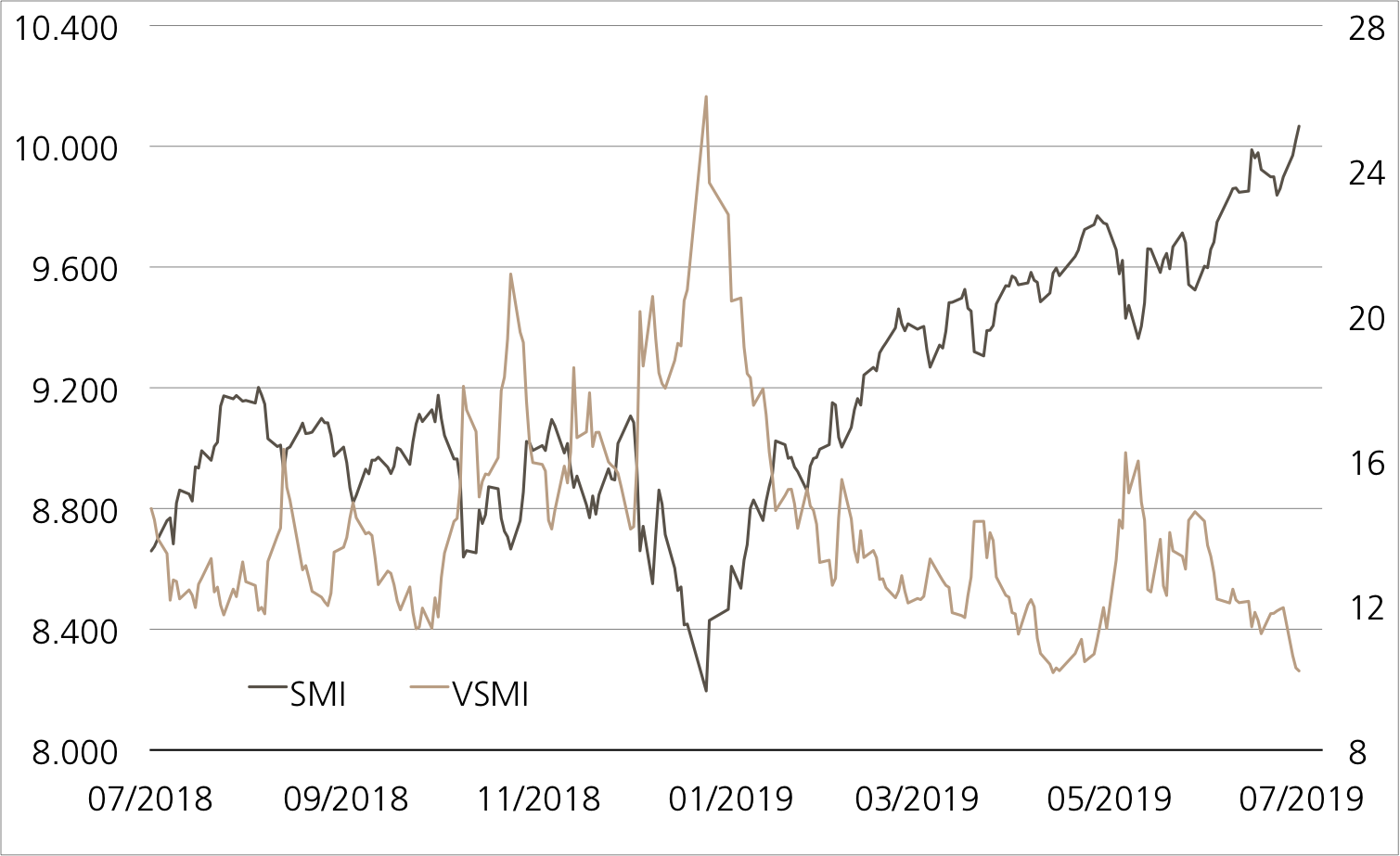

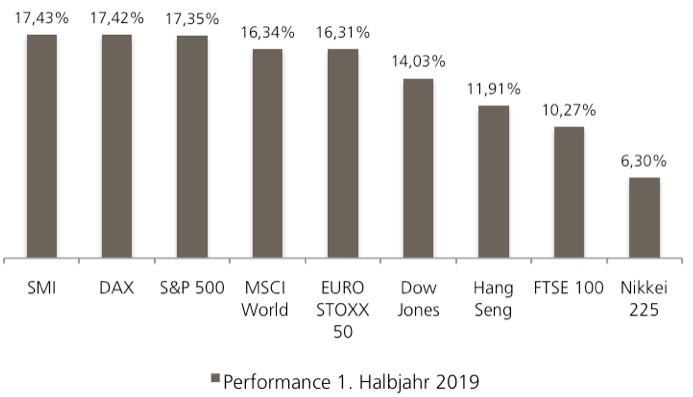

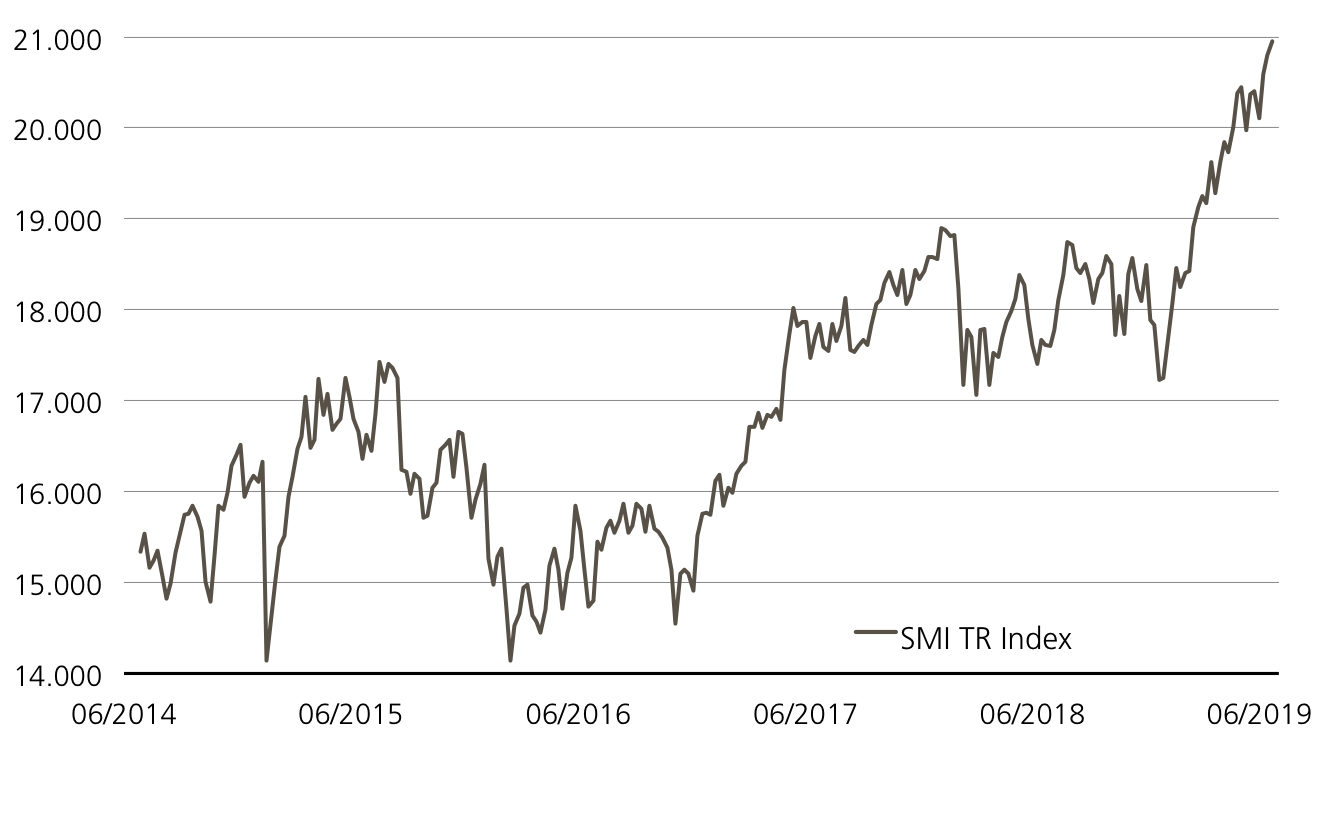

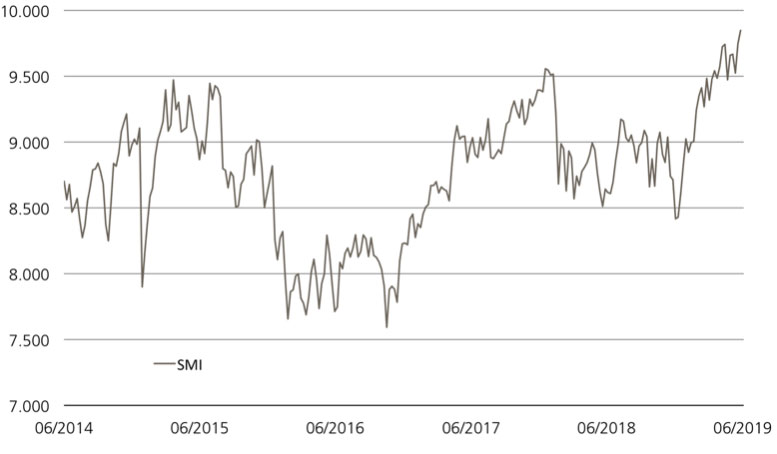

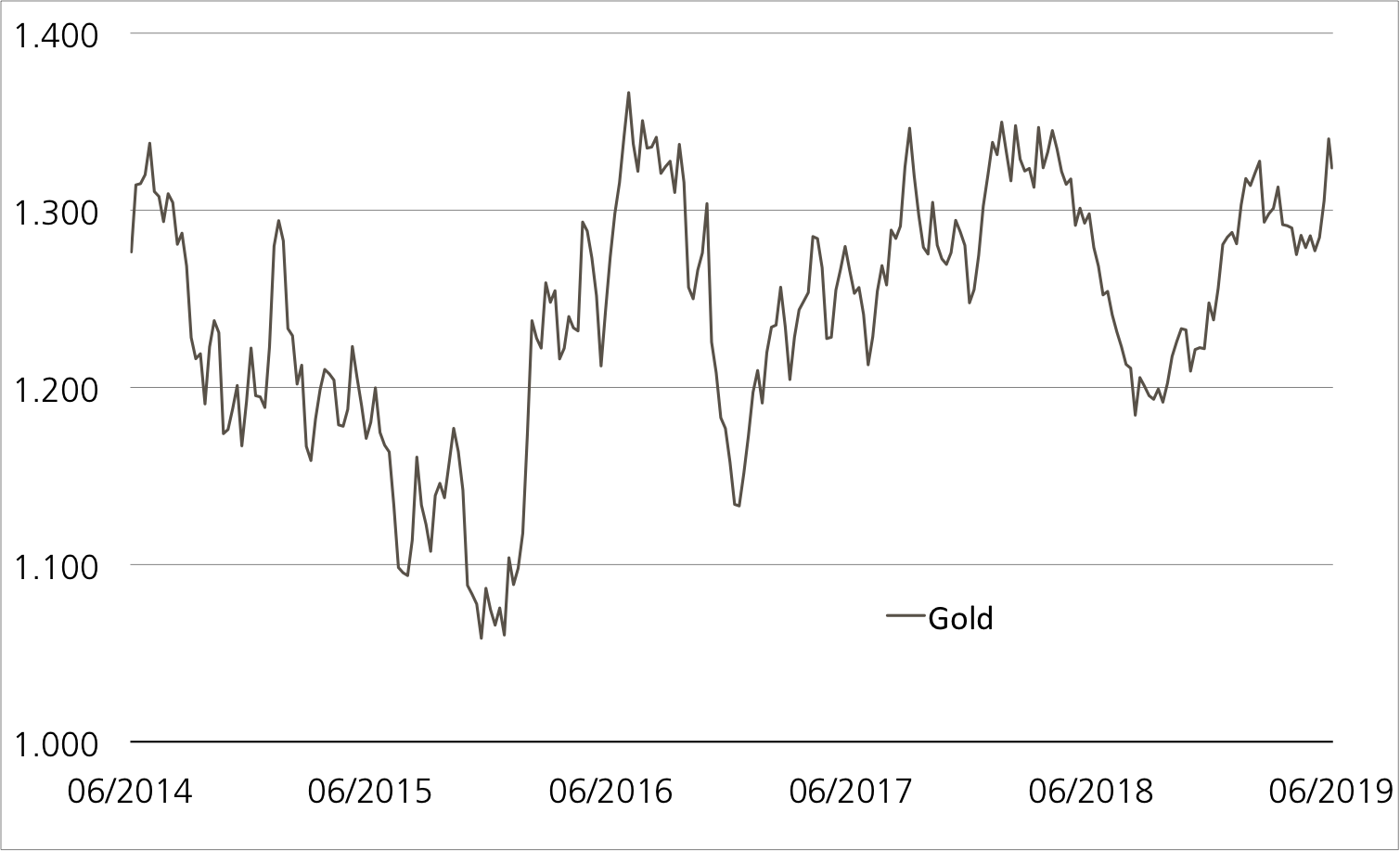

Obwohl die Dauerthemen Handelsstreit und Brexit die globale Konjunktur und damit auch den Gewinnmotor der Unternehmen offenbar abgewürgt haben, erlebte der alte Kontinent bis dato ein starkes Börsenjahr. Gegenüber dem Schlusskurs 2018 gewann der STOXX™ Europe 600 NR Index bis dato 17 Prozent an Wert. Anfang Monat markiert der marktbreite Benchmark ein Allzeithoch (siehe Grafik).1 Insbesondere die Geldpolitik sorgt für Kauflaune. Diesbezüglich hat Jerome Powell in der vergangenen Woche neue Signale gesendet. Während einer Anhörung vor dem Kongress betont der Präsident der US-Notenbank die Bereitschaft „angemessen zu handeln“, um nachhaltiges Wachstum zu sichern. Mittlerweile gehen die Märkte fest davon aus, dass das Fed Ende Monat den Leitzinssatz zum ersten Mal seit Dezember 2008 nach unten anpassen wird. (Quelle: Thomson Reuters, Medienbericht, 10.07.2019)

Bevor das Entscheidungsgremium am 30. Juli zu einer zweitägigen Sitzung zusammenkommt, rücken die Unternehmen in den Fokus. Für Anleger, die dem Aktienmarkt angesichts reduzierter Gewinnerwartungen sowie der Aussicht auf weiter fallende Zinsen eine Fortsetzung der Aufwärtsbewegung zutrauen, könnte der ETT (Symbol: ET600) interessant sein. Das Tracker-Zertifikat bildet den STOXX™ Europe 600 NR Index 1:1, ohne Verwaltungsgebühr und ohne Laufzeitbegrenzung ab.

STOXXTM Europe 600 Net Return Index 5 Jahre¹

Stand: 16.07.2019; Quelle: UBS AG, Bloomberg

¹) Bitte beachten Sie, dass vergangene Wertentwicklungen keine Indikationen für künftige Wertentwicklungen sind.

Wichtige Unternehmenstermine

| Datum | Zeit | Land | Ereignis |

| 16.07.2019 | 14:30 | US | Johnson & Johnson Quartalszahlen |

| 16.07.2019 | 14:30 | US | Goldman Sachs Quartalszahlen |

| 16.07.2019 | 14:30 | US | J.P. Morgan Quartalszahlen |

| 17.07.2019 | k.A. | CH | Temenos Quartalszahlen |

| 17.07.2019 | 07:00 | NL | ASML Quartalszahlen |

| 17.07.2019 | 22:00 | US | Netflix Quartalszahlen |

| 17.07.2019 | 22:00 | US | IBM Quartalszahlen |

| 18.07.2019 | k.A. | CH | Novartis Quartalszahlen |

| 18.07.2019 | k.A. | DE | SAP Quartalszahlen |

| 18.07.2019 | 07:00 | CH | SGS Semesterzahlen |

| 18.07.2019 | 07:00 | CH | Givaudan Semesterzahlen |

| 18.07.2019 | 22:00 | US | Microsoft Semesterzahlen |

| 19.07.2019 | 14:30 | US | American Express Quartalszahlen |

Stand: 16.07.2019; Quelle: Thomson Reuters

Weitere Blogeinträge:

Spannende Berichtssaison gepaart mit Zinshoffnungen

Follow us on LinkedIn 12. Februar 2024 Spannende Berichtssaison gepaart mit Zinshoffnungen Wohin man auch blickt, überall sieht man derzeit fröhliche Gesichter. Kein Wunder, schliesslich geht der Karneval diese [...]

Paukenschlag vor dem Wochenende

Follow us on LinkedIn 05. Februar 2024 Paukenschlag vor dem Wochenende Auf den ersten Blick scheint die Entwicklung an den Aktienmärkten während der vergangenen Woche schwer nachvollziehbar. Obwohl Fed-Präsident [...]

Das volle Programm

Follow us on LinkedIn 29. Januar 2024 Das volle Programm Die Wall Street bleibt auch im Börsenjahr 2024 das Mass aller Dinge. Kurz vor dem Monatsende notierte der S&P [...]