Weekly Hits: Marché du pétrole & Secteur du luxe

Vendredi, 15.03.2019

- Thème 1: Marché du pétrole - Moins de pression dans les pipelines

- Thème 2: Secteur du luxe - Swatch sous les feux de la rampe

Marché du pétrole

Moins de pression dans les pipelines

On entend beaucoup parler de l’« OPEP+ » sur les marchés de l’énergie en ce moment. Derrière cet acronyme se cache une alliance entre l’Organisation des pays exportateurs de pétrole et d’autres producteurs d’or noir, notamment la Russie. L’OPEP+ a freiné la production pour prévenir le risque de surproduction, et ce calcul semble porter ses fruits jusqu’à présent : depuis le début de l’année, le prix du baril de Brent de la mer du Nord a gagné 23%.¹ UBS CIO GWM pense que le cours va continuer de grimper. L’ETC (symbole : TCOCIU) propose une participation transparente et rentable à l’UBS Bloomberg CMCI Brent Crude Oil USD TR Index. Le nouveau Kick-In GOAL (symbole : KDHDDU) sur WTI Crude Oil offre quant à lui une alternative à un positionnement direct dans les sources d’énergie. Le produit en souscription est doté d’un coupon de 10,00% p.a. Le sous-jacent commence la période de 18 mois avec une marge de sécurité de 32,5%.

Face à la correction des prix de l’énergie observée au quatrième trimestre 2018, les membres de l’OPEP+ se sont entendus en décembre pour réduire la production de pétrole de 1,2 million de barils à partir de début 2019. Bien que le cours se soit ressaisi entre-temps, l’OPEP+ ne devrait pas relever la cadence pour l’instant, comme Khalid al-Falih, le ministre saoudien de l’énergie, l’a avoué dans un entretien avec l’agence Reuters. Le représentant du membre le plus influent de l’OPEP estime qu’il serait précipité de modifier l’accord avant la réunion du groupe en juin. Les membres de l’OPEP+ se réuniront les 17 et 18 avril à Vienne avant de se rencontrer à nouveau les 25 et 26 juin. (Source : Thomson Reuters, revue de presse, 11.03.2019).

UBS CIO GWM se penche actuellement sur une analyse de la demande sur le marché mondial du pétrole. Les experts constatent que la Chine a récemment importé pendant quatre mois consécutifs plus de 10 millions de barils de pétrole par jour. D’après CIO GWM, cette tendance pourrait se poursuivre. Alors que la consommation du plus gros importateur mondial ne cesse de croître, la production domestique n’a jamais été aussi basse depuis plusieurs années. Selon les analystes, la hausse des importations pourrait également s’expliquer par une éventuelle consolidation des réserves stratégiques. D’après CIO GWM, l’Empire du Milieu fait généralement office d’« éponge » en ce sens que la Chine absorbe les excédents de production et contribue ainsi à raréfier l’offre. Les experts ne partagent pas les craintes selon lesquelles la demande émanant des pays en voie de développement pourrait baisser en raison du ralentissement de la conjoncture. Au contraire, les craintes de ruptures d’approvisionnement liées aux sanctions américaines contre les membres de l’OPEP que sont le Venezuela et l’Iran devraient maintenir les besoins de la Chine à un niveau élevé. CIO GWM table sur une poursuite de la pénurie sur le marché du pétrole à l’échelle mondiale pour ce deuxième trimestre. Dans un tel contexte, le Brent pourrait grimper dans une fourchette de 70 à 80 dollars américains dans les mois à venir. (Source : UBS CIO GWM, Energy, « Crude oil: China’s sponge function », 11.03.2019)Opportunités: Avec l’ETC (symbole : TCOCIU) sur l’UBS Bloomberg CMCI Brent Crude Oil TR, les investisseurs peuvent miser sur la hausse du cours du pétrole. Grâce au positionnement sur toute la courbe des futurs, le sous-jacent offre une plus grande diversification en termes d’échéances des futurs. Le processus de roulement CMCI optimisé est également utilisé – il peut réduire les effets négatifs dans une situation de contango. Actuellement, le Early Redemption Kick-In GOAL (symbole : KDHDDU) se base sur le contrat à terme WTI arrivant prochainement à échéance. Tant que ce contrat à terme n’atteindra ou ne passera pas en-dessous de la barrière de 67,50% du cours initial, le produit produira à l’échéance le rendement maximal de 10% p.a. En raison de la fonction « Early Redemption » il y a une possibilité de remboursement anticipé, y compris un coupon proportionnel. Pour ce faire, le prix du WTI Crude Oil doit fermer au niveau ou au-dessus de la fixation initiale lors d’une journée d’observation.

Risques: les produits présentés n’offrent pas de protection du capital. Il peut y avoir des pertes avec l’ETC lorsque l’indice sous-jacent baisse. Si pendant la durée de l’investissement le cours du WTI du Kick-In GOAL atteint ou franchit une seule fois le Kick-In Level (barrière) et la fonction « Early Redemption » ne se produit pas, le contrat à terme doit remonter au moins au niveau du prix d’exercice à l’échéance. Dans le cas contraire, le remboursement sera réduit à hauteur du repli du prix d’exercice. Le coupon sera dans tous les cas versé. Par ailleurs, avec les produits structurés, l’investisseur supporte le risque d’émetteur. Cela signifie qu’en cas d’insolvabilité d’UBS SA, le capital investi peut être perdu, indépendamment de l’évolution du sous-jacent.

Vous trouverez davantage de produits UBS et des informations sur les opportunités et les risques à l’adresse ubs.com/keyinvest.

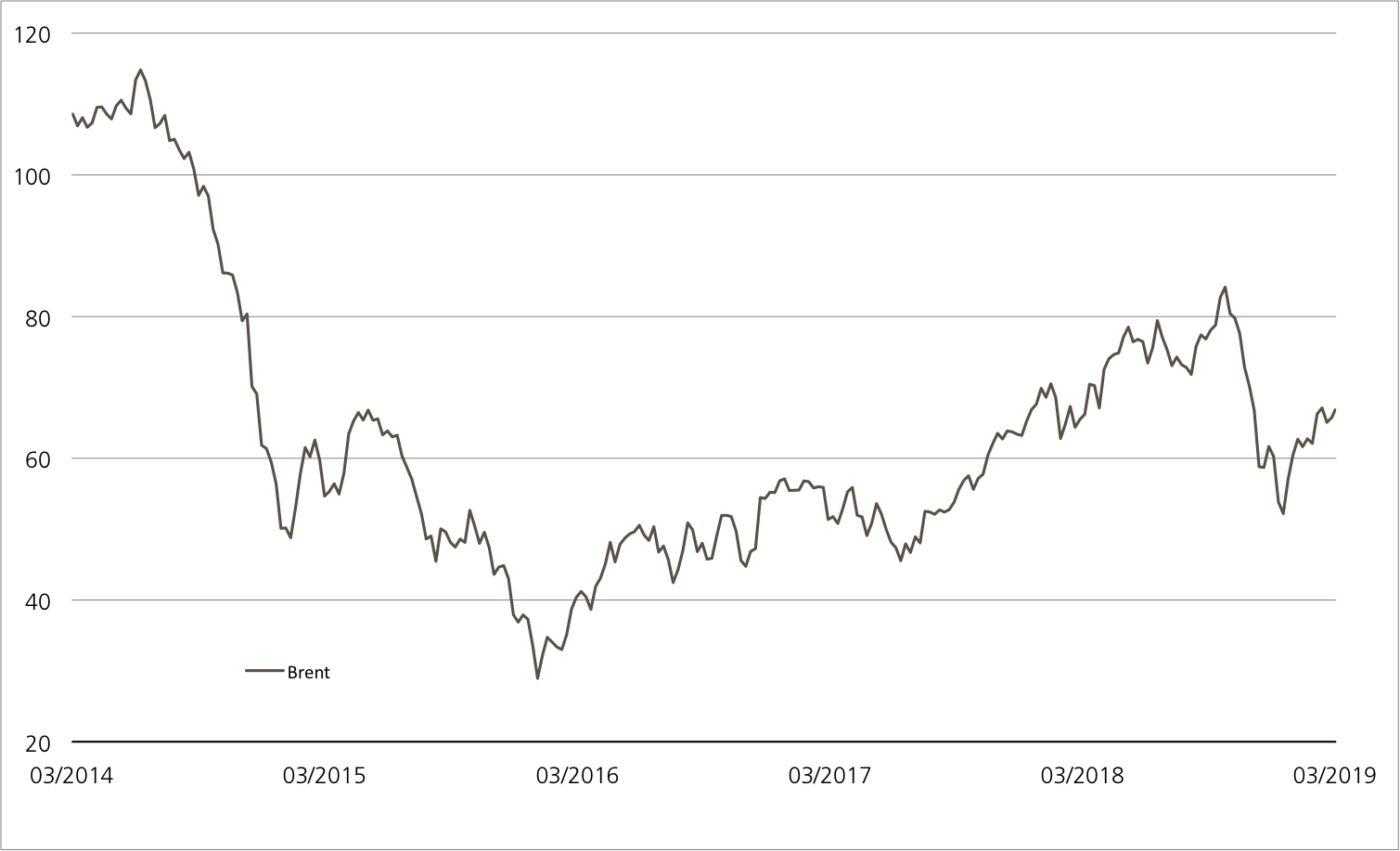

Pétrole brut Brent (en dollars américains par baril) 5 ans¹

Après avoir atteint son plus haut niveau depuis environ quatre ans en octobre 2018, la tendance haussière du Brent a pris brusquement fin. Depuis le début de l’année, le baril de pétrole de la mer du Nord repart à la hausse.

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

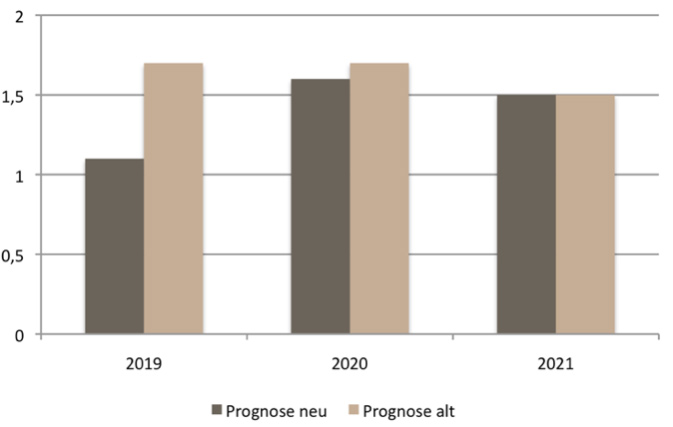

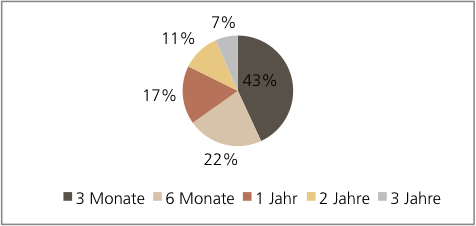

UBS Bloomberg CMCI Brent Crude Oil TR Index : pondérations cibles des échéances

Comme souvent pour la méthodologie CMCI, l’engagement pour cet indice Brent s’étend sur toute la courbe des futurs. En moyenne, l’échéance des contrats à terme détenus s’élève à 0,81 an.

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

¹) La performance passée n’indique pas les résultats futures.

²) Les condition des ETTs sont vérifiés annuellement et peuvent être ajustées avec un délai de 13 mois après la publication.

ETC sur UBS Bloomberg CMCI Brent Crude Oil USD TR Index

| Symbol | TCOCIU |

| SVSP Name | Tracker Certifikat |

| SVSP Code | 1300 |

| Sous-jacent | UBS Bloomberg CMCI Brent Crude Oil USD TR Index |

| Devise | USD |

| Rapport de souscription | 10:1 |

| Frais de gestion | 0.30% p.a. |

| Participation | 100% |

| Echéance | Open End |

| Émetteur | UBS AG, London |

| Bid/Ask | USD 91.95 / 92.45 |

10.00% p.a. Early Redemption Kick-In GOAL sur WTI Crude Oil

| Symbol | KDHDDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230 (Auto-Callable) |

| Sous-jacent | WTI Crude Oil |

| Devise | USD |

| Coupon | 10.00% p.a. |

| Kick-In Level (barrière) | 67.50% |

| Echéance | 28.09.2020 |

| Émetteur | UBS AG, London |

| Date de fixation du prix | 27.03.2019, 15:00 h |

Vous trouverez davantage de produits UBS et des informations sur les opportunités et les risques à l’adresse ubs.com/keyinvest.

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

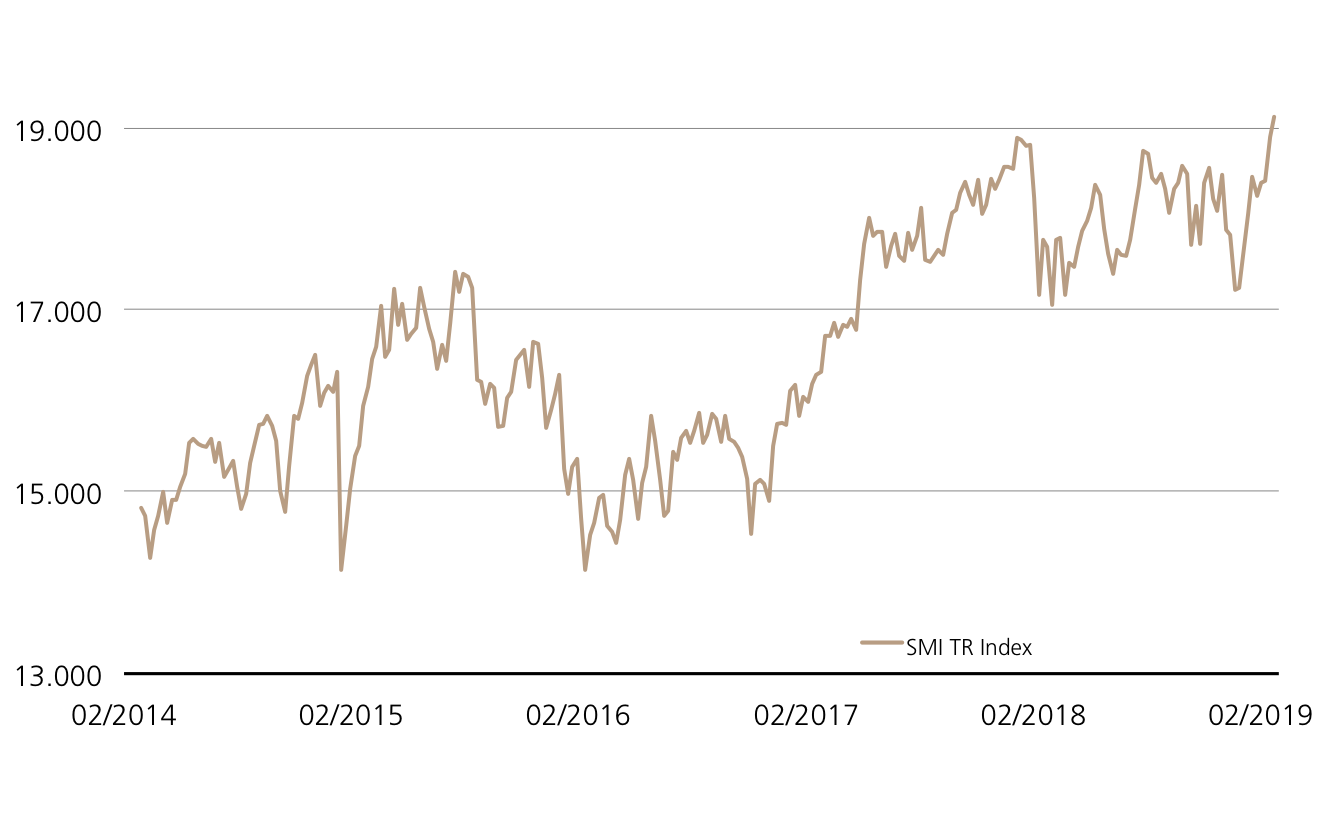

Apérçu du marché

| Index | Citation | Semaine¹ |

| SMI™ | 9’387.43 Pt. | -0.2% |

| SLI™ | 1’447.05 Pt. | -0.4% |

| S&P 500™ | 2’810.92 Pt. | 1.4% |

| Euro STOXX 50™ | 3’323.87 Pt. | 0.0% |

| S&P™ BRIC 40 | 4’289.27 Pt. | 0.2% |

| CMCI™ Compos. | 929.97 Pt. | 1.0% |

| Gold (troy ounce) | 1’309.30 USD | 1.7% |

¹ Changement basé sur le cours de clôture du jour précédent par rapport au cours de clôture de la semaine dernière.

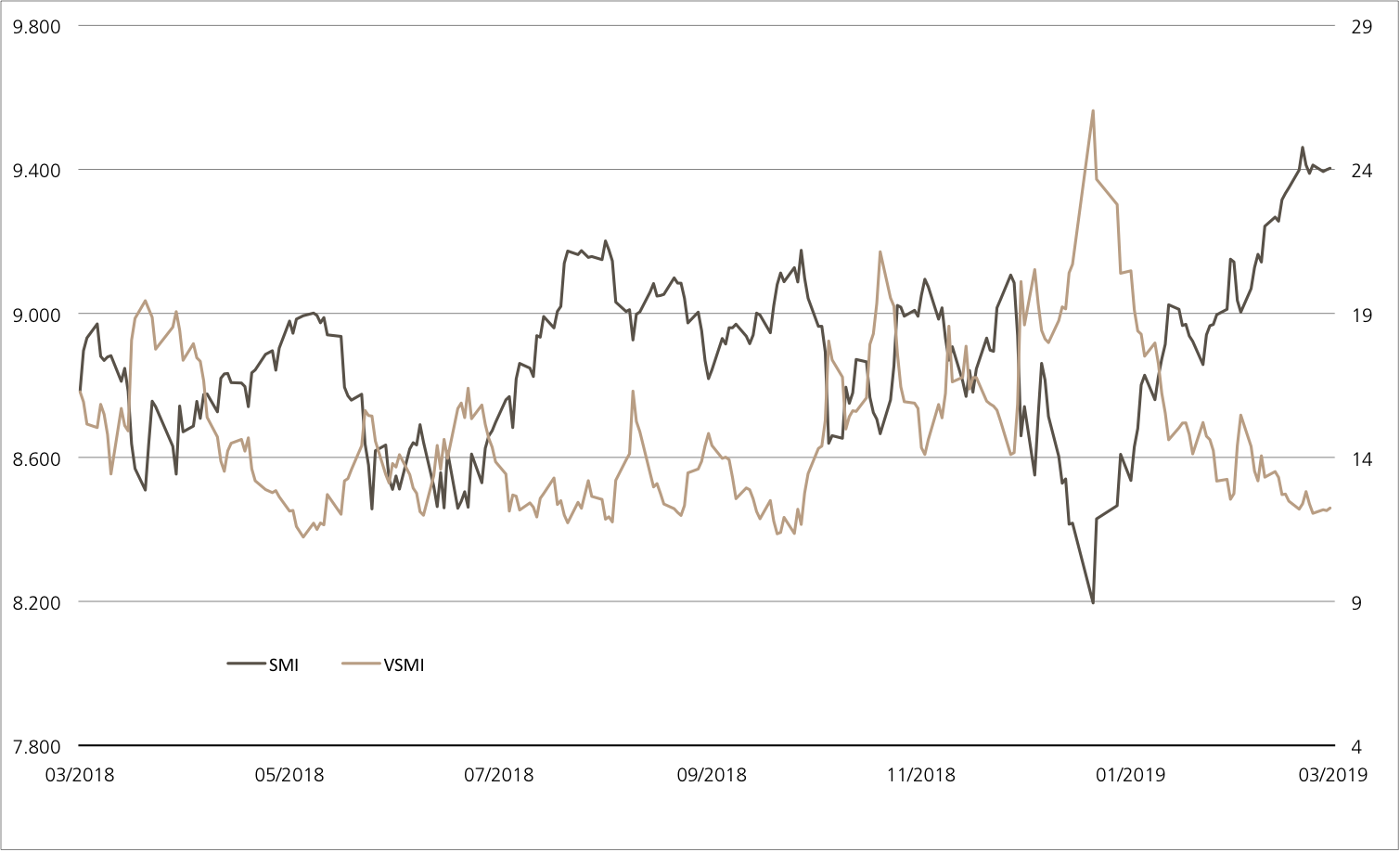

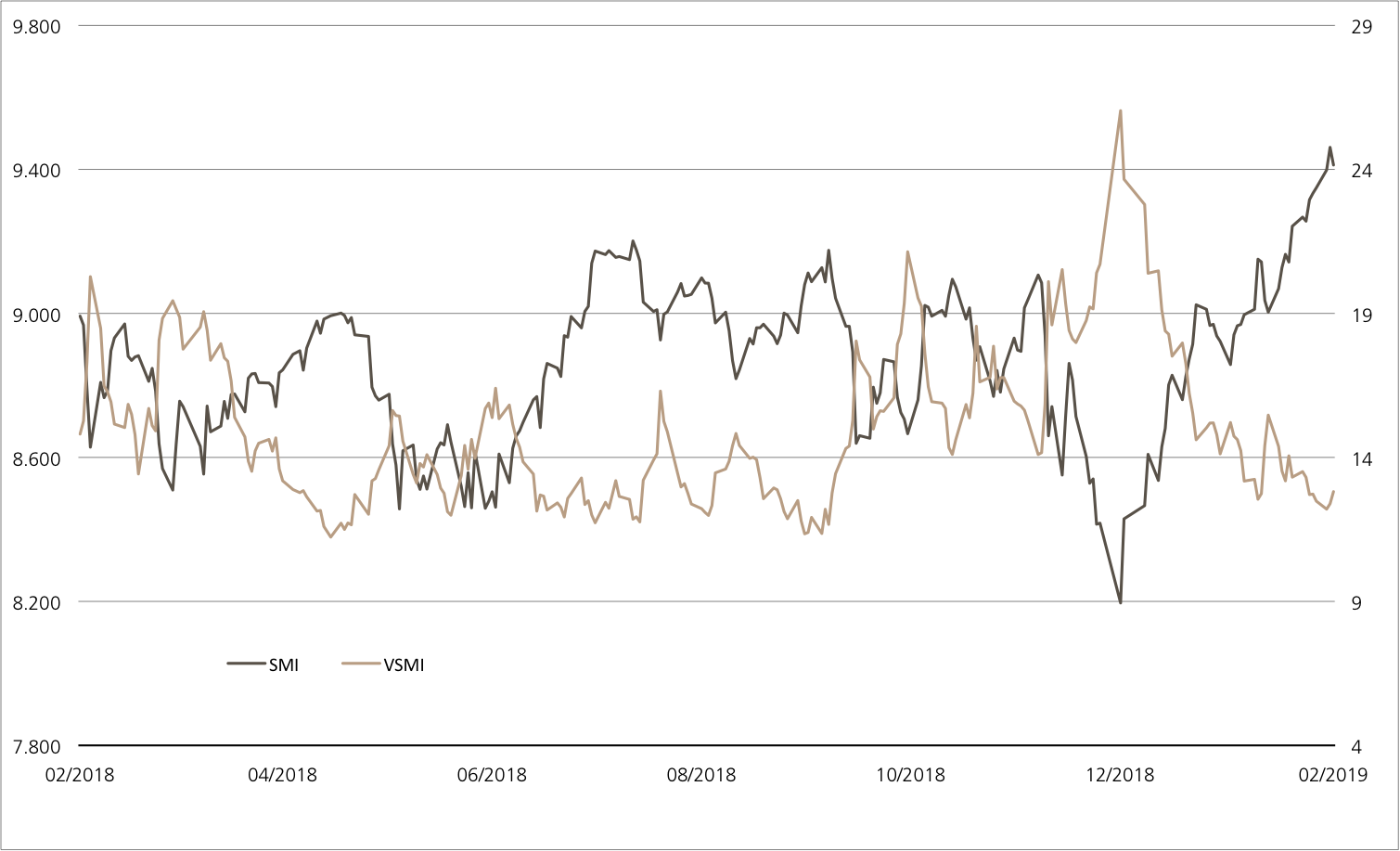

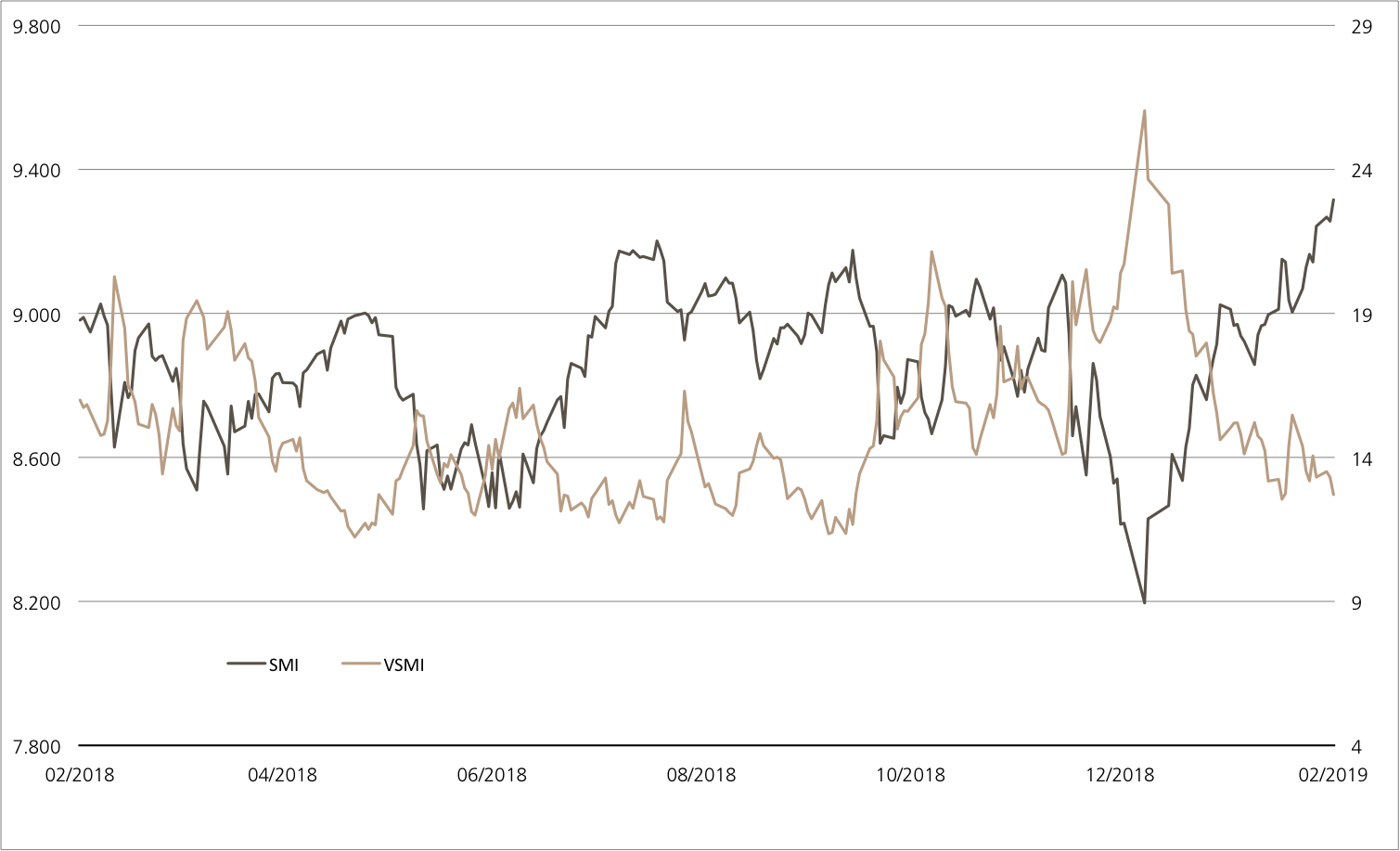

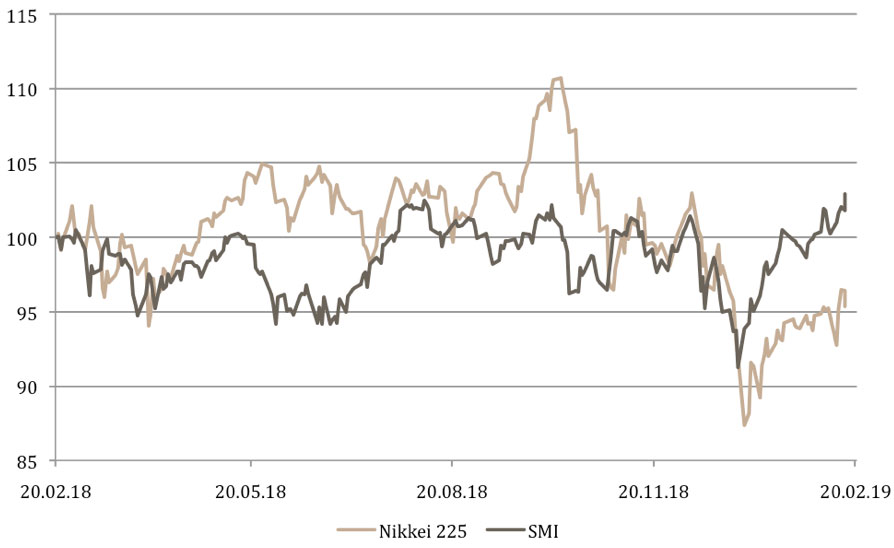

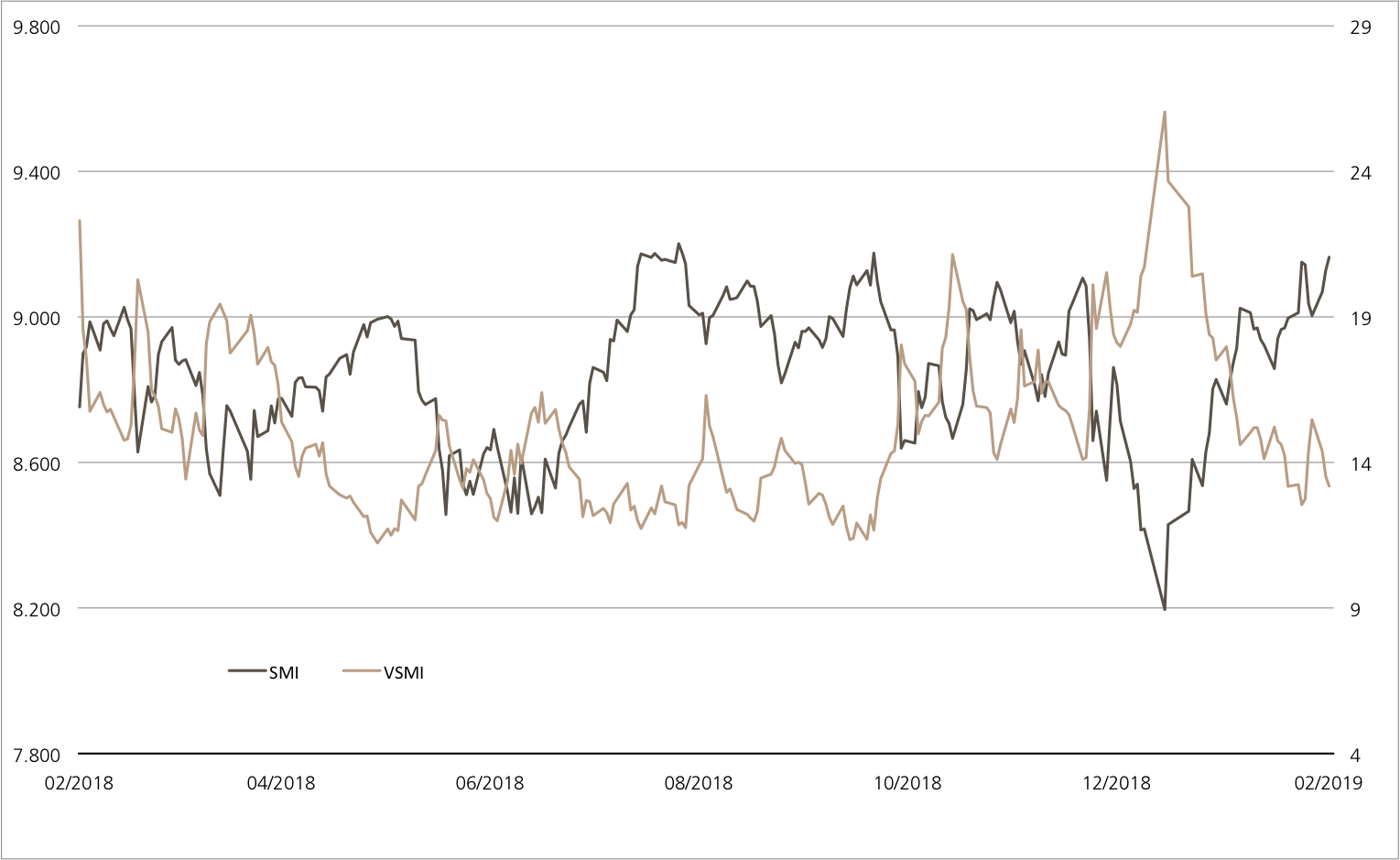

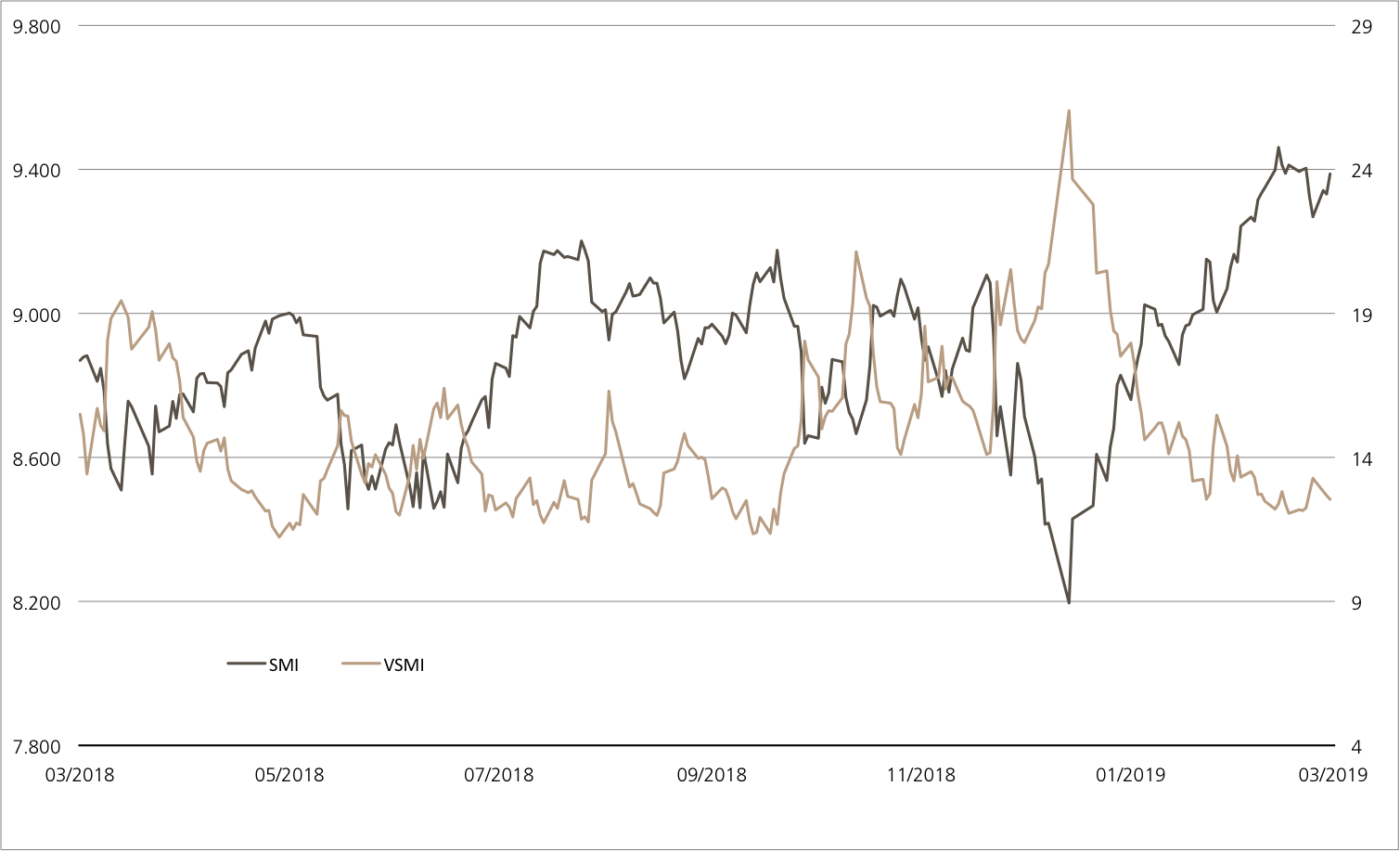

SMI™ vs. VSMI™ 1 année

L’index VSMI™ est calculé depuis 2005. Il affiche la volatilité des actions inclus dans le SMI™ index. Pour la calculation, un portefeuille est utilisé qui ne réagit qu’au variations de la volatilité au lieu des variations des prix. En le faisant, la méthodologie du VSMI™ utilise la volatilité carré, connu sous le terme variance, des options sur le SMI avec 30 jours jusqu’à l’échéance négociées à la Bourse Eurex.

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

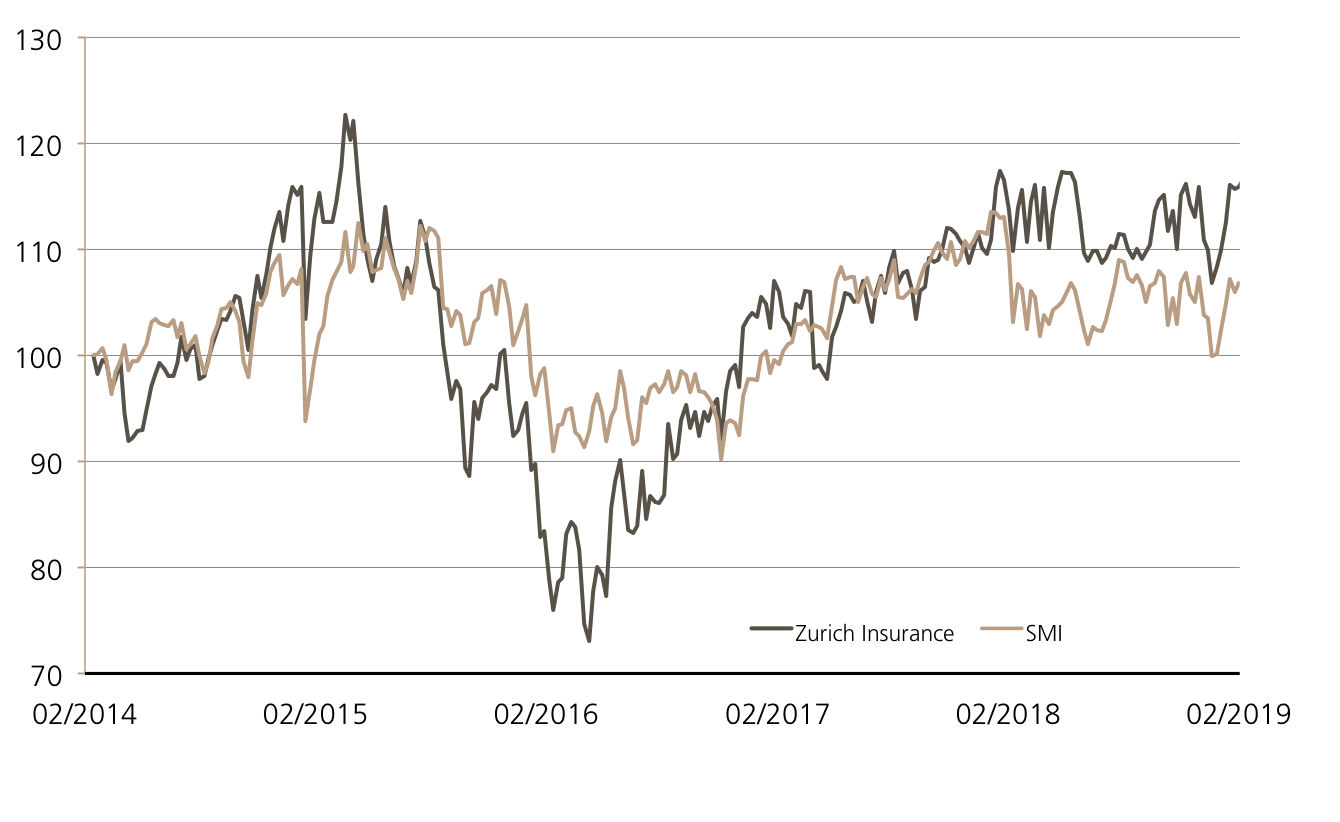

Secteur du luxe

Swatch sous les feux de la rampe

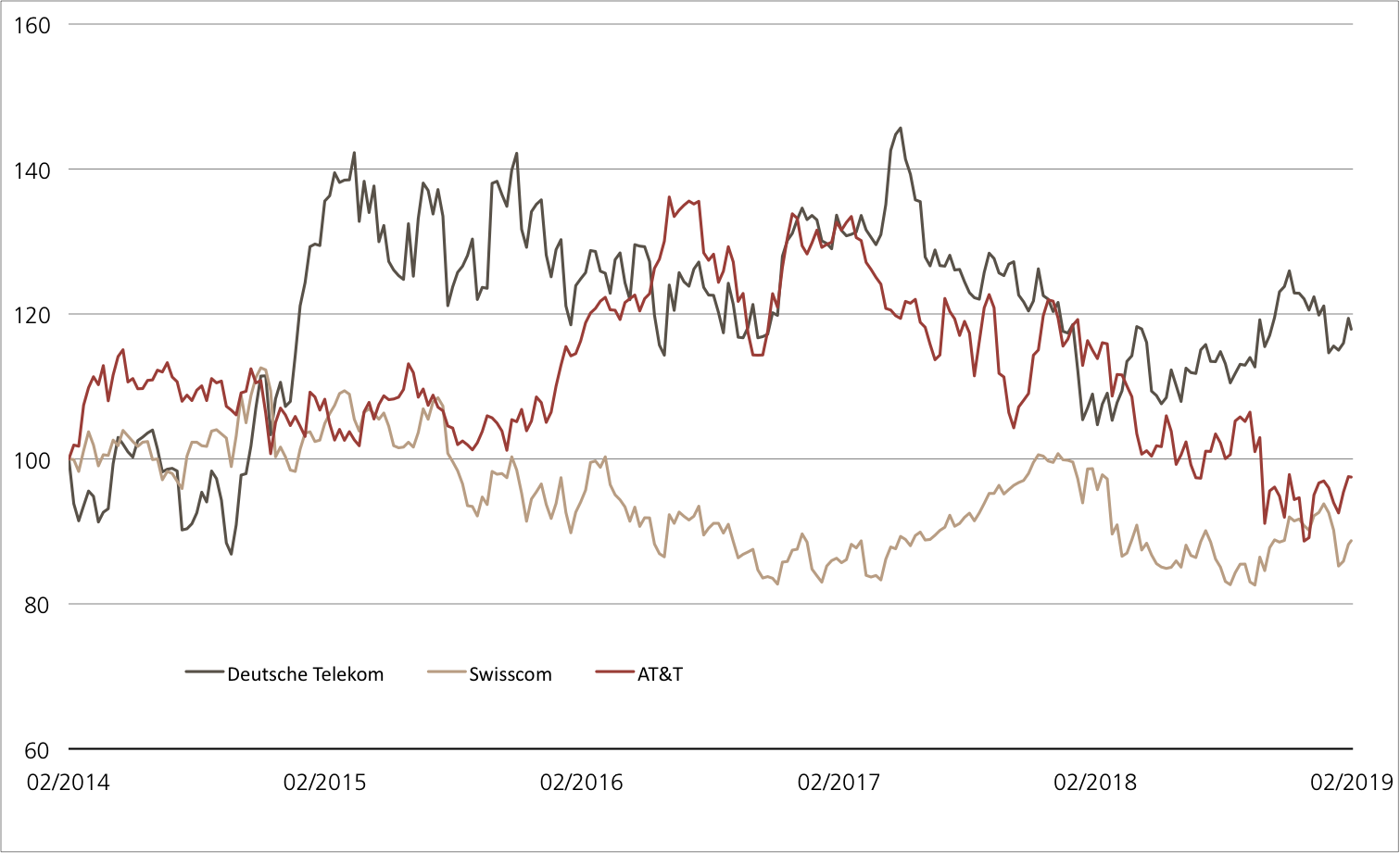

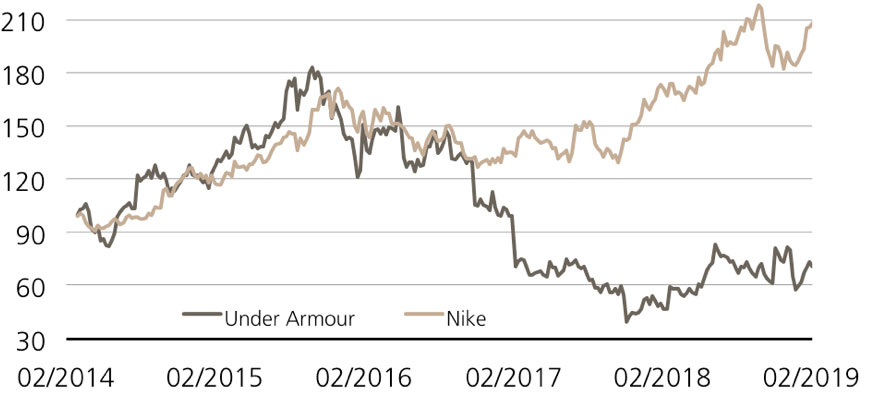

Aujourd’hui a lieu la conférence de presse pour le bilan de Swatch. Alors que l’entreprise a déjà publié des premiers indicateurs pour 2018, les marchés attendent avec impatience les perspectives de la direction. L’Oréal et LVMH ont récemment brossé un tableau positif du marché du luxe mondial. UBS réunit comme sous-jacents les deux représentants français de la branche et Swatch pour un Callable Worst of Kick-In GOAL (symbole : KDGVDU). Le trio de luxe permet un coupon de 8,00% p.a. Cette opportunité de rendement s’accompagne d’un écart de la barrière de 40% initialement pour les trois actions.

En 2018, Swatch a vu son chiffre d’affaires grimper de 5,7% pour s’établir à 8,5 milliards de francs suisses. Au premier semestre, l’entreprise avait enregistré une croissance à deux chiffres mais les activités, en France et en Asie notamment, ont ensuite considérablement marqué le pas. Le bénéfice du groupe horloger a progressé de 14,8% pour se hisser à 867 millions de francs suisses. Swatch n’a toutefois pas répondu aux attentes des analystes. La direction semble satisfaite de ce début d’année et laisse entrevoir une croissance positive pour 2019. (Source : Thomson Reuters, revue de presse, 31.01.2019) La conférence de presse révèlera si le CEO Nick Hayek peut déjà concrétiser ces perspectives.

L’Oréal présente également son bilan 2018 aujourd’hui. Selon les chiffres provisoires, le fabricant de produits cosmétiques a signé la plus forte progression de son chiffre d’affaires depuis dix ans (+7,1%). Ses recettes ont affiché une croissance à deux chiffres en pourcentage dans le segment du luxe ainsi que dans le secteur moins développé des « Active Cosmetics ». Le groupe a enregistré un nouveau record en portant à 18,3% sa marge opérationnelle. (Source : L’Oréal, communiqué de presse, 07.02.2019) Du côté de LVMH aussi les activités ne se sont jamais aussi bien portées. En 2018, le groupe, dont le portefeuille compte entre autres les sacs Louis Vuitton, les montres Hublot ou encore les parfums Christian Dior, a généré une croissance organique de son chiffre d’affaires de 11%. Sa marge opérationnelle a augmenté de plus de 20%. (Source : LVMH, communiqué de presse, 29.01.2019)

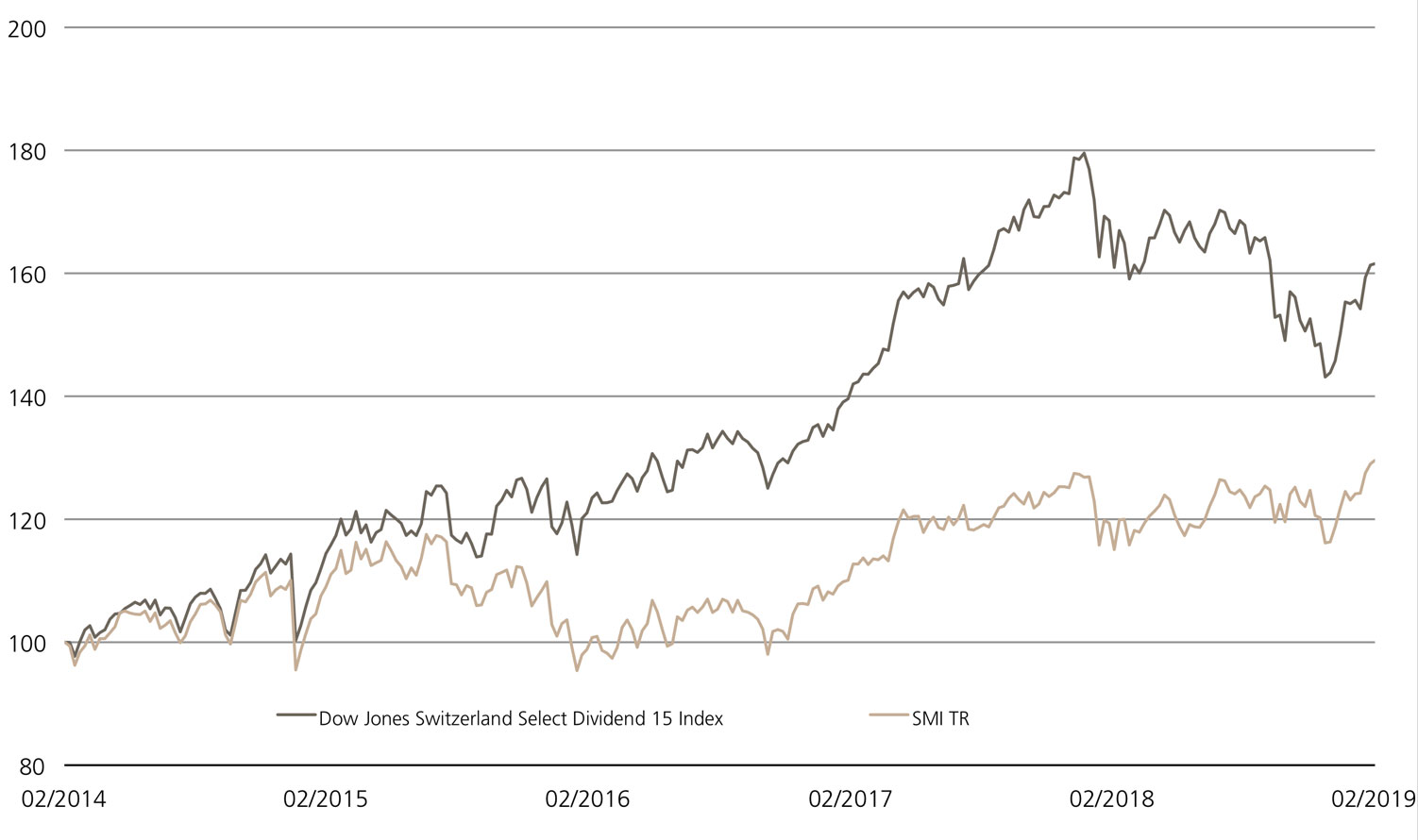

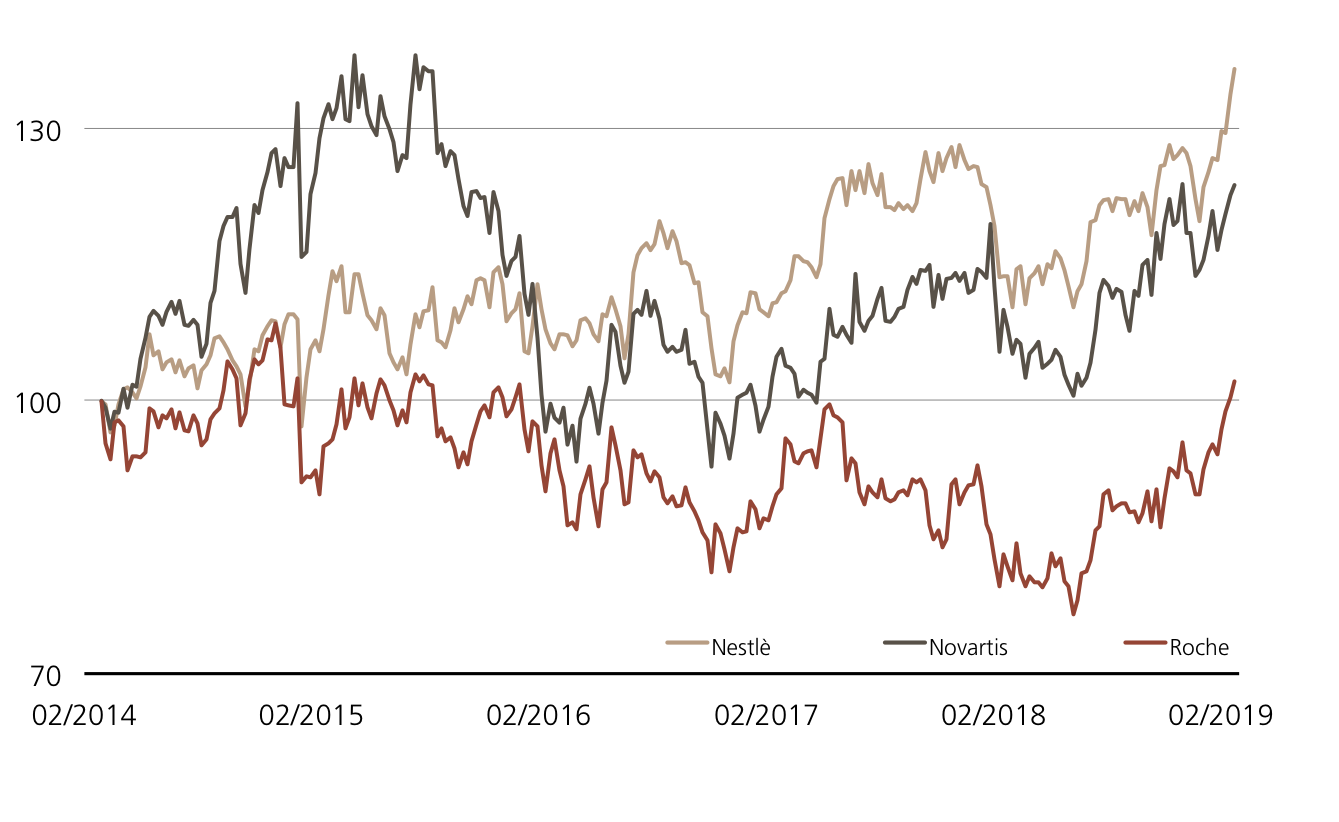

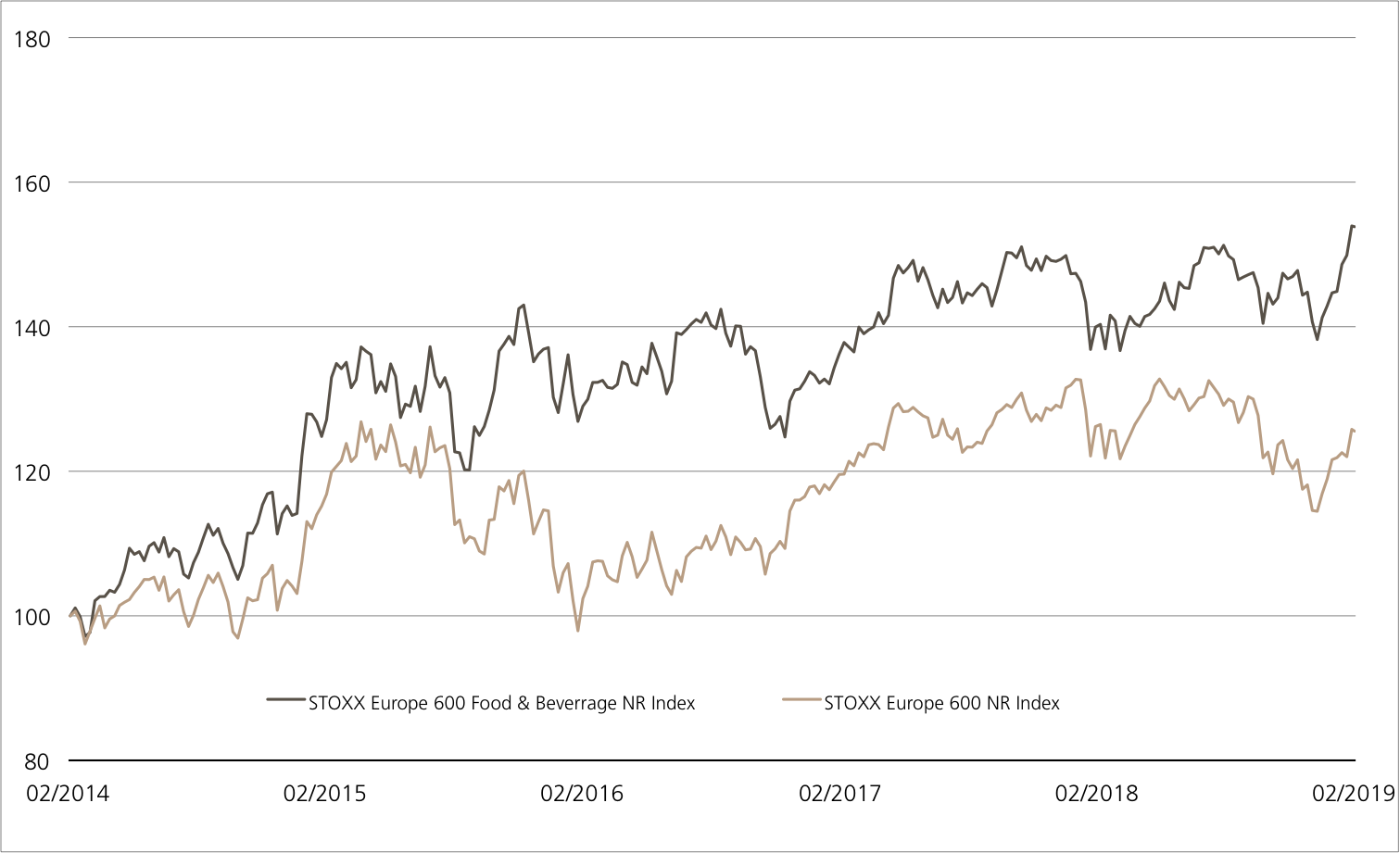

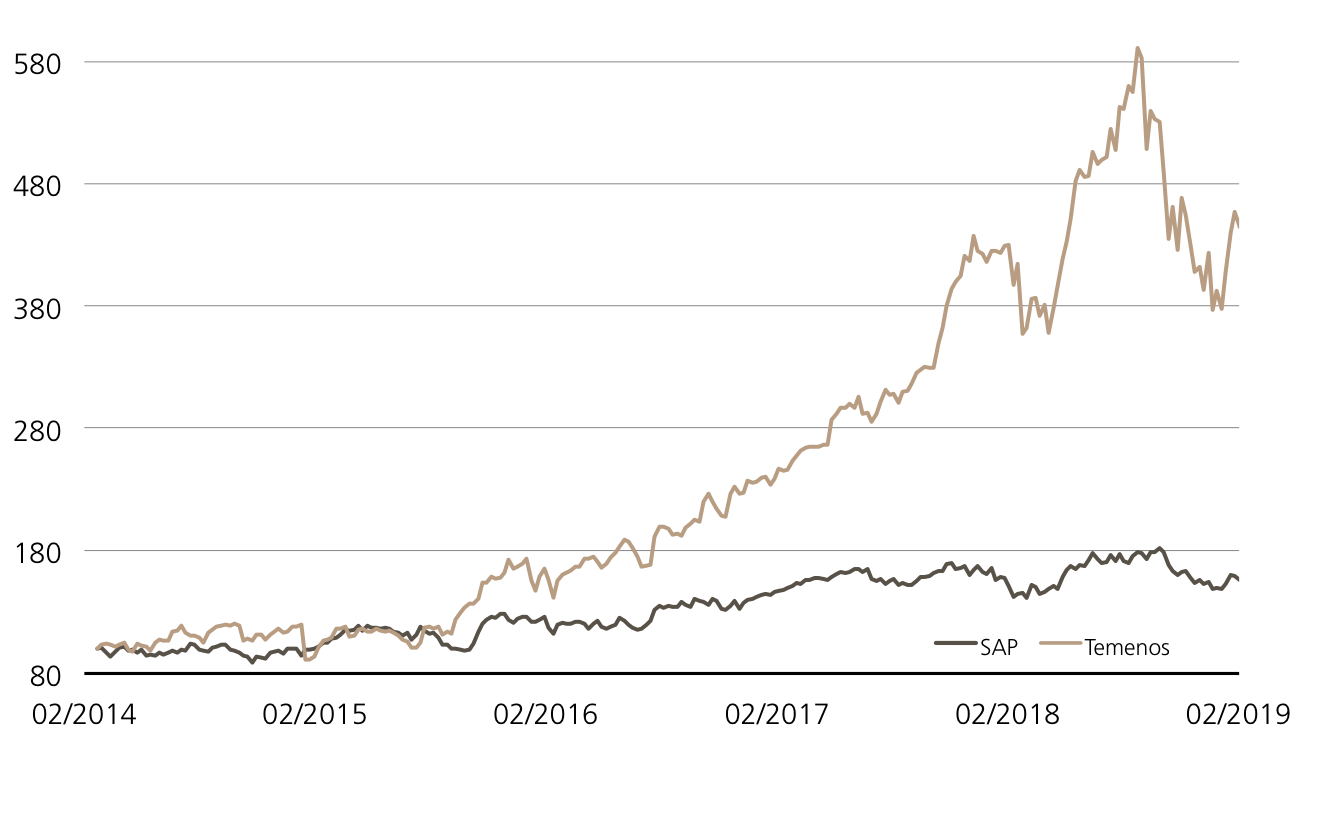

Opportunités: Si l’action LVMH a manqué de peu de renouer avec son plus haut historique de l’an dernier, L’Oréal a battu un nouveau record. De son côté le groupe Swatch a récemment stagné.¹ Pour le Callable Worst of Kick-In GOAL (symbole : KDGVDU), une évolution latérale des trois actions suffirait pour atteindre le rendement maximal de 8,00% p.a., à condition qu’aucun des titres ne tombe au niveau ou en dessous de sa barrière pendant la période. L’émetteur dispose néanmoins d’un droit de résiliation auquel il peut recourir tous les trois mois à compter du 20 mars 2020.

Risques: les Worst of Kick-In GOALS ne bénéficient d’aucune protection du capital. Si, pendant la durée de l’investissement, l’un des sous-jacents atteint une seule fois la barrière respective («Kick-In Level») ou descend en dessous, et que la fonction de Callable ne s’applique pas, le remboursement à l’échéance par remboursement en espèces est basé sur la performance la plus faible (base Strike) du trio (au maximum toutefois à la valeur nominale majorée du coupon). Dans un tel cas, des pertes sont probables. De plus, avec les produits structurés, l’investisseur supporte le risque d’émetteur. Cela signifie qu’en cas d’insolvabilité d’UBS SA, le capital investi peut être perdu, indépendamment de l’évolution des sous-jacents.

Vous trouverez davantage de produits UBS et des informations sur les opportunités et les risques à l’adresse ubs.com/keyinvest.

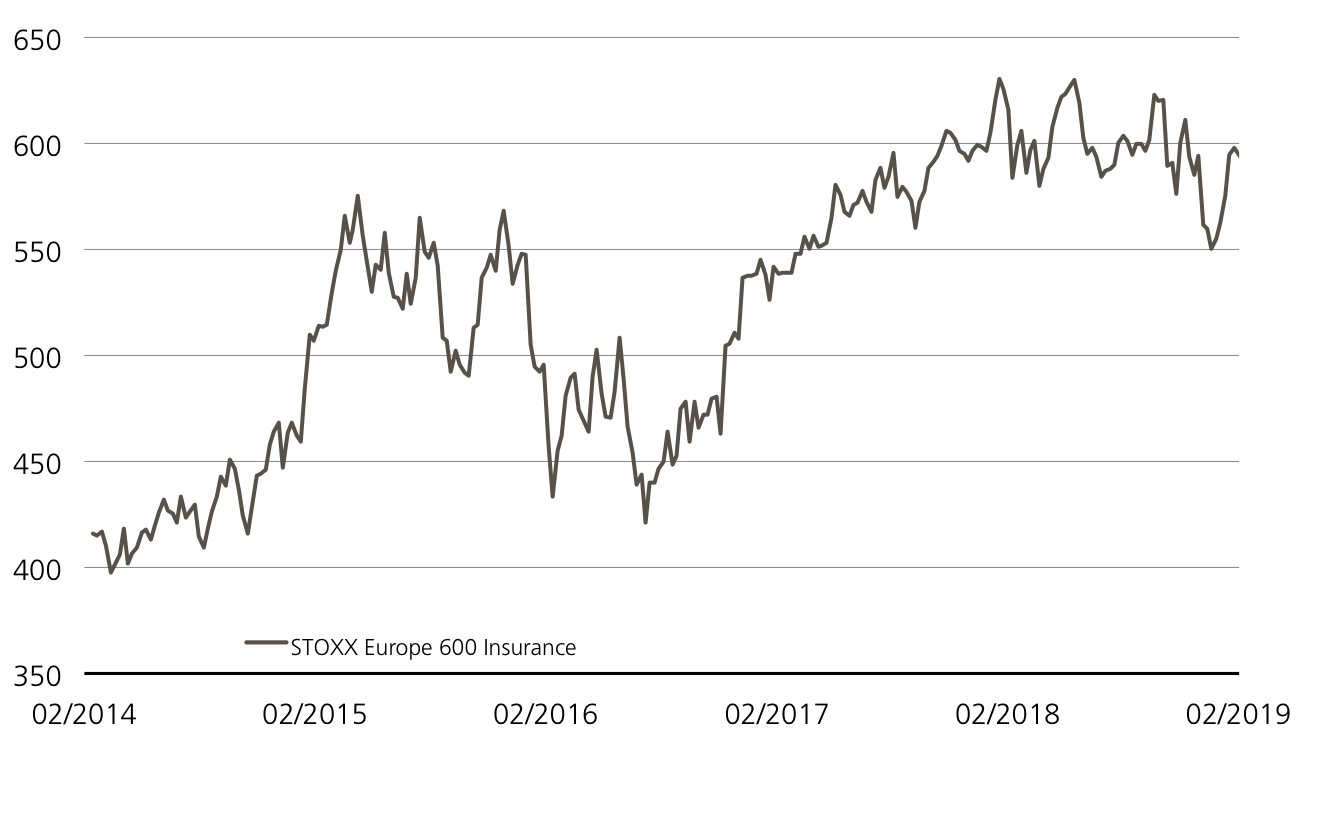

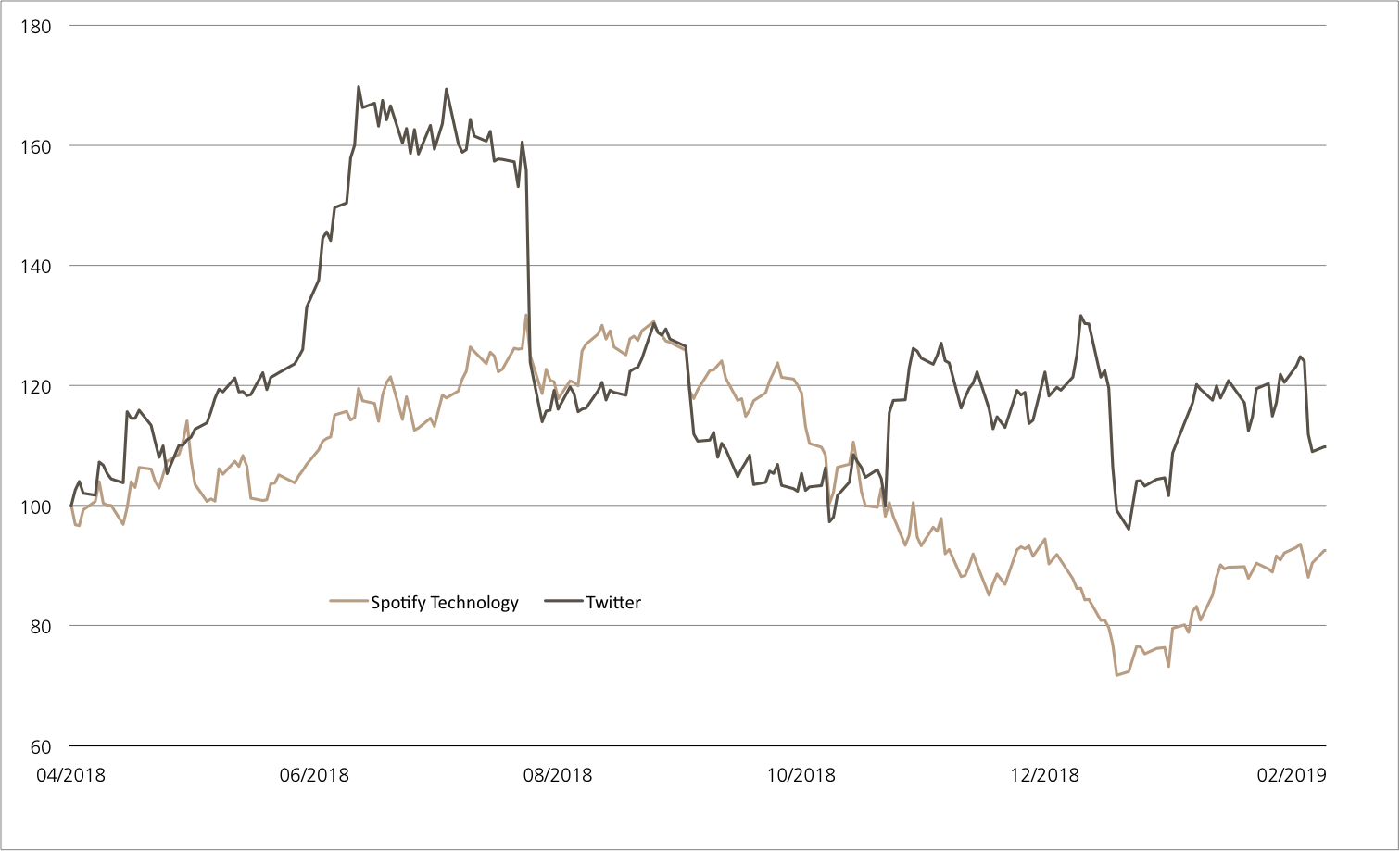

Swatch I vs. L’Oréal vs. LVMH

(5 ans, aux fins d’illustration uniquement, données en %)¹

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

8.00% p.a. Callable Kick-In GOAL sur Swatch I / L’Oréal / LVMH

| Symbol | KDGVDU |

| SVSP Name | Barrier Reverse Convertible |

| SPVSP Code | 1230, Callable |

| Sous-jacent | Swatch I / L’Oréal / LVMH |

| Devise | CHF (Quanto) |

| Coupon | 8.00% p.a. |

| Kick-In Level (barrière) |

60% |

| Echéance | 22.03.2021 |

| Émetteur | UBS AG, London |

| Date de fixation du prix | 20.03.2019, 15:00 h |

Vous trouverez davantage de produits UBS et des informations sur les opportunités et les risques à l’adresse ubs.com/keyinvest.

Source: UBS AG, Bloomberg

Valeurs du: 13.03.2019

¹) La performance passée n’indique pas les résultats futures.

²) Les condition des ETTs sont vérifiés annuellement et peuvent être ajustées avec un délai de 13 mois après la publication.