Der Mai geht, die Probleme bleiben

3. Juni 2019 – UBS Wochenkommentar Rück-/Ausblick

Der Mai geht, die Probleme bleiben

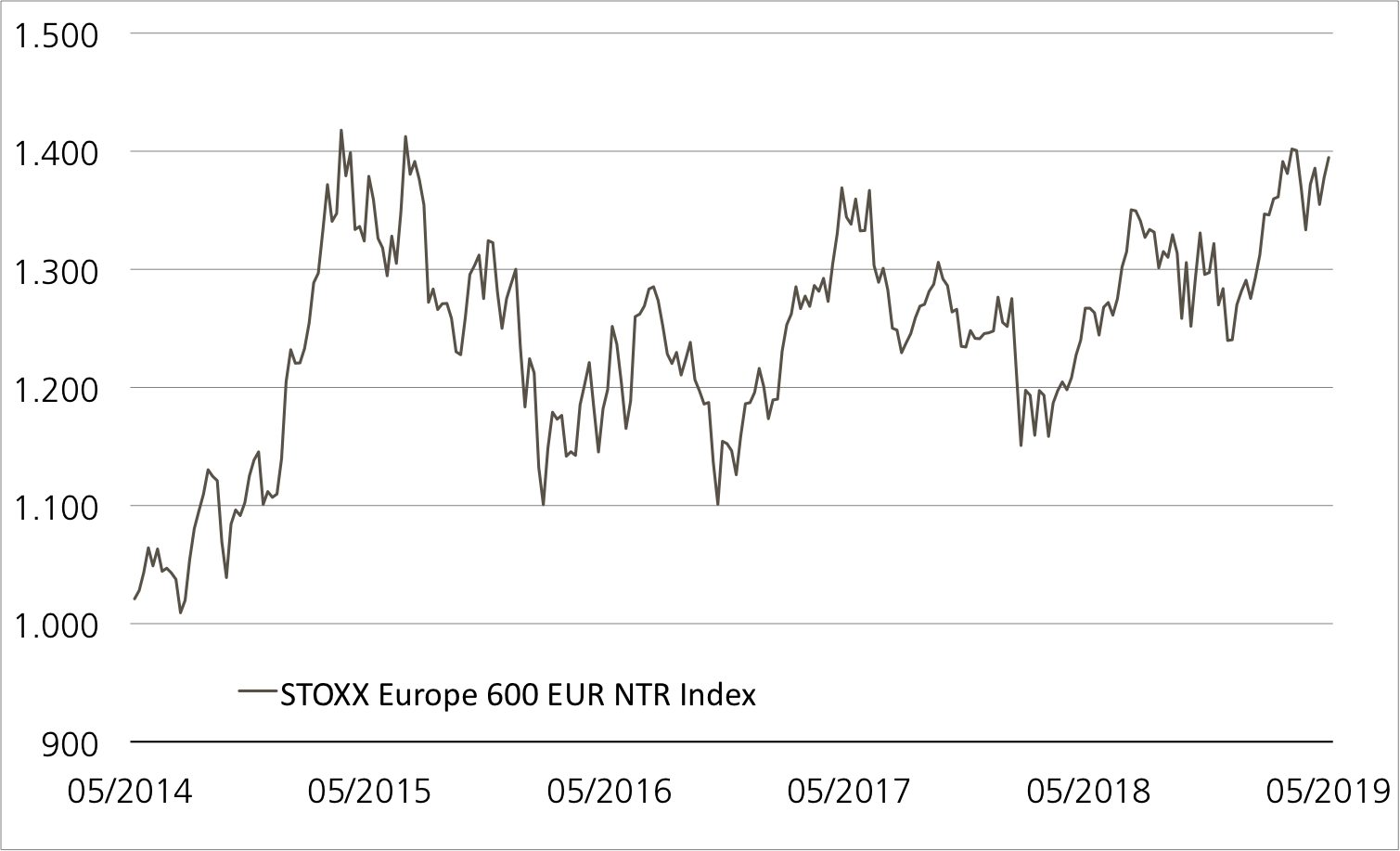

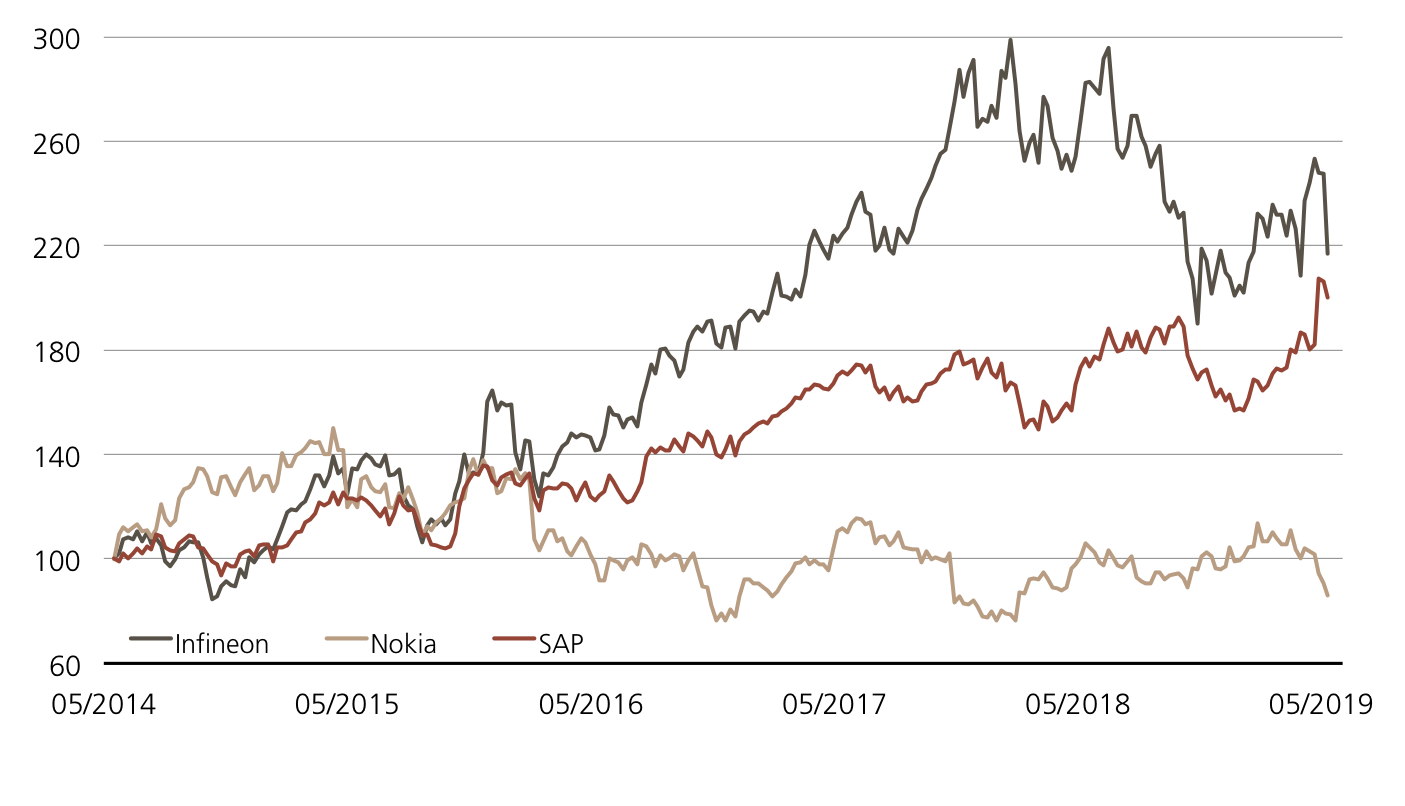

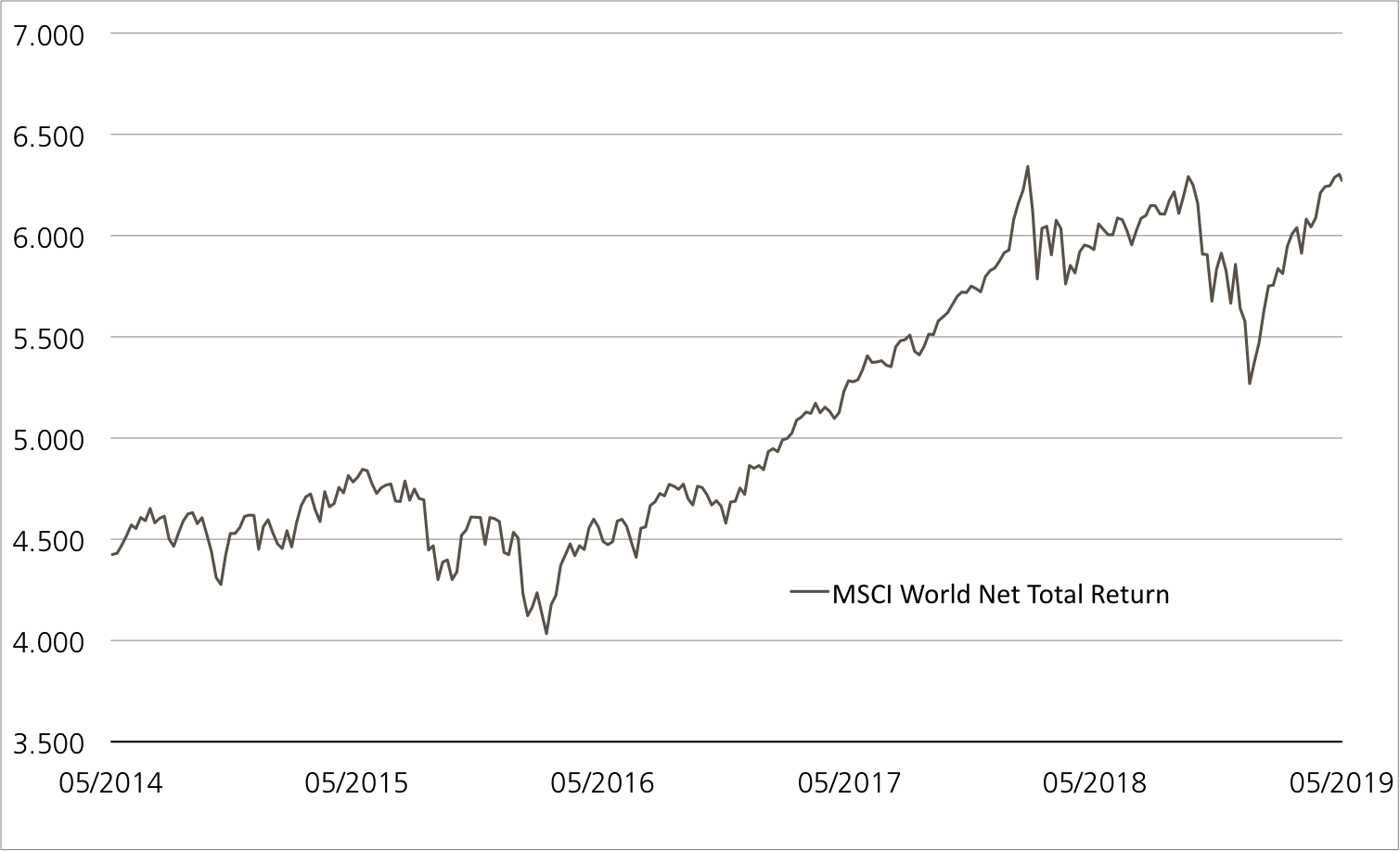

An den Börsen konnte im Mai von Frühlingsgefühlen nicht die Rede sein. Vor allem die Eskalation im Zollstreit sowie eine weiterhin ungelöste Brexit-Frage lasteten auf den Kursen. Immerhin: Die Aktienmärkte gehen mit einer positiven Zwischenbilanz für 2019 auf die Zielgeraden des ersten Semesters.

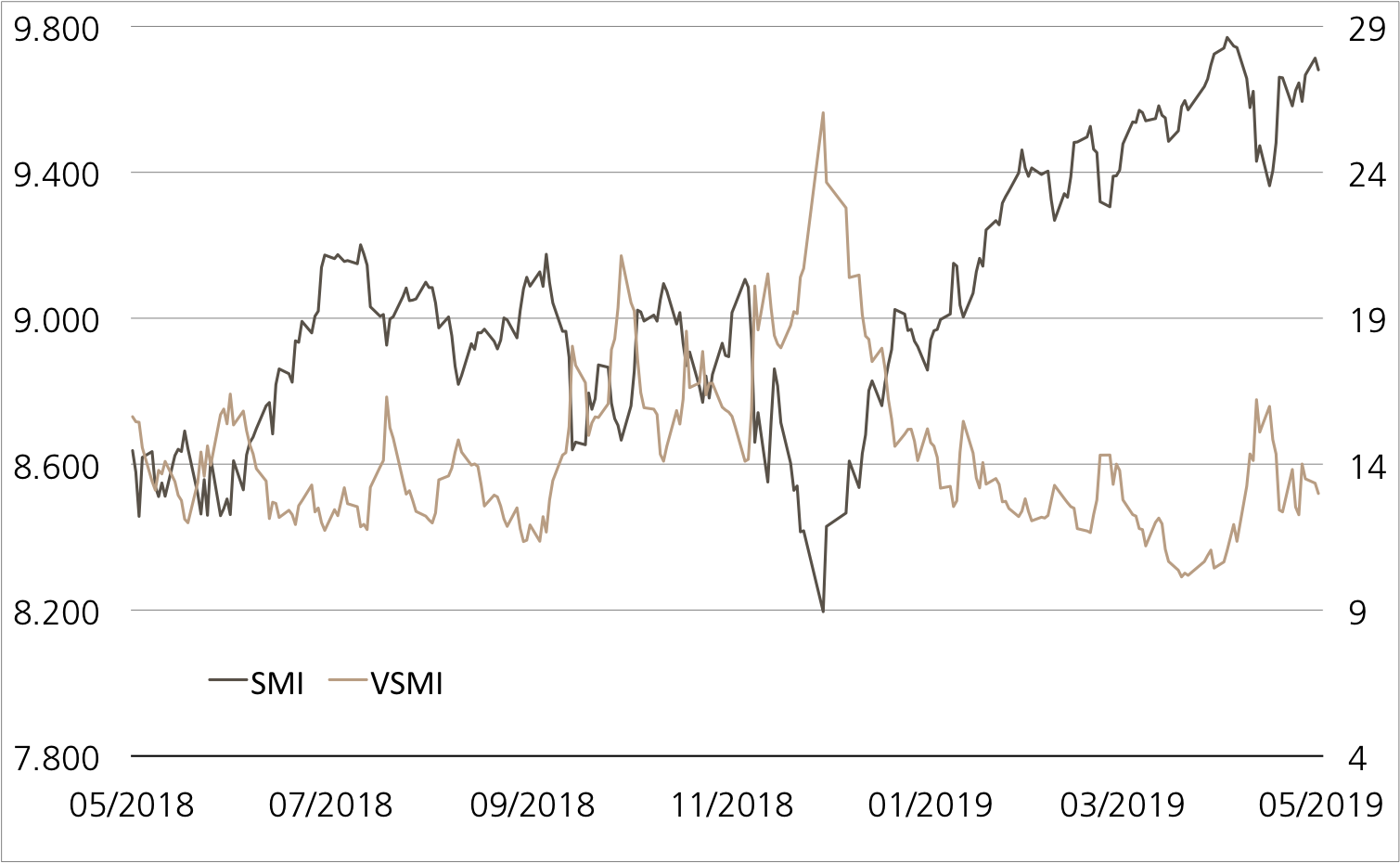

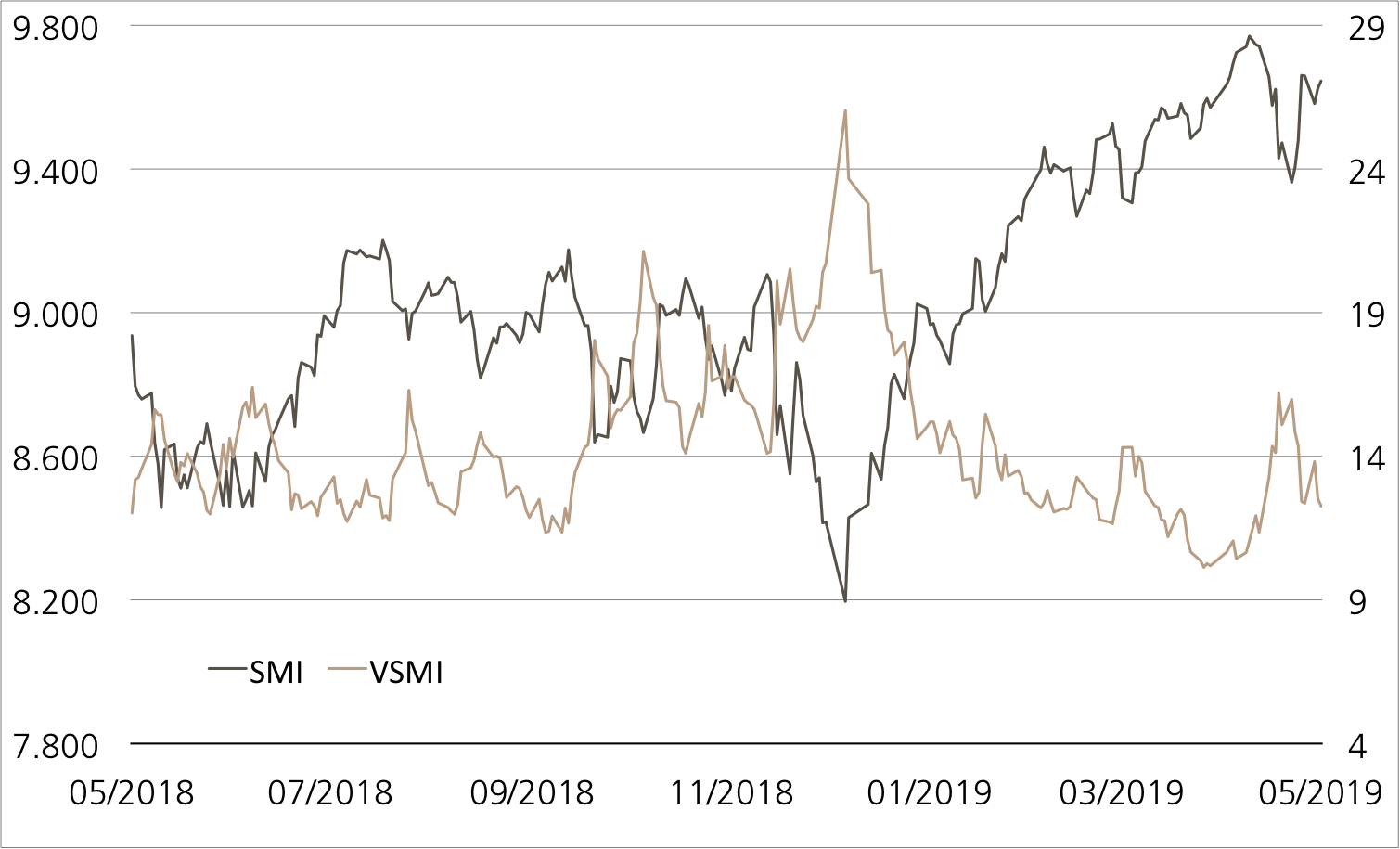

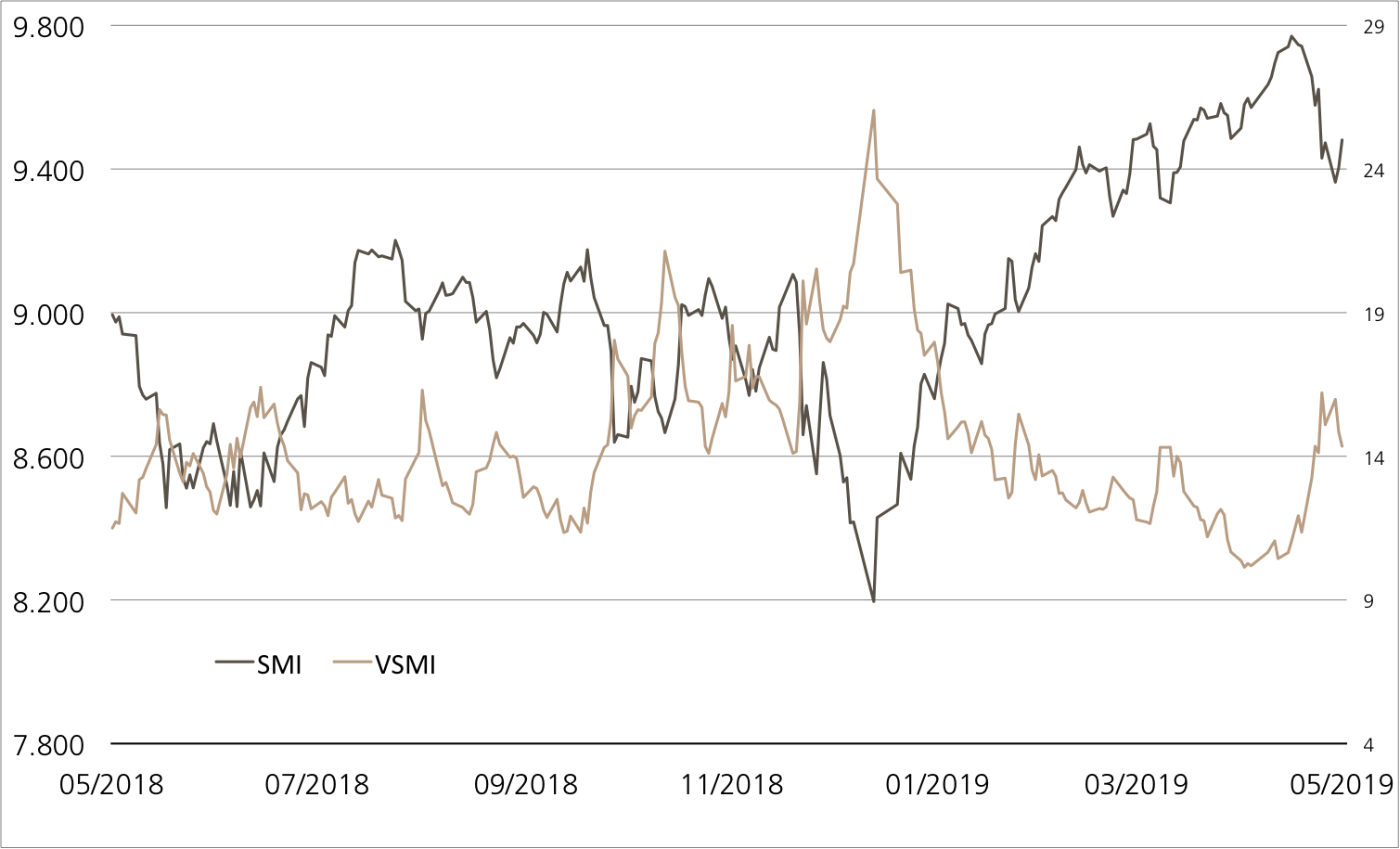

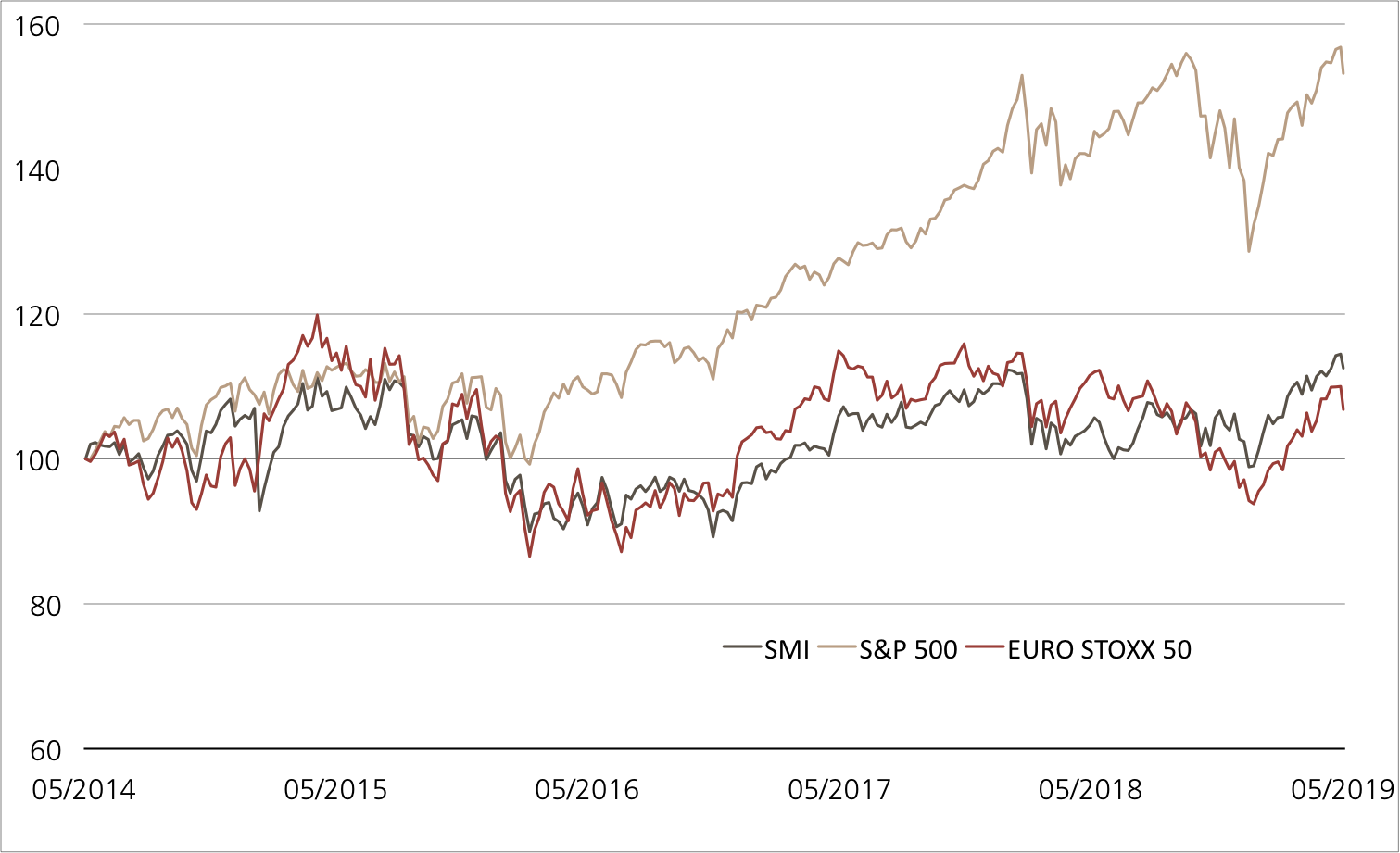

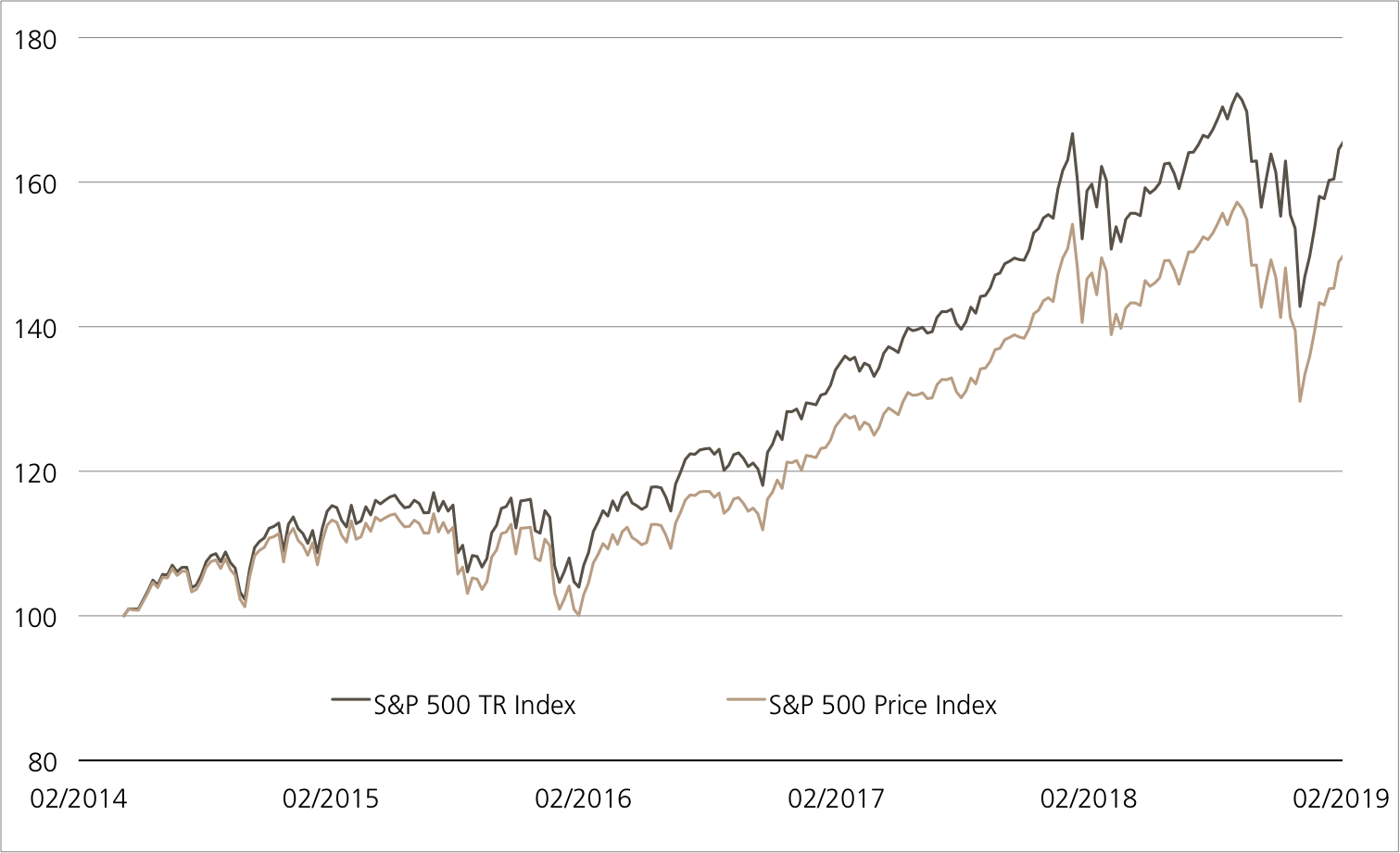

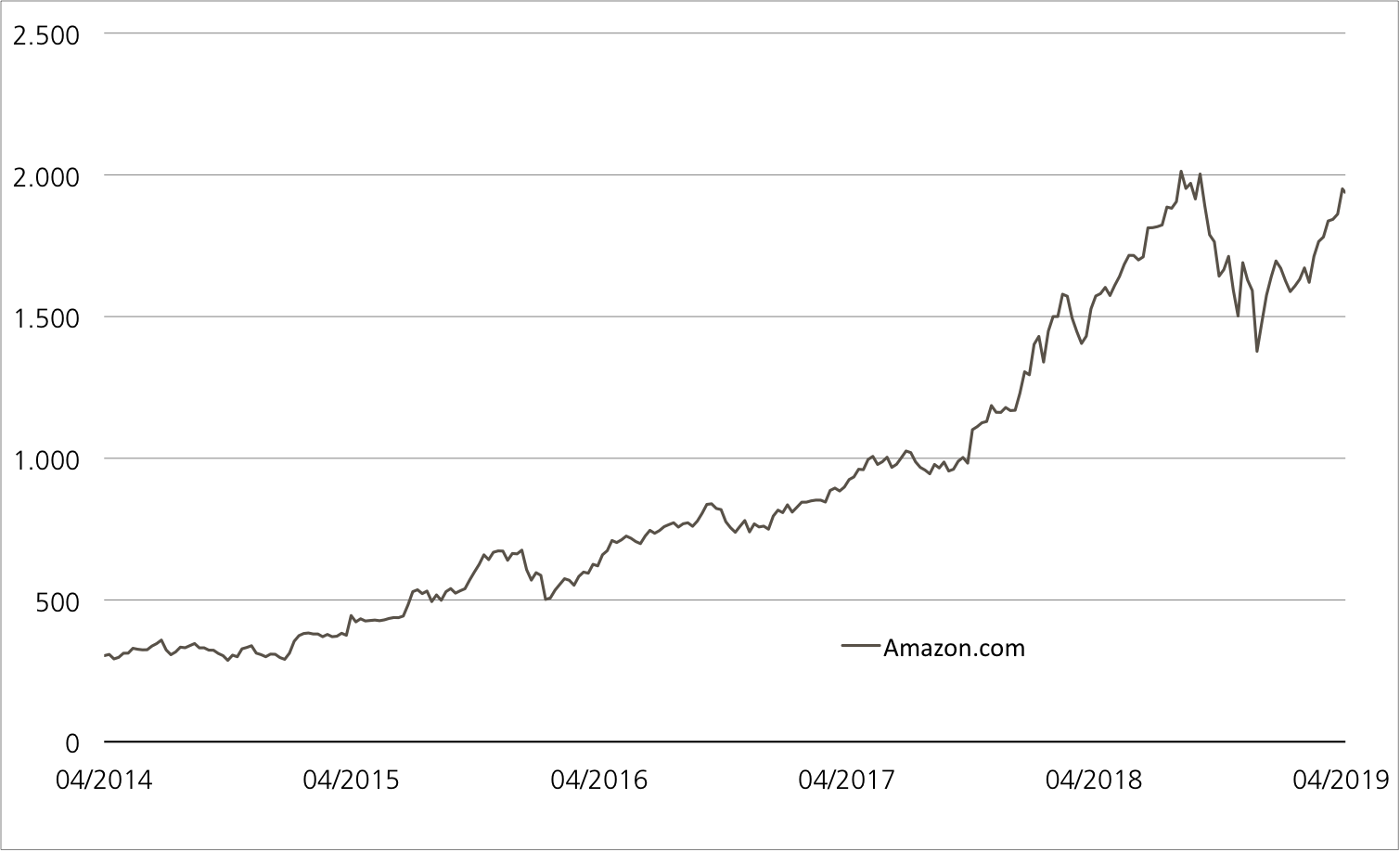

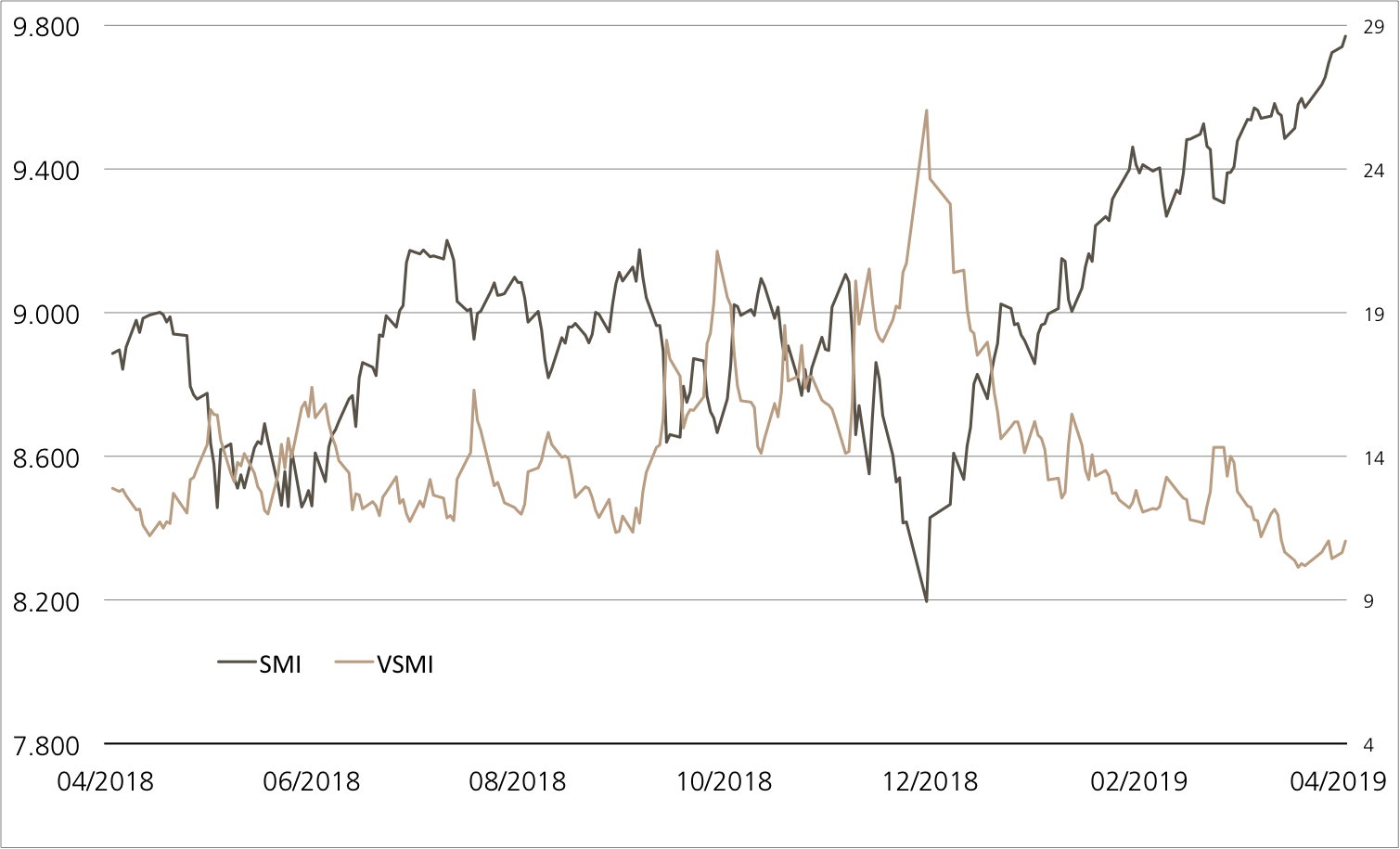

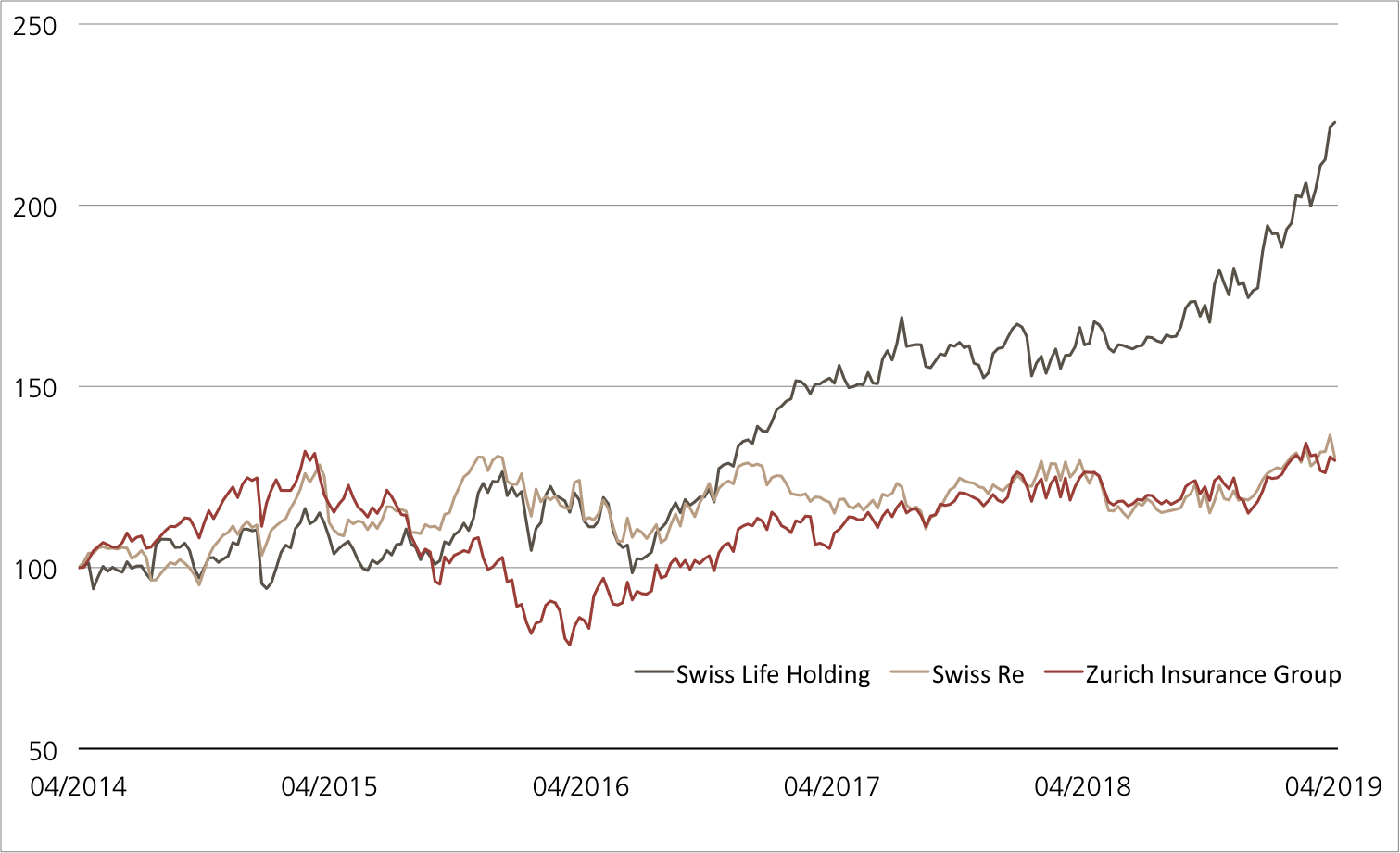

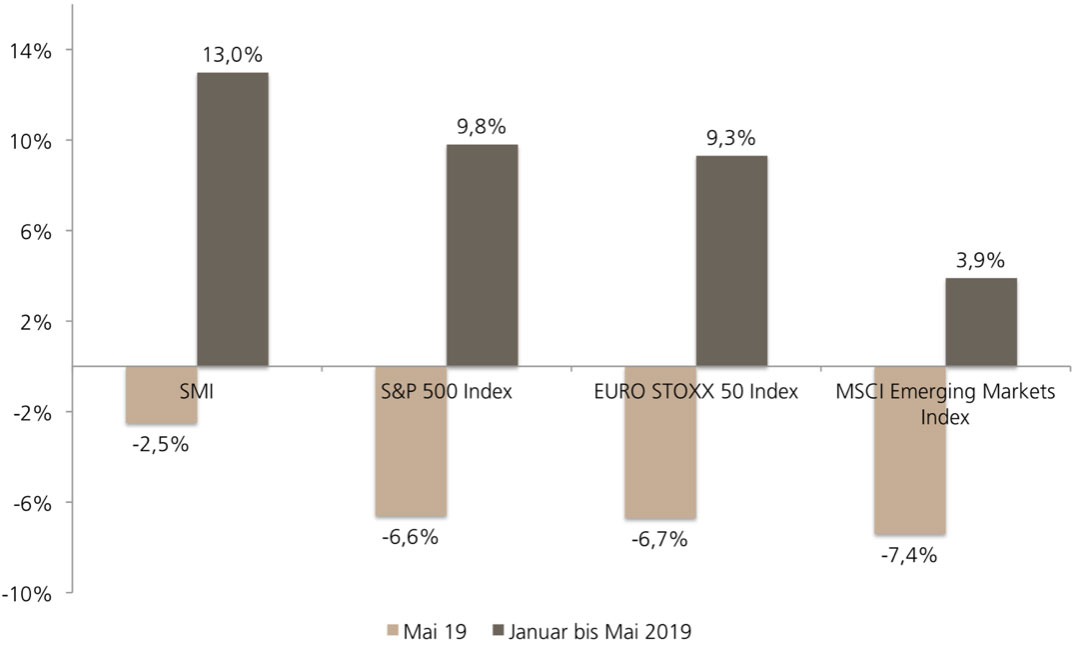

«Sell in May and go away» – diese alte Börsenweisheit dürfte sich so mancher Anleger in den vergangenen Wochen ins Gedächtnis gerufen haben. Denn an den Aktienmärkten gab es im Wonnemonat wahrlich nichts zu holen, die Kurse gaben auf breiter Front nach. Dabei kam die Schweiz noch relativ glimpflich davon. Per Ende Monat notierte der SMITM 2.6 Prozent unter dem April-Schlussstand. An der Wall Street, in der Eurozone sowie den Schwellenländern fiel das Minus deutlich grösser aus. Gleichwohl kann sich die Zwischenbilanz für die ersten fünf Monate 2019 in jedem der erwähnten Märkte sehen lassen (siehe Grafik).

Trump packt die „Zollkeule“ aus

Ein Thema zieht sich wie ein roter Faden durch das Börsenjahr 2019, der Handelsstreit. Im abgelaufenen Monat sorgte US-Präsident Donald Trump hier für gleich zwei kalte Duschen. Zunächst kündigte er am 5. Mai die Erhöhung von einem Teil der Strafzölle auf chinesischen Einfuhren von zehn auf 25 Prozent an. Mit dieser inzwischen umgesetzten Massnahme hievte Trump den Disput mit Peking in der Eskalationsspirale ein weiteres Mal nach oben. Wenig überraschend führten die hochrangigen Verhandlungen zwischen beiden Ländern vor diesem Hintergrund nicht zu einem Ergebnis.

Vergangene Woche packte der US-Präsident auch noch gegen Mexiko die „Zollkeule“ aus. Trump kündigte Einfuhrabgaben auf sämtliche Waren aus dem Nachbarland an. Sie sollen ab dem 10. Juni erhoben werden und fünf Prozent betragen. Auf diese Weise möchte der Republikaner Mexiko zu Massnahmen gegen die illegale Migration zwingen. «Der Zoll wird stufenweise steigen, bis das Problem der illegalen Einwanderung gelöst ist», verkündete Trump über sein Sprachrohr Twitter. Der jüngste Schritt überraschte insofern, da sich die USA erst vor kurzem mit Mexiko auf ein überarbeitetes Handelsabkommen verständigt hatten. (Quelle: Thomson Reuters, Medienbericht, 31.05.2019) Heute reist Donald Trump an den Schauplatz des zweiten politischen Dauerthemas, dem Brexit. In London wird der US-Präsident von Theresa May zum Staatsbesuch empfangen. Damit spielt er eine Hauptrolle, wenn die britische Regierungschefin einen ihrer letzten grossen Auftritte hat. Am Freitag, 7. Juni, gibt May den Vorsitz der konservativen Partei ab. Sobald die Tories ihre Nachfolge geregelt haben, wird May auch den Posten als Premierministerin räumen. Fest steht: Der Brexit wird die Märkte auch im neuen Monat beschäftigen – obwohl sich das ursprüngliche Votum der Briten für den EU-Austritt am 23. Juni bereits das dritte Mal jährt.ASCO: Blick in die Produktpipelines

Der schwache Börsenmonat Mai zeigt, dass an den Märkten die Sorge vor den negativen Folgen der politischen Wirren umgeht. Vor allem in den USA zeigte sich die Konjunktur bis zuletzt relativ robust. Ob es dabei bleibt, dürfte sich ein Stück weit am Freitag zeigen, wenn in Washington D.C. der Arbeitsmarktbericht „Nonfarm Payrolls“ für Mai publiziert wird.

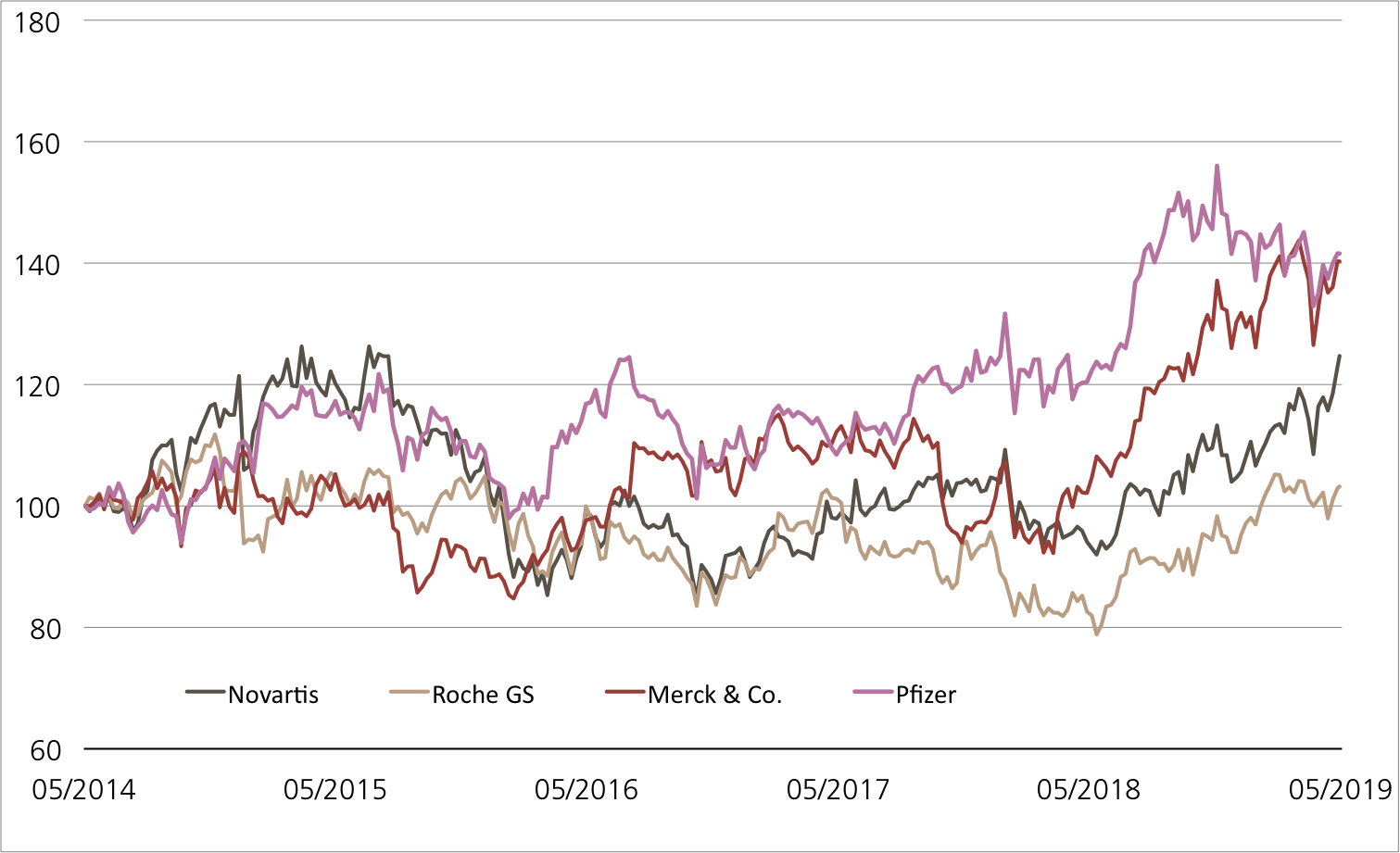

Heute und morgen steht Chicago im Fokus der Märkte. In der Metropole am Lake Michigan läuft bereits seit vergangenem Freitag die ASCO 2019. An der viel beachteten Konferenz präsentiert der Pharma- und Biotechnologiesektor die neuesten Erkenntnisse auf dem Gebiet der Onkologie. Auch die beiden heimischen Branchenvertreter Roche und Novartis sind vor Ort und stellen ihre aktuellen Produktpipelines vor. Pünktlich zur ASCO hat UBS das Basler Duo zusammen mit den US-Konkurrenten Merck und Pfizer als Basiswerte für einen Callable Kick-In GOAL (Symbol: KDRJDU) zusammengebracht. Das Zeichnungsprodukt stellt eine Seitwärtsrendite von 6.50 Prozent p.a. in Aussicht. Voraussetzung: Keine Aktie aus dem Quartett fällt während der Laufzeit auf oder unter die Barriere von 60 Prozent der Anfangsfixierung.

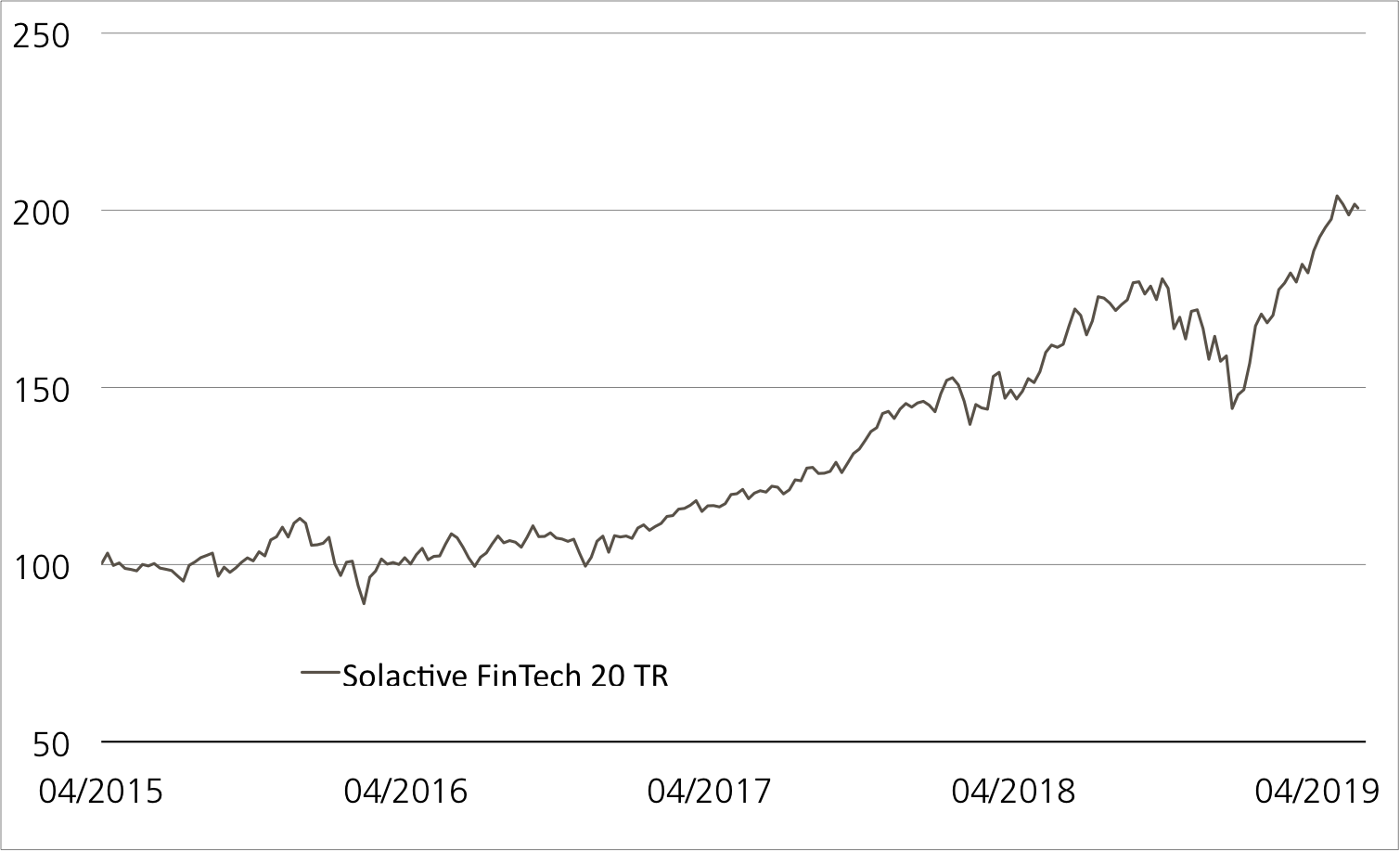

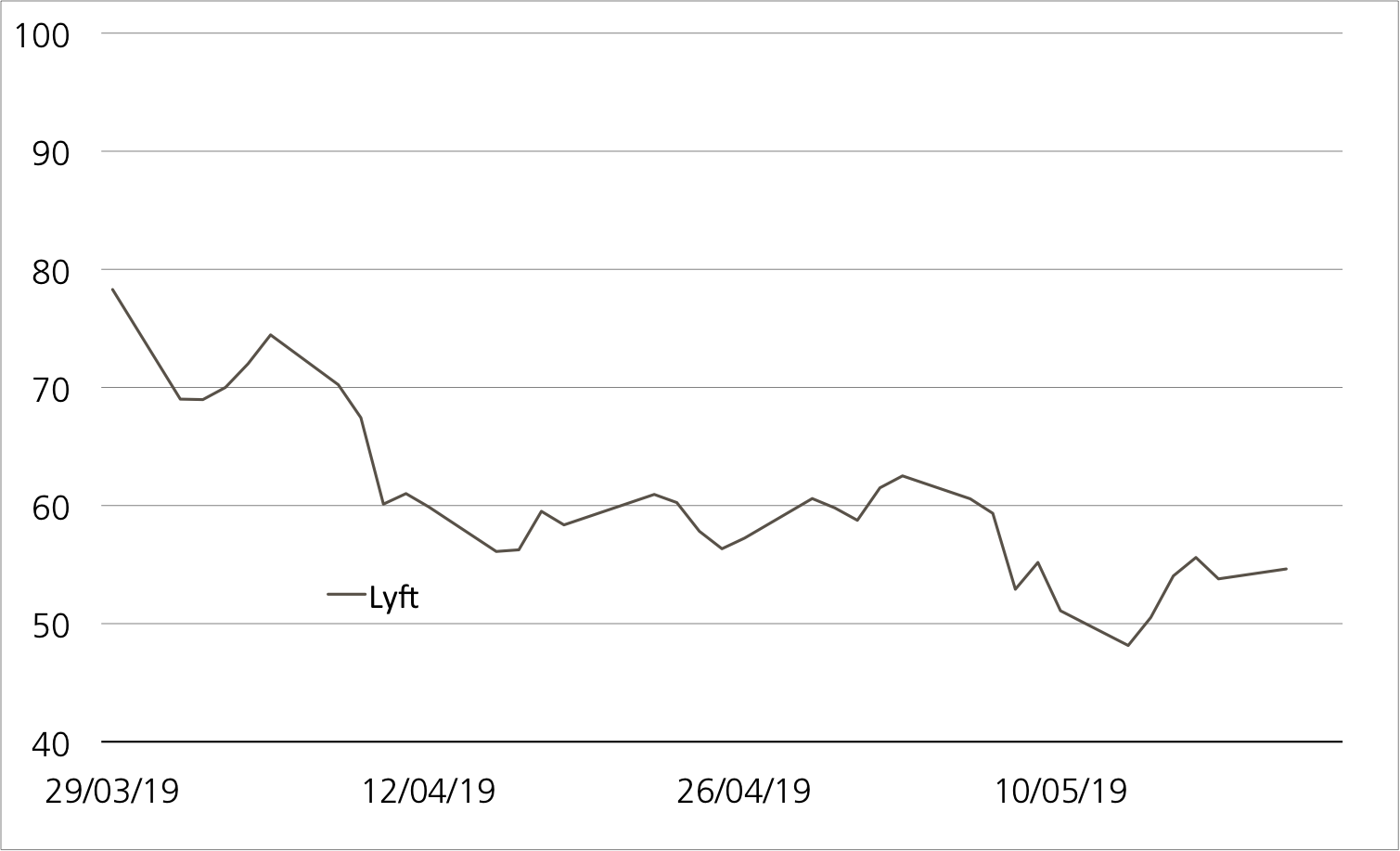

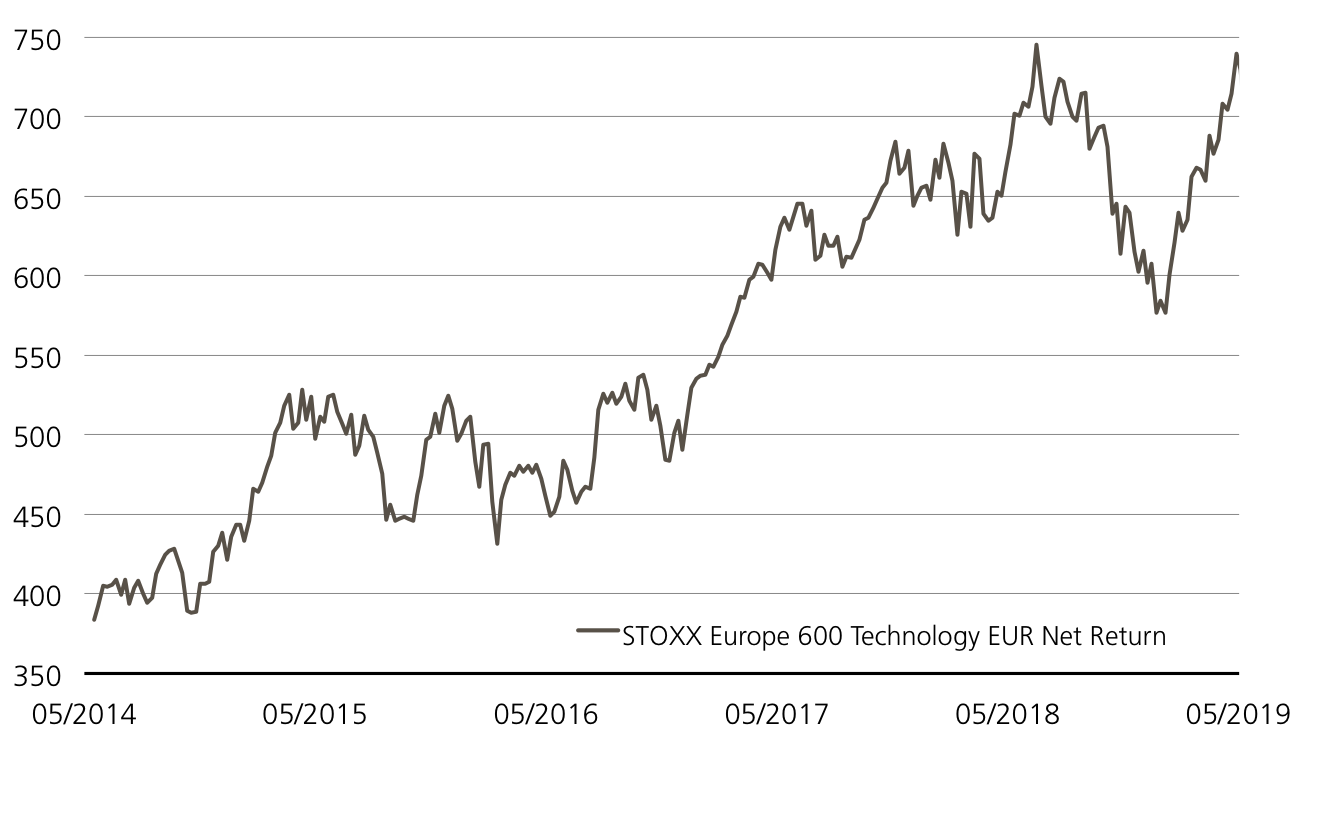

Performance ausgewählte Börsenindizes¹

Stand: 31.05.2019; Quelle: UBS AG, Bloomberg

¹) Bitte beachten Sie, dass vergangene Wertentwicklungen keine Indikationen für künftige Wertentwicklungen sind.

Konjunkturtermine

| Datum | Zeit | Land | Ereignis |

| 03.06.2019 | 16:00 | US | ISM Einkaufsmanagerindex Juni 2019 |

| 03.06.2019 | 21:30 | US | Fahrzeugverkäufe Mai 2019 |

| 04.06.2019 | 11:00 | EZ | Konsumentenpreise Mai 2019 |

| 05.06.2019 | 10:00 | EZ | Einkaufsmanagerindex Mai 2019 |

| 05.06.2019 | 11:00 | EZ | Detailhandelsumsätze April 2019 |

| 06.06.2019 | 11:00 | EZ | BIP-revidiert 1. Quartal 2019 |

| 07.06.2019 | 07:45 | CH | Arbeitsmarktbericht Mai 2019 |

| 07.06.2019 | 08:00 | DE | Industrieproduktion April 2019 |

| 07.06.2019 | 14:30 | US | Arbeitsmarktbericht Mai 2019 |

| 07.06.2019 | 16:00 | US | Grosshandel Lagerbestände Mai 2019 |

Stand: 27.05.2019; Quelle: Thomson Reuters

Weitere Blogeinträge:

Das Zahlenbuffet ist angerichtet

Follow us on LinkedIn 15. Januar 2024 Das Zahlenbuffet ist angerichtet Das neue Jahr ist gerademal zwei Wochen alt und schon richten sich die Augen der Anleger auf die [...]

SMI mit gutem Start

Follow us on LinkedIn 08. Januar 2024 SMI mit gutem Start Am Wochenende feierte Marco Odermatt beim Riesenslalom in Adelboden seinen dritten Sieg in Folge. 25'000 Zuschauer verzauberten das [...]

Ende gut, alles gut

Follow us on LinkedIn 18. Dezember 2023 Ende gut, alles gut Schluss, Aus, Vorbei! Auch wenn das (Kapitalmarkt)-Jahr noch nicht ganz beendet ist, von Seiten der westlichen Notenbanken scheint [...]